While crude oil prices have come down dramatically since reaching their near-term high of $102.53 per barrel on June 25th to close last week at $66.15 for a stunning drop of 35.48% in just five months, not all energy stocks in the space have hurt as badly.

What is more, there is one industry in particular that regularly outperforms crude oil both on the way down as well as up – the midstream transporters. Where oil wells can and do shut down when oil falls below their extraction costs, the transporters are always hard at work, delivering energy to an economy that never stops consuming, even if some wells stop producing.

Let’s take a look at just three such energy transporters to note their superior performance in both falling and rising oil prices, and then anticipate their future growth prospects.

Three Midstream Energy Transporters to Look At

• Kirby Corporation (NYSE: KEX), market cap of $5.49 billion, headquartered in Houston, Texas, provides marine transportation and diesel engine services for the inland and coastal markets, transporting petrochemicals, refined petroleum products, black oil products, and agricultural chemicals by tank barges, including coastal transportation of dry-bulk cargoes.

As of February 21, 2014, the company owned or operated 861 inland tank barges, 253 inland towboats, 72 coastal tank barges, 76 coastal tugboats, 8 offshore dry-cargo barge and tugboat units, and 1 docking tugboat, which it uses to provide services to inland and offshore barge operators, oilfield service companies, oil and gas operators and producers, compression companies, offshore fishing companies, marine, and on-highway transportation companies, as well as the United States Coast Guard, the United States Navy, and power generation, nuclear, and industrial companies.

• Golar LNG Ltd. (NASDAQ: GLNG), market cap of $3.87 billion, headquartered in Hamilton, Bermuda, engages in the transportation, regasification and liquefaction of natural gas. It acquires, owns, operates, and charters liquid natural gas (LNG) carriers and floating storage regasification units (FSRU), with a fleet of eight LNG carriers and FSRUs.

• Teekay Corporation (NYSE: TK), market cap of $3.6 billion, headquartered in Hamilton, Bermuda, uses its fleet of shuttle tankers and floating storage and off-take units for offloading and transporting cargo from offshore oil and gas platforms to onshore terminals, in addition to providing floating storage services. It primarily services energy and utility companies, oil traders, oil and LNG consumers, petroleum product producers, government agencies, and various other entities that require marine transportation.

As the crude oil price has been falling since late June, it has taken most oil producing stocks down with it, including the three midstream transporters highlighted above. Only these three have not fallen as hard.

The reason? Oil production in the U.S. is still rising.

U.S. Oil Production Still Rising

Despite the plunge in oil prices since June, oil production in the U.S. has been rising steadily since the economic recovery began in early 2009 – even during the past five months. As per the graphs below, while oil prices have fallen 35%, oil production in the U.S. has increased by 3.9% during these past five months of price declines.

Source: TradingEconomics.com

This means all those midstream energy transporters are still busy hauling their cargos. What is more, consumers still consume more gasoline and heating oil with each passing year, with lower prices actually spurring the purchasing of more gas-guzzling SUV’s, increasing consumption of gasoline all the more.

Thus, even if some oil producers, such as the costlier fracking operations in the North Dakota and Montana Bakken shale fields, are forced to shut down as oil falls below their extraction costs, the lower price of oil is not decreasing the flow of oil out of other fields nor decreasing the transporting of oil and gas from well to refineries, nor from the refineries to the energy retailers.

Our three energy transporters have real staying power, as they have proven in the past.

Transporters Outperform Oil

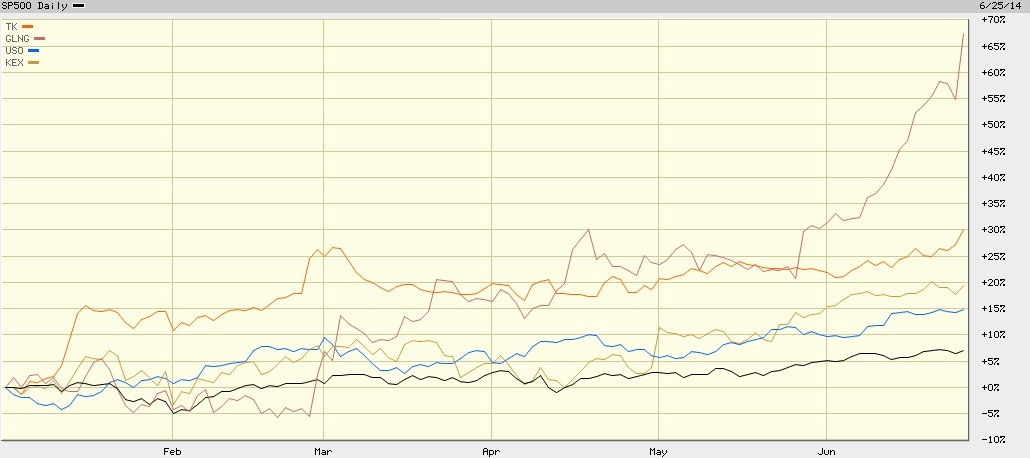

The transporters’ advantages can be clearly noted in the following graphs depicting their performance during oil price upswings and downturns.

First up, notice how the three above-mentioned transporters performed during the first six months of this year as the oil price rose. Where the United States Oil ETF (NYSE: USO) [blue] rose 15% by this year’s peak on June 25th, Kirby [beige] rose 19%, Teekay [orange] rose 30%, while Golar [purple] rose an astounding 67%.

Source: BigCharts.com

Yet their superior position within the midstream segment helped them outperform oil even on the way down since June 25th, as graphed below. Where USO has fallen 35%, all three above mentioned transporters have fallen less – with Kirby falling 17%, Teekay falling 19%, and Golar falling 31%.

Source: BigCharts.com

And their stellar outperformance is projected to continue.

Transporters’ Outperformance To Continue

Looking forward, analysts project the earnings growth of the three above-noted transporters to outpace the broader market’s average earnings growth rate as tabled below, where green indicates outperformance while yellow denotes underperformance.

Where Golan is the only one expected to shrink in earnings over the current and next quarters, given its exclusive involvement with natural gas, it is expected to make up for it with explosive growth in 2015 of 2100% over 2014’s earnings, beating the broader market’s average growth at some 196.26 times the rate.

Kirby and Teekay, for their part, are seen outgrowing the broader market’s growth rate much more consistently, with Teekay mounting huge growth rates of some 58.82 times in the current quarter to as much as 86.08 times in 2015.

So if falling oil prices are causing you to abandon the oil and gas sector, look again. There are plenty of gems to be found among the midstream transporters. Even if some producers reduce their production, the overall U.S. oil market is still increasing production. Why? Because consumers are still increasing their consumption of gasoline and heating gas.

What is more, as the economy continues to improve, with GDP continually on the rise, manufacturing and industry will continue to consume more energy as well. Increasing production at one end, and increasing consumption at the other end, means that the transporters in the middle are going to remain very busy indeed – with their stocks continuing to outperform oil whether it falls or rises.

Joseph Cafariello