How China Took Over the Rare Earth Market — and How U.S. Companies Are Fighting Back

Over the past two decades, China pulled off one of the greatest long games in modern economic history…

While the West obsessed over going green, China was quietly cornering the global market for the very materials that make “green” technology possible — rare earth elements.

And while these obscure metals don’t make headlines like oil or gold, rare earths are absolutely critical to the technologies of today — and tomorrow.

But not just for electric vehicles and wind turbines…

These minerals are found in smartphones, fighter jets, medical devices, satellites, and just about anything that requires a strong, lightweight magnet or precise electronics.

That’s why China’s stranglehold on the market is such a BIG deal…

How China Used Climate Guilt to Corner the Market

Back in the early 2000s, Western nations began ramping up environmental regulations and cutting back on domestic mining.

Rare earth processing — an energy-intensive and often messy operation — was deemed too dirty. So production shifted overseas.

China, meanwhile, doubled down.

With fewer environmental constraints and state-backed industrial policy, it scaled rare earth mining and refining operations at breakneck speed.

But China didn’t just dig the rocks out of the ground — it built the entire supply chain: mining, processing, separation, and manufacturing.

The result?

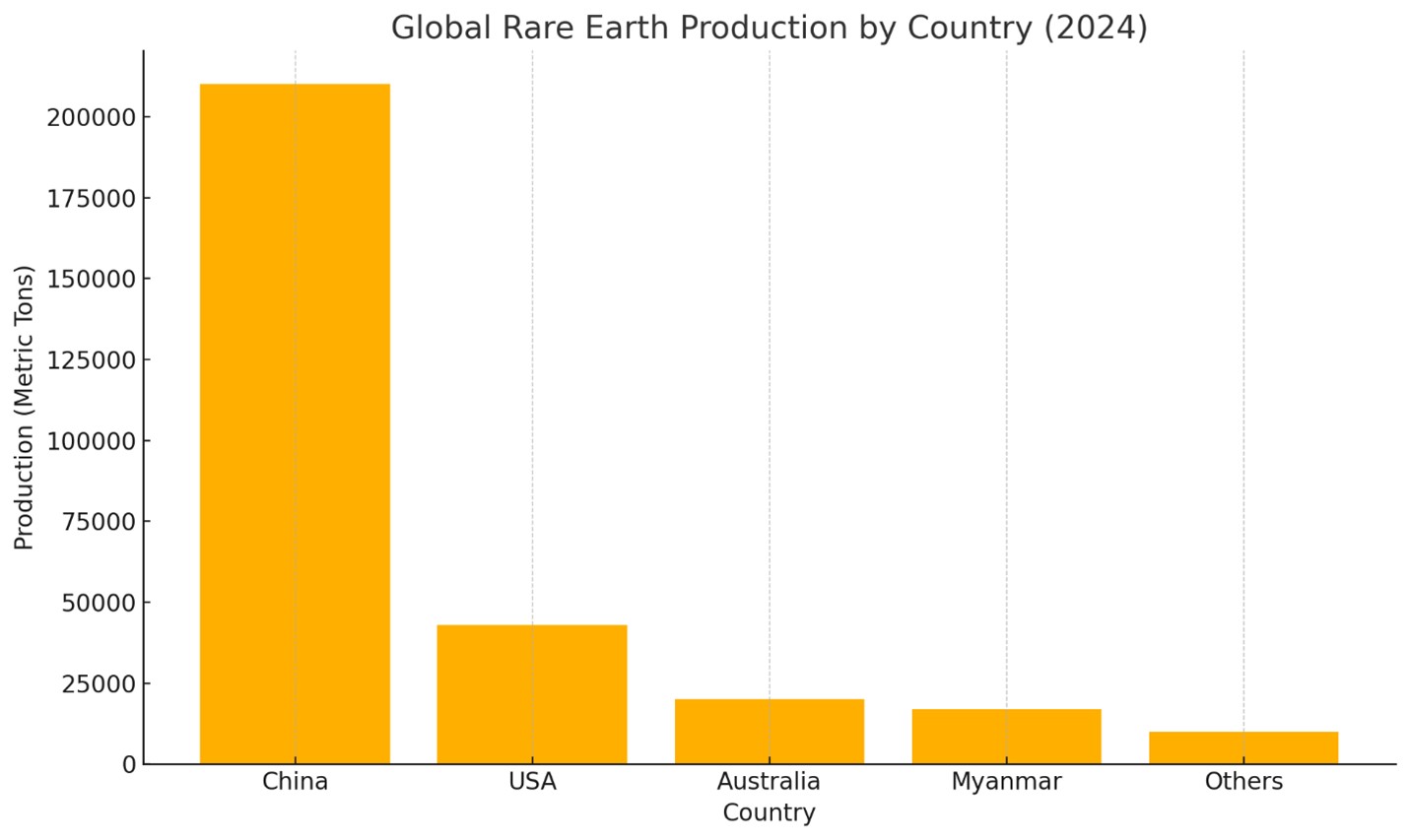

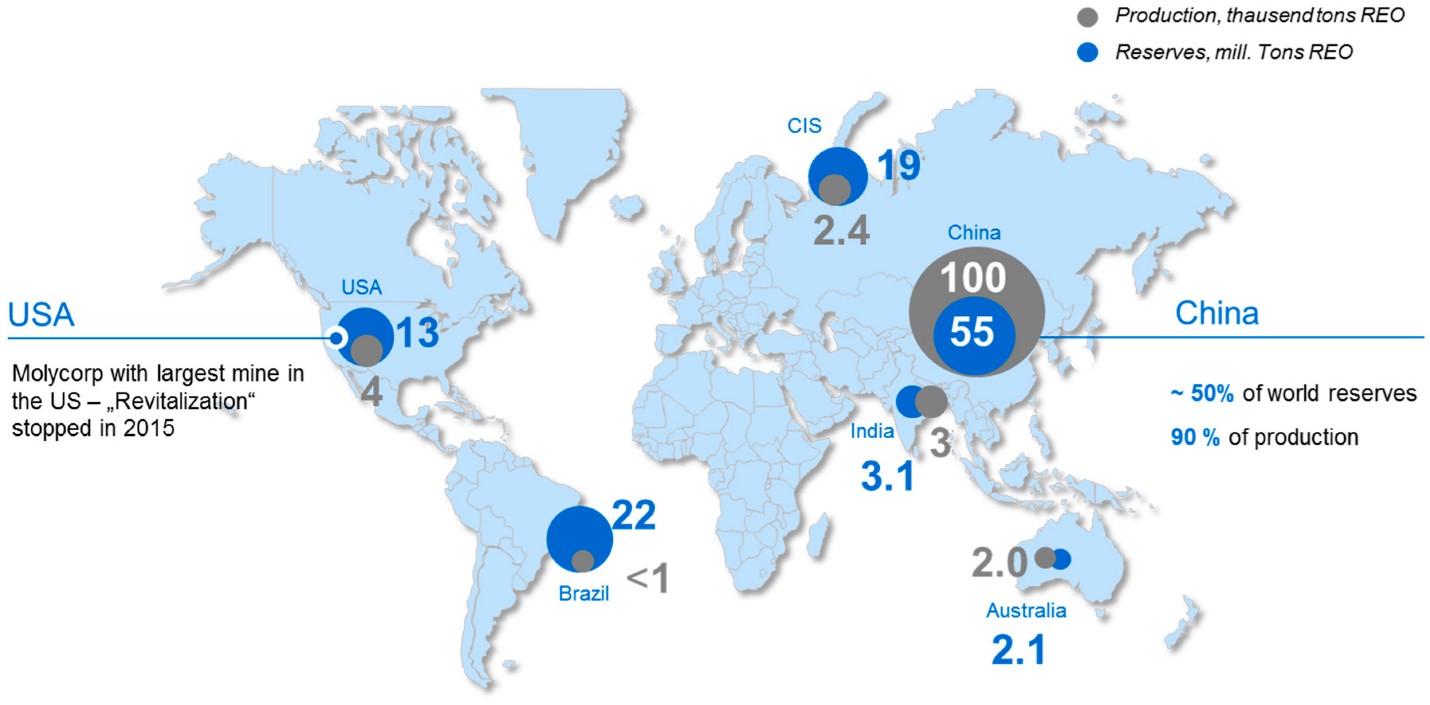

China now controls over 90% of global rare earth refining and around 60% of global rare earth production.

The Best Free Investment You’ll Ever Make

Join Wealth Daily today for FREE. We”ll keep you on top of all the hottest investment ideas before they hit Wall Street. Become a member today, and get our latest free report: “A Maverick’s Guide to Gold: 3 Gold Stocks Set to Disrupt the Market”

It contains full details on something incredibly important that’s unfolding and affecting how gold is classified as an investment..

