There’s a massive shift underway in the automotive market. It’s still in its infancy now, but over the next few decades, it’s going to change everything we know about passenger vehicles.

I’m of course talking about the evolution of electric vehicles (EVs)…

Just a few years ago, there were barely any EVs on the road. Today, there are around 2 million. But when it comes to the total number of passenger vehicles out there, that’s not even a drop in the bucket.

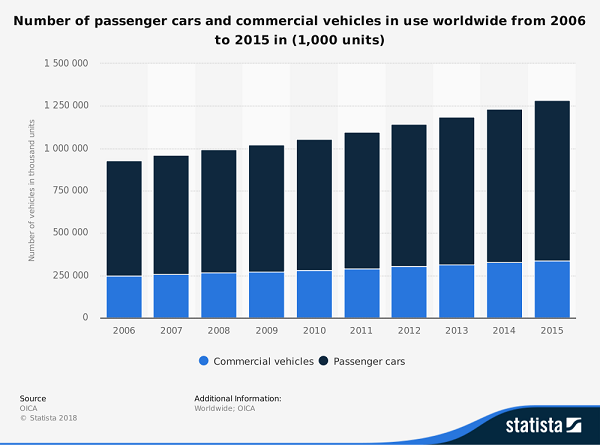

You see, as of 2016, there were over 1 billion cars on the road. Over 947 million of them were passenger vehicles. That’s 40% more than just a decade earlier, or a compound average growth rate (CAGR) of about 4% a year.

While 4% a year may not seem that impressive, it adds up to an additional 33 million vehicles a year.

As the global population has grown, so has that number. And with the middle class continuing to expand in developing countries like China and India, that growth isn’t slowing anytime soon. If anything, it will accelerate even faster.

And there’s a huge opportunity brewing just under the surface that could make investors as much as $126,400 for every $1,000 invested.

Two Going on Twenty

That’s because more and more people are going to make the switch to EVs in the coming years. The vehicles are getting closer and closer to cost equilibrium with traditional internal combustion engine (ICE) vehicles.

And the batteries that power them are getting more and more efficient. Soon they’ll provide as much power, as long of a range, and less downtime than their ICE brethren. And once it costs the same — or even less — to own an EV, and they give you the same convenience as an ICE, there’s really no reason not to.

You’ll remember I pointed out that there are already over 2 million EVs on the road today. But that’s not even 1% of the global market. Those 2 million EVs only account for 0.20% of all passenger vehicles out there.

If that number moves up to 1%, which it will, that’ll be about 7.5 million more EVs. And 1% is an extremely conservative figure. China wants all the vehicles within its borders to be electric. Other countries with massive populations of drivers do, too.

If just China were to switch to EVs, that’s a whopping 21.15 million new EVs hitting the road each year. And that’s going to drive the stock of every company involved through the roof.

Never Too Late

But the thing is, most of the companies involved in this burgeoning industry have already seen their stocks double, triple, even quadruple, as excitement about the future of this brand-new market has exploded.

Tesla shares currently cost nearly $350 each after running up more than 900% in the past five years. General Mining Corp., a lithium producer, soared more than 12,500% between 2015 and 2016.

And General Mining wasn’t the only lithium producer to explode thanks to interest in EVs…

Nearly every company with a hand in extracting or refining lithium for the EV market grew by triple or quadruple digits.

I’m talking about gains like:

- 1,553% on Galaxy Resources Limited

- 700% on Dakota Minerals

- 325% on Prospect Resources

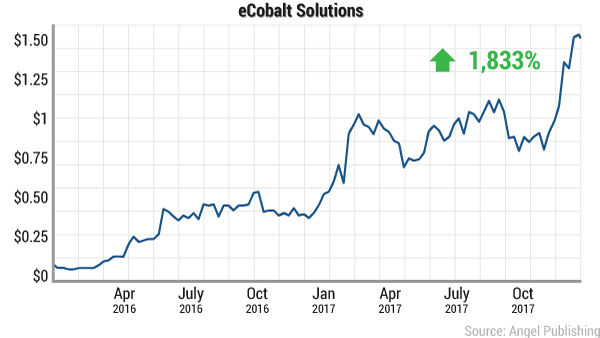

But then another metal came into focus. It was being added to batteries to extend their driving range. It was called cobalt. And nearly every company with a connection to cobalt has already seen massive gains.

Join Wealth Daily today for FREE. We’ll keep you on top of all the hottest investment ideas before they hit Wall Street. Become a member today, and get our latest free report: “Investing in Rare Earth Stocks.”

