Dear Reader,

In the world of commodities, there is lithium and there is everything else.

Lithium is a "technology" metal — an element without which the world of consumer and industrial tech simply would not run.

Unless you’ve been living under a rock for the last 30 years, you already know this.

It runs your phone. It runs your tablet and laptop. If you drive an EV, it runs your car. If you have solar panels in your house or pay for renewable energy, it also stores and helps run your day to day life.

Demand for lithium has just recently struck the universally sought-after "hockey stick" pattern, and prices have done the same thing, exploding from $10,000/ton to over $70,000/ ton in just two short years.

Investors couldn’t be happier of course, because when was the last time a commodity — any commodity — has seen 600% gains in half of a presidential term. Join Wealth Daily today for FREE. We’ll keep you on top of all the hottest investment ideas before they hit Wall Street. Become a member today, and get our latest free report: “How to Make Your Fortune in Stocks”The Best Free Investment You’ll Ever Make

It contains full details on why dividends are an amazing tool for growing your wealth.

Ever Meet a Poor Lithium Investor? Me Neither

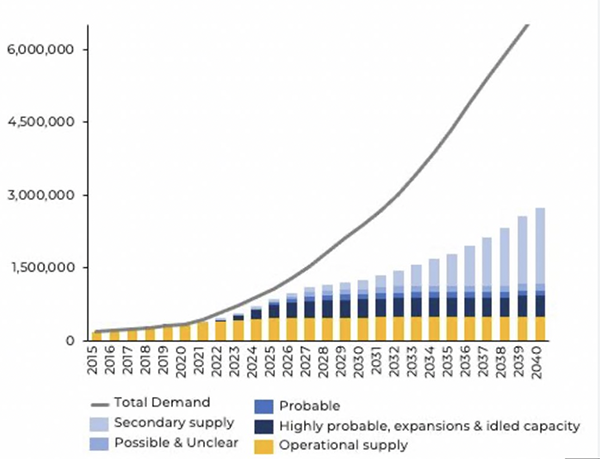

The problem is that while investors and speculators are counting their winnings, the business world is scratching its collective head looking at the chart you see below, trying to figure out where our next million tons of lithium is going to come from.

And this is a serious problem, because right now we’re on pace to quadruple demand — demand that, as of this year, we already can’t keep up with — by the end of the decade.

Most of that demand will be coming from the automotive sector, where the biggest shift in industrial history is set to take place in the next 5–7 years.

Just how profound is this shift? Here’s a quick example: Jaguar, the famous British automaker that made its reputation building the world’s sleekest, most desirable motorcars, just announced that it is canceling its entire gas-driven line by the year 2025.

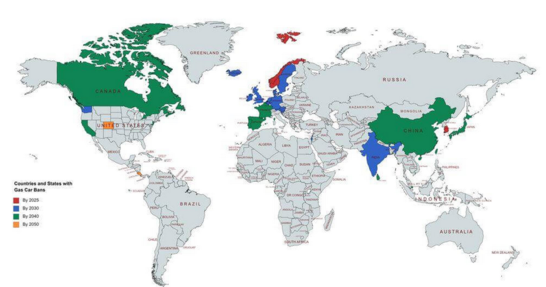

And that’s just one company. The same pledge is being made by entire European nations, starting with Norway, which has already put a mandate in place outlawing internal combustion vehicles. This is a country whose economy largely depends on its state-run oil industry… A country that produces more oil per capita than Saudi Arabia.

And in two years, they’re killing the internal combustion automobile.

Much of western Europe will follow suit by the end of the decade, with Asia and North American following closely behind.

To put it as concisely as possible: Lithium demand today is just a faint shadow of what it will be in the coming years, yet here we are, already unable to fill demand at current consumption rates.

The Problem: There Isn't Enough Lithium to Go Around

The answer to this catastrophe in the making cannot be more traditional lithium mining.

Why? Because lithium mining requires exploration, which takes years and cannot promise results.

Even after lithium is found, it takes additional years to mine it, refine it, and get it ready for battery production.

A lithium explorer going into business today stands virtually no chance of producing anything in volume for at least half a decade.

