The Future of Money Has a New Name — and It's Sparkling

For thousands of years, gold has been the ultimate symbol of wealth, power, and trust.

From ancient kings hoarding bars in royal vaults to central banks stacking it by the ton, gold has always held a special place in the financial world.

But recently, it’s been doing more than just sitting pretty. Gold has surged back into the spotlight with a vengeance.

Prices are pushing up toward all-time highs again, driven by inflation worries, rising geopolitical tension, and a growing distrust in fiat currencies. When the world gets shaky, gold shines brightest — and investors are waking up to that truth once again.

Why?

Because gold doesn’t need a central bank’s permission to hold value.

It doesn’t care about interest rate policies or political agendas.

It simply is what it is — a scarce, tangible store of wealth.

And in an age of mounting debt, currency debasement, and central bank flip-flops, that kind of reliability is in high demand.

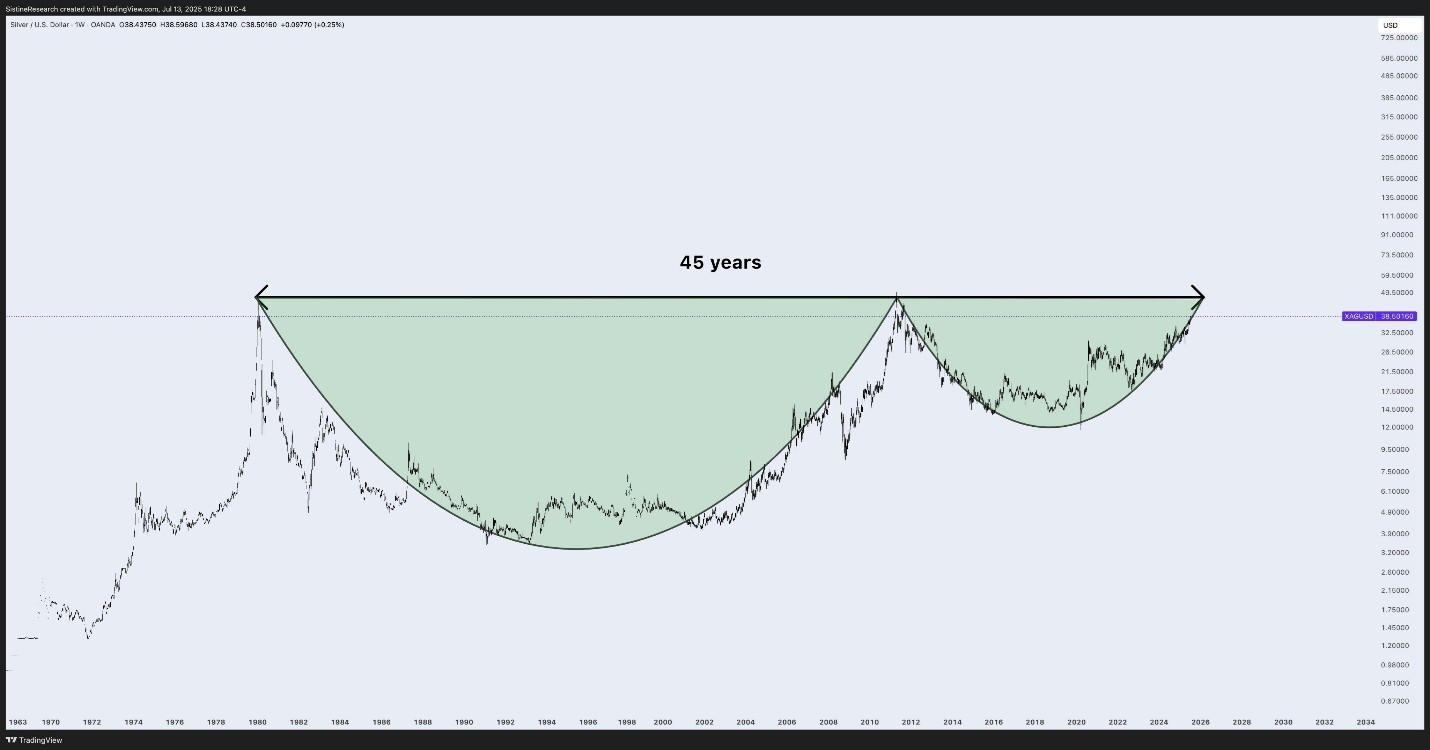

Silver’s Breakout From a 45-Year Slumber

While gold has been stealing the headlines, silver has quietly been preparing for its own long-overdue breakout.

