Dear Reader,

If there’s one single element that’s got everyone talking right now, it’s lithium.

I imagine that it’s very close to what the topic of gasoline would have been like sometime around the turn of the 20th century.

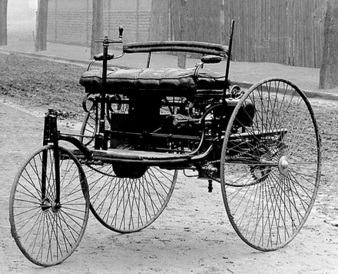

Back then, just 14 years after Carl Benz applied for a patent for his gasoline-engine power car, the true prospect of an easily portable, durable, power-on-demand energy storage medium was becoming real for the average consumer.

Of course, gasoline, like lithium is today, was also the topic of plenty of arguments about whether it was just a passing fad.

A fair share of early 20th-century investors and bankers balked at the idea, stating openly that it would never replace animal muscles as humanity’s primary motivating force. Join Wealth Daily today for FREE. We’ll keep you on top of all the hottest investment ideas before they hit Wall Street. Become a member today, and get our latest free report: “How to Make Your Fortune in Stocks”The Best Free Investment You’ll Ever Make

It contains full details on why dividends are an amazing tool for growing your wealth.

By 1908, and the introduction of the Ford Model T, most of those skeptics had either changed their minds and jumped on the proverbial bus or were regretting not doing so.

Today, 115 years later, the same exact dynamic is playing out with the next replacement… Or I should say has played out, because as battery storage capacity is now replacing fuel tanks as well as powering the ongoing explosion in personal wireless device demand, the investment community has all but universally embraced lithium as the most prospective commodity market of our age.

Going With the Crowd Has a Price

For most investors — and this very likely includes you — buying into the lithium market presents a double-edged sword.

On one side of the blade, you’re almost sure to win, but on the other, the spectrum of choices is so wide that it’s impossible to make a choice.

Again, most investors have little choice other than to go into the biggest lithium mining plays…

Massive, diversified firms like the $16 billion Albemarle (NYSE: ALB) or the lithium processing giant, Livent (NYSE: LTHM), or anything else that has a firm grip on the market.

That would be the prudent way to go and, like I said, is all but guaranteed to give you gains over a long enough timeline.

For some of you, however, that’s not enough.

Some of you want more bang from your buck and want to take this all-but-guaranteed macro trend and magnify the potential profit by hitting revolutionary new companies while they’re still on the ground floor.

We've Been Saying It From the Start: Fortune Favors the Bold

When it comes to lithium, I’ve seen all sorts of game-changing ideas in their nascent stages.

I’ve seen next-gen cathode companies explode from penny stocks into small caps. I’ve seen junior minors sitting on massive deposits getting taken down in buyouts for multiple times their market capitalization. And I’ve seen next-generation battery companies that are changing the world with higher energy densities, radically decreased charge times, and dramatically improved life expectancies.

But there is one that stands out among the rest.

This company has managed to do something that won’t just change the lithium production industry, but might just save us from a catastrophic, recession-causing shortage currently looming over our heads.

This company isn't a miner. It's a lithium technology firm.

Specifically, it’s the creator of a highly scalable method for large-scale extraction of lithium from standard oil field brine.

There’s no searching for lithium. There are no geological studies. There’s no mining.

Lithium From Oil Brine?

Instead, this company simply filters water already collected in massive containment ponds, and pulls lithium — which has leached into the solution over years of continued usage — out.

Standard mining operations take, on average, 10 years to produce their first ton of the metal.

This company can set up a filtration facility and have lithium flowing out within two months.

I know this seems a bit too good to be true, but progress often takes place in sudden, substantial leaps forward, and this is exactly what that looks like.

Within a year, this company will initiate commercial production at a 671-square-mile oil- and gas-bearing property in northwestern Alberta.

Within three years, it could be producing as much as 20,000 tons per year at a cost of just $4,000 per ton.

And best of all, almost any oil and gas company can lease or license this technology to supplement their existing operations with cheap, quick, efficient lithium production.

With lithium prices blowing up in recent years and demand set to go nowhere but up for the next couple decades, companies like this are the brand names of the future.

The No. 1 Hurdle to True Wealth Creation: Risk Aversion

But like I said, only some of you will be able to tolerate the anxiety of getting involved with a company like this.

Why? Because as of today, the company is trading at a market capitalization of barely $20 million.

It’s still virtually unknown. This lithium extraction technology is the only thing it does. It’s the reason the company was formed in the first place, by a team of petrochemical experts.

So most of you will steer clear.

You’ll see nothing but risk and opt to take the calmer, more guaranteed approach. And there's nothing wrong with that.

But for a certain type, all you see is the potential down the road.

Generational Wealth Starts With One Big Swing

A $250 million of valuation, which could easily result from as little as 5,000 tons of annual production at today’s market prices, is easily within reach within the 2024 calendar year — already close to a 12x gain over today’s market cap.

In the longer term, the valuation could, and should, grow into the billions.

All the company has to do is follow along its planned milestone roadmap, and that’s exactly what we’ll see.

For those few who feel awakened and invigorated by this potential, I invite you to watch a presentation I recently released on this company.

It’ll give you all the details and explain where the company came from, where it is today, and, most important of all, where it will be in the next months and years.

For instant, registration-free access, enter here.

Fortune favors the bold, Alex Koyfman His flagship service, Microcap Insider, provides market-beating insights into some of the fastest moving, highest profit-potential companies available for public trading on the U.S. and Canadian exchanges. With more than 5 years of track record to back it up, Microcap Insider is the choice for the growth-minded investor. Alex contributes his thoughts and insights regularly to Energy and Capital. To learn more about Alex, click here.