A week or so ago, I sent an update to the readers of my pre-IPO investing service Main Street Ventures with that same subject line: “Why We Do Research.”

I’d promised my investors a new pre-IPO deal the week before. I’d been researching a few offers that had come across my desk and both looked like pretty good deals on first blush.

But we never invest based on the first blush. That can get you into a lot of trouble. On first blush, a lot of companies seem like great investments. Maybe they’re solving a common problem in an existing industry, or maybe they’re creating an entirely new industry (like Facebook did with social media).

But the idea or the product is only part of the picture. And when you get right down to it, it’s not really that big a part.

The reason I decided against that deal was the structure and the valuation. The company was trying to come to market with a valuation way too high for what it was. And the early investors barely contributed any money but would control nearly 97% of the outstanding shares.

But there are other reasons I’ll say no to a deal. One of them is if the founders give me a “bad vibe.” You know what I mean. Sometimes you meet someone and there’s just something about them that rubs you the wrong way.

I’ve told you about the founders who told me that retail investors are too stupid to realize they’re getting a raw deal. And I’ve told you about the ones who’ve said (not in these exact words of course) they’re in it to get rich and get out.

But there have been a few others that didn’t sit right for various reasons. And recently, we’ve got a good idea of what happens to a company and its investors when those feelings go unaddressed.

The Tesla of Trucks Tricks

This past June, the markets were in love with a new company that had just gone public via a reverse merger with a blank check company, also known as a special-purpose acquisition company (SPAC).

The SPAC had been started by GM’s former vice-chair, Steve Girsky. And the company he merged with was none other than Nikola, the alleged manufacturer of electric and hydrogen-powered trucks.

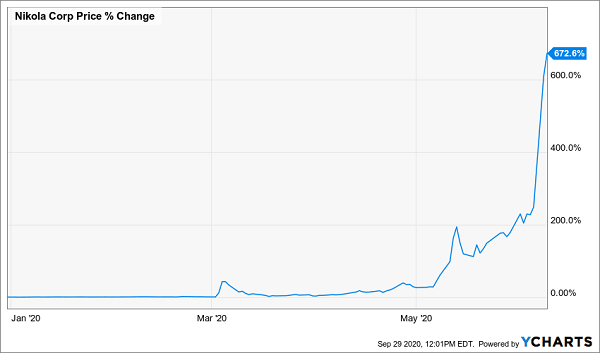

Shares took off as Nikola (and other EV companies) followed the trajectory of Tesla’s stock and ran up hundreds of percent as investors pumped money into the sector.

Shares of the newly public company soared 672.6% in just a few days!

Since then, however, it’s lost over 75% of its value as it keeps sliding further and further over a cliff.

So, what happened to the “Tesla of Trucks”?

Well, it turns out that it was actually the “Tesla of Tricks” and most of what the founder had claimed was untrue.

The company did not have the technology it claimed. Its fuel cells were all supplied by another company. Its “working” truck didn’t have the ability to move on its own and was missing several other critical parts. It even bought the designs for its planned vehicles from another company. The only thing Nikola created was the trade name “Nikola.”

And it turns out that the founder, Trevor Milton, has a history of shady business dealings that typically end in court and with him (and his investors) losing.

But the thing that’s so concerning about this is that early investors knew about the issues. And back in March, long before the reverse merger took Nikola public, they’d forced the founder to give up his spot as the CEO. They also had his father removed from the board of directors.

You see, the founder had a record of unscrupulous dealings which worried the early investors enough to give him the boot.

What dealings you might ask? Well, let’s go down the line:

- In 2009, he founded a company called Upillar.com that failed and took all investor funds with it.

- The same year, he founded a company that retrofitted diesel vehicles with natural-gas-burning turbines. That company ended in court after it defaulted on a $322,000 loan and failed to retrofit the vehicles it was contracted to update.

- In 2012, Milton tried to sell that failed clean propulsion company but that deal got stuck in court as the other party accused Milton of exaggerating technological capabilities (sound familiar?).

- Then came Nikola. He hired his family members despite them having resumes that didn’t fit their jobs at all. And he put his father on the board of directors as well as doling out millions in stock incentives to his brother and uncle.

- And that’s not to mention the cousin who accused him of sexual assault when she was 15 and he was 17.

That’s just a selection of the nefarious deeds he’s been accused of in the past, but he still got tons of money from investors. He even conned General Motors into a deal, too.

I’m going to go out on a limb here and guess that somebody in the due diligence department at GM isn’t getting a big bonus this year.

Don’t Blame Trevor

But the thing here is that everybody is talking about how this guy, Trevor, hoodwinked everyone. They’re not talking about how everyone missed all those bright red flags waving over the investment.

But I am. How could you miss that much evidence this guy was a liar and a cheat? Don’t blame him for being what he’s always been. Blame yourselves for thinking he was something different than what he’s shown he is.

That’s why we do research because you can’t just take whatever people say at face value just because you want it to be true. You’ve got to do your own research. You’ve got to do real due diligence.

That’s why I spend hours pouring over SEC documents and financial statements. That’s why I look into all of the people working at the company. That’s why I learn about the other investors. Only if I’m satisfied with everything will I make an investment myself or recommend an investment to you.

You can’t get upset because a shark bit you; that’s what sharks do. It’s what they’ve always done. So, if you want to swim with them, you’ve got to accept the fact that you’re going to get bitten one of these days if you don’t take proper precautions.

If you don’t want to get bitten, you don’t swim where the sharks are or you get yourself a high-quality shark cage.

That’s why I started Main Street Ventures. There are a lot of great opportunities out there for regular investors to get in on private companies before they go public. I want to help people find those.