After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox daily.

More Than Just “Green” Metals

It’s a mistake to think of rare earths as only climate transition metals, though. That’s a big mistake a lot of investors have made.

Sure, they’re essential for wind turbines and electric vehicles, but they also underpin industries far beyond the clean energy narrative.

This isn’t just about wind turbines and Teslas. It’s far bigger than that…

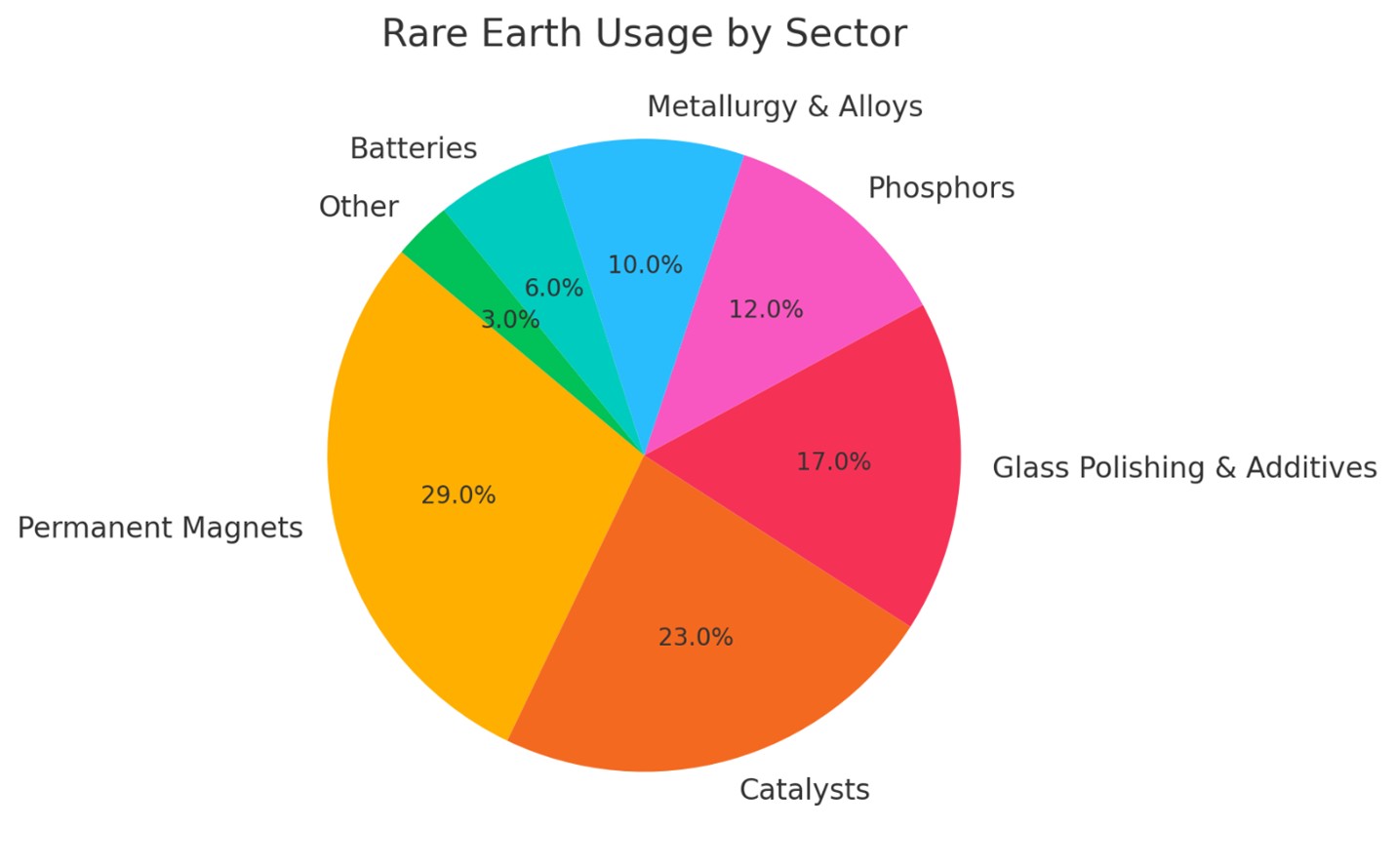

- Permanent magnets (29%): Used in electric motors, generators, hard drives, and guided missile systems.