And technically speaking, silver just pulled off one of the most important moves in modern chart history — breaking free from a 45-year cup and handle pattern.

If that sounds like gibberish to you, here’s the short version: This is a textbook pattern that suggests explosive upside potential.

The last time silver broke out like this was in 2010, and within a year it soared from $18 to nearly $50 an ounce. And that was after a far shorter pattern broke.

We’re not saying history will repeat exactly. But silver’s fundamentals are stronger than ever…

Industrial demand is growing thanks to electric vehicles, solar panels, and a global electrification boom.

Investors are piling in as a cheaper way to play the precious metals rally.

And now, with the technicals flashing green, silver might finally be ready to follow gold’s lead in a big way — and then some.

The Best Free Investment You’ll Ever Make

Join Wealth Daily today for FREE. We”ll keep you on top of all the hottest investment ideas before they hit Wall Street. Become a member today, and get our latest free report: “A Maverick’s Guide to Gold: 3 Gold Stocks Set to Disrupt the Market”

It contains full details on something incredibly important that’s unfolding and affecting how gold is classified as an investment..

After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox daily.

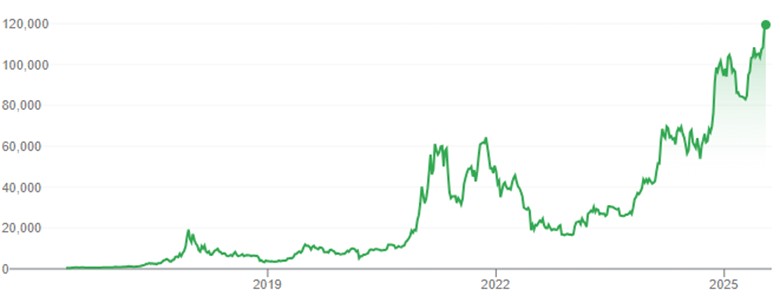

Bitcoin Hits the Stratosphere

Now, let’s talk about the rebel of the financial world: Bitcoin.

Once considered a fringe idea cooked up by a few cyberpunks, Bitcoin has officially gone mainstream. And not just mainstream… it’s gone dominant.

As of this writing, Bitcoin has shattered expectations and soared to a record-smashing high above $120,000.

It’s not just retail investors driving this move. Institutions are pouring in too.

Spot ETFs have opened the floodgates. And big-name firms are now allocating real capital to what was once dismissed as “magic internet money.”

Why? Because people are hungry for sound money.

Bitcoin has a fixed supply. It’s decentralized. It can move across borders at the speed of light. It’s fast becoming the digital store of value for the modern age.

But even with all its strengths, Bitcoin isn’t perfect.

It’s volatile. It’s not backed by anything tangible. And when the internet goes down, your Bitcoin wallet is basically locked in a vault with no key.

Still, the message is clear: The world wants something new.

Something better than dollars.

Something more trustworthy than central banks.

Something more versatile than just shiny metal or digital code.

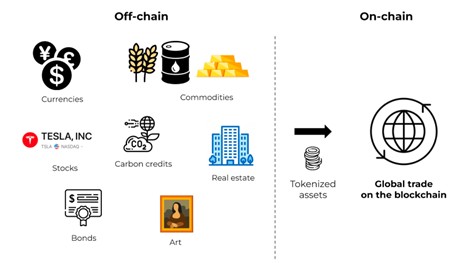

Tokenization Is Changing Everything

This brings us to a much bigger transformation — one that’s changing how we think about value altogether.

