Famed investor John Templeton once said, “Bull markets are born on pessimism, grown on skepticism, mature on optimism, and die on euphoria.”

I have written numerous times in the past regarding the stages of a bull market…

John Templeton was right.

Do you remember back in 2008 when everything China was coming up roses?

There were stories that China was going to take over as the world’s largest economy.

China was buying up all the commodities in the world… nine out of ten skyscraper building cranes were in use in China… etc., etc.

Well, if you had bought into the euphoria, hype, and speculation at the top, you would have lost two-thirds of your investment.

Here is what the Shanghai Index has looked like over the past six years:

The Shanghai is interesting because it contains mostly retail investors. Large institutions are limited from investing in the Shanghai exchange; so in that regard, it might be the best “pure” stock market in the world.

As you can see, the Shanghai market just got hammered.

If you had bought at almost any time over the last half a decade, you would have lost money.

But to me, this chart looks great. I love it.

We have reached a point where none of the mom-and-pop money wants to invest in China — yet at the same time, things are picking up…

HSBC recently reported that its measure of sentiment among manufacturing purchasing managers advanced to 51.2, the highest level in six months.

On a technical basis, the chart has put in a double bottom, has broken its downtrend line, and looks like it will break out to the upside.

It looks to me like all of the sellers have been squeezed out.

Any positive news from here on out will push Chinese stocks higher.

Sir Templeton

Getting back to John Templeton, who became a billionaire by pioneering mutual funds…

He was one of the first to invest in Japan in 1960.

Templeton made his bones during the Depression, when he bought 100 shares of each of the 109 NYSE stocks, then trading for under $1 a share. He made a fortune in the run-up to WWII.

In other words, he was a classic contrarian investor with a good eye for seeing the bottom.

If he were alive today, I can’t help but think he would be buying China…

If bull markets are born on pessimism, then China as an investment has plenty.

But it’s this very pessimism that makes China a powerful investment opportunity.

I know that many of you won’t be buying China. You are, after all, human. Your instincts are toward herd preservation. If you do buy, it will be after the index has doubled and all of the easy money has been made.

But to be a great investor, you have to fight these instincts.

If you are worried when you are buying, that’s a good sign.

If you need further proof, look at this chart…

That’s the NASDAQ from 1999-2003. It had lost more than two-thirds its value.

Can you remember a decade ago?

Internet stocks were a joke. People were crying over losing their retirement when Fogdog and AOL crashed.

William Shatner refused to do more commercials for Priceline.com, because he didn’t think they were going to make it.

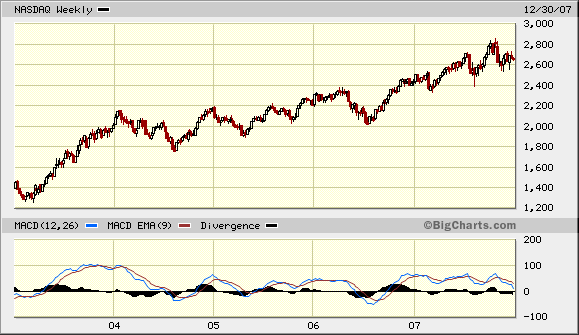

Here is what the NASDAQ chart looks like from 2003-2008 after the double bottom:

That’s a pretty good run, up 133%.

Now it’s even better: a decade after the dot-com crash bottomed out, and the NASDAQ is trading at 3,787 up from its lows below 1,200.

That’s an incredible run for an index.

You would have made even more if you’d picked specific stocks…

Priceline (NASDAQ: PCLN), for example, went from below $5 in 2003 to $998 today, a whopping 19,900% return.

Rumor has it Shatner made more than $600 million with Priceline — more than all his acting work combined.

Good hunting,

Christian DeHaemer

Christian is the founder of Bull and Bust Report and an editor at Energy and Capital. For more on Christian, see his editor’s page.