- Catalysts (23%): Vital for oil refining and emissions control in vehicles.

- Glass and ceramics (17%): Improve clarity and heat resistance in camera lenses and screens.

- Phosphors (12%): Found in energy-efficient lighting and display screens.

- Metallurgy (10%): Strengthens alloys used in jet engines and structural components.

- Batteries (6%): Key component in nickel-metal hydride batteries used in hybrid cars.

In short, rare earths power everything from your iPhone to the F-35 stealth fighter.

This isn’t just about “going green.”

It’s about national security, technological leadership, and economic independence.

Why It Matters Now

In an increasingly fractured geopolitical world, depending on China for strategic resources is risky business. And Washington knows it.

That’s why the U.S. Department of Defense has labeled rare earth independence a national priority.

Billions of dollars in grants, subsidies, and public-private partnerships are flowing into the sector to rebuild domestic capabilities. And it’s not just about diversifying supply chains…

It’s about mitigating a very real and growing threat.

China has a long track record of weaponizing its dominance over rare earths, and recent events have only underscored how serious that threat has become.

In 2010, it restricted rare earth exports to Japan following a maritime dispute. That caused global prices to spike and sent shock waves through the tech and defense sectors.

At the time, many believed that would be the wake-up call. But it wasn’t…

Fast-forward to 2023 — China struck again, this time targeting the West’s chip ambitions by banning exports of gallium and germanium, two critical materials used in semiconductors, LEDs, and solar panels.

The move was a direct response to U.S. restrictions on advanced chip exports to China. It was a clear message: “If you choke our tech, we’ll choke your minerals.”

Then in 2024, Beijing expanded those export controls to include graphite, which is essential for battery anodes in electric vehicles.

The restrictions targeted companies in the U.S., EU, and a handful of other nations deemed “unfriendly,” highlighting just how willing China is to selectively cut off access to vital materials.

And most recently, in mid-2025, China shocked markets by slapping new license requirements on the export of several heavy rare earth elements, including dysprosium and terbium.

These are essential for high-performance magnets used in military applications and electric vehicles.

The new restrictions have already caused delays and forced European and American manufacturers to scramble for alternative sources — sources that don’t yet fully exist outside of China.

These moves aren’t isolated. They’re part of a broader strategy that combines industrial dominance with geopolitical leverage. It’s economic warfare in slow motion.

That’s why the U.S. and its allies are no longer just talking about reshoring rare earth supply chains…

Now they’re finally writing checks.

The Pentagon has stepped in as both financier and customer. Permitting is being streamlined. And private capital is flooding into exploration, mining, and processing companies across North America and Australia.

All that added together makes right now a uniquely powerful entry point for investors…The rare earth space isn’t just a niche commodity market anymore.

It’s at the heart of the next global industrial cycle. And the companies working to break China’s monopoly aren’t just providing minerals. They’re delivering geopolitical insurance.

With China tightening the screws more frequently and aggressively, the need for reliable, non-Chinese sources of rare earths isn’t just a matter of economic strategy anymore…

It’s become a national security imperative.

So now that you’ve got a better idea of where we stand and why all this matters so much, let’s talk a little bit about three of the public companies helping break China’s kung fu grip on the global rare earths market…

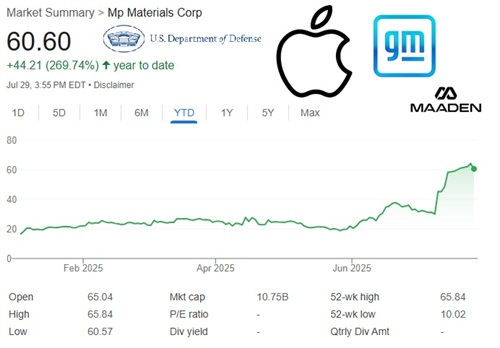

1. MP Materials (NYSE: MP)

Location: Mountain Pass, California

Focus: Mining, separation, magnet production

Backers: U.S. Department of Defense, GM, Sumitomo, Apple, Ma’aden

MP Materials owns and operates the Mountain Pass mine — the only active rare earth mine in the United States. But mining is just the beginning.

MP has secured hundreds of millions in government support to bring rare earth processing and magnet-making back to American soil.

Their Stage II operations aim to reestablish full separation and refining capacity at Mountain Pass.

Stage III will include downstream magnet production, a critical component that currently doesn’t exist in the U.S.

