Silver’s Rebellion: Why This Bull Market Could Shock the World

Sometimes it pays to be early. Scratch that — it always pays to be early. Especially when the mainstream shrugs, the so-called experts roll their eyes, and Wall Street yawns.

That’s when contrarians know it’s time to move.

Back in the early days, when silver was still an afterthought in the financial press, I told you something few wanted to hear: The white metal was about to steal the show.

And look where we are now…

Six straight weeks of blistering outperformance. Silver hasn’t just kept pace with gold — it’s humiliated it in 2025…

The headlines are finally starting to catch up, but you and I were already here, positioned for the surge before the herd even noticed the starting gun.

Silver: The Underdog That Bites Back

Mainstream analysts love to sneer at silver. Too volatile, too speculative, too dependent on industrial demand, they say. The respectable money goes into gold.

But history doesn’t back up their condescension…

Every single major gold bull market has eventually seen silver not only keep up, but sprint past. It happened in the 1930s, the 1970s, and the early 2000s.

Gold may light the fire, but silver pours on the gasoline.

That means this isn’t a one-off move. This is the beginning of a cycle where silver takes the wheel — and it’s already happening.

The Best Free Investment You’ll Ever Make

Join Wealth Daily today for FREE. We’ll keep you on top of all the hottest investment ideas before they

hit Wall Street. Become a member today, and get our latest free report: “Why You Need to Fire Your Money

Manager.”

It contains full details on why money managers are overpaid and provides you with

tools for growing your wealth.On your own terms. No fees, no commission.

The Rally Nobody Believes In

Look around you for a minute… Are your neighbors hoarding silver coins?

Is CNBC running wall-to-wall coverage of silver miners? Are your friends texting you about the next hot silver stock? Not even close.

That’s what makes this rally so powerful. Nobody believes it yet.

Which means the real upside hasn’t even begun. When the herd finally wakes up, they’ll come running. And prices will go vertical.

Let’s rewind the tape to the last great silver mania to give you an example of how parabolic things can go…

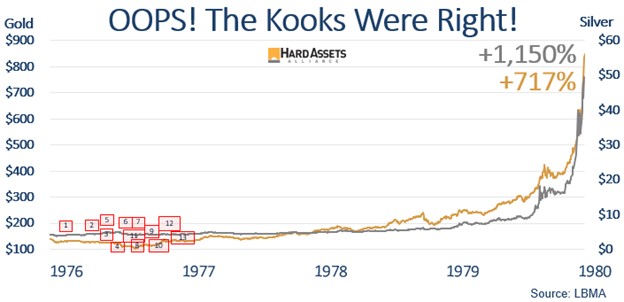

In 1976, silver was trading for barely $4 an ounce. The global economy was reeling from inflation, oil shocks, and political instability — sound familiar?

Gold began to climb, and silver followed. But then, silver did what silver always does: It went into overdrive.

By January 1980, silver hit nearly $50 an ounce — a more than 1,000% increase in just four years.

That was the era when the Hunt brothers famously tried to corner the silver market.

But here’s the part most people forget: Even without their antics, the setup was ripe for a silver explosion…

Investors had finally realized silver wasn’t just jewelry and coins. It was money. Real money that couldn’t be printed away.

And in that frenzy, tiny miners became absolute investment legends…

One of them, Lion Mines, delivered a return so insane it still boggles the mind: 54,000% between 1976 and 1980.

A few hundred dollars staked in Lion Mines turned into generational wealth.

Now, am I saying we’re about to see another Lion Mines? I’ll leave the crystal ball to fortune tellers.

And I’ll just say that history teaches us that in silver bull markets, the unimaginable quickly becomes reality.

And here’s the kicker: Just like today, in 1976 most people thought the rally had already gone too far. They thought it was too late.

In fact, here’s a chart noting 13 dates in 1976 alone where mainstream financial outlets called the rally in gold and silver “dead”…

They couldn’t see that the mania was only beginning.

Debt, Chaos, and Solar Panels

Fast-forward to today, and the setup is even more explosive…

Governments are drowning in debt. Central banks are panic-buying gold as if tomorrow’s fiat system might collapse (because maybe it will). Geopolitics are on a knife’s edge.

Every headline screams instability.

And silver? It benefits from all of it.

It’s the monetary twin of gold, the safe haven investors reach for when the world looks shaky.

But it’s also the industrial backbone of modern technology. Solar panels, electric vehicles, semiconductors, and medical equipment all devour silver.

That dual role makes silver unique. It’s both protection against chaos and fuel for the future. There is no modern economy without silver — and demand is only rising.

