Over the past several months, my colleague Alex Koyfman and I have been calling your attention to a looming shortage that could completely derail both the EV revolution and the race for alternative energy sources.

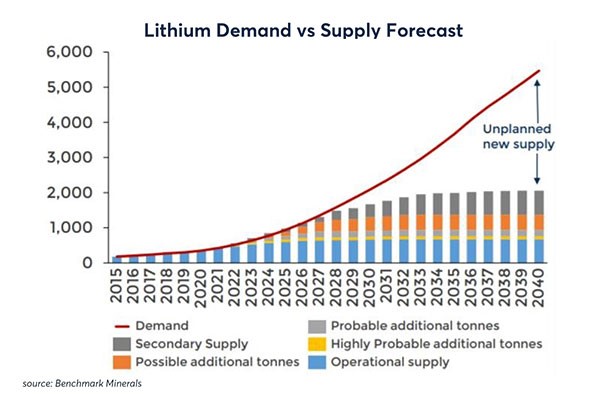

You might recognize this chart (or a similar one) from several of our updates:

The numbers on that chart are thousands of tons and they show that by 2040, the world will be looking at a potential 4 million-ton shortage of lithium for making the batteries those EVs run on and those alternative energy sources store power in.

And it shows that shortage starting to develop and grow as soon as 2028.

But the thing is, it’s not accurate — at least not according to those folks really “in the know.”

You see, while we’ve been warning you about the impending shortage and sharing opportunities for you to profit from it, the analysts working for the lithium miners, the ones with their boots on the ground, have been recalculating their estimates.

And their most recent estimate is both shocking and kind of terrifying at the same time… Join Wealth Daily today for FREE. We’ll keep you on top of all the hottest investment ideas before they hit Wall Street. Become a member today, and get our latest free report: “How to Make Your Fortune in Stocks”The Best Free Investment You’ll Ever Make

It contains full details on why dividends are an amazing tool for growing your wealth.

That Escalated Quickly

As of yesterday morning, September 21, 2023, the new estimates indicate that shortage Alex and I have been forewarning isn’t going to start in 2040. And it’s not going to start in 2028, either.

It’s actually predicted to start THIS YEAR!

That’s right, the folks who know the most about the lithium mining industry, the lithium miners themselves, are admitting that they’re not producing anywhere near enough of the material to meet even current demand.

A recent report from Grand View Research projected that the global lithium market size, which was valued at $7.49 billion in 2022, is expected to reach $8.20 billion in 2023 and to grow at a compound annual growth rate (CAGR) of 12.3% from 2023–2030.

The report went on to say, "The U.S. holds major significance in battery production after China, which makes it one of the key lithium-consuming countries in the world.”

The researchers admit that, “the country has huge reserves of this important metal,” but also note that, “the country mines only about 1.0% of the total demand in the world.”

And if the U.S. (and other countries) don’t step up those mining operations, the researchers predict that by the end of 2023, this year, that lithium demand would outpace supply.

And that’s going to lead to two things: First, it’ll cause a huge rally in the price of the metal as more people compete for the same amount of supply, and second, it’ll cause a flurry of investment in mining companies that could potentially help address the shortage.

That’s where the opportunities Alex and I have been sharing with you come into play…

We Needed It Yesterday

You see, the process of getting a new lithium mine going is an extremely long one.

First, you’ve got to identify a target area, get permits, and explore it. That takes time and money.

Then, once you locate a resource, you’ve got to get permits to start developing that resource. This also takes a lot of time and money.

Then you’ve got to staff your operations. Again, this can take a lot of time and costs even more money.

And finally, when you’re explored, proven, permitted, and staffed, if you’re mining lithium from brine deposits (which make up somewhere around 70%–80% of the world’s reserves), you’ve got to set up your evaporation ponds.

You’ve heard me talk about these before. They’re massive complexes of hundreds of man-made ponds that span across acres upon acres of land.

They cost a lot to build, require more permits to get approval to build, and take a lot of time to get fully operational.

