“It doesn’t take much to see that these trends could result in a full-on 'bank run' to abandon gas cars and buy EVs, depending on how unbalanced the supply-demand equation becomes.”

— Electrek

Dear Reader,

There are some big things happening in the auto industry.

There’s a supply and demand problem that’s going to shake up the entire landscape.

And Tesla could get screwed in the process.

In fact, it may already be having an effect.

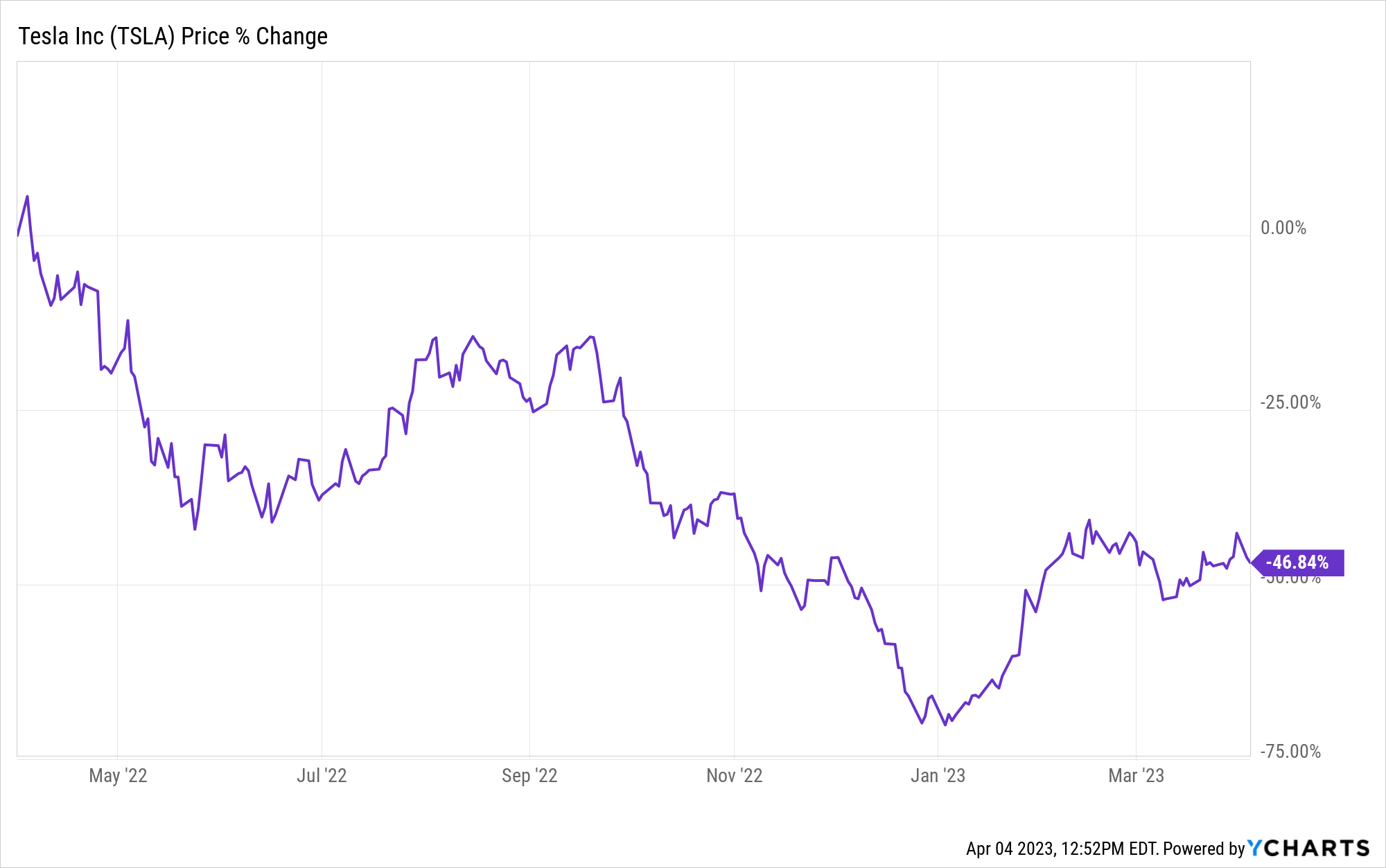

Tesla stock dropped more than 6% Monday after reporting mundane delivery numbers and an inventory glut.

It’s down roughly 50% from this time last year.

Even though the delivery numbers were originally reported as a record for the company, investors saw through the smoke and mirrors.

It was the excess inventory coupled with price cuts that brought the stock down.

Yahoo Finance notes, “In the trailing 12 months, Tesla has built more than 78,000 [more] cars than it has delivered to customers.”

That’s not what investors wanted to hear.

But excess inventory and supply and demand disparity will be felt by all automakers, some say as soon as July.

Car prices could drop like a rock in the process, especially for gas- and diesel-powered vehicles.

It may sound like a good thing for electric vehicles, but I’ll explain why it’s not below.

For some context, all we have to do is look at what’s going on in China right now. Join Wealth Daily today for FREE. We’ll keep you on top of all the hottest investment ideas before they hit Wall Street. Become a member today, and get our latest free report: “How to Make Your Fortune in Stocks”The Best Free Investment You’ll Ever Make

It contains full details on why dividends are an amazing tool for growing your wealth.

