Silvercorp Metals' (SVM) Record Highs

Publisher’s Preface: Verifying Gold’s Existence — and the Birth of a New Asset Class

Before we begin today’s editorial — a story about silver’s awakening and the institutional players who quietly prepared for this moment — I want to share something that will become foundational to how you understand the future of gold ownership.

NatGold has just released what I believe is one of the most important educational videos in the entire Digital Mining 101 series. Episode 2 — "How Do We Know the Gold Is There? Verifying Gold’s Existence" — tackles the single most important question in the NatGold model: If the gold remains in the ground, how can anyone verify that it actually exists?

The answer is far more sophisticated, far more transparent, and far more trusted than most people realize.

This episode walks through the exact geological, analytical, and verification processes used by the world’s largest mining companies, investment bankers, royalty firms, auditors, and stock exchanges. It explains how every claim about a mineral deposit must be scrutinized by independent, licensed geological professionals — essentially auditors of the earth — who enforce compliance with internationally recognized standards like NI 43-101, the JORC Code, and S-K 1300.

Nothing is taken on faith. Everything is verified, cross-checked, sampled, modeled, and certified. Only then does the deposit become “official” and “reportable,” forming the basis for billions of dollars in financing, development, or — in NatGold’s case — tokenized representation.

If global capital markets trust these standards to justify billion-dollar mine builds, they can absolutely trust them to underpin a cleaner, smarter, more sustainable alternative that leaves the gold in place while unlocking its economic value.

This video explains that bridge — from the old world to the NatGold world — better than anything we have released so far.

Watch Episode 2 now, right here.

Now let’s turn to silver — because last week, silver didn’t simply move…

It declared something.

The Night Silver Finally Spoke

There are nights in the financial world when price ceases to be a number and becomes a message. Most people miss these moments because they are looking at charts instead of listening to what the market is actually saying. But every so often, a metal steps out of the noise and speaks plainly — not in whispers, not in hints, but in a single decisive motion that redraws the contours of the future.

Silver’s breakout above $60 an ounce was one of those moments. It wasn’t a rally. It wasn’t a speculative pop. It wasn’t a sentiment shift. It was silver, after decades of being misunderstood and mispriced, finally revealing what it has become in a world transformed by AI, electrification, defense modernization, and the physical demands of the 21st-century economy.

The truth is that this moment didn’t arrive suddenly. The ground had been rumbling for years. Even while the headlines focused on tech stocks, central banks, elections, or even gold, something deeper and far more consequential was happening beneath the surface.

A fault line had been forming — extending from the supply chains of mining districts to the circuitry of data centers, from the power grids of industrial nations to the classified procurement budgets of defense ministries. The world was quietly pushing toward a point where more electricity, more computation, more weaponry, more mobility, and more automation would demand more silver than the mining industry could ever responsibly produce.

Silver is the strangest of the great metals because it lives a double life.

It is both a monetary relic and a modern necessity, a safe-haven asset and a vanishing industrial ingredient.

Gold can sit in a vault for a thousand years.

Silver cannot.

It travels through wires and circuit boards, dissolves into solar cells, threads itself into electric vehicles, radar systems, satellites, microchips, and weapon platforms.

Once deployed, it seldom returns.

It is the most consumed precious metal in history not because people want it, but because the future requires it.

The Best Free Investment You’ll Ever Make

Join Wealth Daily today for FREE. We”ll keep you on top of all the hottest investment ideas before they hit Wall Street. Become a member today, and get our latest free report: “A Maverick’s Guide to Gold: 3 Gold Stocks Set to Disrupt the Market”

It contains full details on something incredibly important that’s unfolding and affecting how gold is classified as an investment..

After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox daily.

And that is precisely why the world mispriced silver for so long.

The last century treated it as cheap, abundant, interchangeable — a metal that could always be mined in greater volume if the price justified the effort. But mining doesn’t work that way.

