The Bioengineering Breakthrough That Could Mint Millions

If you’ve been around the markets long enough, you know real wealth doesn’t come from chasing the headlines. By the time CNBC is blasting an idea across the ticker, the big money has already been made.

The true fortunes are built when someone sees a world-changing breakthrough before it becomes obvious — and takes a stake while the rest of the crowd is still yawning.

Right now that breakthrough is called bioengineering. And it’s about to turn the way we think about health, medicine, and even human longevity completely upside down.

We’re not talking about incremental improvements or some niche treatment for a single disease here, either…

Bioengineering is rewriting the rules of biology itself. It’s the marriage of advanced computing power, AI, and genetic science — essentially transforming scientists into software engineers who can write, edit, and debug the very code of life.

And if that doesn’t get your investor radar humming, it should. Because this isn’t just the future of medicine — it’s the future of trillion-dollar industries.

From Fantasy to Fortune

For decades, the dream of custom-designed cures lived mostly in science fiction…

Imagine a world where instead of a blanket prescription, doctors could treat you with a therapy designed specifically for your DNA. Or where a genetic disorder can be “patched” as easily as fixing a bug in a smartphone app.

That dream is becoming reality. The field has already produced therapies that cure previously untreatable diseases, extend life spans in lab models, and open doors to human enhancement that would have sounded crazy even five years ago.

Take sickle-cell disease, a painful and often life-shortening condition that until recently had no real cure. Today, thanks to gene-editing therapies like CRISPR-based treatments, patients are walking away with their lives back.

Or look at CAR-T cell therapy, where a patient’s own immune cells are engineered to hunt down and destroy cancer cells. For some leukemia and lymphoma patients, that has meant complete remission after all other options failed.

Then there’s the work being done on Duchenne muscular dystrophy, a brutal genetic disease that leaves young boys in wheelchairs. New bioengineered therapies are already restoring mobility in clinical trials — something families never thought they’d see.

And in the lab, scientists have managed to extend the life spans of mice by as much as 30% using gene-editing techniques designed to repair cellular damage. Human applications may not be far behind.

So if you’re getting the sense that this isn’t “business as usual” medicine — you’re right.

This is a new frontier, and it’s moving fast.

The Best Free Investment You’ll Ever Make

Join Wealth Daily today for FREE. We’ll keep you on top of all the hottest investment ideas before they hit Wall Street. Become a member today, and get our latest free report: “How to Make Your Fortune in Stocks”

It contains full details on why dividends are an amazing tool for growing your wealth.