Which means if there is an answer, it has to be radical. It has to be a complete departure from everything we know as standard today.

Right now such a solution is coming together in northwestern Alberta, and its origins are as unlikely as can be imagined.

It’s there, on a 671-square-mile property operated by an oil and gas company, that the answer to our global lithium deficit sits waiting.

More than 4.3 million tons of the metal, dissolved in hundreds of brine ponds, is ready to be processed.

It’s been there for decades. We’ve known about it for decades. The one thing that’s been missing is a method for extracting the lithium.

From Fossil Fuel to Lithium in One Step

Earlier this year, that missing puzzle piece finally fell into place.

A Canadian company, founded and run by veterans of the petrochemical industry, has figured out a way to separate lithium from the rest of the solution at up to 97% efficiency.

No exploration. No mining. The brine is simply pumped through a filtration facility, the lithium is extracted, and the brine is returned to the pond for continued usage.

This lithium — and, by extension, the batteries that humanity thirsts for — literally comes as a byproduct of oil production.

Is it irony? Is it madness? Is it genius?

It could be all three, but the reality is, this newly formed company now holds the keys, and the rights, to harvesting a resource that’s worth $322 billion at today’s market prices.

And that 4.3 million tons of lithium is enough to fill global demand for up to three years, all by itself.

Amazing, right? Well, if you’re an investor, there are two more facts which could make you lightheaded.

First of all, this company is currently valued at just under $20 million — about 1/16,000 the value of the resource it’s legally contracted to extract.

How Does a Microcap Grow Into a Multibillion-Dollar Giant? Exactly Like This

And second, this company is less than a year away from initiating commercial production.

Traditional lithium refinement takes up to two years and involves a slow, excruciatingly inefficient evaporation process.

With this new extraction method, we could go from zero to salable lithium in less than 1/10th that time.

And because we know where all the lithium is, the process can be scaled and repeated over and over again until the entire resource is tapped.

Right now this company’s stock is trading in both Canada and the U.S. at just pennies.

Within 12 months, it could be trading in the dollars, but more likely, it will already be the target of a nine- or even 10-figure buyout by a major energy company.

Now, analysts and writers often throw around the buyout scenario as a potential exit strategy for early investors, but in this case, it’s far more likely than not.

You see, this company is already being approached by commercial end users. I’m talking about electric vehicle-makers, some of the biggest in the world, that are in a desperate search for a North American supplier.

The World Is Already Beating a Path to Its Door

Without it, these companies will have to deal with China, the world’s heavyweight champion of lithium production.

With it, they will have the freedom and flexibility to build the batteries they need to supply one of the fastest-growing markets in modern history.

That makes this microcap lithium producer among the most important companies in existence today, despite its miniscule valuation.

If you think I sound excited about this company, then you couldn’t be more right. I’m so excited that I went and bought a truckload of its stock on the open market.

I have no fear telling you that, because that’s how much I believe in its future.

I don’t intend on selling before the middle of next year, and likely, if the company's plans continue to progress toward its ultimate goal, I just may hold on for another year or two down the line.

Right now the timetable includes plans to scale up to 20,000 tons per year at an overhead cost of $3,000–$4,000 per ton.

If You Only Take One Big Swing This Year…

With a market price of over $70,000/ton, that annual production rate should yield over $1.4 billion in profit each and every year until the next ramp-up in production.

All of this from a company valued at just $20 million today.

You do the math. The potential here is unlike anything I’ve ever seen, and I’ve seen it all.

There’s a lot more information to digest, as you can imagine, so I went ahead and did the homework myself so that making the ultimate decision would be easier for my readers.

Want a look at my findings? Go right ahead.

It’s all there in plain English. Access is instant, and because you’re one of our valued Wealth Daily readers, it’s completely free of charge.

Fortune favors the bold, Alex Koyfman His flagship service, Microcap Insider, provides market-beating insights into some of the fastest moving, highest profit-potential companies available for public trading on the U.S. and Canadian exchanges. With more than 5 years of track record to back it up, Microcap Insider is the choice for the growth-minded investor. Alex contributes his thoughts and insights regularly to Energy and Capital. To learn more about Alex, click here.