There’s no question by now that the 2019 novel coronavirus (COVID-19) is hammering the global stock market. The Dow Jones has shed ~9.75% of its value this week as COVID-19 has now been confirmed on six continents (everywhere except Antarctica), with the first case of community spread in the U.S.

Likewise, the Nasdaq is down 10.4% this week, while the S&P 500 is off 9.8%. Technically, this puts all the major U.S. indices into “correction” territory. It also marks their worst weekly percentage drops since the 2007–2009 financial crisis.

Needless to say, the market and media are going into full panic mode right now, with much of the blame being put on COVID-19. There’s reason to attribute the sell-off to other factors as well (i.e., Bernie Sanders looking to clinch the Democratic primary), but the narrative is certainly centered on the virus more so than anything else.

This week, a few major developments stoking fears over COVID-19 have really stood out.

The U.S. Centers for Disease Control and Prevention (CDC), for one, warned on Wednesday that it expects the virus to start spreading in the U.S. The CDC confirmed that COVID-19 has now infected more than 82,000 people worldwide.

“We are asking the American public to work with us to prepare for the expectation that this could be bad,” said one top CDC official during a press conference.

The CDC wasn’t the only federal agency stoking fear over the coronavirus, either. On Wednesday, Peter Marks, head of the FDA’s Center for Biologics Evaluation and Research, said that we are “on the cusp of a pandemic.”

Institutions have also come out expressing their increased bearishness due to the virus.

In a note on Thursday, Goldman Sachs said that U.S. companies will generate no earnings growth in 2020 due to supply-chain disruption and “severe decline in Chinese economic activity.” The bank went as far as to say it may lead to a U.S. recession.

Microsoft has also warned that it will miss guidance due to disruptions caused by COVID-19, following a similar warning from Apple. Nutanix and Nvidia can also be added to the list of tech companies tempering their forecasts due to the spread of the virus.

The question for investors, of course, is whether or not all this panic is truly warranted. Are the fears surrounding COVID-19 and the consequent market sell-off overblown or is it actually time to batten down the hatches and prepare for the coming storm?

Is the Coronavirus Really that Bad?

Unfortunately, there’s no way to tell just how much of an economic impact COVID-19 will have. Personally, I expect current panic relating to the virus will prove overdone, but I also believe that a market correction (or even a crash) is warranted given today’s lofty stock valuations.

The market has been in need of a correction for some time now (everyone knows it), and COVID-19 is a nice little excuse for Wall Street to bring prices back down. Does it justify a 10% decline in the value of U.S. equities on its own? No. But it breeds the emotions necessary to get the job done.

For some much needed perspective, it helps to consider that COVID-19 has so far led to just 2,800 deaths over the course of two months after emerging in the most densely populated area of the world. While the virus is indeed now crossing borders, we already know that it’s far from catastrophic, at least relative to other diseases.

Join Wealth Daily today for FREE. We’ll keep you on top of all the hottest investment ideas before they hit Wall Street. Become a member today, and get our latest free report: “How to Make Your Fortune in Stocks”

It contains full details on why dividends are an amazing tool for growing your wealth.

Influenza, for reference, killed 61,000 in the most recently recorded flu season, more than 21 times the amount COVID-19 has so far.

Of course, the media and the market don’t get frenzied over influenza because it’s nothing new. It’s not the kind of thing that drives headlines through panic and fear, so no one is going to waste their time selling that story. As we’ve seen happen time and time again with novel disease outbreaks, the fear mongering around COVID-19 will most likely soon fade.

For investors, this doesn’t mean you shouldn’t be playing it defensively right now in general, but it does mean that there may be some specific buying opportunities emerging from all the panic.

Blood in the Water

There’s an old adage on Wall Street that “the time to buy is when there’s blood in the streets.” Baron Rothschild is credited with that one after buying the panic following the Battle of Waterloo (Napoleon’s last stand) and subsequently making a fortune.

In the wake of the novel coronavirus outbreak, Rothschild’s advice may very well be worth following today, except you might instead say that the time to buy is when blood is in the water.

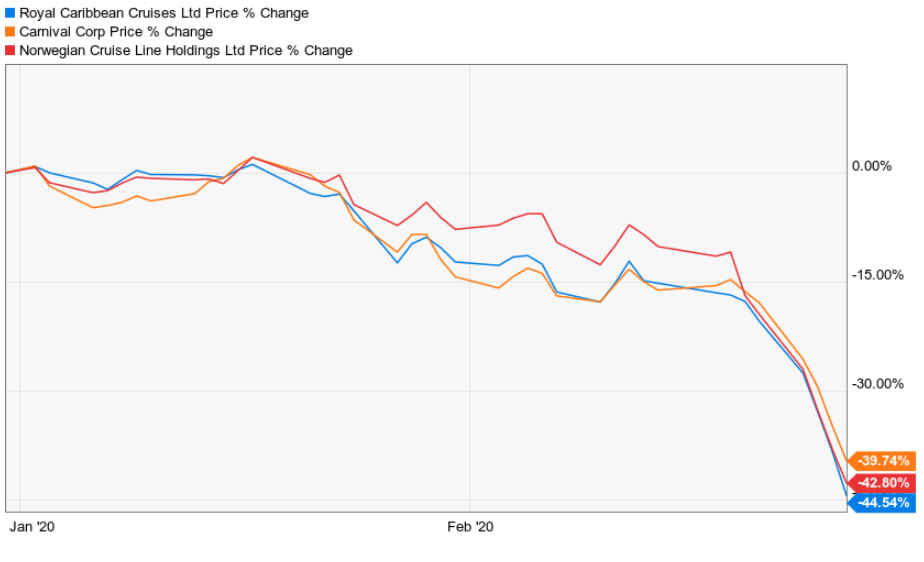

Easily, the most discounted basket of stocks right now is cruise liners. Royal Caribbean Cruises (NYSE: RCL), Carnival Corp (NYSE: CCL), and Norwegian Cruise Line Holdings (NYSE: NCLH) have been absolutely hammered over the past two months, shedding between 45% and 49% of their value due to coronavirus fears:

No doubt, these companies are going to take a hit to revenue growth as vacationers grow wary of travelling in contained vessels with 6,000 other passengers, but it’s nothing to justify a ~40% decline in value.

Royal Caribbean and Carnival Corp are particularly compelling after this market discount given their respective dividend yields of 3.79% and 6.04%. These companies have solid margins ranging between 15.7% and 19.0% and were previously growing revenue ~7.5% across the board.

I picked up a few shares of Carnival Corp today to take advantage of the flash crash in the cruise line industry. My plan is to average down if prices drop further, which is always a possibility when you try to catch a falling knife. Long term, though, this basket looks like an obvious contrarian buy.

Until next time, Jason Stutman![]()