Dear Reader,

When asked how long one should hold a stock, Warren Buffett famously responded: “My favorite holding period is forever.”

Coming from a guy who almost never invests in companies valued at less than $1 billion, it makes sense.

You buy a position worth hundreds of millions, and you wait, and wait, and wait, collecting dividends along the way, reinvesting those dividends, and a couple decades later, you’re sitting on profits big enough to run small nations.

It’s this style of investing that made the Oracle of Omaha the wealthiest investor in history, but, as the very core of his methodology requires, it took time.

A lot of it.

In today’s world, time, even for the young among us, isn’t something that’s perceived as abundant.

Scientific Greed: Today’s Winners Are All Doing It

We want it all right now, with no delays. Instant results. Immediate gratification. It’s a drug addict’s philosophy applied to every aspect of life.

In the world of investing, these expectations, to say nothing of the habits those expectations give rise to, can be very dangerous.

Does that mean major gains — the kind it might take a student of Warren Buffett years to achieve — cannot be generated in a matter of months?

No, it doesn’t.

If you’re willing to start small, it’s very possible to achieve triple-digit gains in your portfolio in just months.

I’m about to show you five examples of how this can be done (and has been done), but before I do, there are a few things you’ll need to understand first.

Because the companies you’ll need to invest in to make gains in the 300–700% range in a several-month timeframe are small, you cannot expect to sustain these rates of return throughout the course of your evolution as an investor.

When your single trades start approaching the mid-six-figure range in total value, the companies that bring you these astronomical rates of return will simply be too small.

Which means, sadly, that you probably won’t build an eight-figure net worth trading small stocks.

To grow your fortune past the single-digit million mark, you’ll need to adjust your strategies to more resemble the long-term approach Mr. Buffett used to build his own fortune.

But that’s another problem altogether — one most people would kill to have.

For now, let’s work on getting you to that point.

Minimum Risk, Maximum Gains

Below are five Nasdaq-listed companies that could have put you on the road to investment wealth over the last 12 to 18 months.

Though I refer to these companies as “penny stocks,” you’ll notice that four of them are outside out of the microcap category, mostly as a result of the meteoric growth that landed them on this list.

Since they all started out as penny stocks, they’re ideal examples of what success should look like.

Marinus Pharmaceuticals, Inc. (NASDAQ: MRNS)

With a market capitalization of a quarter-billion dollars, this biopharmaceutical company saw its value more than double this past spring.

Since then, it’s corrected a bit, but it still retains the bulk of its 2018 gains, despite an increasing operational burn rate.

If you had invested $5,000 in this stock back in March, your position would be worth $11,500 by July, a gain of 230%.

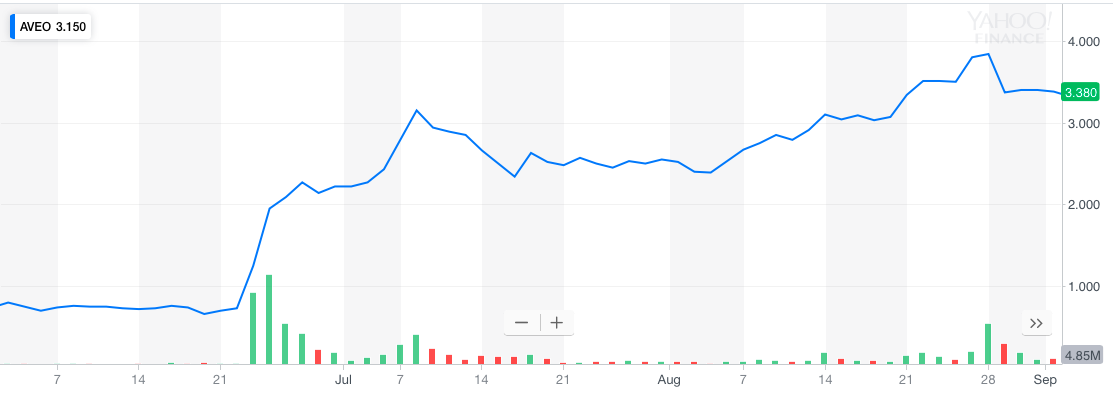

AVEO Pharmaceuticals, Inc. (NASDAQ: AVEO)

At $453 million, this cancer med developer is securely in the small-cap category, but this wasn’t always the case.

