The first round of analyst comments about Disney’s new video streaming service, Disney+, won’t come out for a few more months.

But the competition is already shaking up the streaming industry.

This is the first real competition for Netflix’s video-streaming dominance…

Not only is it going to have ALL of Disney’s intellectual property, but we just found out a few days ago that it’s also going to host shows and movies from other parties. As if competing with Star Wars and Marvel weren’t enough.

And Netflix investors are scared. The stock is still up in 2019. But that’s more of a reflection of how far it fell toward the end of last year.

But let’s talk a little about Netflix’s past instead of its future. Because I’ve got an opportunity for you that’s akin to going back four years and investing in Netflix when shares cost over 600% less than today…

What Would You Do with 600% Gains?

Back in 2015, Netflix had been around as a company for nearly 20 years. And it had been publicly traded for a little over a decade.

Initial investors — those who bought at the IPO in 2002 — were sitting on very nice profits. Their adjusted entry price was around $1. And the stock was trading around $50.

But the gains were far from over. Folks who saw the value and the future bought Netflix stock at $50. And they’re up over 600% just four years later…

You see, in 2015, Netflix was still small. It wasn’t capturing 10% of U.S. TV screen time like it is now. It only had about 55 million paying customers.

But after a run from $1 to $50, a lot of investors figured the good times were over. And they missed out on some major gains.

Every $1,000 invested in 2015 is worth $7,070 now. Every $15,000 is worth $106,050 today. And anyone with the guts to invest $100,000 is looking at a position worth nearly a million dollars just four years later.

That doesn’t sound like a stock that was done growing to me.

But there’s another company out there that’s cornering the streaming market. And it’s looking a lot like Netflix did back in 2015…

Introducing: The Next Netflix

This company is actually coming to market with far more value than Netflix had at its age.

It’s got more paying subscribers after only a decade than Netflix had after 20 years in the game. And it’s close to surpassing Netflix’s current subscriber count. That’s likely to happen this year.

When it comes to sales growth in dollars, it’s wiping up the court with Netflix, too…

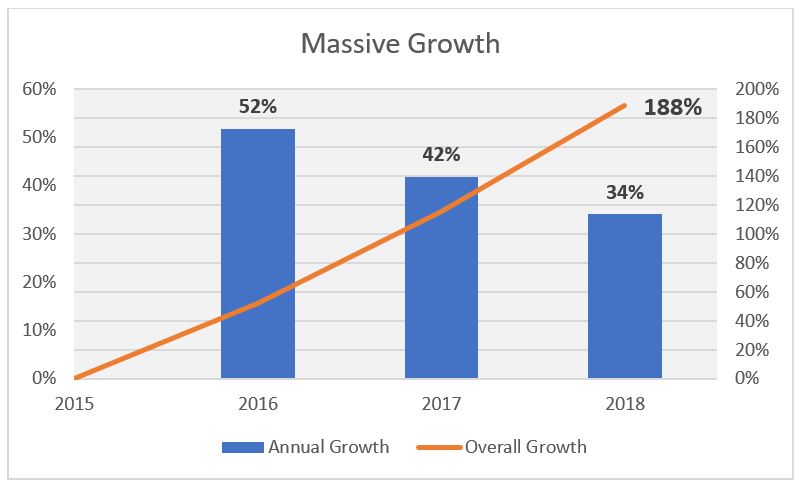

Since Netflix went on that 600% run, it’s managed to grow revenues by an impressive 133%. That’s about 33.25% a year. That’s really good.

But the Next Netflix scorched those numbers by growing sales 188.5% in the same time. That means it’s averaging 50% revenue growth every single year.

And thanks to a recent note from the head of the Next Netflix, we know for certain that pace isn’t slowing down at all.

The Best Free Investment You’ll Ever Make

Join Wealth Daily today for FREE. We’ll keep you on top of all the hottest investment ideas before they hit Wall Street. When you become a member today, you’ll get our latest free report: “The Nvidia Killer: Unlocking the $100 Trillion AI Boom.”

It contains the most promising AI companies and sectors poised for explosive growth. Our team of expert analysts has conducted thorough market research to uncover a hidden gem currently trading at just $2.

After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox daily.

Biggest, Best, and Still Growing

This company may be out-growing and out-selling Netflix, but its management was smart enough to target a corner of the market Netflix has stayed out of entirely. And that’s helped it scream right to the top.

You see, this company is already dominating its market. But there are some very big players trying to crush it into nonexistence.

And they’ve got a ton of cash to throw around in the battle for dominance. I’m talking billions.

The two biggest competitors have combined market capitalizations of $1.6 TRILLION. And they’ve got cash on hand totaling over $37 BILLION.

But even with all that muscle behind them, neither has even come close to catching the Next Netflix.

If you add up the two biggest competitors, they still don’t have as many paying customers as this little gem:

With trillions to throw into the fight, even these two giants can’t compete with the Next Netflix.

Activate Flux Capacitors

So if you wish you’d gotten into Netflix back in 2015…

If you’re looking for the next major tech company to mint a new round of millionaires…

If you just want to secure a healthy future for your family…

This is the investment you need to make.

It’s already got the customers. And it’s growing by leaps and bounds every year…

I see 50% upside in 2019 at the bare minimum. And once that rally starts, there’s no telling how much higher it’ll go.

I’m probably being conservative when I compare the potential to Netflix’s 600% rally. We could easily see a 1,000% return over the long run.

Just remember that Netflix chart when you think about investing…

Within a year, it was up 100%. After two, it had grown 250%. And by the end of 2018, the shares had doubled three times over.

When these investments start to move like that, they move fast. And if you wait until they start moving, your potential profits drop just as fast.

So don’t delay. Click here and join the members of The Wealth Advisory as we capitalize on the Next Netflix.

To your wealth,

To your wealth,

Jason Williams

After graduating Cum Laude in finance and economics, Jason designed and analyzed complex projects for the U.S. Army. He made the jump to the private sector as an investment banking analyst at Morgan Stanley, where he eventually led his own team responsible for billions of dollars in daily trading. Jason left Wall Street to found his own investment office and now shares the strategies he used and the network he built with you. Jason is the founder of Main Street Ventures, a pre-IPO investment newsletter; the founder of Future Giants, a nano cap investing service; and authors The Wealth Advisory income stock newsletter. He is also the managing editor of Wealth Daily. To learn more about Jason, click here.

Want to hear more from Jason? Sign up to receive emails directly from him ranging from market commentaries to opportunities that he has his eye on.

@TheReal_JayDubs

@TheReal_JayDubs Angel Research on Youtube

Angel Research on Youtube