That’s why this rally isn’t just another blip. I’m convinced it’s a supercycle with staying power.

Stocks: Where Silver Becomes a Money Machine

Sure, stacking silver bars and coins is smart. It’s your insurance policy.

But if you want to multiply your wealth, you need to look at the companies pulling silver out of the ground — or financing the ones that do.

A $2 move in silver is nice for bullion holders. But for miners, that same $2 can expand profit margins by 20%, 30%, even 50%.

Markets reward that kind of leverage with stock prices that move two, three, even five times faster than the metal itself.

That’s how fortunes are built. Not just by owning ounces, but by owning the companies that mint money when silver runs.

The Rebel’s Three Silver Plays

Let me spell out three names that every serious investor should dig into right now.

Avino Silver and Gold Mines — The Scrappy Fighter…

Avino operates in Mexico, with decades of history and efficient operations. It’s not flashy, but that’s exactly why I like it. Avino doesn’t need massive new spending to scale.

Its existing mines are built to deliver. When silver rises, Avino’s profits surge disproportionately — and so does its stock price.

Wheaton Precious Metals — The Banker of the Boom…

Wheaton isn’t a traditional miner. It’s a streaming and royalty company, which means it finances other miners in exchange for the right to buy their silver (and gold) at locked-in, rock-bottom prices.

That model is beautiful in a bull market. Wheaton soaks up the upside without dealing with mining headaches.

It’s one of the smartest, most resilient ways to get leveraged exposure to silver.

Apollo Silver — The Wild Card…

Apollo doesn’t yet have the production of Avino or the established revenues of Wheaton. But it has something equally valuable: potential.

Its Calico project in California is one of the largest undeveloped silver resources in the U.S. Right now it’s speculative. But if silver surges like I believe it will, Apollo’s project could transform into one of the most valuable assets in the country.

For aggressive investors, this is the asymmetric bet that could deliver the kind of eye-popping returns we’ve seen in past silver manias.

Put these three together and you’ve got the contrarian’s trifecta: stability, leverage, and speculation.

Don’t Let Fear Kill Your Fortune

The easy thing to do right now is to say, “I missed it.” To believe the headlines that silver’s already run too far. To listen to the mainstream voices who always, always say it’s too late.

That’s exactly what people said in 1976. And four years later, they were kicking themselves while the bold contrarians were measuring their profits in multiples, not percentages.

The hard thing — the contrarian thing — is to see this rally for what it is: still young, still powerful, and still loaded with upside.

The Bottom Line: Get in or Get Left Behind

Silver is in open rebellion. It’s outshining gold, mocking the experts, and proving once again that contrarians were right.

We called it early, and now we’re watching the cycle unfold exactly as history says it would.

But don’t kid yourself — the biggest moves are still ahead. Investor participation is tiny.

Central banks are still buying. Industrial demand is soaring. And history shows silver can move further and faster than anyone dares to imagine.

Between proven operators like Avino, smart financiers like Wheaton, and speculative wild cards like Apollo, the opportunity is laid out right in front of you.

The only question is: Will you seize it now, or will you let the herd beat you to it?

Because this silver rebellion is just beginning. And those who hesitate will be left watching from the sidelines as the bold rake in the gains.

Now’s the time to get invested — and to dig even deeper…

That’s why we’ve prepared a brand-new research report, "Silver Lining in a Golden Age."

Inside, you’ll discover four more top ways to play this silver supercycle — opportunities with the potential to deliver the kind of explosive returns that make rallies like this legendary.

Don’t wait. Get your copy today and make sure you’re positioned before the next leg higher takes silver — and silver stocks — to heights no one thinks possible.

To your wealth,

Jason Williams

After graduating Cum Laude in finance and economics, Jason designed and analyzed complex projects for the U.S. Army. He made the jump to the private sector as an investment banking analyst at Morgan Stanley, where he eventually led his own team responsible for billions of dollars in daily trading. Jason left Wall Street to found his own investment office and now shares the strategies he used and the network he built with you. Jason is the founder of Main Street Ventures, a pre-IPO investment newsletter; the founder of Future Giants, a nano cap investing service; and authors The Wealth Advisory income stock newsletter. He is also the managing editor of Wealth Daily. To learn more about Jason, click here.

Want to hear more from Jason? Sign up to receive emails directly from him ranging from market commentaries to opportunities that he has his eye on.

The Best Free Investment You'll Ever Make

We never spam! View our Privacy Policy

After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox daily.

@TheReal_JayDubs

@TheReal_JayDubs Angel Research on Youtube

Angel Research on Youtube