And then, once you’ve done all that work, spent all that time, and expended all that money, you can finally start pumping brine to the surface and letting the evaporation ponds do their thing, which is to let the water evaporate.

This process takes about two years to complete before the brine is condensed to a state where it can be transported to a processing plant where it’s then “washed” with harsh chemicals to remove the impurities and leave you with sellable lithium.

It’s a long process. It’s an expensive process.

And it’s certainly not the process that’s going to allow us to increase our lithium production quickly enough to avoid yet another economy-halting shortage of this critical mineral.

We don’t need to increase supply in two years. We need to increase supply today. In fact, we really needed to increase it yesterday if we were serious about avoiding this impending shortage.

But we didn’t. And here we are. Lithium prices are likely to skyrocket in short order as the world realizes there are a whole lot more of us competing over the same small amount of lithium.

And any company that can find a better, faster way to get that lithium to market is going to capture the lion’s share of that massive growth I mentioned earlier.

Newer, Better, Faster

But it just so happens that several companies are out there developing, testing, and implementing better processes for extracting that lithium and getting it ready to turn into batteries.

And those are the industry pioneers Alex and I have been pounding the table about, insisting that everyone needs to have a stake in.

You see, these companies have developed a new process that takes advantage of the advances in technology to bring lithium mining out of the Stone Age.

Instead of relying on the sun to evaporate away the water from the lithium, they’re pioneering a new technology that allows them to pull it directly from the liquid without evaporating anything.

Not only that, but the process doesn’t require the harsh chemicals traditionally used to strip away contaminants from the final product.

And to really add a cherry to this sundae, the process — get this — takes as little as a few hours to complete.

Now, it can take up to two days for really contaminated samples, but that’s still a whole lot better than two years in an evaporation pond.

And not only does the new process speed up production, but it also produces a cleaner, more pure form of the metal that’s more valuable and easier to refine into battery materials.

On top of all of that, while evaporation ponds give you the ability to capture about 40% of the lithium dissolved in those brines, this new technique recovers 90% or more.

So it’s exponentially faster, it produces a cleaner end product, AND companies using it are able to extract more than twice as much of the newly-minted "precious metal" from each well.

Leaders Become Laggards

I’ve been calling it lithium’s fracking moment because it reminds me of the time when that technology was new and small companies in the U.S. started pioneering it.

Those small companies are now multibillion-dollar operations and their early investors made out like bandits.

And that’s exactly the same thing I see happening in the lithium industry…

Former market leaders who refuse to adapt and evolve will be left in the dust.

Tiny, unheard-of companies will take the lead from them and their shareholders will walk away with blockbuster gains in the process.

And I want you to be one of those shareholders. So I’m reaching out one more time to make sure you’re really paying attention to this impending shortage and the opportunities it will present.

And I’m offering to share my research with you one more time so that you can get yourself invested in the companies that will move the industry forward as they address the shortage with new technology.

So I implore you to take a little time today or over the weekend to digest the information I’ve compiled in this special urgent investor presentation.

You can also get access to all the same information in this easy-to-read report I put together for the members of my premium investing community, Future Giants.

They’re already invested and profiting, and I can’t wait for you to join them.

To your wealth, Jason Williams After graduating Cum Laude in finance

and economics, Jason designed and analyzed complex projects for the U.S. Army. He made the jump to the private

sector as an investment banking analyst at Morgan Stanley, where he eventually led his own team

responsible for billions of dollars in daily trading. Jason left Wall Street to found his own

investment office and now shares the strategies he used and the network he built with you. Jason

is the founder of Main Street

Ventures, a pre-IPO investment newsletter; the founder of

Future Giants, a nano cap investing service; and authors The Wealth Advisory income stock

newsletter. He is also the managing editor of Wealth

Daily. To learn more about Jason, click here. Want to hear more from Jason? Sign up to receive emails directly from him ranging from market commentaries to opportunities that he has his eye on.

@TheReal_JayDubs

@TheReal_JayDubs Angel Research on Youtube

Angel Research on Youtube