The Money Already Moving

The smart money has already noticed…

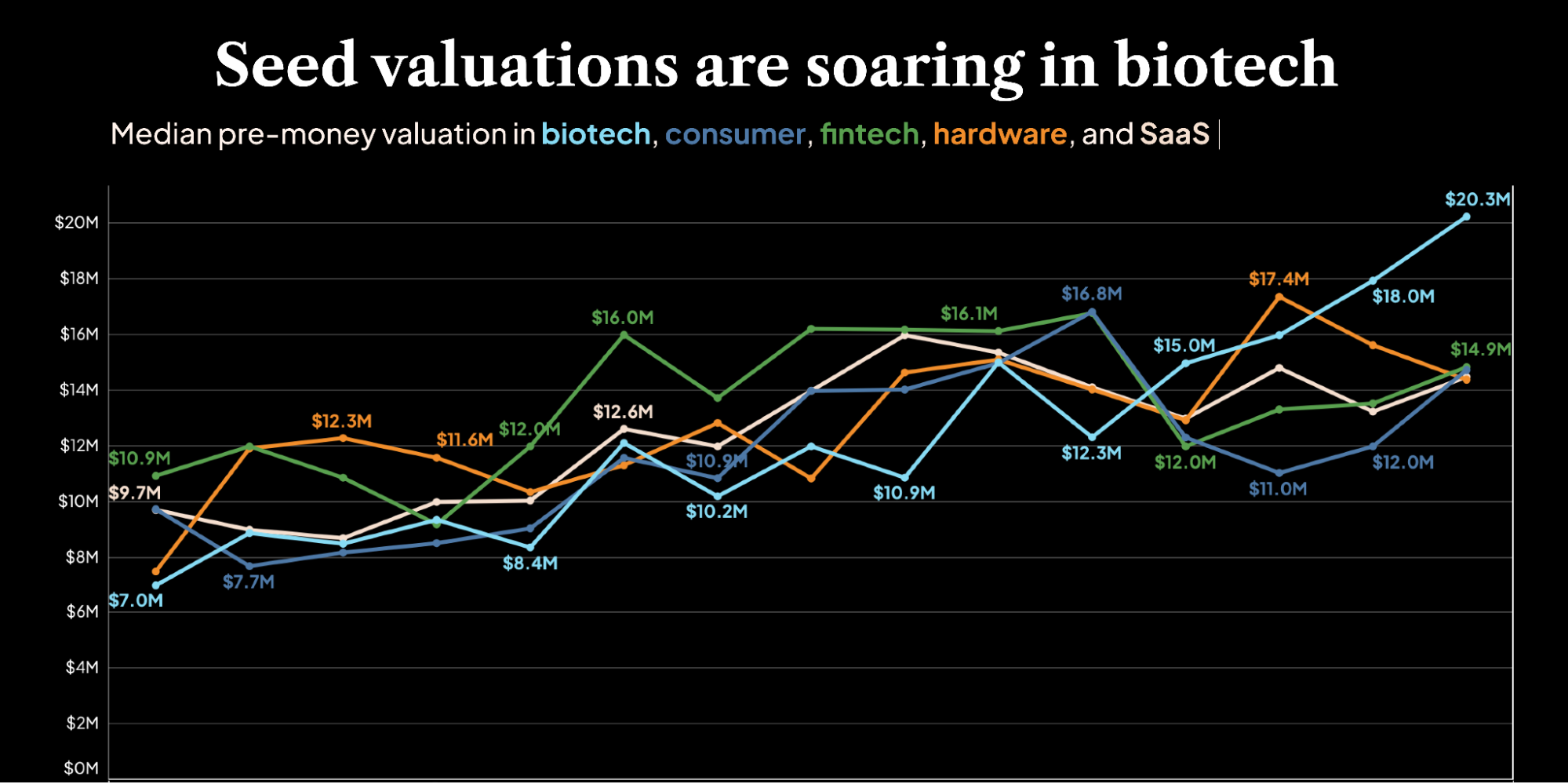

Venture capital firms have been pouring tens of billions of dollars into bioengineering startups for years, and the pace is only accelerating.

Governments are jumping in too — because whoever controls this technology will control the future of health care, defense, and food security.

And Wall Street’s biggest names are quietly positioning themselves to ride this wave before the public catches on.

That should tell you everything you need to know…

Because history shows that when transformative technologies hit this stage — when they shift from the labs to the boardrooms — the early investors can make life-changing gains.

Think about the internet in the '90s. Or smartphones in the 2000s. Or AI just a few years ago….

Bioengineering is on that same trajectory, only faster and potentially even more profitable.

The Scale of the Opportunity

Here’s the part most people don’t get: This isn’t just a “healthcare” story…

The total addressable market here is almost comically massive. Analysts estimate that bioengineering could touch more than $4 trillion in annual global economic activity within the next decade.

That’s not some pie-in-the-sky projection — it’s baked into the trends we’re already seeing…

Pharma companies are retooling pipelines to focus on genetic therapies. Food giants are experimenting with bioengineered crops and proteins.

Energy firms are investing in biotech approaches to clean fuels. And the military is exploring bioengineering for everything from advanced medical kits to battlefield survival.

This is bigger than a single industry. It’s an entire economy waiting to be remade. And investors who stake their claim now are the ones who stand to reap the biggest windfalls.

Why Now?

Timing is everything. And bioengineering’s inflection point is here.

The technology is ready. Costs have fallen. AI has provided the horsepower to run simulations and test therapies at breakneck speed.

Regulatory agencies, once a major bottleneck, are now accelerating approvals as the benefits become too obvious to ignore.

Meanwhile, the demand side is exploding at the exact same time…

The world’s population is aging, healthcare costs are soaring, and patients are demanding solutions that actually work — not just expensive maintenance drugs that mask symptoms.

Bioengineering answers all those needs in one package.

That’s why I believe we’re standing on the ground floor of a once-in-a-generation investment wave.

The Companies Leading the Charge

Now, here’s where it gets really interesting…

While Big Pharma will certainly play a role, the real upside lies with the smaller, more innovative players leading the charge in bioengineering breakthroughs.

These are the companies with cutting-edge intellectual property, nimble leadership teams, and the ability to outmaneuver slower, bloated giants.

Some are already making headlines for curing genetic disorders in clinical trials. Others are developing platform technologies that could generate dozens of new therapies in the coming years.

And a few are working on applications so radical — like reversing aging — that their valuations could skyrocket if they even get halfway there.

This isn’t about throwing darts at the biotech sector.

It’s about identifying the firms at the forefront of the bioengineering revolution and getting in while the market still undervalues them.

A New Investment Playbook

Here’s the bottom line: Bioengineering isn’t just another biotech trend. It’s a new playbook for human health and wealth creation.

The combination of AI, genetic science, and bio-manufacturing is creating an investment landscape unlike anything we’ve seen before.

Early investors could see venture capital-style gains on public markets. The kind of asymmetric returns that turn modest positions into serious fortunes.

But as with all revolutions, timing is critical…

Wait too long and the biggest profits will be gone. Get in now and you could ride the crest of this wave as it transforms the global economy.

Your Next Step

That’s why we’ve prepared a special report dedicated to this opportunity.

It covers everything you need to know about bioengineering, the scale of the profit potential, and — most importantly — the companies leading the charge.

I’ll be blunt: You don’t want to sit this one out.

Just like investors who dismissed the early days of the internet, there will be plenty of people who scoff until it’s too late. Don’t be one of them.

Instead, get the facts. See for yourself how bioengineering is set to create wealth on a scale we haven’t witnessed in decades.

And learn about the companies already positioning themselves to dominate the space.

Because if history is any guide, the people who move first will be the ones telling the stories of life-changing gains a few years from now. And I want you to be one of them.

So click here to access the full report now — and discover how you can stake your claim in the bioengineering revolution before the rest of Wall Street wakes up.

To your wealth,

Jason Williams

After graduating Cum Laude in finance and economics, Jason designed and analyzed complex projects for the U.S. Army. He made the jump to the private sector as an investment banking analyst at Morgan Stanley, where he eventually led his own team responsible for billions of dollars in daily trading. Jason left Wall Street to found his own investment office and now shares the strategies he used and the network he built with you. Jason is the founder of Main Street Ventures, a pre-IPO investment newsletter; the founder of Future Giants, a nano cap investing service; and authors The Wealth Advisory income stock newsletter. He is also the managing editor of Wealth Daily. To learn more about Jason, click here.

Want to hear more from Jason? Sign up to receive emails directly from him ranging from market commentaries to opportunities that he has his eye on.

The Best Free Investment You'll Ever Make

We never spam! View our Privacy Policy

After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox daily.

@TheReal_JayDubs

@TheReal_JayDubs Angel Research on Youtube

Angel Research on Youtube