You cannot conjure new ore bodies into existence simply because demand rises. You cannot accelerate permitting to match geopolitical turbulence. You cannot shortcut geological discovery. And you certainly cannot rebuild a global mining workforce overnight.

Silver didn’t surge above $60 because traders suddenly got excited. Silver surged because the world finally ran out of excuses for pretending this metal wasn’t what it has always been destined to become.

When silver crossed that threshold, it wasn’t a line on a chart. It was a declaration. It was the metal saying: “You finally see me.”

And that recognition has consequences that will ripple across everything — from national energy strategies to corporate supply chains to the balance sheets of the miners who have been operating in silence while the world slept on their very existence.

Which brings us to one of the most interesting developments in the wake of this repricing: the miners themselves. Companies like Silvercorp Metals, long accustomed to producing silver profitably in the old world of $20–$30 pricing, suddenly find themselves operating in a new monetary climate.

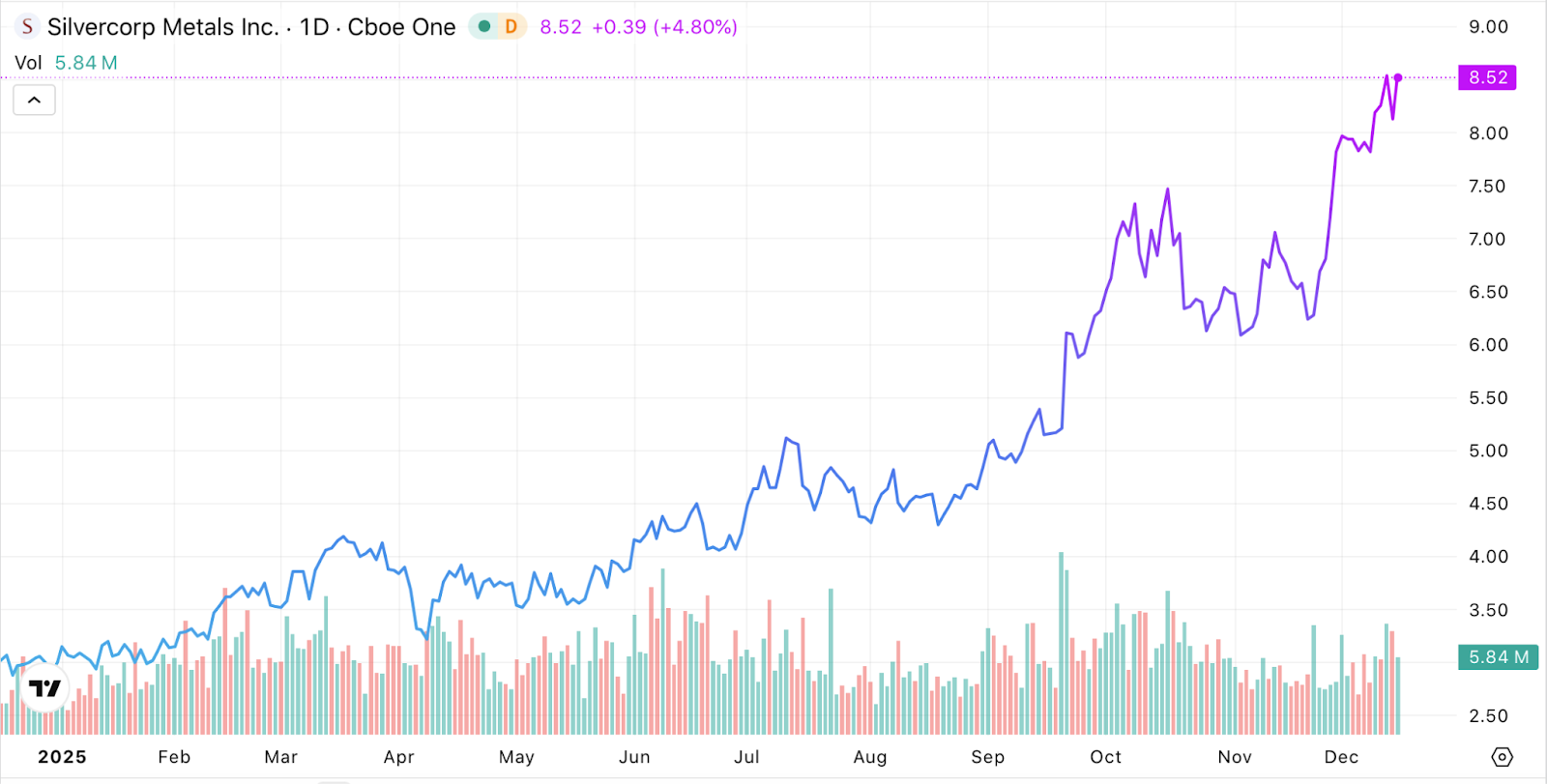

I alerted you to the opportunity in Silvercorp Metals (SVM) in Wealth Daily back on March 8 of this year when it was still trading for less than $4 a share!

Since my article, Silvercorp Metals has ripped to new highs.

A producer designed for yesterday has awakened in a world where the economics of extraction and the economics of scarcity have collided into a single, irreversible truth: this metal is no longer optional. It is essential.

The MoneyQuake thesis — the idea that the digital world and the physical world must rise together — is not theoretical anymore. It’s happening in real time. And silver is no longer standing in the shadow of gold watching history unfold. It is now the metal upon which the modern world is building its nervous system.

The night silver broke above $60 was not an ending. It was an awakening. And the world is just beginning to understand what that means.

The Institutional Shadow Play: JPMorgan, the Silent Accumulator, and the Yearslong Prelude to the Breakout

If you really want to understand the magnitude of silver’s reclassification, you have to examine not what the public saw — but what the institutions did while no one was looking.

For more than a decade, a curious pattern appeared again and again in the COMEX vault data. Each time silver was beaten down, whenever headlines declared it irrelevant or obsolete, whenever speculators fled and retail holders grew disillusioned, one name would quietly reappear at the center of physical accumulation: JPMorgan Chase.

