Recently, my schedule changed a little bit. You might have noticed… And you might not have.

But if you didn’t notice, now you know: Instead of getting my emails on Fridays and Wednesdays, now you’re getting them on Fridays and Mondays.

That means sometimes, in order to help everyone else stay on schedule, I have to write an article on Friday that you’re not going to read until Monday.

And sometimes that can get a little complicated.

I’m sure I don’t have to tell you how much can change in a weekend. We’ve all seen far too many examples over the past two years alone…

The markets started to crash over the weekend in February 2020 as we realized COVID-19 was not just a Chinese and European problem:

Texas and much of the rest of the southwest froze over the weekend during a freak storm in February 2021:

Just this month, the entire country of Afghanistan fell to the Taliban over a weekend:

So it can get a little complicated trying to write about investing when you’ve got so much time for something to happen.

And this is one of those weeks. But this time, it’s my schedule that’s got me writing in advance.

I’ve got an incredibly busy week ahead of me…

The Wealth Advisory’s Top Ten Stocks for September

First on the agenda, Monday morning, I’m coming into the studio to meet up with the co-author of my stock advisory service, Briton Ryle.

We’re getting together to film a short video we send out to the subscribers of The Wealth Advisory where we pick our top stocks for short-term gains from the model portfolio.

We’ve been doing the Top Ten list for a while now and we introduced the videos a few years ago. We’ve usually got about 30 stocks in the model portfolio to choose from.

And we’ve given our investors access to some serious short-term gains in the process. Just this past month, for instance, we’ve got four double-digit gains:

- Innovative Industrial Properties (NYSE: IIPR) is up over 12%.

- Uniti Group (NASDAQ: UNIT) is up over 14%.

- Albemarle (NYSE: ALB) is up over 22%.

- Dick’s Sporting Goods (NYSE: DKS) is up a whopping 31%.

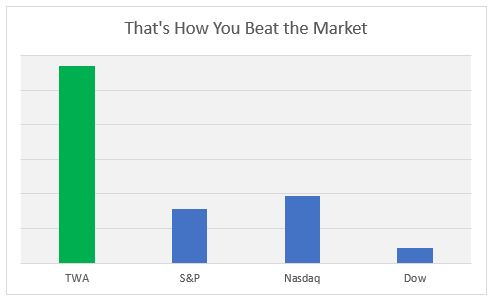

And if that’s not impressive enough, we’ve got an average gain of 5.7% across all 10 stocks, while the S&P 500 is up 1.6%, the Nasdaq is up 2%, and the Dow is barely up 0.5%.

I’m not telling you this to brag… well, maybe a little. It is pretty impressive. But really, the reason I’m telling you about it is that I want you to get the same access my subscribers get.

We send these out every month as close to the first day as possible to help our long-term investors maximize their short-term allocations, but to be honest, you could make a nice profit trading them too.

And I want you to get access to the September Top Ten the second we release it next month.

So I’ve got a special offer for you if you give my advisory service a test-drive this month.

Just click here to see what it is.

And if you’re not convinced and you’d like to see the Top Ten for free before you make a decision to pay for a subscription, we also post it to our YouTube channel.

Now, to be fair, we post it up there a week after we give it to our paying readers. But the advice is always still actionable.

Check out the channel and last month’s video and see what you’re missing.

And make sure you hit the “Subscribe” button to follow the channel and the button that looks like a bell so that you’ll get notified when the September Top Ten goes up.

Join Wealth Daily today for FREE. We’ll keep you on top of all the hottest investment ideas before they hit Wall Street. Become a member today, and get our latest free report: “The Private Market: Where the Action Is Now.”

After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox daily.

Going to California

Pretty much as soon as I’m finished filming the Top Ten with Brit and the crew, I’ll be grabbing my carry-on and heading to the airport. I’ll be off on another research trip.

This time I’m going to California (but with no aching in my heart). I’m headed out to the Advanced Clean Transportation (ACT) Expo in Long Beach.

I’m pretty excited, too. You know I’m a conservationist at heart for the sole fact that I’m an outdoorsman. You’ve got to protect nature if you want to keep enjoying the outdoors.

