Rhodium stocks have had an intense ride since the pandemic. With all-time high rhodium prices, certain stocks benefit greatly. However, the fun didn't last forever.

While the sector has cooled off from all-time highs. Certain rhodium companies are in a seemingly better position than ever. But before we get into the top rhodium stocks to buy, let's cover some basics.

Rhodium is a rare, silvery-white, hard, corrosion-resistant transition metal. It is the most chemically inert of all the PGMs. Rhodium is a member of the platinum group of elements, which are also known as the PGMs. Other PGMs include ruthenium, palladium, osmium, iridium, and platinum.

Various applications utilize rhodium, such as catalytic converters, jewelry (owing to its luster and tarnish resistance), electronics, and dental fillings. Catalytic converters also help decrease car emissions.

The world's largest producer of rhodium is South Africa. The company that is the largest producer of rhodium is Anglo American Platinum. The company was founded in 1917 and is headquartered in Johannesburg, South Africa. Join Wealth Daily today for FREE. We’ll keep you on top of all the hottest investment ideas before they hit Wall Street. Become a member today, and get our latest free report: “How to Make Your Fortune in Stocks”

It contains full details on why dividends are an amazing tool for growing your wealth.

We’ll discuss more about Anglo American below.

Other major producers of rhodium include Russia, Canada, and the United States. The price of rhodium has been volatile in recent years, reaching a record high of over $20,000 per ounce in 2020.

Rhodium's value is intricately tied to supply and demand due to its rarity. The limited supply, fueled by demand from catalytic converters and other uses, directly influences its price. With that being said, let's get into the top rhodium stocks for 2023.

Top 5 Rhodium Stocks to Buy 2023

- Anglo American Platinum (OTCMKTS: ANGPY)

- Impala Platinum Holdings Limited (OTCMKTS: IMPUY)

- Sibanye Stillwater Limited (NYSE: SBSW)

- Zimplats Holdings Limited (ASX: ZIM)

- Artemis Resources Ltd (OTCMKTS: ARTTF)

Top Rhodium Stocks #1: Anglo American Platinum(ANGPY)

As stated before, Anglo American Platinum is a South African mining company that is one of the world's largest producers of PGMs (PGMs).

Anglo American Platinum's mines are located in the Bushveld Igneous Complex, which is the world's largest PGM deposit. ANGPY produces about 40% of the world's rhodium, 35% of the world's platinum, and 20% of the world's palladium.

Anglo American Platinum is committed to sustainable mining practices. The company has a number of initiatives in place to reduce its environmental impact, including the use of water conservation techniques and the recycling of waste materials.

The current CEO of Anglo American Platinum is Natascha Viljoen. She was appointed CEO in April 2020 and is the first woman to hold the position. Viljoen has over 30 years of experience in the mining industry and has held a number of senior positions at Anglo American Platinum, including Chief Financial Officer and Executive Vice President of Operations.

Viljoen strongly advocates for sustainable mining practices and aims to position Anglo American Platinum as a frontrunner in environmental and social responsibility. She is also a member of the World Economic Forum's Global Future Council on the Future of Mining and Metals.

