Are Biotech and Defense Not So Different After All?

Dear Reader,

Unless a public alien visitation or something of similar magnitude takes place in the near future, the whole COVID saga will most likely go down as the most transformative event (or sequence of events) to take place in our lifetimes.

It happened to humanity, but it also happened to each one of us personally.

Professionally, emotionally, financially… we’ve all been hit with our own unique combination of challenges over the last 20 months.

For the lucky, it’s amounted to nothing more than some minor inconveniences and temporary setbacks. For others, it’s been earth-shattering, with families and financial stability left in ruin.

For business, it’s been the same story. Lockdowns, supply chain interruptions — it’s all flipped our economy upside down, evolved it, mutated it, and redefined many aspects of it.

Millions of us never worked from home before all this. Millions of us will never work from an office again. Just that one, isolated aspect of the COVID transformation already implies a major shift both on a micro and macro level.

Most industries suffered during these last 20 months, with a few marked exceptions being those industries that catered specifically to the new life patterns we were all forced to adopt.

Delivery services blossomed. Online conferencing platforms flourished… But there’s one industry that stood above all else, and it should come as no surprise: biotechnology.

One Sector to Rule Them All

Biotech’s advantages during a time of a global medical emergency are obvious. It’s this industry and the companies belonging to it that are humanity’s vanguard against all forms of health risks.

And not surprisingly, these companies are also some of the biggest benefactors of the crisis.

Look no further than the two pharmaceutical giants whose names have been most closely tied with the biggest vaccination campaign in human history: Pfizer Inc. (NYSE: PFE) and Moderna Inc. (NASDAQ: MRNA).

Since the depths of last March 2020’s panic-driven lows, Pfizer is up 60% — no small feat for a $270 billion-market-cap mega-giant. Moderna, however, takes the gold medal for COVID gains with an astonishing 245% rally from last March’s depths — representing a $130 billion gain in market capitalization.

Those are just two of the most visible examples. The list goes on and on.

AbbVie Inc. (NYSE: ABBV) is up 77% from last March, German pharma giant BioNTech SE (NASDAQ: BNTX) is up an impressive 605%, and Novavax (NASDAQ: NVAX), whose coronavirus vaccine is currently in Phase 3 FDA trials, is up a staggering 1662% in that same time frame.

The pandemic has been good to the smaller players, too. Entera Bio (NASDAQ: ENTX), with a market cap of $140 million, is up 418% year to date. $2.6 billion midcap player Prothena Corp. (NASDAQ: PRTA) is up 381% YTD. And $4 billion Cassava Sciences (NASDAQ: SAVA) is up 1,424% YTD.

That’s the other side of the COVID economy, but it’s just one reason why biotech is now officially a “forever-bullish” industry.

Biotech, you see, stands at the crossroads of today’s two most exciting realms of human endeavor: technology and medicine.

Medicine… The Defense Industry for the Human Body

However, while consumer technology itself is generally aimed at improving the quality, length, and enjoyment of life, biotech deals with more critical issues.

In fact, if I had to compare biotech to any other sector, I’d probably draw a parallel with the defense industry. Both rely heavily on cutting-edge technology in a life-or-death struggle to stay ahead of a potentially lethal threat.

The difference is that in the case of the defense industry, the threat is human.

All other tech sectors, by contrast, generally pit their players against each other in yearlong contests to determine who can propel their products to a higher spot on the “must-have” hierarchy come next Christmas.

Combating disease and age-related illness really is more akin to going to war than simply competing for market share, and as the average age of first-world dwellers progressively increases and the costs of caring for and treating these people skyrockets, that war will grow more and more desperate.

The Best Free Investment You’ll Ever Make

Join Wealth Daily today for FREE. We’ll keep you on top of all the hottest investment ideas before they

hit Wall Street. Become a member today, and get our latest free report: “Why You Need to Fire Your Money

Manager.”

It contains full details on why money managers are overpaid and provides you with

tools for growing your wealth. On your own terms. No fees, no comission.

We already know what that desperation looks like when you convert it into numbers:

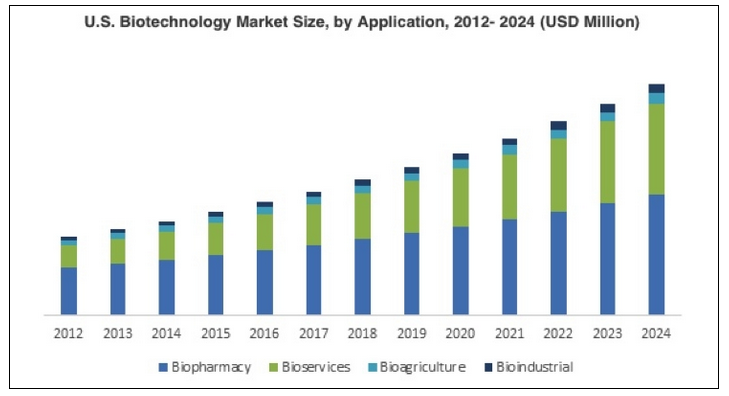

By 2024, total annual investment in U.S. biotech firms is projected to reach $774 billion, with a 9.9% CAGR.

On the battle lines, however, where breakthroughs are made and cures are actually found, this flow of capital will open up an era of medical research and discovery the likes of which has never been seen before.

In the coming years, you’ll see unprecedented advancements and history-changing victories over diseases like cancer and Alzheimer’s… and it’s already begun.

Thanks to the biggest catalyst to come around since the end of the last world war, the opportunity investors have today may be the biggest we will see in the first half of the 21st century.

But to squeeze the most juice out of this lemon, you won’t be able to just drop your money into another Moderna or Pfizer or Novavax and expect past performance to repeat itself.

You need to find the next big hit and get into it before the crowds find it and blow the stock into the stratosphere.

To do that, you could quit your job and spend the next six months doing nothing but studying the industry, looking into all the small unknowns out there, hoping to find that one diamond in the rough.

This Isn’t the Time for Amateurs and Hobbyists

You might succeed, too, but since time is of the utmost importance, you’ll waste your best entry points (which are presenting themselves right now) just doing your due diligence.

Your other option is to turn to the guy that all the experts I know turn to when it comes to the latest in biotech.

Keith Kohl has made it his business to find the biggest, most overlooked opportunities emerging in the medical technology markets today.

He’s unearthed many winners already, but the COVID revolution has rewritten all the rules.

If you don’t want to waste what could be the biggest opportunity you ever get in your investing career, I suggest you watch Keith’s video right now.

It’s free of charge and requires no sign-ups or sign-ins. Just click, watch, and see what you’re missing.

Don’t wait another minute, because this market sure won’t.

Fortune favors the bold,

Alex Koyfman

His flagship service, Microcap Insider, provides market-beating insights into some of the fastest moving, highest profit-potential companies available for public trading on the U.S. and Canadian exchanges. With more than 5 years of track record to back it up, Microcap Insider is the choice for the growth-minded investor. Alex contributes his thoughts and insights regularly to Energy and Capital. To learn more about Alex, click here.

The Best Free Investment You'll Ever Make

We never spam! View our Privacy Policy

After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox daily.