And I’ll be seeing some of the latest advances in clean tech in the transportation industry. From school buses powered by batteries to big trucks powered by hydrogen cells, I’m going to get an in-depth look at what’s going on out there.

I’ll be getting some footage of my visit and hopefully some interviews I can share of the executives behind these new companies.

I’m also looking forward to seeing some of the advances in battery technology and energy storage they’ll have there.

I’ve already uncovered a company revolutionizing how lithium batteries are made. Theirs will be smaller but pack more power, and they’ll last far longer and charge far faster than today’s technology allows.

You can learn more about them in this presentation I put together:

And you can keep your eyes out for alerts from the YouTube channel to see the footage from the trip (a week or so after the paying subscribers see it, of course).

I’m really excited to see all these companies and get to know their technology and founders, but the real reason I’m going out to the ACT Expo this year is to see a very specific company…

Built by Main Street

Last year, I uncovered a unique opportunity to invest in a private company working to create a new EV truck for last-mile deliveries. It’s called CityFreighter.

And I say it was a unique opportunity because there were no income or net worth limitations on making the investment.

You see, for nearly a century, the private markets have been off-limits to regular investors. You had to be a millionaire already if you wanted a piece of the action.

And the action is very lucrative. In all the years I spent on Wall Street, I never once saw someone make as much buying public stocks as those buying private companies.

But up until very recently, as I said, this market was off-limits.

Now, thanks to a rule change from Congress, we can all participate.

So I started an advisory service focused on those kinds of opportunities: private investments for the little guys.

I call it Main Street Ventures. And this week, I’m heading out to California to see the EV our funding helped to build.

I’m really excited to see what we’ve helped to create. And I’m even more excited for all the potential customers at the expo to see it.

I expect we’ll get some letters of intent for orders almost immediately, and I know it will drive up the value of the company and, therefore, our initial investment.

The opportunity to invest in CityFreighter has passed for now (although there’s always the possibility of a future round at a higher valuation), but there are still lots of amazing opportunities out there.

You just have to know where to look. And I can help with that.

So I’ve got another special offer for you today…

You can go to the YouTube channel and subscribe (and I highly suggest you do) and you’ll get to see a lot of the investments we make after the fact.

But if you want to make sure you get the chance to participate in them and potentially make life-changing profits with us, then you need instant access to these deals.

And the only way to get that is with a risk-free trial of Main Street Ventures.

Because I got into this business to help people change their financial futures, and I know firsthand how incredibly profitable this market is, I’m offering a massive discount on the cost of a membership.

But I can only offer it today. After that, you’ll have to pay retail price like everyone else out there.

I’m also offering a risk-free guarantee with your trial membership. If for any reason, you’re dissatisfied, I’ll give you back every penny you’ve spent.

Coming Soon

I think I’ve filled enough space for today. And what I wrote about certainly isn’t going to change by the time you’re reading this. So I’m pretty satisfied with myself.

But I’m not resting on any laurels. You know me better than that.

I’ll be back from California later in the week and back to keeping you informed about the best investments.

And I’ll be sharing the footage from my trip with the subscribers of The Wealth Advisory and Main Street Ventures when I return as well.

If you want first access to that and all our incredible investments, join The Wealth Advisory here and join Main Street Ventures here.

If you’d rather wait for it to come out on YouTube (which it eventually will), head over to the channel and hit that subscribe button and the bell that comes up after.

I’ll see you when I get back. Have a great week!

To your wealth,

Jason Williams

After graduating Cum Laude in finance and economics, Jason designed and analyzed complex projects for the U.S. Army. He made the jump to the private sector as an investment banking analyst at Morgan Stanley, where he eventually led his own team responsible for billions of dollars in daily trading. Jason left Wall Street to found his own investment office and now shares the strategies he used and the network he built with you. Jason is the founder of Main Street Ventures, a pre-IPO investment newsletter; the founder of Future Giants, a nano cap investing service; and authors The Wealth Advisory income stock newsletter. He is also the managing editor of Wealth Daily. To learn more about Jason, click here.

Want to hear more from Jason? Sign up to receive emails directly from him ranging from market commentaries to opportunities that he has his eye on.

@TheReal_JayDubs

@TheReal_JayDubs Angel Research on Youtube

Angel Research on Youtube