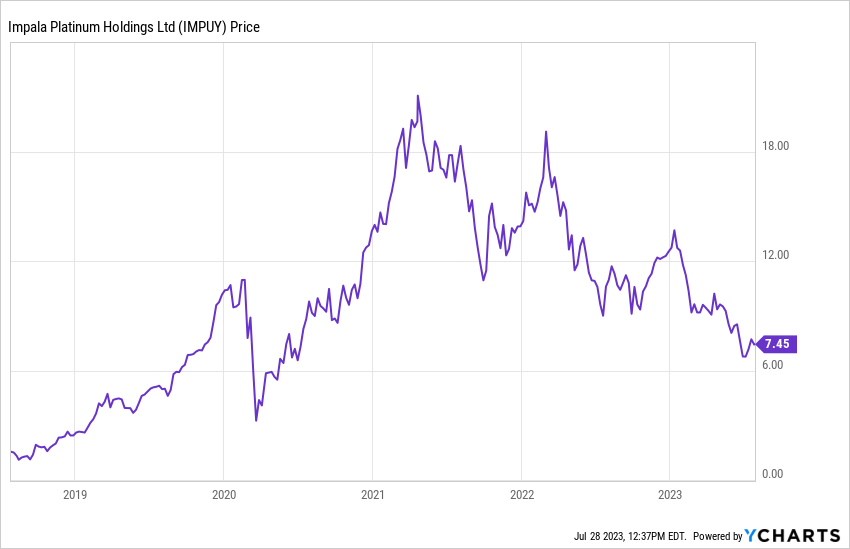

Top Rhodium Stocks #2: Impala Platinum Holdings Ltd (OTCMKTS: IMPUY)

Impala Platinum Holdings Ltd (OTCMKTS: IMPUY) is a major player in the global PGMs market. The company extracts, refines, and markets platinum, palladium, rhodium, gold, and other PGMs. With its diversified portfolio, IMPUY caters to various industries, including automotive and electronics.

Safety and sustainability are paramount to IMPUY. The company prioritizes responsible mining practices, environmental consciousness, and positive contributions to local communities. Innovation drives IMPUY's success. The company invests in technology and research to improve operational efficiency and maintain its leading position in the PGM industry.

Impala Platinum Holdings Ltd (OTCMKTS: IMPUY) also has a significant presence in the rhodium market. Rhodium is one of the PGMs and plays a crucial role in various industrial applications, especially in catalytic converters for vehicles.

IMPUY's rhodium operations are a key contributor to the company's overall PGM production. The company extracts rhodium from mines, with a focus on the Bushveld Complex in South Africa, renowned for its abundant deposits of platinum and rhodium.

Due to the growing demand for clean energy and stricter emission regulations worldwide, the demand for rhodium in catalytic converters has surged. As a result, rhodium prices have seen significant fluctuations over the years, impacting IMPUY's revenue and profitability.

To optimize its rhodium operations, IMPUY invests in technological advancements and process improvements. The company continuously explores innovative methods to enhance resource recovery and increase the efficiency of rhodium extraction and refining processes.

IMPUY's commitment to sustainable mining practices extends to its rhodium operations. The company places great importance on environmental stewardship. They actively seek to minimize the ecological footprint of their activities, including rhodium extraction.

Investors interested in IMPUY should consider the potential impact of rhodium prices on the company's financial performance. While the rhodium market presents lucrative opportunities, it is essential to weigh the inherent risks associated with commodity price volatility and the broader economic environment.

Top Rhodium Stocks #3: Sibanye Stillwater Limited (NYSE: SBSW)

Sibanye Stillwater Limited (NYSE: SBSW) is a major player in the precious metals industry. The company extracts and processes platinum, palladium, rhodium, gold, and other valuable metals. SBSW's operations focus on South Africa and the United States, known for rich PGM deposits.

SBSW currently has a market cap of just over $5 billion and pays a 7.37% dividend. As with most rhodium stocks, SBSW's financial performance is inherently linked to the prevailing prices of PGMs in the global market.

Neal Froneman has been CEO of Sibanye Stillwater for the last 10 years. The share price is sitting at nearly double that when he took the reigns. Sibanye Stillwater is a well-managed company with a strong track record of profitability. The company has been able to weather the recent downturn in the mining industry and is well-positioned for future growth.

