For the past several months, I’ve been writing about the trend toward the electrification of the transportation industry — consumer adoption of electric vehicles (EVs) specifically.

But from some of the feedback I’ve seen, it seems like not everyone out there believes me.

Or maybe, as I hope is the case, you’ve just missed the nearly dozen articles in which I’ve explained the harsh reality of the EV revolution.

There will be no mass adoption. Period. Hard stop.

As I’ve explained in other selections, EVs just can’t compete on a level that will get them the mass adoption zealots and governments want them to get.

First and foremost, they’re not as dependable as gas-powered vehicles. You just can’t count on them getting you where you need to go in an emergency.

“I’ve Got to Wait HOW Long?!”

Think about it for a second. If you’ve got an emergency that requires you drive more than the range on your EV’s batteries, you’ll have to stop partway there to wait a few hours while it charges.

And that’s IF you can find a fast charger. If your only option is to plug into a regular outlet, you’ve got a potential three-day wait to get fully charged again.

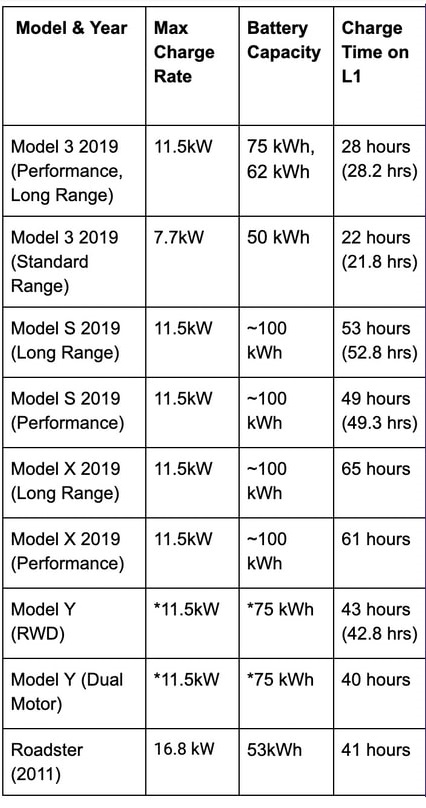

Yeah. That’s an accurate stat. I’m not pulling your leg. If all you can get is what they call “Level 1” charging, you’re looking at 65 hours to recharge a Tesla Model X.

If you’ve got a Model 3, you could get on the road a little faster. That “tank” fills up in a zippy 22 hours on a household charger.

Source: EVCharging and Enel X

But it’s not just the insanely long charging times that are preventing adoption. It’s the inadequate network of chargers out there open for the public to use.

I mean, there are tens of thousands of home chargers out there, but good luck pulling up at a stranger’s house to “top off.”

Eventually, there will be more available to the public, but that’s not helping us right now. And it’s not going to happen fast enough to meet the 2030s timelines all those governments have set in their pledges to ban fossil fuels.

“Wait, It Might Blow Up?!”

Long charge times and short ranges aren’t the only things holding EV adoption back. They’re just a couple of the things. There’s also the safety issue.

I’ve discussed that before, but it bears mentioning again: lithium-ion batteries (the ones powering EVs) have a tendency to explode from time to time.

It’s a design flaw. But there’s no way around it other than making the walls as strong as possible to take the pressure.

You see, lithium-ion batteries, while exceptional pieces of technology, are flawed by design. In order to store and then discharge electricity, they have to be made of a liquid core.

Liquids expand and contract far more than solids when they get hot or cold. And when you’ve got a heavy load on a battery, it tends to heat up… a LOT.

If the battery can’t hold the expansion, the liquid explodes out and the combustible metals react with the air they’re now exposed to and erupt violently.

It’s not a pretty sight or, I imagine, a fun experience.

So they make the walls of the battery as thick as possible. But thick walls plus liquid core equals really heavy. And they still explode sometimes, as you can see with this Tesla:

Well, what if there were a battery that didn’t explode or a way to make batteries safer without making them weigh a ton?

Join Wealth Daily today for FREE. We’ll keep you on top of all the hottest investment ideas before they hit Wall Street. Become a member today, and get our latest free report: “Battery Technology and Energy Storage Investing for 2022”

.

