Dear Reader,

It's long been known that Twitter is a nexus of rhetorical garbage, smack talk, and consequence-free provocations.

In short, it's troll central, and every day the community continues to exist, it festers into a bigger, deeper, smellier pit of alphabetic bile.

Sometimes, however, it can provide us with some comedy, and right now one such scenario is playing out.

Back in the summer of 2018, Elon Musk dropped this bombshell via his massively popular Twitter account, which at the time boasted a high eight-figure follower count:

It raised eyebrows for a couple reasons — the first and most important being the potential SEC violation he committed by making this statement publicly.

Adding the "funding secured" language at the end was especially troublesome, as it signaled to shareholders that a major shift in the nature of the company was imminent.

A Troll's Gotta Troll

The tweet led to a temporary trading halt of Tesla stock, and sent shock waves through the investment community — shock waves that are still being felt today.

Though he probably had a good chuckle over his absurd amount of influence over his giant fan club (and, by extension, the state of Tesla's market capitalization) today, he's not laughing.

Tesla shareholders are now suing Musk for losses stemming from this bit of comedic stock market manipulation.

Does it matter that Tesla's market cap increased by a factor of 35 in the 15 months that separated that fateful tweet and the company's high-water mark, which came in November of the following year? Not at all.

Manipulation is manipulation, and once he clicked "tweet," his liability rose to a level actionable in the American court system.

Right now, Musk is busy trying to change the venue of the approaching trial from California, where he claims he cannot get a fair shake, to Texas, where the company relocated in December 2021.

Whether he's successful in his motion for change of venue remains to be seen, but in any case, it's clear that the fun and games are now over for both the company and the firebrand CEO.

Not So Funny Anymore?

The trial, however, is far from the biggest problem facing both chief executive and firm at the moment.

In fact, it's little more than yet another distraction, both for him and for the company.

A bigger problem has been brewing for a while now, and unlike Musk's headline-grabbing tweets, it's flown largely under the radar for more than a year now.

The issue is technical.

It's an engineering problem, and it's big enough today that it threatens Tesla's very existence.

Here it is in a nutshell: Tesla's electric motors are now obsolete… and there's no easy fix for them.

Now, before you go looking for another electric vehicle company stock to ride into the coming EV revolution, let me add this: The problem isn't isolated to Tesla.

Every existing electric car out there suffers from the same shortcoming. Who survives the coming technological battle will depend solely on which companies take quick and decisive actions right now.

Let me explain…

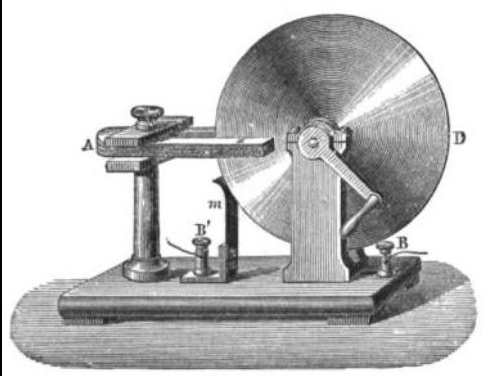

Their electric motors, which are built using the same essential design DNA first introduced by Michael Faraday nearly 200 years ago, are all on the cusp of extinction.

The problem lies in the very heart of the electric motor — in the copper coil core. Join Wealth Daily today for FREE. We’ll keep you on top of all the hottest investment ideas before they hit Wall Street. Become a member today, and get our latest free report: “How to Make Your Fortune in Stocks”The Best Free Investment You’ll Ever Make

It contains full details on why dividends are an amazing tool for growing your wealth.

Today's Most Advanced Vehicles Run off 200-Year-Old Tech

As in almost all electric motors, the core serves the crucial function of turning electrical charge into rotational force.

Michael Faraday's early designs, though smaller and flimsier and built of less refined materials, all shared the same configuration.

The design has worked so well up until now that electric motors today consume more than half of all electrical energy generated.

A recent advancement in artificial intelligence, however, has just pulled the rug out from under this standard and sent the entire engineering world into a nervous frenzy.

A small tech company based in Calgary has patented a method for regulating the flow of charge through this coil that allowed for electric motors to run more efficiently at any given rotational speed.

How much more efficiently? As much as 8%–10%.

When calculating the benefit in performance across all electric motors, that 8%–10% adds up to annual energy conservation greater than the entire energy demand of the United Kingdom.

That's a massive difference all by itself, but along with improvements in performance, electric motors equipped with this smart power management technology also produce less heat and less wear and tear, resulting in markedly increased service life expectancy.

The Most Important Innovation You've Never Heard Of

The young, relatively unknown tech company behind this innovation now sits at the intersection of dozens of sectors, ranging from personal digital devices (electric motors are what give your smartphone its vibration feature) all the way up to high-speed rail and heavy shipping.

Altogether, trillions of dollars in consumer goods and commercial equipment will be affected by this innovation in the coming years — one of the largest categories being the EV industry.

Now Tesla and its many competitors have a choice: They can continue to operate as they have and eventually start to lose market share as their vehicles become outclassed by smaller, more powerful, longer-lasting electric motors; they can license the technology from the company; or they can buy the company outright.

As I write this, the company's stock (yes, it's public) is trading at less than $3, giving the company a market capitalization of less than a USD$250 million.

It wouldn't be much of a chore for any of the major automakers to buy this company outright, even at a major premium to today's market value.

Once the company is acquired, along with the intellectual property rights, that EV-maker could then turn around and license the tech to its competitors… or withhold the tech and simply let the rest of the field fend for itself.

Could This Be the Cheapest Tech Stock on the Market Today?

What happens remains to be seen, but one thing is clear: This Calgary-based company is already in the crosshairs of some of the biggest corporations in the world as a buyout target.

Management isn't just sitting around waiting for this to happen, however.

They've already licensed the tech to a number of partner companies, including an e-bike maker, an electric boat builder, and even a Canadian electric mass-transit company.

Whether or not Tesla, Toyota, or VW takes the ultimate plunge doesn't matter, as the company has already made itself indispensable, in large part, to a wide spectrum of consumer and commercial product brands.

I've been following this company since it was trading for less than $1. Back in the spring of 2021, when the industry first took notice, shares rapidly jumped in value.

A chart of their share price tells the whole story.

The next step, however, could turn this upstart into a true industrial giant in its own right.

For the savvy investor, that opens a major opportunity window right now.

Time Is of the Essence

There's a lot more to this story, of course. Technical details and realistic projections of where things may go in the next three–five years.

For those who want to know more, I recently published this informational video.

It distills all the crucial facts and data, allowing you to do your due diligence quickly and efficiently.

It's the result of many hours of research, and I'm giving you access right now, absolutely free of charge.

Go here to watch it, but please don't forward this to anybody, as I don't want my readers missing out on the massive profit potential.

What you do with the information is your choice, but keep this in mind… The mainstream media haven't picked up on this just yet.

Once they do, the secret will be out and the biggest gains will have already been realized.

Don't miss your chance.

Enter here for instant access.

Fortune favors the bold, Alex Koyfman His flagship service, Microcap Insider, provides market-beating insights into some of the fastest moving, highest profit-potential companies available for public trading on the U.S. and Canadian exchanges. With more than 5 years of track record to back it up, Microcap Insider is the choice for the growth-minded investor. Alex contributes his thoughts and insights regularly to Energy and Capital. To learn more about Alex, click here.