In June of 2017, shares were trading for just $0.60, putting its market cap at just $94 million.

If you had put $5,000 into AVEO that April, your position would have been worth $30,400 by September 1st, a gain of 508%.

The Best Free Investment You’ll Ever Make

Join Wealth Daily today for FREE. We’ll keep you on top of all the hottest investment ideas before they

hit Wall Street. Become a member today, and get our latest free report: “Why You Need to Fire Your Money

Manager.”

It contains full details on why money managers are overpaid and provides you with

tools for growing your wealth. On your own terms. No fees, no comission.

Pieris Pharmaceuticals, Inc. (NASDAQ: PIRS)

Also a clinical-stage biopharma firm, Pieris is another modestly sized small-cap company with a market capitalization just shy of $300 million.

Shares currently trade for $5.54, but this past February, they went as high as $8.51.

In December of 2016, however, the going rate was just $1.40.

A $5,000 investment in Pieris back then, sold at the peak in February 2018, would have led to a total position value of $30,392, a gain of 507%.

Verastem, Inc. (NASDAQ: VSTM)

The biggest of this group is currently valued at $702 million and trades at $9.50, making it large even by small-cap standards — but this wasn’t always the case.

It’s another cancer drug maker, and the last two years have probably been some of the best years for major shareholders.

In February of last year, this stock was trading at just $1.14, giving it a total market capitalization of $84 million.

If you had put $5,000 into Verastem that month and sold those shares today, your position would be worth $41,700 today, a gain of 734%.

Blink Charging Co. (NASDAQ: BLNK)

The only non-pharmaceutical play in this list, and also the smallest company by far, is Florida-based Blink Charging.

Blink operates in an industry set to see some major growth in the coming years: It owns, operates, and provides electric vehicle charging equipment and networked EV charging services.

The company’s current market cap is $77.5 million, making it a true penny stock in the valuation sense.

That valuation, however, comes after a pretty substantial correction from this past spring, when shares were trading over $8.

Being the smallest, this stock also gave its owners by far the fastest rate of return.

If you had invested $5,000 at $1.48 in BLNK on May 4 of this year, you could have cashed out less than two weeks later on May 17 for $8.01.

Your $5,000 position would have appreciated 441% over the course of those 13 days, bringing its value to $27,060.

Not Your Daddy’s Penny Stocks

As I mentioned before, these aren’t the sub-$0.10 nano-cap stocks that you probably think about when you hear the words “penny stock.”

These are established, fairly stable, Nasdaq-listed firms with healthy trading volumes and solid long-term prospects.

They are small and therefore will not be of much use to whale investors accustomed to throwing millions at every trade and then forgetting about the stock for months at a time.

Stocks like these require weekly, if not daily monitoring, and if you’re looking to invest more than several hundred thousand, you probably won’t be able to do so without chasing share prices (bidding them up).

However, if you’ve maxed out your more conservative investment portfolio and are looking to turn a couple thousand dollars into the beginnings of a fortune, this is precisely where you could start.

The biggest hurdle is, of course, finding the next in line to join this list.

It’s not easy, but there is a mathematical, scientific way of cutting out about 99% of the field and isolating stocks with precisely this sort of long-term potential.

It’s not a hard method to implement. All it takes is a couple filters on your stock screener, and you’re in business.

Click here to learn all about these filters and how effective, consistent application of the method can boost your returns on your very next trade.

Fortune favors the bold,

Alex Koyfman

His flagship service, Microcap Insider, provides market-beating insights into some of the fastest moving, highest profit-potential companies available for public trading on the U.S. and Canadian exchanges. With more than 5 years of track record to back it up, Microcap Insider is the choice for the growth-minded investor. Alex contributes his thoughts and insights regularly to Energy and Capital. To learn more about Alex, click here.