After getting your report, you’ll begin receiving the e-Letter, delivered to your inbox daily.

“And It’s Gonna Cost HOW Much?!”

But, again, that’s not the only thing holding back the EV revolution we’ve all heard so much about. There’s also the cost of the vehicles. And in particular the cost of the batteries powering them.

You see, the reason it’s nearly impossible to make an EV that costs as little as or less than a gas-powered car is because the components of the batteries are really expensive.

Lithium costs $15.25 per kilo and there are about 10 kilos of lithium in each EV battery. There’s also the graphite. It costs as much as $620 a kilo and there are about 70 kilos in each battery.

Then there’s the cobalt. EV batteries can have as much as 20 kg of cobalt per 100 kilowatt-hour pack. There are 10 of those in an average EV, so that means there can be up to 200 kg of cobalt per car. And cobalt cost around $80 a kilo.

Add it all up and there’s a pretty hefty price tag just to assemble the materials for an EV battery, let alone actually manufacture it.

That’s why EV owners need to be ready for a battery replacement price tag of up to $10,000 in some cases.

And replace those batteries they will. On average, an EV battery loses a few percent of capacity every year. Technically it’s every charge, but that’s too small an amount to measure.

And the drop each year may go unnoticed at first as well.

But as the years go on and the battery keeps losing capacity, all of a sudden you’re going to notice you can only go a couple hundred miles when you used to have a range of 400.

Source: TrueCar.com

It’s going to be a tough sell at the dealership when you realize you’re paying for a car that goes less and less distance every time you drive it. Especially in an expansive country like this.

But now there’s a battery that holds up to the miles, one that holds its capacity through tens of thousands of charging and use cycles.

The Bottom Line

You know me. I’m a conservationist if ever there was one. Not because I think it’s noble, but because I enjoy being outside. It’s completely selfish, and that’s OK.

I’m pretty sure Teddy Roosevelt only shared the national parks because Congress would never approve a private playground that big for any president.

So I hope we find a way to get away from powering our cars with fossil fuels. But I know it’s not going to be EVs as long as we’re still driving them with technology invented in the 1970s.

We need a breakthrough. And I’ve found one company that’s made just that: a breakthrough of epic proportions.

I want you to be in on the ground floor as an investor in this company because I know it’s got life-changing potential written all over it.

I want you to change your life. I want you to be able to have the most comfortable one you can imagine.

I want you on a beach sipping tropical drinks with little umbrellas in them. And if you’re already on a beach with a fancy drink, I want you to have two of them and a boat just offshore.

And I really think this company has the kind of potential to turn a relatively modest investment now into a real fortune down the road.

That’s why I took a lot of time to put together a special presentation all about the opportunity:

But the thing is that time is of the essence here, and maybe more than with other investments.

Because more and more people are finding out about this company and its groundbreaking discovery every day.

And they’re spreading the word to their friends. That added interest is going to drive the share price up. And the further it goes, the smaller your potential profits will be.

So take a little time out of your day today to watch my presentation.

Or, if you prefer to read a little more, you can also get access to a written report by clicking here.

Both have the same information. How you get it doesn’t matter. That you get it does.

Like I said, I want you in on the ground floor. And I see the elevator doors closing.

So I just want to make sure you get a chance to get on board before we start the trip up.

Click here now to learn all about this incredible technology and how you can get invested in the company behind it.

Maybe I’ll see you on the beach in a year or two if you do.

To your wealth,

Jason Williams

After graduating Cum Laude in finance and economics, Jason designed and analyzed complex projects for the U.S. Army. He made the jump to the private sector as an investment banking analyst at Morgan Stanley, where he eventually led his own team responsible for billions of dollars in daily trading. Jason left Wall Street to found his own investment office and now shares the strategies he used and the network he built with you. Jason is the founder of Main Street Ventures, a pre-IPO investment newsletter; the founder of Future Giants, a nano cap investing service; and authors The Wealth Advisory income stock newsletter. He is also the managing editor of Wealth Daily. To learn more about Jason, click here.

Want to hear more from Jason? Sign up to receive emails directly from him ranging from market commentaries to opportunities that he has his eye on.

@TheReal_JayDubs

@TheReal_JayDubs Angel Research on Youtube

Angel Research on Youtube