A “Bank Run” on Gas-Powered Vehicles

A recent article by Electrek paints a solemn picture for the car market.

If you’re thinking about buying a new car, you should probably first consider what’s going on overseas.

The article states that hundreds of thousands of gas-powered vehicles are unsellable because of China’s strict new emissions policy that kicks in this July.

That’s only a few months away…

Gas-powered vehicles might quite literally be worth nothing as soon as this summer.

The article states, “We’ve also seen some drivers, not even high-mileage ones, realize that renting, fueling, and maintaining an EV is cheaper than the continued running costs of using a paid-for gas car. When that happens, the value of the gas car is effectively zero — it’s worse to continue driving it than it is to get a whole new EV.”

Not only will gas-powered cars be worth nothing, but banks might not touch them in terms of loans and insurance. The article continues, “Another reason this is important is that a lot of cars are actually financed with loans. Those loans are backed by the car on the premise that it has some value. When that stops being true, those loans are basically under water. So it will become harder to get one. This dynamic will be interesting to see playing out in places like the U.S. There’s basically a car debt bubble forming there.”

So first, we’ve got a car price bubble because inventories are going to skyrocket. Once China stops importing cars from the U.S., car lots will be giving away cars.

On top of that, we’ve got a car loan bubble because banks won’t issue loans for car buyers.

Finally, adding fuel to the fire is the current administration offering tax breaks for new EVs.

Tax Breaks for the Rich

The Treasury released a statement last week detailing the new tax breaks.

Treasury Secretary Janet Yellen said, “The Inflation Reduction Act is a once-in-a-generation piece of legislation that is lowering costs for American consumers, building a strong U.S. industrial base, and bolstering supply chains. Today, [the] Treasury is taking an important step that will help consumers save up to $7,500 on a new clean vehicle and hundreds of dollars per year on gas, while creating American manufacturing jobs and strengthening our energy and national security.”

Basically, depending on what kind of EV you buy and whether the “critical minerals” in the battery are mined here in the U.S., you’ll get a tax break anywhere from $3,750–$7,500.

The White House released a follow-up statement applauding the move, saying, “Today’s announcement ensures that the clean vehicle credit provided by the Inflation Reduction Act will lower costs for consumers, revitalize our industrial base, and spur manufacturing here at home.”

What they’re not telling you is minerals like aluminum, zinc, and nickel are on the critical metal list, which are very easy to come by.

So it’s not going to have as much of an impact on U.S. manufacturing as it seems.

So let's call this what it is: a tax break for the rich who can afford a new EV.

But if you think all the government subsidies are going to help a stock like Tesla, think again.

Would You Buy One?

Let’s think about this situation logically.

Car buyers now have three options.

First, you can shell out $60,000 (the average price for a new EV) and get a measly $7,500 in tax credits if you’re lucky.

Second, you can keep driving your gas-powered car that will be worth nothing once inventories rise to historic levels because of the supply and demand environment mentioned above.

Third, you can wait and purchase a brand-new gas-powered car for pennies on the dollar when prices crash this summer.

I think a lot of Americans would agree that they’re not prepared to buy a new car.

Inflation and poor investment returns don’t lead to new car purchases, no matter how much money the government throws at the problem.

As for Tesla, this isn’t going to cause new buyers to rush out and spend money they don’t have on a car they don’t need.

Now, if EVs came with a manual transmission, I might hop on board.

New Kid on the Block

Here's the rub…

There's a new clean-energy vehicle that no one is talking about.

And it just made every EV on the road obsolete…

This car throws a wrench into everything we've been talking about.

Because it does NOT run on batteries.

Instead, this car runs on another kind of zero-emission fuel called “Blue Gas.”

And the only thing it emits is water so pure that, yes, you can drink it.

Even with all the tax breaks in the world, companies that produce electric cars (like Tesla) are about to go down in flames.

In fact, in the next few years, experts predict there will be more than 10 million “Blue Gas” vehicles on the road…

The tiny company driving the “Blue Gas” industry is primed to absolutely shatter any gains ever paid out by Tesla.

While the White House and Wall Street play catch-up, you can see the "Blue Gas" car making Tesla obsolete here.

Stay frosty, Alexander Boulden After Alexander’s passion for economics and investing drew him to one of the largest financial publishers in the world, where he rubbed elbows with former Chicago Board Options Exchange floor traders, Wall Street hedge fund managers, and International Monetary Fund analysts, he decided to take up the pen and guide others through this new age of investing. Alexander is the investment director of Insider Stakeout — a weekly investment advisory service dedicated to tracking the smartest money on the planet so that his readers can achieve life-altering, market-beating returns. He also serves at the managing editor for R.I.C.H. Report, a comprehensive service that uses the highest-quality investment research and strategies that guides its members in growing their wealth on top of preserving it.

Check out his editor’s page here. Want to hear more from Alexander? Sign up to receive emails directly from him ranging from market commentaries to opportunities that he has his eye on.

Editor, Wealth Daily

Check us out on YouTube!

Check us out on YouTube!