Is buying Bass Pro Shops stock a possibility yet? It's a question investors and outdoor enthusiasts alike ask themselves daily. Right now, Bass Pro Shops dominates the outdoor retail industry. Who's to say they wouldn't dominate Wall Street? There's just one problem. It's not a publicly traded company, yet…

As a privately held company, speculation abounds regarding the possibility of a Bass Pro Shops IPO. An IPO could raise capital, expand operations, and provide investors with access to a well-established outdoor retail brand.

Bass Pro Shops, a renowned outdoor retail giant, dominates the world of camping, fishing, and hunting enthusiasts. Its extensive network of stores and diverse product range makes it a go-to destination for outdoor lovers.

Investors eagerly anticipate a potential IPO, as rumors swirl about Bass Pro Shops going public. In this article, we explore the prospect of owning Bass Pro Shopsstock and discuss initial public offering (IPO) implications for investors.

Join Wealth Daily today for FREE. We’ll keep you on top of all the hottest investment ideas before they hit Wall Street. Become a member today, and get our latest free report: “How to Make Your Fortune in Stocks”

The Best Free Investment You’ll Ever Make

It contains full details on why dividends are an amazing tool for growing your wealth.

Bass Pro Shops Stock: What You Need to Know

Founded in 1971 by Johnny Morris in Springfield, Missouri, the company caters to diverse outdoor interests, offering fishing gear, camping equipment, hunting apparel, and boating essentials. With an unwavering commitment to customer experiences, Bass Pro Shops has become a household name.

Perhaps it’s time the company takes advantage of its popularity. If Bass Pro was to go public, investors would surely flock to Bass Pro Shops stock…

Our objective is to assess Bass Pro Shops’ financial landscape and explore if the IPO could be a lucrative opportunity for investors. We'll weigh the risks and rewards of investing in a retail sector closely tied to consumer behavior and seasonal trends.

However, as an IPO's possibility looms, it's vital to consider alternative investment avenues within outdoor retail. Therefore, alongside exploring Bass Pro Shops potential IPO, we'll spotlight other publicly traded companies in the sector. This will enable investors to make well-informed decisions and discover investment opportunities beyond one entity.

Join us as we delve into Bass Pro Shops' IPO potential, assess competitors, and discover other promising publicly traded outdoor retail companies.

Whether you're an avid investor or an outdoor enthusiast, this article equips you with valuable insights to navigate the world of Bass Pro Shops stock and beyond.

The Pros and Cons of Owning Bass Pro Shops Stock (IF It Goes Public)

If Bass Pro Shops decides to go public, potential investors must weigh the advantages and disadvantages of investing in its stock. Understanding these pros and cons is crucial for making well-informed investment decisions:

Pros:

- Established Brand and Loyal Customer Base: Bass Pro Shops boasts a well-established brand with a strong reputation in the outdoor retail industry. Its loyal customer base could translate into consistent demand for its products and potentially contribute to stock price stability.

- Diversified Product Offerings: The company's diverse range of products caters to various outdoor activities, enabling it to capture a broader market. This diversification may act as a protective measure during economic downturns or changes in consumer preferences.

- Market Potential and Expansion Opportunities: With the outdoor recreation market showing continuous growth, Bass Pro Shops could capitalize on expanding its reach to new regions or countries. Investors might find this expansion potential promising.

- Seasonal Sales Opportunities: Seasonal spikes in outdoor activities, such as fishing and hunting, may present excellent sales opportunities for the company. For investors, this could mean potential revenue surges during specific times of the year.

Cons:

- Vulnerability to Economic Conditions: Bass Pro Shop's performance might be influenced by overall economic conditions and consumer spending patterns. Economic downturns could lead to reduced discretionary spending on outdoor activities, affecting the company's sales and stock price.

- Competition in the Retail Sector: The outdoor retail industry is highly competitive, with numerous players vying for market share. Intense competition could put pressure on pricing and margins, impacting the company's profitability and, subsequently, its stock performance.

- Seasonality and Weather Dependence: Outdoor activities are often subject to weather conditions, and unfavorable weather might lead to reduced sales and revenue. Investors should consider the seasonality of the business when evaluating the stock's potential.

- Regulatory and Environmental Concerns: The outdoor industry faces regulatory and environmental challenges that could affect business operations. Compliance with these regulations might add additional costs and impact the company's performance.

Careful evaluation of the pros and cons of investing in Bass Pro Shops stock is essential for potential investors, particularly if the company decides to go public.

Though the established brand, diverse product offerings, and growth potential are appealing, investors should remain cautious about the potential risks linked to fierce competition.

Bass Pro Shops Stock Competition

The outdoor retail market is highly competitive. In addition to Bass Pro Shops, there are a few well-established players like REI and Cabela's in the same boat. These companies have a lot of resources and experience, and they can be difficult for smaller companies to compete with.

