I’ve been reading a lot about how electric vehicles are the way of the future and the only way to save the planet from global warming.

But a lot has to change if that’s ever going to be the case…

Electric vehicle sales have surged by historical standards. But they still make up only a sliver of all new car sales.

According to Statista, as of 2020, they made up about 1% of vehicles on North American highways and byways:

But they’re predicting 10% penetration by 2025 and 30% penetration by 2030!?

The ONLY way that happens is if EVs suddenly get a whole lot better, cheaper, and safer.

No EV for Me

You see, the vast majority of the American public still has a lot of concerns about EVs. And when I say a lot, I mean a LOT.

The most common reason drivers give for passing on an EV is their fear that the battery will run out of charge before they get where they’re going.

This is known as “range anxiety” in the EV world. And it’s a very valid concern to have.

If your battery dies and leaves you stranded on the side of the highway, it’s not like you can walk up the road and get a can of charge.

You can, however, get a can of gas. And EV drivers learned how dangerous a situation that can lead to in my own state of Maryland just this past winter.

There was a backup on I-95 from southern Virginia all the way up through southern Maryland.

And people were stuck in traffic for days. EVs ran out of battery and their occupants had to decide whether to freeze to death or make friends with some ICE-driving strangers.

Fortunately for those EV owners who literally got left out in the cold, we gas guzzlers are a sympathetic bunch so we let them sit in our cars to warm up for a bit.

So the 58% of Americans who won’t buy an EV because it might leave them stranded have some pretty good real-world proof their fears are well-founded.

As do the 49% who fear not being able to find a charging station when they really need one.

But unreliable charging networks and unreliable batteries aren’t the only reasons Americans are giving EVs a hard pass.

It’s also the cost. Sure, driving a gas-powered car has gotten pricier as the climate brigade has attacked the fossil fuel industry for providing power to the world.

But it’s still not as prohibitive as the price tag for a new EV…

And over 40% of consumers report that the cost is a determining factor as to why they won’t buy an EV.

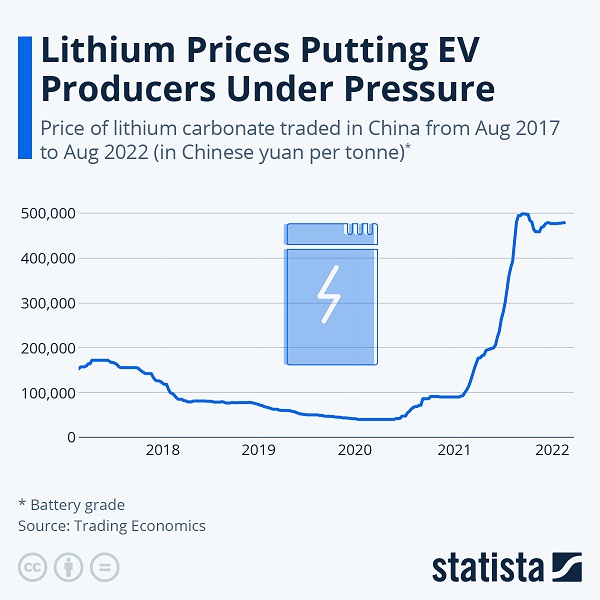

And if you think EVs are going to get cheaper, just take a look at the price of the lithium they must come pre-installed with:

It’s not getting any cheaper. It’s also not getting any easier to find or any more prevalent in the earth’s crust.

But even if it gets cheaper, it’s not going to get any safer. What’s that? You say you didn’t know lithium was dangerous?

Surely you've seen images of Tesla’s bursting into flames because their lithium battery failed…

That’s what happens when lithium is exposed to air: It explodes… INSTANTLY!

Join Wealth Daily today for FREE. We’ll keep you on top of all the hottest investment ideas before they hit Wall Street. Become a member today, and get our latest free report: “How to Make Your Fortune in Stocks”The Best Free Investment You’ll Ever Make

It contains full details on why dividends are an amazing tool for growing your wealth.

So far, the only solution EV enthusiasts have come up with is to make the battery walls thicker.

Judging by the fact that lithium batteries are still randomly exploding, I’m going out on a limb and saying they need a better solution.

EVs will need to be better, more efficient, and much safer if they're going to hit even a 5% penetration rate, let alone 10% or 30%!

Building a Better Mousetrap

Fortunately, there’s a company on the verge of releasing a new kind of battery technology that solves literally all of the problems preventing people from buying EVs:

It’s batteries are safer because they’re not made of an explosive liquid that’s prone to bursting into flames.

They’re more efficient because they can charge in just 15 minutes (compared with the several hours it takes with even the best Tesla battery).

They’re cheaper because they aren’t using up tons of expensive lithium.

They also last longer before needing to be replaced.

They take up less space because they pack more power into a smaller package.

And they’ll give your EV an extra few hundred miles in range to soothe that range anxiety even the most cold-blooded EV driver feels.

They’re basically better no matter how you stack them up and compare the two.

They’re the kind of batteries we need if EVs are ever going to attract more than a couple percent of the drivers on the roads.

And the best part is that the company, after spending decades developing the technology behind closed doors, is ready to hit the market with its new products.

It’s spent years in the lab testing and designing and testing and redesigning its battery cells.

It’s proven they can charge from 10% to 80% in under 15 minutes.

It’s shown that they can last tens of thousands of discharge and recharge cycles without losing any of its power.

It’s shown how safe they are compared with traditional lithium EV batteries.

And it’s completed the construction of a factory to produce the new batteries at scale.

Built-in Billion-Dollar Buyer

But what’s most exciting is that it’s already got a customer for all the batteries it can make once that factory is rolling them out.

And that customer sells more EVs than any other car company on the entire planet.

We’re talking about a $100 BILLION behemoth champing at the bit to get these batteries into its vehicles.

Literally the only thing standing between this company and a massive stock rally is time.

As soon as its batteries are produced at scale, they’re going to be rolling out in every new electric vehicle its partner company produces.

That’s instant revenue worth hundreds of billions of dollars.

But right now the market isn’t valuing the shares based on their future sales. It’s valuing them based on past sales of zero.

And that’s created an opportunity for investors with a little time to wait for the factory to get up and running and the batteries to be in showrooms around the world.

So I’ve created a presentation outlining the company, its technology, why it’s better than what we have, and who’s going to use it once all’s said and done.

It’s got everything you’ll need to know in order to make an informed decision and get yourself invested.

But I highly suggest you take some time today, or at least over the weekend, to learn more.

It’s just a matter of time before the company makes the announcement that sends its shares soaring.

If you’re in before that, you get the profits.

If you’re in after, you get to buy the stock from the people that got the profits.

I want you selling into that rally, not chasing the stock through it.

So I hope you’ll take advantage of the opportunity I’m presenting.

The final choice, as always though, is yours.

To your wealth, Jason Williams After graduating Cum Laude in finance

and economics, Jason designed and analyzed complex projects for the U.S. Army. He made the jump to the private

sector as an investment banking analyst at Morgan Stanley, where he eventually led his own team

responsible for billions of dollars in daily trading. Jason left Wall Street to found his own

investment office and now shares the strategies he used and the network he built with you. Jason

is the founder of Main Street

Ventures, a pre-IPO investment newsletter; the founder of

Future Giants, a nano cap investing service; and authors The Wealth Advisory income stock

newsletter. He is also the managing editor of Wealth

Daily. To learn more about Jason, click here. Want to hear more from Jason? Sign up to receive emails directly from him ranging from market commentaries to opportunities that he has his eye on.

@TheReal_JayDubs

@TheReal_JayDubs Angel Research on Youtube

Angel Research on Youtube