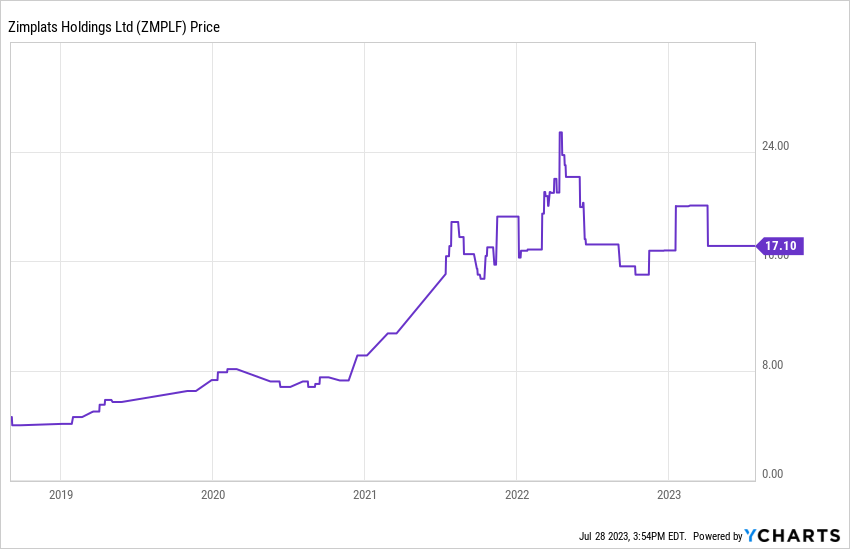

Top Rhodium Stocks #4: Zimplats Holdings Ltd (ASX: ZIM.AX)

Zimplats Holdings Ltd (ASX: ZIM) is another prominent mining company based in Zimbabwe. The company specializes in the extraction, processing, and refining of PMGs.

The company's mining assets are located in the Great Dyke region of Zimbabwe, which is renowned for its abundant PGM-rich mineral deposits. Zimplats has access to some of the world's most extensive platinum reserves.

Alex Mhembere has been CEO since 2007 and he has helped the company reach new heights. Especially within the last five years.

As you can see above, ZIM.AX has seen substantial growth in that time period. While the rest of the industry has seen its share of setbacks, Zimplats seems to weather the storm just fine.

Zimplats has a market cap of just under $3 billion and pays a hefty 11.29% dividend. Between the high dividend yield and the returns they’ve seen over the years, ZIM.AX seems like an excellent rhodium stock.

Top Rhodium Stocks #5: Artemis Resources Ltd (OTCMKTS: ARTTF)

Artemis Resources Ltd, an Australian mining company established in 2003, is dedicated to exploring and developing PMGs. Its headquarters are in Perth, Australia.

Artemis Resources' primary asset is the Wellgreen PGM-gold project, which is located in the Yukon Territory, Canada.

Artemis Resources also has a number of other exploration projects in Australia, Canada, and South Africa. The company's exploration portfolio includes a number of high-potential projects that have the potential to add significant value to the company.

Artemis Resources is involved in the rhodium industry through its Wellgreen PGM-gold project. The Wellgreen project is a large-scale, high-grade PGM-gold deposit that is located in the Yukon Territory, Canada. The project's estimated rhodium reserves exceed 100 million ounces, ranking it among the world's largest rhodium deposits.

The Wellgreen project is currently in the pre-production stage. Artemis Resources is planning to develop the project as an open-pit mine, with production starting in 2025. The project's annual production of over 1 million ounces of rhodium is set to establish it as a significant global source of this precious metal.

The company's stock is currently trading at a relatively low valuation. This presents an opportunity for investors to buy into a high-potential company at a discounted price.

Final Say on Rhodium Stocks

The rhodium industry went on a tear for two years starting in Q2 2020 (as did many industries). Though it seems like it’s cooling off, we could see a resurgence soon. While companies like Zimplats have been able to weather the storm, others have not.

Artemis Resources seems to have been unable to recover from the market turmoil. Because they are the lowest trading rhodium stock on this list they also offer a high upside. Keep in mind, though, that high rewards often come hand-in-hand with high risks.

That is not uncommon for the sector, though. To put it bluntly, rhodium stocks are a risky investment, but they also have the potential for significant rewards. Investors who are considering investing in rhodium stocks should carefully consider the risks and rewards before making a decision.

If you want to stay on top of the mining market in general, then I highly recommend you check out Junior Mining Trading from Luke Burgess.

Luke has been at the forefront of the mining industry and has made himself and his readers some BIG gains. While he might not be shouting about rhodium stocks right now, he's very bullish on gold.

In fact, he says they're going to reach new all-time highs very soon. Not only that but he's found five individual gold stocks that could hand investors 4,000% or more. EACH.

You can check out what he has to say bout those five gold mining stocks right here.

Good luck on your journey for rhodium stocks. Our list of top rhodium stocks should point you in the direction you need to go. Remember to do your own due diligence and make sure you're investing in a company you can trust.