Dear Reader,

Remember the days when everything worth investing in had a dot-com after its name?

I don’t want to refer to is as the dot-com bubble because that’s a term that only came into usage toward the end…

As we drew closer and closer to that inevitable moment when hope and expectation turned into reality and disappointment.

The reason behind it all?

Irrational exuberance is what it’s referred to, and at any given point in history, it’s this mental tick, exhibited on a mass scale, that’s responsible for keeping some bubble, in some sector, inflating its way to an ugly and inevitable conclusion.

The cycle isn’t hard to understand.

When Mania Subsides

Step 1: An industry reaches a point of inflection, garnering the attention of the investment community and the press.

Step 2: Word spreads. Any company engaged in this new and exciting business model immediately gets attention from anybody with pockets.

Step 3: The industry balloons, and the process builds momentum.

The bubble bursts when investors finally realize the reality isn’t what they expected… and that disappointment always comes in the same form: lack of revenue.

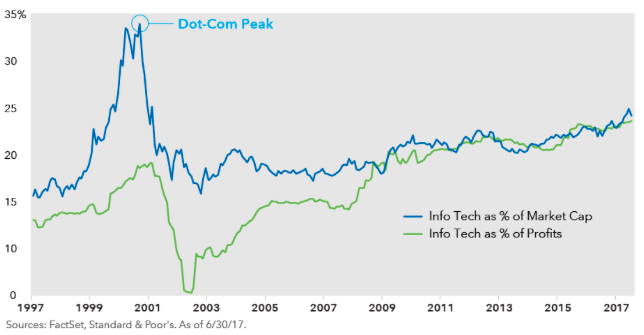

You can see the gap between expectation and reality in the chart below.

Notice how the steady, sustainable growth in market cap didn’t kick in until it was in sync with profits.

In the end, the reality of the dot-com bubble was that most of the companies just didn’t make the kinds of returns investors and analysts had anticipated.

Those who fell into this category died off and will not be remembered. The few that delivered on the promise are still around today, rich as ever.

Today, dot-com has morphed from a bubble into every corner of every other industry, related or unrelated to tech.

Meet the New Bubble, Same as the Old Bubble

But we do have another bubble on our hands, and you probably know what it is: cannabis.

If you invest, you’ve been bombarded by pitches, news articles, and perhaps even rants from your friends who are equally addicted.

Just remember that when it all fails — and this process may have already started — there will be one thing that sets the winners apart from those who die off, not to be remembered: revenue.

Most simply don’t have it.

This goes doubly true for the juniors of the sector — the early-stage companies still orders of magnitude short of the industry benchmarks like Tilray (NASDAQ: TLRY) and Canopy Growth Corp. (NYSE: CGC).

Public cannabis stocks valued at less than $100 million that are actually making money, as opposed to living from raise to raise, are the jewels of the sector, and extremely rare.

Strength That’s Easy to See

And they’ve all proven to have one particular trait: an ability to retain value, even during moments of sector-wide decline and market-wide instability, such as the kind we face today.

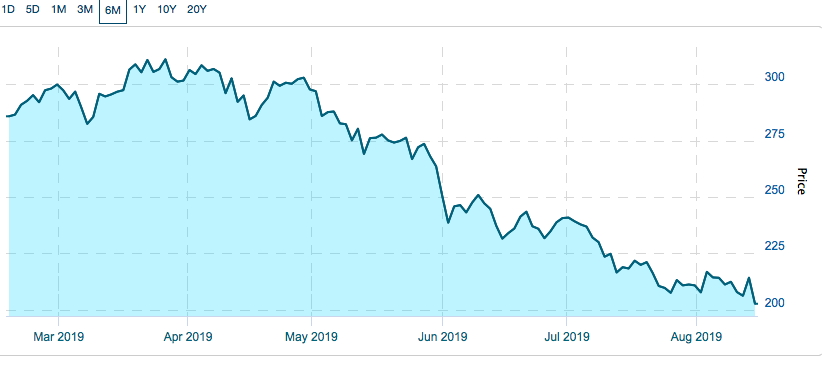

The chart below tracks the North American Marijuana Index, whose list of constituents includes Canopy Growth and the $6 billion Aurora Cannabis (NYSE: ACB).

The last six months have not been pleasant for the industry, to say the least, as the index lost 47%.

It’s too soon to say just yet, but this might actually be a snapshot of the cannabis bubble bursting.

Stay on top of the hottest investment ideas before they hit Wall Street. Sign up for the Wealth Daily newsletter below. You’ll also get our free report, Marijuana Outlook: Best Stocks to Buy.

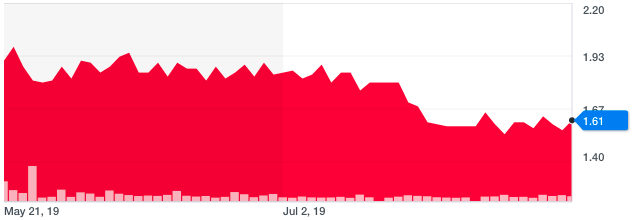

Now, take a look at the chart of a sub-$100 million company along roughly the same timeline.

The company only IPO’d back in May, an event that drew some degree of exuberance, causing the price to balloon to the $2 mark. But when things settled, they settled to a healthy, sustainable $1.60 — or 80% of the price at the peak.

This is while the rest of the market was losing nearly half of its market capitalization.

Think about that for a second.

Canopy Growth is down 33% from its peak. Aurora Cannabis is down 50%. Tilray is down 74%.

The index itself is down by almost half.

These are the industry benchmarks. They are the pulse and blood pressure of the sector, and they’re getting bled out.

And yet this one newcomer is going strong.

A Future Industry Leader?

The reason for this resistance to sector-wide decline, as always, is revenue.

This Vancouver-based company operates as an agricultural technology, services, and property management company.

Through its wholly owned subsidiaries, it engages all aspects of the cannabis business, from cultivation and extraction to manufacture and retail sale of products ranging from vape cartridges to edibles, oils, and topical creams.

The diversification insulates this company against declines in any single corner of the industry, while the sustainable business model allows for the company to scale up.

Income after taxes is up 60% in the year between March 2018 and March 2019, and the pattern is expected to continue.

While the rest of the industry endures a dot-com-caliber culling, this company will quietly take its place among the leaders.

Five years from now, once the cannabis industry has adopted the same growth pattern as tech did in the post-bubble years, this company could emerge as a household name.

I recently published a full report detailing this company for my subscribers.

You’ll have to test-drive my service to get to see it, but it’s risk free to you, and the rewards could be substantial — if you play your cards right.

With share prices holding strong despite the kind of volatility we’re seeing here today, there’s no telling what they might do once things settle down.

Fortune favors the bold,

Alex Koyfman

His flagship service, Microcap Insider, provides market-beating insights into some of the fastest moving, highest profit-potential companies available for public trading on the U.S. and Canadian exchanges. With more than 5 years of track record to back it up, Microcap Insider is the choice for the growth-minded investor. Alex contributes his thoughts and insights regularly to Energy and Capital. To learn more about Alex, click here.