It contains full details on how you should be investing in rare earths.

After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox daily.

eCobalt Solutions was the only company mining cobalt near Tesla’s Gigafactory. And thanks to its location and the new interest in anything cobalt-related, eCobalt’s share price skyrocketed from less than a quarter to over a dollar. That’s a 1,833% gain in just 19 months.

But again, eCobalt wasn’t the only company to ride the new wave of interest in cobalt investments. Katanga Mining, once touted as potentially becoming the “world’s largest cobalt producer,” followed the same trajectory and rose nearly 1,000% in less than a year.

And like the lithium boom, there were many other companies that returned triple-digit gains in practically no time at all:

- 316% on Fortune Minerals Limited

- 276% on Lundin Mining Corporation

- 221% on First Quantum Minerals Limited

Same Dance, Different Song

All you had to do was spot the pattern:

EVs broke into the market with lithium batteries. And companies involved in the lithium business returned millions of dollars in profits.

But EVs didn’t drive far enough on a single charge. So cobalt was introduced to the batteries to extend their range. And cobalt operations became ridiculously profitable. Investors again rode a wave of gains thanks to the EV market.

Now, with the lithium/cobalt combination, we’ve got EVs that can travel hundreds of miles on a single charge, just like ICEs on a single tank of gas. But, unlike ICEs, it takes hours to “refuel” your EV. You can’t just stop at a filling station and top off while you grab a snack or a drink from inside.

And that’s the next challenge for EVs. We need that extended range if they’re going to replace ICEs on the road. But we also need to be able to recharge them faster so we can get back on the road on long trips.

So now it’s time for another rare metal — like lithium and cobalt before it — to become the darling of EV investors. And my colleague Jason Stutman, managing editor of The Cutting Edge and Technology and Opportunity, figured out what metal that’s going to be.

He spotted the pattern with EVs long ago and has helped his readers turn massive profits in the industry already. But he’s convinced — and he’s got me convinced — that the rally about to hit this metal is going to put those in lithium and cobalt to shame.

And not only has Jason zeroed in on the metal that will lead EVs to overtake traditional vehicles, but his research also pointed him to a company that’s poised to become the biggest beneficiary in this building rally.

The $1 Stock Worth $17 Billion

It’s a tiny company that trades for just $1. That gives it a market cap around just $70 million. But it’s sitting on an energy goldmine worth $17.6 billion!

That means you can buy shares for less than 1% of what the assets they represent are worth. Think about that for a minute… Before the stock even moves up, you already own about $250 worth of this rare metal that’s going to change the world.

You pay $1 and you get $250 in return. Sounds like a sweet deal to me. But it gets even better.

You see, this company has a monopoly on the only supply of this metal in the U.S. And with executives like Elon Musk vowing to source as much as possible from the U.S., that makes this little company a big-time player.

There’s no reason the gains here won’t be as big as the ones I mentioned earlier. And I’m talking about the 12,000% gain, not just those still-impressive triple-digit ones.

This investment has the potential to turn every $1,000 you invest into over $126,000. And it could happen even faster than it did with General Mining. I’m talking about a five-digit profit in less than a year!

That’s the kind of opportunity most of us spend our entire lives searching for. And with just a simple click of your mouse, you’ll cut out all the hard work and skip right to the profits.

Jason’s put together a report that details the ins and outs of this stellar investment. After reading it, you’ll know everything we do about this massive opportunity, and you’ll be ready to invest and start watching your profits grow.

I highly recommend you take a little bit of time out of your day and read about what Jason’s discovered. You’ll be thanking yourself that you did when this company goes from miniscule miner to industry titan practically overnight.

To your wealth,

To your wealth,

Jason Williams

After graduating Cum Laude in finance and economics, Jason designed and analyzed complex projects for the U.S. Army. He made the jump to the private sector as an investment banking analyst at Morgan Stanley, where he eventually led his own team responsible for billions of dollars in daily trading. Jason left Wall Street to found his own investment office and now shares the strategies he used and the network he built with you. Jason is the founder of Main Street Ventures, a pre-IPO investment newsletter; the founder of Future Giants, a nano cap investing service; and authors The Wealth Advisory income stock newsletter. He is also the managing editor of Wealth Daily. To learn more about Jason, click here.

Want to hear more from Jason? Sign up to receive emails directly from him ranging from market commentaries to opportunities that he has his eye on.

@TheReal_JayDubs

@TheReal_JayDubs Angel Research on Youtube

Angel Research on Youtube