But there are also a lot of founders like Milton out there waiting for the opportunity to steal your money by blatantly lying to your face. And they’re good. He was able to fool GM. You know they’ve got a big (and well-paid team) team working on these partnerships doing the due diligence. And they still missed all those glaring red flags about the company and its founder.

I want to help people avoid those.

Stay on top of the hottest investment ideas before they hit Wall Street. Sign up for the Wealth Daily newsletter below. You’ll also get our free report, “Seven Techincal Analysis Tools for Investors.“

Financial Shark Diving Tours

So MSV is kind of like a shark cage. You get to go in the water and see what’s going on, but you’ve got a layer of protection keeping the sharks from getting a taste of your soft parts.

And you get the added benefit of having a seasoned tour guide who’s seen a few shark bites in his life and learned the hard way how to avoid them.

Not only do I have a network of entrepreneurs and investors bringing me deals, but I’ve got the experience and the information to vet those deals before passing them on to you.

I’ve got a database of financial statements and regulatory filings at my disposal. I’ve got a state-of-the-art research facility here in Baltimore, Maryland.

I’ve got access to professional and court records of individuals so I can cross-reference any legal issues they’ve had in the past and find any failed companies they’ve been involved with no matter how hard they try to hide them.

And I’ve got years of experience investing in these kinds of companies myself.

But, unlike most of my former co-workers on Wall Street, I’ve also got a conscience. I can’t stomach the idea of doing well for myself by hurting others.

So, I won’t take money to recommend a company. And I won’t take free shares either. And I won’t recommend an investment I wouldn’t make myself with my own money.

I’m what these folks call “earned media,” because there’s no way they can buy my recommendation. They have to earn it based on the merits of the business, the structure of the deal, and the team behind the company.

The Real “Tesla of Trucks”

And one company that’s earned my recommendation is actually doing what Nikola only claimed it was. And it’s got real proof in the form of a truck that really can operate under its own power (and actually has on California’s highway system).

It’s the real “Tesla of Trucks,” and it’s got the potential to make early investors even more than Milton made through his scam company (his stake in Nikola is still worth about $1.5 billion).

You see, this company isn’t trying to bilk investors into thinking it’s something it’s not. To prove that point, it built a functional prototype in just six months last year to debut at the ACT show in Los Angeles.

Now, it’s raising money on the same terms that Elon Musk got when he first invested in Tesla’s seed round. I’m talking about real angel investor profits — Shark Tank stuff.

You see, when the founders of Tesla came to Elon Musk looking for money to get their company off the ground, it was just an idea and a couple of guys. There was no technology. There wasn’t even a name or corporate letterhead.

This company has the technology. It has the name. It has intellectual property. And it’s got a working prototype.

And by this time in 2022, its trucks will be on the road delivering your Amazon packages and Blue Apron meal kits.

Now, I can’t give out the name of the company here because that wouldn’t be fair to the investors who’ve paid to become a part of Main Street Ventures.

I’ve Got Two Tickets Your Ticket to Paradise

But what I can do is offer you a massive discount to join us today. I could easily charge thousands of dollars a year for access to these kinds of investments and this kind of research.

My former clients at Morgan Stanley would pay hundreds of thousands a year in fees for the same kind of due diligence and investment opportunities I provide. But I left Wall Street to help Main Street, and charging a king’s ransom for my help isn’t really helping at all.

So, I’ve convinced the powers that be at our parent company, Angel Publishing, to let me offer my services at a massive discount to their true value.

You won’t have to pay the hundreds of thousands my old clients did at Morgan. You won’t even have to pay the thousands of dollars people suggested I charge when I founded this service.

For less than the cost of a dinner out (remember those?), you can get access to my database of pre-IPO deals and all of the research I do to make sure we’re investing in the “Tesla of Trucks” and not the “Tesla of Tricks.”

You’ll get access to me, my team, my network of entrepreneurs, and all the potential 10-baggers we’re funding. And all you have to do is click this link to get started.

But I can’t offer this discounted price for long. The powers see the value here and they want me to charge more for all the time I spend working on these deals. So, if you want to join me and my investors in these lucrative pre-IPO deals, you’ll have to act fast.

If you delay, you might find out that I’ve been forced to raise the price. Or you might find that I’ve filled the available seats and closed the community to new members.

Plus, these kinds of investments fill up fast. They’re not like stocks where you can always buy them.

They’re only open until they raise the money they’re looking for and then the deal is gone forever and along with it, the opportunity for those massive gains you hear about whenever a company does an IPO.

So, take a few minutes out of your day today to learn how to join us so that you can get in on the real “Tesla of Trucks” and avoid being duped by the Trevor Miltons of the world.

You can access a video presentation detailing the opportunities here. Or you can access a written report with all the same information here.

However you get the information, make sure you do it today. Tomorrow may already be too late to get in on this incredible deal.

So, click here now and learn how you can join us and invest in the true “Tesla of Trucks.”

To your wealth,

Jason Williams

After graduating Cum Laude in finance and economics, Jason designed and analyzed complex projects for the U.S. Army. He made the jump to the private sector as an investment banking analyst at Morgan Stanley, where he eventually led his own team responsible for billions of dollars in daily trading. Jason left Wall Street to found his own investment office and now shares the strategies he used and the network he built with you. Jason is the founder of Main Street Ventures, a pre-IPO investment newsletter; the founder of Future Giants, a nano cap investing service; and authors The Wealth Advisory income stock newsletter. He is also the managing editor of Wealth Daily. To learn more about Jason, click here.

Want to hear more from Jason? Sign up to receive emails directly from him ranging from market commentaries to opportunities that he has his eye on.

@TheReal_JayDubs

@TheReal_JayDubs Angel Research on Youtube

Angel Research on Youtube