Dear Reader,

It happened almost 10 years ago.

The famous Bitcoin Pizza, the first ever open-market transaction involving a cryptocurrency, took place on May 22, 2010.

On that particular Saturday, software engineer Laszlo Hanyecz, probably hypoglycemic from an all-night coding session, decided he wanted to order some pizzas from Papa John’s.

Not the most extraordinary decision in and of itself, until he made the fateful decision that would turn the seemingly mundane purchase into legend.

Instead of using his credit card, Laszlo used Bitcoin.

Back then, Bitcoin’s value was just a small fraction of a dollar. So small, in fact, that Laszlo had to mobilize 10,000 of them just to get his two pizzas, worth less than $40.

Fast-forward seven and a half years…

The crypto market is raging. Bitcoin, the grandfather of what is now hundreds of new and exciting, often confusing, digital currencies, is trading for $9,000 and rising rapidly.

Before the year is out, Bitcoin would top out at $20,000, making the bitcoins Laszlo had exchanged for his two pizzas worth a staggering, mind-blowing, reality-twisting $200 million.

That is the story of the Bitcoin Pizza, the first and most storied of all purchases involving cryptocurrencies.

It was the greatest return on any investment ever. From $40 to $200,000,000 in the space of 2.5 presidential terms.

For those who don’t want to crunch numbers that big, that’s a 5,000,000x return on investment, or, for those with an affinity for percentages, a gain of half a billion percent.

The Biggest Lost Opportunity?

Thinking back to this story makes me wonder the same thing I wondered the first time I heard it: Did Laszlo bother to save enough of his stash of BTC to take advantage of its unparalleled bull run?

I sure hope so, because it pains me to think that somebody out there missed out on a life-changing, generational-wealth-securing fortune like that just because he didn’t feel like tapping into his cash reserves for the sake of satisfying a case of the munchies.

But that’s not what I’m here to talk about today.

You see, after those heady peak days of late 2017, the price of BTC, along with every other crypto out there, collapsed.

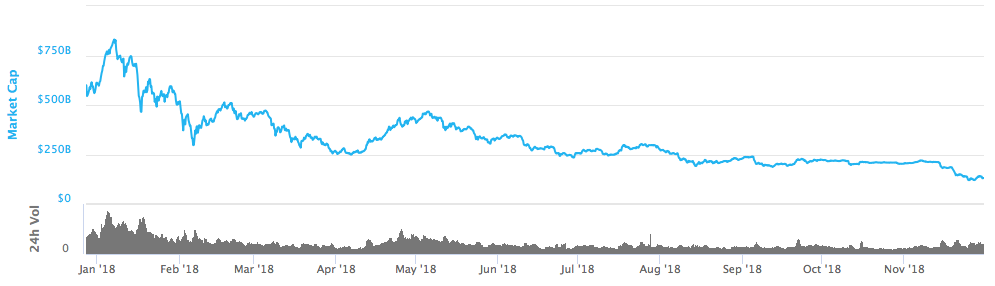

The entire crypto market went from a total market capitalization of $800 billion to just over $110 billion in 11 months.

Bitcoin’s drop took it down from $20K in mid-December 2017 to somewhere around $3K a year later, mirroring the broader crypto market.

The Battle of Hodl! vs. I Told You So

To seasoned investors, this collapse was just a matter of time, and the distance the market fell was directly proportionate to the momentum it carried on the way up.

It was like firing a slingshot. The farther you stretch the bands, the farther the pebble will go.

The mistake everyone made was as old as speculation itself and a clear violation of the first rule of what not to do: making the assumption that today’s and yesterday’s market performance would be repeated tomorrow and the day after.

They all saw the 24/7 media coverage; they all salivated over the 500,000,000% gains, and they were tripping over themselves just to get exposure, any exposure, to this potential.

It was a recipe for disaster, and that’s exactly what many of the late arrivals experienced.

Crypto 2.0

But, again, that’s not what I’m here to talk about.

What I’m here to talk about is what’s happening today.

You see, the mania is gone now. The weak hands, burned, charred, unwilling, and probably unable to ever return to the crypto market, are nothing but a memory.

And yet, as I write this, Bitcoin trades for just a tick under $10,000.

That’s right — since hitting its lows in December of 2018, almost exactly a year from its absolute lows, Bitcoin, the first-ever digital currency, has tripled in value.

Just like the first time around, the rest of the market is following along. Ethereum, the #2 player, has also tripled from its low point.

Ripple, Dash, and all of the other major names have had similar post-collapse resurgences.

The entire sector is following the same path, with today’s total market cap at close to 2.5x where it was during last year’s lows.

Growth is rapid, but there is no mania this time. There is very little media fanfare. Those investing today are the pros, the steady-nerved assassins, the diehards who never sold even when the going was at its toughest.

Devoid of these bull-market steroid shots, the crypto market is back for a second go, and many of the same experts who were predicting a collapse in 2017 are now predicting a steady, long-term bull market.

So if you missed out on the gains, and the losses, of the 2017–2018 days, let me be the first to tell you: Your second and final chance at life-changing gains in the crypto space is here.

The Best Free Investment You’ll Ever Make

Join Wealth Daily today for FREE. We’ll keep you on top of all the hottest investment ideas before they hit Wall Street. When you become a member today, you’ll get our latest free report: “The Nvidia Killer: Unlocking the $100 Trillion AI Boom.”

It contains the most promising AI companies and sectors poised for explosive growth. Our team of expert analysts has conducted thorough market research to uncover a hidden gem currently trading at just $2.

After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox daily.

It’s There If You Want It

There does exist a viable and workable way for you to achieve the gains that early Bitcoin investors saw before this whole circus train left the station back in early 2017.

You might not make millions of percent gains, but the opportunity to multiply your investment by 10, 100, perhaps even 1,000 exists today… For now.

There is just one problem: Bitcoin isn’t going to get the job done.

To see the real returns, you need to go into a category of cryptocurrencies that few knew about, much less dared to enter.

You have to be willing to do the same kind of unorthodox thinking that the early Bitcoin buyers did.

I’m talking about guys like the Bitcoin Pizza buyer himself, Laszlo Hanyecz… And say what you will about him, but remember this: He had to have those 10,000 bitcoins to spend. He most likely had a whole cache he didn’t spend.

He’s probably a multimillionaire today because of it.

Do what he and others like him did with a modern alternative cryptocurrency, and you could see a $500 investment turn into $50,000 inside of a few years.

I’ve been scouring this market since the early days, and though it hasn’t been easy, I’ve pinpointed the one alternative cryptocurrency that I think has all the potential of an early Bitcoin investment.

Perhaps even more.

The technology is revolutionary and, unlike most cryptos, fairly easy to understand.

But the real potential lies in its mid- to long-term growth prospects.

It lost big in last year’s collapse, and it’s still trading close to its lows — which means your chance to get in on the ground floor is here right now.

But you know how fast this market can move.

Today, my microcap crypto discovery is trading under $0.10.

A month from now, it could be five times that. There’s really no way to tell.

Learn all you can about it right now, completely risk free, before it’s too late.

My brand-new report details the tech, the rationale, and even the process of buying.

Fortune favors the bold,

Alex Koyfman

His flagship service, Microcap Insider, provides market-beating insights into some of the fastest moving, highest profit-potential companies available for public trading on the U.S. and Canadian exchanges. With more than 5 years of track record to back it up, Microcap Insider is the choice for the growth-minded investor. Alex contributes his thoughts and insights regularly to Energy and Capital. To learn more about Alex, click here.