In simple terms, tokenization is the process of turning real-world assets — like stocks, real estate, or precious metals — into digital tokens that live on a blockchain.

These tokens can be traded 24/7.

They can be moved instantly and globally.

And they can be programmed with smart contracts to handle all sorts of complex transactions automatically.

This is not sci-fi anymore. This is happening now.

Major banks are launching tokenized treasuries.

Real estate funds are experimenting with tokenized shares.

Even governments are looking at issuing tokenized bonds and digital currencies.

And the holy grail of all this? Tokenized commodities — especially gold.

NatGold: The Digital Asset That Changes the Game

Now imagine this: Take the reliability of gold — a scarce, globally recognized store of value. Combine it with the efficiency, flexibility, and borderless nature of digital assets like bitcoin.

Make it real, tangible, and auditable. Back every digital token with verified in-ground gold, not some vague promise or piece of paper.

That’s NatGold.

NatGold is a brand-new digital asset designed for the new financial world.

It’s backed one-to-one by verified, NI 43-101- or JORC-compliant gold resources still in the ground.

This isn’t gold sitting in a vault or a warehouse somewhere that could be raided, rehypothecated, taxed, or manipulated.

This is gold that’s already been discovered, already confirmed, but is still locked beneath the Earth in politically stable jurisdictions like the United States — with full ownership rights secured.

NatGold is designed to give you all the upside of real gold with all the versatility of Bitcoin.

You can trade it. You can transfer it. You can store it on your phone.

And thanks to blockchain verification, you don’t have to trust anyone — you can verify everything.

It’s the best of both worlds. The security of physical gold and the freedom of digital currency.

Why Now Is the Moment to Get In

Now, I want you to think back to the early days of Bitcoin…

Before the institutions. Before the media frenzy.

When it was still just a strange idea with a handful of believers.

That’s where we are with NatGold right now.

The difference? This time, the asset is backed by something the world already trusts: gold.

And it’s not just a concept. It’s already happening — and it’s here now. Global pre-market demand is absolutely surging!

As of July 16, 2025, 2,076 individuals in 94 countries have reserved 13,705 NatGold Tokens for pre-market trading, representing nearly $24 million in gross demand.

And momentum is only accelerating…

When investors realize they can own verified gold on-chain with full transparency and zero counterparty risk — it’s game over for paper currencies and paper gold.

The Bottom Line: Stake Your Claim Before the Crowd

Gold is rising. Silver is breaking out. Bitcoin has gone parabolic.

And the world is moving toward tokenized, digital-first assets that cut out the middlemen and put control back into your hands.

NatGold brings it all together.

This is your chance to be early. To get in before the headlines…

Before the institutions flood in. Before NatGold becomes the standard unit of account for a digital global economy.

If you missed the first Bitcoin run… if you missed the gold bull market… if you’re just now waking up to silver’s potential…

You’ve got one more shot.

Stake your claim on NatGold today — and own a piece of the future before the future arrives.

To your wealth,

Jason Williams

After graduating Cum Laude in finance and economics, Jason designed and analyzed complex projects for the U.S. Army. He made the jump to the private sector as an investment banking analyst at Morgan Stanley, where he eventually led his own team responsible for billions of dollars in daily trading. Jason left Wall Street to found his own investment office and now shares the strategies he used and the network he built with you. Jason is the founder of Main Street Ventures, a pre-IPO investment newsletter; the founder of Future Giants, a nano cap investing service; and authors The Wealth Advisory income stock newsletter. He is also the managing editor of Wealth Daily. To learn more about Jason, click here.

Want to hear more from Jason? Sign up to receive emails directly from him ranging from market commentaries to opportunities that he has his eye on.

The Best Free Investment You'll Ever Make

We never spam! View our Privacy Policy

After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox daily.

@TheReal_JayDubs

@TheReal_JayDubs Angel Research on Youtube

Angel Research on Youtube