"Wait, what did you just say? You’re predicting $4 a gallon gasoline? That’s interesting. I hadn’t heard that … I know it’s high now."

That quote came from a puzzled President Bush on February 28, as average retail gas prices soared past $3.10 nationwide.

President Bush can’t plead ignorance when we hit the $4 per gallon mark. Likewise, investors will have no excuse for having stayed out of this energy bull market.

It was just this January when President Bush and Secretary of Energy Samuel Bodman both visited Saudi Arabia, asking our favorite oil royals to produce more black gold.

Bush said from the capital Riyadh that oil prices are "tough on our economy," pushing both him and Bodman to beg the Saudis for an OPEC-wide output hike.

This Wednesday, March 5, OPEC is going to meet again, and in all likelihood the 13-member cartel with 40% of the world’s black gold will not raise output.

The Saudis, with the world’s top oil production, did not come through. And the cold hard fact is, they can’t.

My colleague Luke Burgess of Gold World and Energy and Capital has shown in his research that Ghawar, the supergiant field responsible for 60% of Saudi oil production, has likely already entered into irreversible decline.

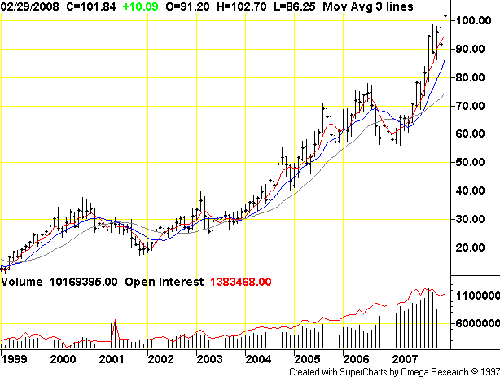

That means the oil price mountain we see below still won’t have a peak:

Saudis Call $60 Oil Bottom… Libya’s Comfortable With $100!

None other than Saudi Oil Minister Ali Al-Naimi said in a report over the weekend that oil prices are not going to fall below the $60-70 USD range, highlighting the increased exploitation of non-traditional fossil fuels like Canadian tar sands and renewable fuels like ethanol as setting a floor for the crude market.

U.S. oil inventories are down 21 million barrels from a year ago, but Naimi says it’s the rise in alternative fuels–not the huge drops in onshore production in the world’s top producing fields like Ghawar–that has created the $60-70 bottom.

"If you take into account all the subsidies involved in the production of a barrel of biofuels, I doubt whether anyone could make money from that with a [crude] price lower than $60 or $70," Algerian media quoted the minister as saying.

Past OPEC remarks from Saudi Arabia and elsewhere point to another factor for that minimum price–these countries want to milk their remaining reserves for the highest price they can get.

After an oil price pullback below $60 in autumn 2006, OPEC took steps to raise prices back to what they called "acceptable levels."

In late September of that year, Iran’s OPEC Governor Hossein Kazempour told official media, "Some OPEC members, by decreasing production, are trying to prevent the slide of oil prices."

"The Islamic Republic of Iran supports any effort by OPEC members to strengthen the oil market and return oil prices to an acceptable and logical level," Kazempour continued.

"No Complaint" about $100 Oil

The oil chief of OPEC member Libya, which has recently come in from the diplomatic cold and brought Africa’s largest oil reserves with it, said this weekend in Vienna that he has "no complaint" with $100 oil.

Shokri Ghanem, the head of Libya’s National Oil Corporation, had already told media on February 2 that he thought prices would "stay between 85 and 90 dollars," after February’s OPEC supply meeting.

This policy stance is likely to continue, creating several opportunities for individual investors to make money.

3 Ways to Invest in Rising Oil and Gasoline

Diverse energy sectors have reaped the benefits of this OPEC approach, with investments like the Wilder Hill Clean Energy ETF (AMEX:PBW) racking up 55% gains from last March through this January as oil prices soared skyward and created more appetite for alternative energy stocks.

The Oil Services HOLDRs ETF (AMEX:OIH) has also banked on rising oil prices, with that fund’s basket of companies getting paid more to drill deeper and farther offshore in places like Brazil, where the country’s national oil company Petrobras has located the 8 billion-barrel Tupi field under 7,060 feet of water, nearly 10,000 feet of sand and rocks, and another 6,600-foot thick layer of salt.

Petrobras (NYSE:PBR) is leading a pack of non-OPEC national oil companies that are enjoying huge spikes in investment every time OPEC fails to raise output.

My Global Growth Stocks subscribers have gained over 70% on PBR since my recommendation just last September!

Gasoline is going to keep rising because oil supplies in major producers are declining, and no amount of political pleading can change geology. But you can offset the pain at the pump with well-placed investments across the energy spectrum. We’ll keep you armed with the latest info and ways to profit.

Regards,

Sam Hopkins