JPM didn’t talk about it. They didn’t issue white papers or press releases. They didn’t host “Silver Day” at investor conferences. They didn’t promote themselves as thought leaders in the precious metals space. They simply gathered metal — real metal, deliverable metal, audited metal — and they did it at a scale large enough to be visible only to those who knew where to look.

Markets are full of noise. But institutions speak in actions.

And their actions suggested something unmistakable: JPMorgan was preparing for a future where silver’s role would not just grow — it would become indispensable.

To the untrained eye, these movements appeared technical or seasonal. But step back and widen the frame, and you begin to see the outline of a thesis that resembles the earliest flickers of the MoneyQuake itself. The digital economy, the electrified economy, the militarized economy, the AI economy — all of them share a single vulnerability: They require more power, more conductivity, more reliability, and therefore more silver than the current supply chain can feasibly support.

If the world ever began to treat silver as a strategic resource rather than a commodity, prices would not drift upward, they would reset. A repricing event, not a rally.

The night silver broke above $60 was not a surprise to the institutions that had been positioning for this reality. It was simply the moment when the future they anticipated finally arrived.

And now, with the public waking up and the media scrambling to explain the surge, the question is no longer whether silver is in a bull market.

The real question is how far behind the world is from where the institutions already stand.

This is the heart of the matter.

This is the MoneyQuake taking shape.

This is the point where history finally catches up to the people who saw it coming.

Get to the good, green grass first…

Brian Hicks

Brian is a founding member and President of Angel Publishing. He writes about general investment strategies for Wealth Daily and Energy and Capital. Brian is the managing editor and investment director of R.I.C.H Report (Retired Independent Carefree Healthy), New World Assets and Extreme Opportunities. For more on Brian, take a look at his editor’s page.

The Best Free Investment You'll Ever Make

We never spam! View our Privacy Policy

After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox daily.