I’m learning more about social media these days.

And I’ve got a couple of impressive (and maybe depressing) stats for you this week:

As of October 2020, there were more than 50 million content creators globally.

Of those people, about 2 MILLION of them were earning six figures a year.

Think about that…

Two million people out there earning $100,000 a year or more for posting pictures and videos on social media.

They’re basically getting paid for doing nothing… What a way to make a living!

It is a little depressing to think about. But at the same time, it should be inspirational.

Because that’s how you really get rich — by making money when you’re not even working.

That’s the real American dream.

And the six-figure social media influencers show that it’s easier to attain than ever.

But better than that, you don’t have to be a social media creator to get paid for doing nothing.

In fact, as easy as making a few Instagram posts sounds, there are far easier ways to make money.

And I‘m going to share the easiest with you today.

But first, I’m going to tell you a story about how I realized I was doing it all wrong…

When Poppa Don’t Work…

It was over a decade ago and I’d recently left my position as an analyst for the U.S. Army.

I’d taken a job at the second-biggest investment bank (at the time), Morgan Stanley.

But because of the position I held, and the access that position came with, I was one of the guys who was forced to take an extended vacation every year.

I say forced because when you only have a few weeks of paid time off, taking two of them concurrently knocks out most of your annual vacation time.

But every year, I had to take those two weeks off in a row so that they could audit my books and make sure I wasn’t doing anything the bank would get fined over.

So I took the time off and did what I could to pass it while my employer treated me like a criminal and locked me out of my accounts.

The first year, I backpacked through Central America with a friend of mine who was also in finance.

But the second year, I couldn’t find anyone to help me fritter away two weeks, so I did more of a “staycation.”

And it was during that staycation, while I was puttering around the house looking for things to do to keep me busy, that I realized why I was feeling so antsy.

I wasn’t accomplishing anything that was getting me closer to my goals.

You see, I’d always fancied the idea of retiring early. I didn’t really want to stop working. I just wanted to do whatever I felt like and have nobody to answer to.

But for my entire life up to that point, the only way I could save money for that retirement was by working for that money.

And if I wasn’t working, I wasn’t getting paid.

But that’s not how you do it. If you really want to retire early (or at all, to be honest), you need to be making money all the time, even when you’re not working.

And when I came to that realization, it changed everything for me.

Momma Don’t Get Paid

I’d been an investor ever since I took my first business class in junior college.

But I always dreamed of those moonshot, once-in-a-lifetime gains.

You know the stories…

People who put all their eggs in one basket and bought Apple or Microsoft right after those companies went public.

Now you hear them about people who went all-in on Bitcoin or Tesla back in 2010.

But the thing is, those people only made money on those investments after they sold them.

And when you can only make money by selling things, eventually you run out of things to sell and you stop making money.

But those were the kinds of investments I was making. I was picking out individual companies and betting big that they were going to win whatever race they were running.

And I did pretty well with some of them. But I lost it all with others. And that’s what happens when you bet on moonshots.

Because if you want to make money even when you’re not doing anything, they’re the wrong investments to make.

Now, if you’ve got your nest egg secured and spinning off cash, then by all means, those moonshots are a great place to stick a few grand you don’t mind losing.

They could turn out to be lottery tickets that pay off in droves.

But if that’s not the case for you, then they should be the last thing on your mind.

And the first thing on it should be investments that pay you for owning them.

Aggressively Seeking Passive Income

There are a lot of those out there if you’re willing to look for them…

Landlords get paid just for owning properties other people want to live in. You could become a landlord.

People buy things from vending machines at all hours of the day and night. You could buy a couple of those.

Obviously, those social media influencers get paid while they’re doing other things (since those social media posts are up 24 hours a day, seven days a week).

You could get into the short-term rental market and turn your second home, spare bedroom, or extra couch into an Airbnb listing. I hear people are even renting out tents in their backyards these days.

But all of those income streams require either a particular skill set, a pretty large upfront investment, or a decent amount of work to get set up.

So maybe they’re not for everyone… and maybe they’re not quite so “passive.”

But there is a guaranteed way to make real passive income…

It works for everyone… and you can get started with as little as $5 in some cases.

I’m talking about investing in companies that pay their shareholders dividends. Join Wealth Daily today for FREE. We’ll keep you on top of all the hottest investment ideas before they hit Wall Street. Become a member today, and get our latest free report: “How to Make Your Fortune in Stocks”The Best Free Investment You’ll Ever Make

It contains full details on why dividends are an amazing tool for growing your wealth.

“What Is a Dividend?”

Dividends are cash payments made to shareholders of a company’s stock out of that company’s profits.

They go by many names: distributions, profit sharing, payments, and, of course, dividends.

Sometimes they’re known as “special dividends,” when a company doesn’t plan on paying them regularly.

But most of the time, they’re paid on a strict schedule every month, quarter, half, or year.