MP has already partnered with General Motors to supply magnets for EV motors and is building out a magnet facility in Fort Worth, Texas.

It’s also got partnerships with Apple, the Pentagon, and Saudia Arabia’s state-owned mining behemoth Ma’aden.

And investors are loving the deals, sending shares up nearly 300% this year alone!

Why it matters: MP Materials is vertically integrating the rare earth supply chain — from rock to magnet — on U.S. soil. That gives it a massive strategic advantage and positions it as the flagship of America’s rare earth revival.

And while its stock is already soaring thanks to all the strategic partnerships and strategic investments, this is a long-term opportunity, and MP has first-mover advantage.

(Side note: MP Materials is a recommendation in my premium investment community, The Wealth Advisory, who bought in June of this year and are up over 80% in the past month alone.)

2. Lynas Rare Earths (ASX: LYC; OTC: LYSCF)

Location: Western Australia; expansion in Texas

Focus: Mining and processing of light rare earths

Backers: U.S. Department of Defense, Australian Government

Lynas is the largest rare earths producer outside of China.

Its Mount Weld mine in Western Australia is one of the richest rare earth deposits in the world.

The company also operates a processing facility in Malaysia and is now building a heavy rare earth separation plant in Texas. That’s being partially funded by the U.S. government.

Lynas specializes in light rare earths like neodymium and praseodymium, which are crucial for magnets used in EVs, robotics, and defense systems.

With expansion underway, Lynas is securing long-term contracts and emerging as a key U.S. ally in the rare earth arms race.

Why it matters: Lynas provides scale, credibility, and active production in a market dominated by Chinese firms. It’s the backbone of the Western rare earth push, and its U.S. expansion adds to its upside.

3. Rare Element Resources (OTCQB: REEMF)

Location: Bear Lodge, Wyoming

Focus: Heavy rare earth development and demonstration plant

Backers: U.S. Department of Energy

Rare Element Resources is a small-cap name with big ambitions…

Its Bear Lodge project contains a high concentration of heavy rare earth elements — like dysprosium and terbium — that are harder to find and even more strategically critical.

With a recent $22 million grant from the U.S. Department of Energy, the company is currently constructing a demonstration-scale processing facility in Wyoming.

If successful, this would pave the way for full-scale development and establish a new source of heavy rare earths in North America.

Why it matters: It’s early-stage and speculative, but REEMF is one of the few U.S.-based plays focused on heavy rare earths, which have even fewer Western supply options.

That makes this one high risk but potentially very high reward.

The Investment Case

We’ve talked about the elements. We’ve talked about their uses. We’ve talked about China’s dominance and the Western push to break that…

But it’s time we get to the bottom line..

Physical rare earths may be in demand, but it’s the companies who mine, refine, and scale the supply chain that stand to capture the real profits.

These companies offer investors leveraged exposure to rare earth price increases, geopolitical tailwinds, and government-backed expansion.

As the image below makes crystal clear, the market needs to find more supply outside of China:

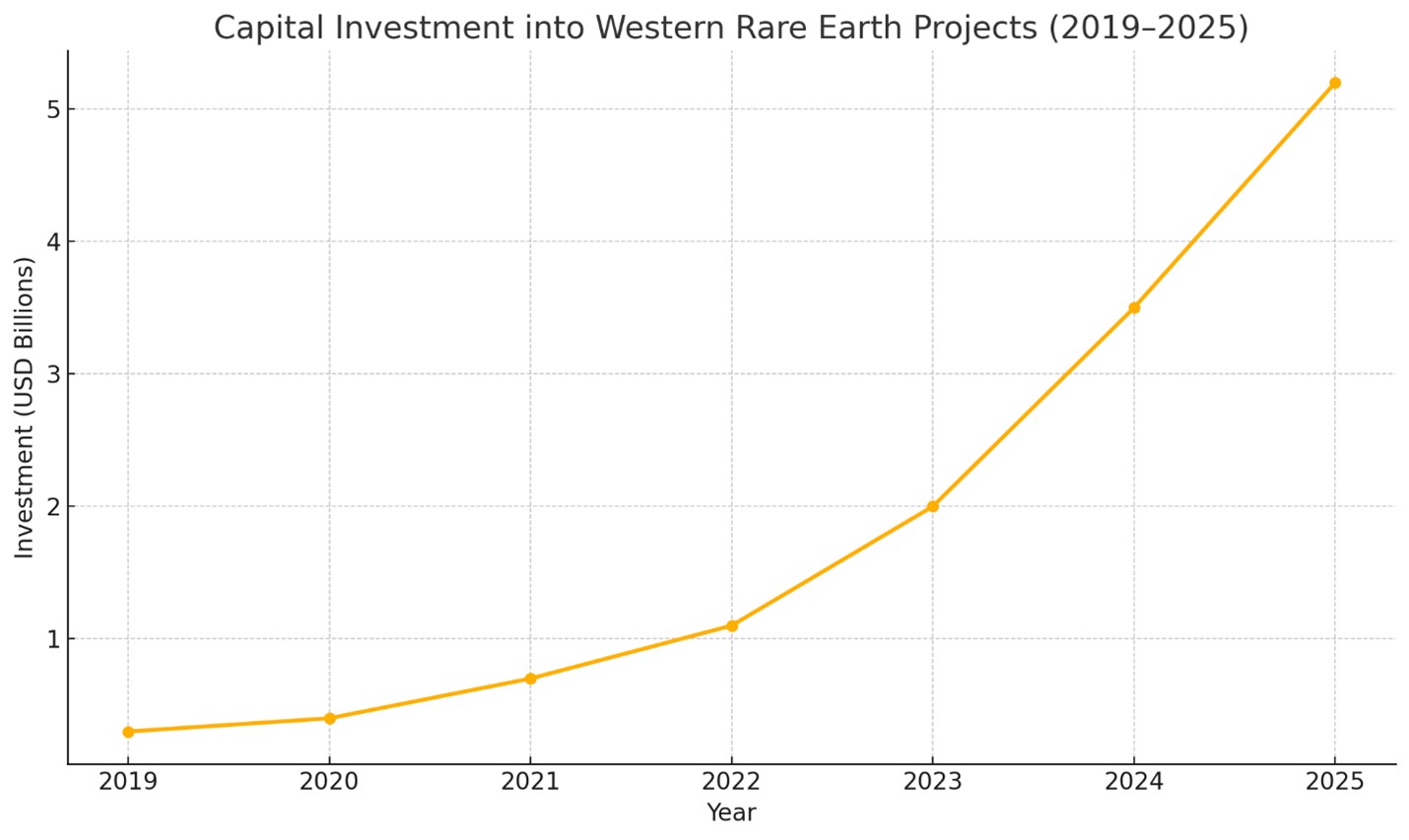

And as the chart below shows, they’re willing to pay up BIG-time for it…

In the short term, tensions between China and the West, new sanctions, and global infrastructure spending will all keep rare earths in the spotlight.

But the real opportunity lies in the long game…

Global demand for rare earths is projected to grow by over 50% in the next decade, driven not just by clean energy, but by continued growth in electronics, aerospace, defense, and AI hardware.

The Real Bottom Line

For years, China has used the West’s climate guilt as cover to dominate the world’s most strategic supply chain. Now that the world has caught on, there’s a scramble to catch up.

Companies like MP Materials, Lynas, and Rare Element Resources are answering the call.

And in doing so, they offer investors a rare opportunity to ride a long-term trend just as it’s gathering steam.

We’re witnessing the dawn of a global resource reshuffle.

Those who position themselves early in the right rare earth miners won’t just be investing in metals — they’ll be investing in energy independence, national security, and the next wave of industrial transformation.

So we advise you get off the sidelines if you’re still on them and get in now.

Because once the West finally breaks free from China’s grip, the biggest gains will already be behind us.

To your wealth,

Jason Williams

After graduating Cum Laude in finance and economics, Jason designed and analyzed complex projects for the U.S. Army. He made the jump to the private sector as an investment banking analyst at Morgan Stanley, where he eventually led his own team responsible for billions of dollars in daily trading. Jason left Wall Street to found his own investment office and now shares the strategies he used and the network he built with you. Jason is the founder of Main Street Ventures, a pre-IPO investment newsletter; the founder of Future Giants, a nano cap investing service; and authors The Wealth Advisory income stock newsletter. He is also the managing editor of Wealth Daily. To learn more about Jason, click here.

Want to hear more from Jason? Sign up to receive emails directly from him ranging from market commentaries to opportunities that he has his eye on.

The Best Free Investment You'll Ever Make

We never spam! View our Privacy Policy

After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox daily.

@TheReal_JayDubs

@TheReal_JayDubs Angel Research on Youtube

Angel Research on Youtube