The Investment That Has Musk and Zuckerberg at War

Mark Zuckerberg and Elon Musk are fighting like teenage girls over this one $20 billion industry.

You heard me right.

On Tuesday, Facebook’s founder openly berated the Tesla CEO for statements about one rapidly growing technology investment.

Musk fired back, saying that Zuckerberg had a “limited understanding” of the industry.

All gossip aside, the industry Musk and Zuckerberg are fighting over is actually worth the fuss.

It could make investors gains unseen since the birth of the internet.

What has these two millionaires so worked up is artificial intelligence (AI), a rapidly developing technology industry that will likely power dozens of massive companies for years to come.

Musk is against it, while Zuckerberg is all for it.

The Facebook CEO points out that artificial intelligence will power the autonomous car industry, health care, social media, etc.

And he’s right. At the moment, dozens of technology companies are racing toward AI.

That’s why companies like Apple, IBM, and Microsoft are all trying to lock down artificial intelligence: They know they are sitting on a profit landslide.

If investors can take one thing away from Musk and Zuckerberg’s squabble, it’s this…

It doesn’t matter if the technology community is divided about artificial intelligence. One thing is certain: The multibillion-dollar AI industry is coming, and it’s coming fast.

That means at this stage, the only thing investors should fear is missing out on profits.

Luckily, there are a few ways you can start investing in artificial intelligence today.

There are dozens of established companies busy tinkering with artificial intelligence.

But I also want to tell you about one small penny-stock company poised to overtake these industry leaders.

Investing in the “Picks and Shovels” Behind the AI Boom

Perhaps you guessed that artificial intelligence was going to be huge and were waiting for a chance to jump in. 2017 may be your last chance.

We are currently hurtling toward dynamic industry growth.

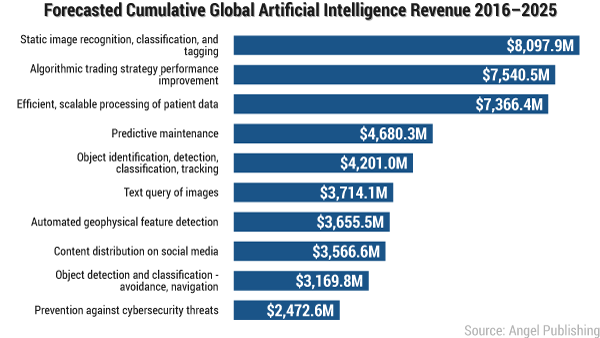

Analysts expect spending in the artificial intelligence sector to hit $46 billion by 2020. The chart below illustrates spending in just a handful of sectors.

We’ve only spent $12.5 billion this year…. meaning spending is set to more than triple.

And that has investors out looking for a profit.

It’s just too bad that many of them are going about it the wrong way.

Less imaginative investors will buy stock in companies like Facebook and Google. This will likely generate modest returns. But more than likely they are going to be disappointed. Unfortunately, investing in big companies is cutting a very small profit slice from a multibillion-dollar industry.

You see, if history has taught us anything about investing, it’s that mega-companies aren’t the best investment if you are looking to profit on emerging technologies.

These companies will do fairly well, but since they are established, the profit potential is limited.

The Best Free Investment You’ll Ever Make

Join Wealth Daily today for FREE. We’ll keep you on top of all the hottest investment ideas before they hit Wall Street. When you become a member today, you’ll get our latest free report: “The Nvidia Killer: Unlocking the $100 Trillion AI Boom.”

It contains the most promising AI companies and sectors poised for explosive growth. Our team of expert analysts has conducted thorough market research to uncover a hidden gem currently trading at just $2.

After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox daily.

The same is not true of the small companies that provide the “picks and shovels” powering major technology trends.

These companies make a killing in developing sectors because they provide crucial technology to a wide range of suppliers.

This approach allows small companies to pave a path to future profits.

At the birth of our internet age, investors who put money into companies powering technology giants saw massive returns — some topping 2,000%.

And it all happened in a matter of months.

Artificial intelligence provides the perfect opportunity for this trend to repeat itself.

At this point, we are deep enough in the AI game that some of these small companies have already made an appearance.

I am going to tell you about one such company in a minute. (This company is already producing technology for Amazon’s artificial intelligence robot Alexa!)

But first, I want to highlight some other “picks and shovels” profits already seen in the AI industry.

You see, as Musk and Zuckerberg squabble about how to implement AI, these industries are already turning a profit.

Robots: A Literal Profit Machine

In the artificial intelligence sector, a handful of companies are meeting one of the greatest demands of the early AI sector: robotic hardware.

At the start of 2017, dozens of analysts made a bold prediction. They said we had entered the year of the robot.

This prediction proved to be a lucrative one. With the race to unlock AI heating up, more and more companies are forging partnerships with capable robotic hardware producers.

That’s why robotics- and artificial intelligence-focused ETFs outperformed the Dow.

One of these ETFs, the Global X Robotics and Artificial Intelligence ETF, is up by over 30% since the start of this year. That’s roughly three times the Dow Industrial Average’s 9% rise.

That ETF hosts a collection of international corporations that are providing crucial technologies to mega-giants trying to implement AI.

Proponents of the technology think these stocks could soon unseat the stocks of million-dollar companies like Facebook, Amazon, Netflix, and Alphabet.

Of course, you may have failed to invest in the robotics sector.

In all fairness, you probably weren’t aware it was about to surge.

Unless you’re inspecting the technology sector every day, it’s hard to locate the companies that will make an impact in the future.

But if you are having some investor regret after hearing about those gains, I have good news for you.

The small company I talked about earlier is still in its early stages. And the technology it produces is so major, it could be far more lucrative than the robotics sector…

The Small Company Powering Apple, Amazon, and Samsung

The company I am about to tell you about is already the darling of technology giants like Amazon.

In fact, without this company’s landmark technology, Amazon wouldn’t be able to create its home device Alexa.

This small company controls 59% of its market, making it the obvious choice for technology giants who need its crucial technology to pioneer AI.

In fact, the division of the artificial intelligence movement it is powering is expected to grow by $127.6 billion by 2024.

If you want to learn more about this stock, click here.

Alexandra Perry @AlexandraPerryC on Twitter

@AlexandraPerryC on Twitter

Alexandra Perry is a contributing analyst for Wealth Daily and Energy and Capital. She has multiple years of experience working with startup companies, primarily focusing on artificial intelligence, cybersecurity, alternative energy, and biotech. Her take on investing is simple: a new age of investor can make monumental returns by investing in emerging industries and foundational startup ventures.

The Best Free Investment You'll Ever Make

We never spam! View our Privacy Policy

After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox daily.