I was still in college when Bitcoin was invented.

Admittedly, I didn’t care much about finance back then.

We were smack-dab in the middle of the Great Recession, and people were not happy with our financial leadership.

It’s no coincidence that Satoshi Nakamoto, whoever that is, released Bitcoin into the world at this time.

Nevertheless, it was so new that it wasn’t really on anyone’s radar yet.

So it wasn’t until the summer of 2010 that crypto gained traction and I started paying attention.

That’s when the first-ever crypto transaction occurred.

On May 18, 2010, Florida resident Laszlo Hanyecz posted a request on the Bitcointalk forum saying that he would send 10,000 Bitcoins to whoever would send him two large pizzas.

Jeremy Sturdivant, then a student in California, fulfilled the request, creating the first crypto “transaction,” even though it was really more of a trade.

But it cemented the technology behind Bitcoin, the blockchain, as a viable means of performing a transaction.

Remember — and this is important for what's happening today — it’s the blockchain, not cryptocurrency, that holds the true power.

The coins were reportedly worth $41 at the time (they’d be worth more than $170 million today).

That pizza order opened the crypto floodgates.

We started hearing about Bitcoin, then Ethereum, then Litecoin…

(There are now over 20,000 different cryptos — can you say oversaturation?)

Then we heard about the dark web and people buying narcotics off Silk Road using Bitcoin.

All this made me very skeptical.

How could you not be?

People were using it to buy pizza and narcotics, really groundbreaking stuff…

But that was the point.

Crypto was never supposed to be worth anything as a store of value.

According to The Telegraph, Sturdivant said, “If I had treated it as an investment, I might have held on a bit longer."

But no one treated it that way.

In fact, the first people to use Bitcoin were just proving the power of the blockchain.

It was supposed to be a new form of money.

But then people got greedy and started a fad.

The rest is history.

But now that the FTX scandal has reached new heights, it’s the beginning of the end for crypto.

Government regulation is coming fast, and along with it, a possible government-backed digital currency.

There are three trends this week that prove the point.

Sam Bankman-Fried Goes to the Slammer

First, the breaking news is that Sam Bankman-Fried, also known as SBF, has finally been arrested in the Bahamas after the SEC filed charges.

According to The New York Times, the charges include wire fraud, wire fraud conspiracy, securities fraud, securities fraud conspiracy, and money laundering.

The problem for SBF is that he had a private crypto hedge fund called Alameda Research, to which he funneled FTX customers' funds.

He then allegedly used this money to back VC investments, buy expensive real estate, and donate to politicians.

The BBC wrote, "The SEC also alleges he concealed FTX's exposure to Alameda's significant holdings of overvalued FTX-affiliated tokens."

People are calling him a modern-day Bernie Madoff, but it looks like he's just the fall guy.

His entire team had to know what was going on.

Or maybe they were so hopped up on meth they didn't care.

CEO of Alameda and supposed girlfriend of SBF Caroline Ellison tweeted about her regular amphetamine use.

According to the FDA, there's a shortage of amphetamine mixed salts, aka Adderall.

Maybe that's where all the drugs went…

Meth's a hell of a drug. Join Wealth Daily today for FREE. We’ll keep you on top of all the hottest investment ideas before they hit Wall Street. Become a member today, and get our latest free report: “How to Make Your Fortune in Stocks”The Best Free Investment You’ll Ever Make

It contains full details on why dividends are an amazing tool for growing your wealth.

Mysterious Goings-On

Second, if you thought the FTX scandal was bad, wait until you hear about a string of mysterious deaths in the crypto world.

Tiantian Kullander, co-founder of Amber Group, a crypto trading platform valued at $3 billion, died in his sleep last week at just 30 years old.

Then 29-year-old crypto millionaire Nikolai Mushegian drowned in Puerto Rico after tweeting that the CIA and Mossad were after him.

Businessman Vyacheslav Taran, co-founder of trading and investment platforms Libertex and Forex Club, died in a helicopter crash in Switzerland. According to the Daily Mail, "Mystery surrounds his death, as the crash happened in good weather — and after another passenger reportedly cancelled last minute."

Obviously, we don't know if any of these deaths are related, and we're not trying to fuel any conspiracy theories.

But it does make you wonder whether something else is going on beneath the surface.

