Dear Reader,

In what's quickly become one of the most salient sound bites of the year, Nancy Pelosi went before the press earlier this week, saying, "We still support the 'One China' policy," and following that up with the even more astounding statement: "China is one of the freest societies in the world."

She made these statements on the heels of a trip to Taiwan, which, at the time, was seen as a gesture of support for a nation that has been fighting for recognition as a self-governing entity, distinct and independent from the People's Republic of China, for half a century.

The true nature of her visit, however, becomes more clear when we take into account one particular, unofficial travel companion — her son, Paul Pelosi Jr.

Paul Jr. was an unnamed guest on the trip, but this wasn't just a case of mom taking sonny out for a quick jaunt across the world on the taxpayers' dime.

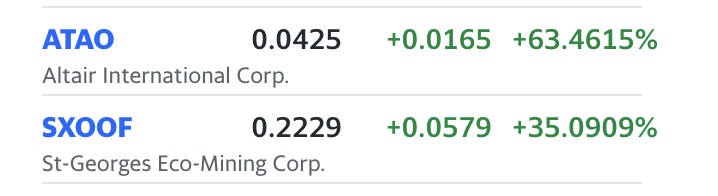

You see, Paul sits on the boards of two junior lithium mining exploration companies, St-Georges Eco-Mining Corp. (OTC: SXOOF) and Altair International Corp. (OTC: ATAO).

And what's Paul's purpose as a high-level officer of these companies?

Well, according to Altair International's website, "His focus will be on Altair’s corporate mission developing strategic partnerships with other companies in the lithium mining and related sectors."

As of midday Wednesday, those two stocks were up 63% and 35%, respectively, for that session alone. Coincidence, right?

It shouldn't take too much of a logical leap to see where this is going.

Lithium: The Gasoline of the 21st Century?

Lithium is the key ingredient in lithium-ion batteries, the current world benchmark for rechargeable power solutions ranging in magnitude from coin-sized cells to building-sized distributed power storage arrays.

China's home to some of the world's top lithium-ion battery producers, including Tesla's (NASDAQ: TSLA) own chief supplier, CATL.

On top of that, China also owns a massive chunk of the lithium mining exploration sector, a portfolio that it continues to grow on an almost weekly basis.

To Paul Pelosi, whose interests and personal fortune are now largely tied up in lithium, China isn't so much a competitor as it is a necessary partner — or, given the CCP's penchant for control, a potential taskmaster.

In light of these unpleasant realities, Pelosi's trip to Asia looks less like a show of support for Taiwan and more of a great big bow before the chief shareholder of the global lithium battery market.

Now, I know what some of you may be thinking right now… Politicians like Pelosi — and, more specifically, Pelosi herself — need to go.

I will assume that most of you also understand just how unlikely it is that she will ever leave office so long as she is able to stay upright.

There are few things that Californians like more than electing crooked, virtue-signaling fraudsters as their representatives, but one of those things is reelecting them… With Pelosi being the third-most-powerful politician in office today, she is about as close as it comes to running unopposed in the next election cycle.

She Cannot Afford to Quit

Add to that the fact that both she and her husband may well face criminal charges in the event that she loses power, and the result is simple: She's here to stay.

What can be done, at least with regard to this situation, comes from a completely different angle.

We can circumvent the crooked politician and go straight for the resource at the heart of the matter: lithium.

Right now there is a push to replace lithium as the chief building block of modern batteries, and one of the least-well known yet most prospective front-runners is a futuristic material known as graphene.

Graphene isn't an element, like lithium, but a man-made nanomaterial engineered on a molecular level.

It's 200 times as strong as steel, yet so light that an acre-sized sheet of it weighs less than 1 gram.

It's one of the best conductors of electricity, and is the best conductor of heat known to man — making it an ideal candidate for battery cathodes.

A battery made from graphene boasts performance stats that are in line with its incredible physical properties.

Join Wealth Daily today for FREE. We’ll keep you on top of all the hottest investment ideas before they hit Wall Street. Become a member today, and get our latest free report: “How to Make Your Fortune in Stocks”The Best Free Investment You’ll Ever Make

It contains full details on why dividends are an amazing tool for growing your wealth.

The Most Important Breakthrough in Materials Science Since the Advent of Carbon Steel

For one, it's got a much higher energy density, which means an electric vehicle powered by graphene will have a range of up to 1,000 miles, a life span of up to 1 million miles, and a charge speed up to 70 times as fast as a similar-sized lithium-ion battery pack.

That's no typo. Stick a graphene battery pack into your Tesla and it will charge from 0% to 100% in less than one minute, making it quicker to achieve full range than pumping a tank full of gasoline.

Yes, it's that revolutionary.

So revolutionary, in fact, that graphene-powered EVs stand a very good chance of eliminating the internal-combustion vehicle market in just a few short years.

But that's not where the benefits end.

Thanks to a recent breakthrough in graphene production, this wonder material can now be produced very cheaply, using nothing more than natural gas and electricity.

That means no more reliance on China or its growing collection of lithium properties.

No supply chain issues means no delays in production or delivery… and no need to grovel before the Chinese Communist Party the way Speaker Pelosi did earlier this week.

The Key to a Graphene World Lies in Queensland

If you can't throw out the witch, you can, at the very least, take away her broom and cauldron.

There is one company in operation today that owns the patent to this disruptive new production method, and it too is not Chinese.

It's Australian, and its batteries are already rolling off the assembly lines, on their way to client firms for testing and evaluation.

This would be the biggest story in tech today if this company were a multibillion-dollar tech brand.

The reality, however, is that this company is currently trading (yes, it's public) with a market cap of just a few hundred million dollars.

I know I probably don't need to tell you this, but I will anyway. When graphene batteries hit the market and are adopted by the tech and automotive industries, they have the potential to virtually wipe the $50 billion-per-year lithium sector off the map.

For those doing the math, that's roughly $200 of value for every dollar of current market capitalization — each and every year.

There is obviously much, much more to this story than what you just read here. More facts and figures that will open your eyes to the realities of our supposed lithium-powered future, and to the potential of graphene as its replacement.

My video production team has compiled all of this data into a quick, easy-to-digest video made just for our Wealth Daily readers.

I urge you to check it out at your soonest convenience. It's available right here, in its entirety. No registration or emails required.

Just watch and learn.

Fortune favors the bold, Alex Koyfman His flagship service, Microcap Insider, provides market-beating insights into some of the fastest moving, highest profit-potential companies available for public trading on the U.S. and Canadian exchanges. With more than 5 years of track record to back it up, Microcap Insider is the choice for the growth-minded investor. Alex contributes his thoughts and insights regularly to Energy and Capital. To learn more about Alex, click here.