And those are the kind I became a specialist in. Because those are the kind that really pay you whether you’re working or not.

They also pay you even if you hold onto them forever (unlike those moonshots that only pay off once you sell them).

In fact, the longer you hold investments that pay dividends, the more dividends they pay you.

And since that fateful staycation all those years ago, they’ve been my favorite kind of investment.

“Why Should I Care?”

They’ve helped cushion my accounts when markets got bearish and started to drop.

They’ve boosted my gains when markets were bullish and ran up the charts.

And they’ve provided some of my best returns as a professional investor…

Actually, the most money I ever made on an individual stock was on one I bought for the juicy payouts it was distributing.

The company was what’s called a real estate investment trust (or REIT).

That’s a technical term for a company that owns real estate and gets special tax treatment by paying the majority of its profits to shareholders.

This REIT owned industrial facilities that it would buy with debt and then lease out to other companies for a little more than the payments on the debt.

The difference between the rate of interest they paid on the loans and the rate they charged to lease the buildings was the profit.

It’s really boring when you break it down like that. So I forgive you if you’re yawning.

But the profits were incredibly exciting…

When I bought my first shares, the company was paying out a respectable $0.15 per share each quarter.

That was back in 2017.

As of today, it’s paying over 10 times more, at $1.80 per share each quarter!

And as more people caught on to the payments and saw how they were growing, the share price went up too (as is almost always the case when you invest in a company that grows its dividend).

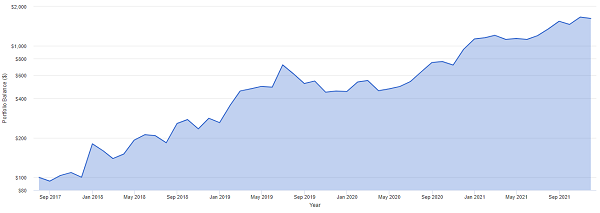

When I bought those first shares, I paid less than $20. Before the markets took a dive this year, the share price had grown more than 10 times over as well and gotten as high as $280 each.

That share price growth, or capital appreciation, scored me a 1,600% gain… and that’s not even counting those juicy dividend payments.

I paid about $17 each for those shares in 2017. As of today, I’ve collected $19.92 per share in dividends…

That means I’ve not only paid for those shares entirely with dividends, but now I’m making FREE money!

Literally every payment I get (and have gotten for the past year) has been free. I already got my money back for buying those initial shares.

Plus I’ve got an extra $3 a share to show for it!

That’s 117% return on my investment in dividends alone!

PLUS I got that 1,600% capital appreciation gain as more and more people decided they wanted to get paid for doing nothing too.

Add it all up and that investment turned every $100 from 2017 into $1,621 by 2021.

“How Can I Get Started?”

That’s the power of dividends. That’s why they’re the only way to really guarantee yourself financial freedom and a real retirement.

And that’s why they’re the focus of my flagship investment advisory service, The Wealth Advisory…

Because I know that the super-wealthy don’t work for their money. They make that money work for them.

That’s also why billionaire investors are going crazy for dividends right now.

They’re the only thing that can both cushion your account from the wild swings of a failing market…

AND they’re the only investment out there that can even hope to beat the sky-high inflation we’re seeing all around.

But you can’t just buy any stock because it pays a dividend. If you want the kind of returns I just told you about, you’ve got to be selective and buy only the BEST dividend stocks.

That’s why I want to extend a personal invitation to join me and the tens of thousands of investors who’ve already “seen the light” and are finally making their money earn its keep.

Because I work with a team made up of the best and brightest minds in finance.

And we’ve identified the best opportunities to protect and grow your portfolio with both inflation-beating income AND market-beating moves.

Now we want you to have access to those investments with their steadily growing payouts and the capital appreciation that comes with them.

And we’re making it as easy as possible for you to join our community of investors and secure your dreams of doing whatever you want whenever you care to.

Because the goal isn’t just to be comfortable; it’s to be free.

To your wealth, Jason Williams After graduating Cum Laude in finance

and economics, Jason designed and analyzed complex projects for the U.S. Army. He made the jump to the private

sector as an investment banking analyst at Morgan Stanley, where he eventually led his own team

responsible for billions of dollars in daily trading. Jason left Wall Street to found his own

investment office and now shares the strategies he used and the network he built with you. Jason

is the founder of Main Street

Ventures, a pre-IPO investment newsletter; the founder of

Future Giants, a nano cap investing service; and authors The Wealth Advisory income stock

newsletter. He is also the managing editor of Wealth

Daily. To learn more about Jason, click here. Want to hear more from Jason? Sign up to receive emails directly from him ranging from market commentaries to opportunities that he has his eye on.

@TheReal_JayDubs

@TheReal_JayDubs Angel Research on Youtube

Angel Research on Youtube