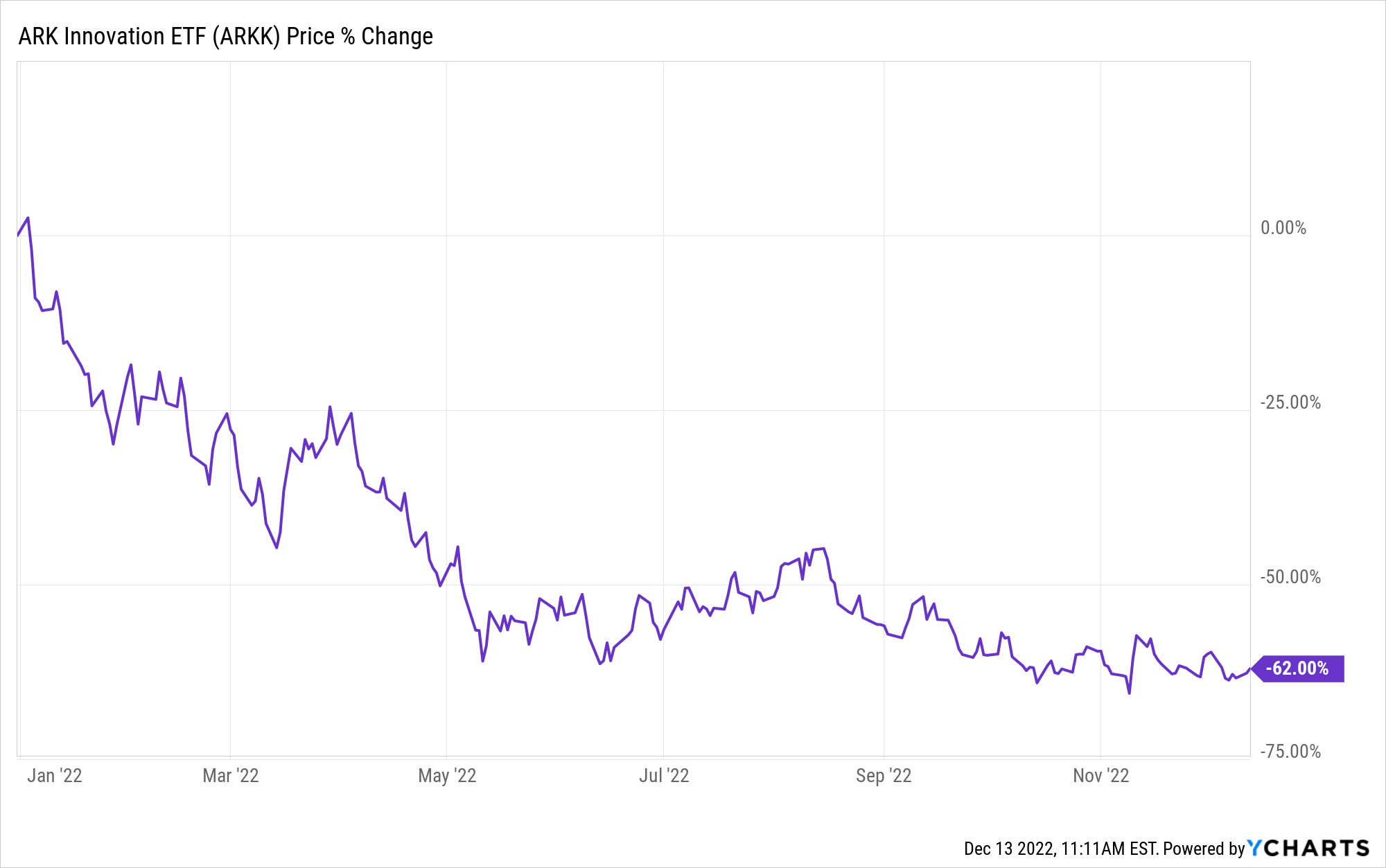

Cathie Wood’s ARKK Takes on Water

And last but not least, fund managers are still pumping crypto.

According to a recent Wall Street Journal article, Cathie Wood's taking a lot of heat lately for her risky tech growth stock purchases.

Investors are pulling out.

Her latest misstep?

Buying more Coinbase stock.

Her ARK Innovation ETF purchased 78,982 shares of Coinbase stock, valued at $3.2 million.

That puts the fund's total Coinbase holdings at 3.39%.

Oof.

As for the fund?

Well, it's not doing so good.

Down 62% year to date.

Sorry to be the bearer of bad news, but the crypto ride's over, folks.

BIG Crypto Announcement This Week

Like a bad gambler returning to the roulette wheel “just one more time,” these fund managers just can't let it go.

Gollum needs his “precious” after all.

As we saw above, crypto was never intended to be a store of value.

It was meant to prove the utility of the blockchain — that's it.

And now, because of people's greed, the great crypto experiment has failed miserably.

Investors greedily sprinted in the first mile of this long-distance marathon.

So don't be fooled twice.

Bitcoin's days are numbered.

In fact, President Biden is about to unleash what the CoinDesk calls an "anti-crypto offensive."

It could come as soon as this week.

And it will impact anyone who has a bank account, collects Social Security, or gets a paycheck.

I urge you to get the details here today.

Stay frosty, Alexander Boulden After Alexander’s passion for economics and investing drew him to one of the largest financial publishers in the world, where he rubbed elbows with former Chicago Board Options Exchange floor traders, Wall Street hedge fund managers, and International Monetary Fund analysts, he decided to take up the pen and guide others through this new age of investing. Alexander is the investment director of Insider Stakeout — a weekly investment advisory service dedicated to tracking the smartest money on the planet so that his readers can achieve life-altering, market-beating returns. He also serves at the managing editor for R.I.C.H. Report, a comprehensive service that uses the highest-quality investment research and strategies that guides its members in growing their wealth on top of preserving it.

Check out his editor’s page here. Want to hear more from Alexander? Sign up to receive emails directly from him ranging from market commentaries to opportunities that he has his eye on.

Editor, Wealth Daily

Check us out on YouTube!

Check us out on YouTube!