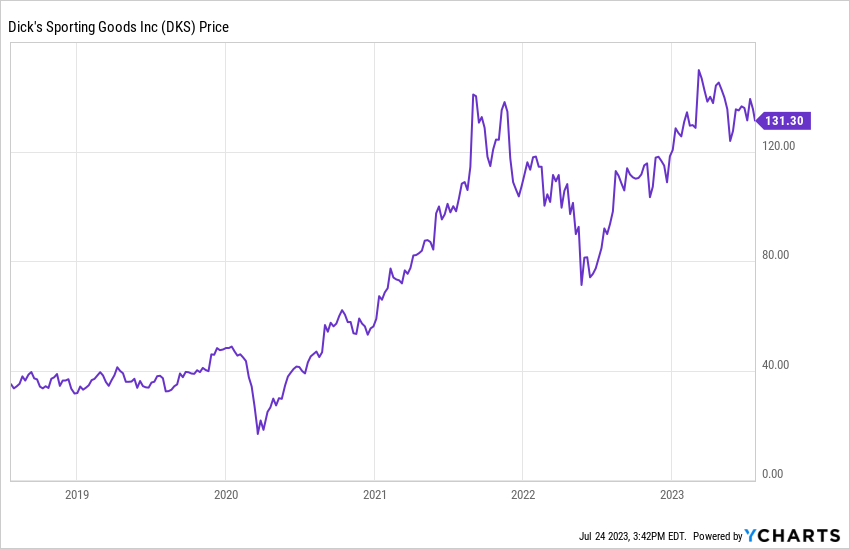

Fortunately for Bass Pro Shops, REI and Cabela’s are not public. But two companies that are public that may give Bass Pro Shops stock some difficulty in this hypothetical scenario are Dick’s Sporting Goods, Inc. (NYSE: DKS) and Acadamedy Sports and Outdoors, Inc. (NASDAQ: ASO).

While DKS and ASO focus more on traditional sports in addition to outdoor sports, they are both established dividend-paying stocks. A huge hurdle that Bass Pro Shops stock would have to battle on Wall Street.

DICK'S Sporting Goods, Inc. (DKS)

DICK'S Sporting Goods, Inc. is an American sporting goods retailer headquartered in Coraopolis, Pennsylvania. It is the largest sporting goods retailer in the United States, with over 800 stores in 47 states.

In the 1980s, DICK'S began to expand its product offerings, and it also began to open larger stores. DKS expanded its geographic reach, establishing stores in all 50 states by the decade's end.

In the 1990s, DICK'S continued to grow, and it also began to acquire other sporting goods retailers. The company acquired Galyan's Trading Company in 1999, and it acquired Eastern Mountain Sports in 2003.

In the 2000s, DICK'S continued to grow, and it also began to expand its international reach. The company opened its first international store in Canada in 2004, and it has since opened stores in Mexico, Japan, and China.

DICK'S Sporting Goods is traded on the New York Stock Exchange under the ticker symbol "DKS." The company has a market capitalization of over $11 billion and pays a 2.26% dividend.

Academy Sports and Outdoors, Inc. (ASO)

Academy Sports and Outdoors, Inc. is an American sporting goods retailer headquartered in Katy, Texas. It is the second largest sporting goods retailer in the United States, with over 270 stores in 18 states.

The company was founded in 1938 as a family business in Texas, and it has since grown to become one of the largest sporting goods retailers in the country. Academy Sports offers a wide variety of products for outdoor recreation, including hunting, fishing, camping, and sports equipment.

The company also operates an online store, academy.com, which offers a wider selection of products than the stores. Academy Sports is traded on the Nasdaq Stock Exchange under the ticker symbol "ASO." The company has a market capitalization of over $4 billion and pays a 0.64% dividend.

If Bass Pro Shops stock wants to compete on Wall Street, it’ll have to take out this Texas titan first.

The Final Say on Bass Pro Shops Stock

In conclusion, the potential IPO of Bass Pro Shop stock presents a promising investment opportunity. Once the company goes public, investors may benefit from its strong brand recognition and loyal customer base within the outdoor retail industry. Bass Pro Shop's diversified product offerings and commitment to exceptional customer experiences position it as an appealing prospect for those looking to diversify their investment portfolios.

However, the road to success for Bass Pro Shop on Wall Street may encounter challenges due to fierce competition from major players like Dick's Sporting Goods (DKS) and Academy Sports and Outdoors, Inc. (ASO). The dynamic landscape of the outdoor retail sector requires continuous vigilance and innovation to maintain a competitive edge.

As with any investment, careful consideration of the industry's seasonality, economic dependencies, and environmental regulations is essential. Investors should analyze key financial metrics, market trends, and competitive landscapes to make informed decisions.

By leveraging insights gained from assessing Bass Pro Shop's IPO potential, evaluating its competitors, and exploring alternative investment opportunities, investors can position themselves for success in the ever-evolving outdoor retail market.

Adhering to active analysis and informed decision-making empowers investors to navigate the dynamic world of outdoor retail investments with confidence. As the sun rises on Wall Street's horizon, wise investors will embrace the allure of the great outdoors and seize potential rewards ahead.

Your Ticket to Pre-IPO Investing

Want to start investing in companies BEFORE they IPO but not sure how to get started? Searching Google for pre-IPO opportunities won't lead you to the next Facebook or Tesla offer.

Accessing top-tier pre-IPO investments requires knowing the right people — and today, luck is on your side. Wealth Daily analyst, Jason Williams, once a frontline player on Wall Street, possesses years of experience in pre-IPO investing. Having witnessed countless deals and the exploitation of retail investors in this arena, he established Main Street Ventures to level the playing field.

Main Street Ventures grants you the opportunity to partake in pre-IPO investing deals. Jason's extensive network, consisting of venture capitalists, private equity consultants, serial entrepreneurs, and corporate executives, opens doors that were previously out of reach.

So what is it exactly? It’s your ticket to take part in pre-IPO investing deals.

Jason has spent over a decade building up a network of venture capitalists, private equity consultants, serial entrepreneurs, and corporate executives. All you need to do to get access to Jason and his extensive network is take the first step right here.