America’s Lost Platinum Vein — Rediscovered at the Perfect Moment

Note From the President and Founder, Brian Hicks:

Every year, right about this time, something wild happens around here.

Our inbox fills up.

Old subscribers resurface.

New readers pile in.

And everyone is asking the same thing: “When is the predictions podcast coming out?”

Over the years, this annual event has quietly turned into something of a cult ritual. Not because we’re flashy… but because our calls have had an uncanny habit of coming true.

We were early on gold’s last big move — and we stuck our necks out again before this latest breakout in gold and silver. We were pounding the table on precious metals while Wall Street was still half-asleep.

We’ve highlighted the “Conjoined Twins” of this new era — the AI and infrastructure boom on one side, and the commodity and hard-asset boom on the other — long before it became fashionable to talk about it on CNBC.

We called the quiet accumulation in gold and silver years ago…

We alerted you about the coming renaissance in America’s mining sector…

We spotlighted crypto and tokenization of real-world assets before the last two major runs…

And we didn’t just talk in vague generalities. We named names.

- Northern Dynasty when almost no one wanted to touch it

- Silvercorp Metals when silver was still treated like a sideshow

- A slate of “forgotten” resource and infrastructure plays that are now dead center in the MoneyQuake I’ve been writing about

Both Northern Dynasty and Silvercorp Metals are up 290% and 190% this year, respectively.

This year’s predictions podcast is, in my view, the most important and shocking yet.

Our gold and silver price targets are jaw-dropping. And that means massive profits in the junior mining stocks we recommend.

Because 2026 isn’t just “another year” on the calendar. It’s the next major leg of a once-in-a-generation realignment in money, markets, and hard assets — the kind of environment where a single correctly timed move can compress 5–10 years of gains into a fraction of that time.

In the days ahead, you’ll see this podcast mentioned throughout our editorials. Consider those notes your invitation to join us as we walk through where we think the Dow, the S&P, the Nasdaq, gold, silver, crypto, and select “MoneyQuake” stocks are headed in 2026 — and why.

If you’ve been with me for a while, you know…

We don’t make timid predictions.

We make testable ones.

And this year, we’re swinging for the fences again.

Without further ado, welcome to Angel Investment Research’s annual predictions podcast.

Now on to your regularly scheduled Wealth Daily…

The story begins, as great American mining stories often do, with a lone prospector, a mule, and a hunch.

In the summer of 1882, in the shadow of the Beartooth Mountains, a man named John H. Baron was panning along a cold Montana creek when he noticed something unusual in his sediment. It wasn’t gold. It wasn’t silver. It wasn’t copper. It was a strange, heavy, whitish metal that didn’t behave like anything he had ever seen.

Baron didn’t know it then, but he had just stumbled upon the first trace of what would become one of the most important mineral discoveries in American history.

He had found platinum, a metal rarer than gold, more chemically stubborn than anything in his experience, and completely misunderstood by the American industrial class of the day.

Baron took his samples into town. The assay office shrugged. No one cared. There was no commercial use, no national awareness, and no infrastructure to support development of this “curiosity metal” that was, at that moment, not much more valuable than tin.

So America did what America often did in the 19th century when it discovered something ahead of its time…

It walked away from it.

And that’s where our story nearly ended — a forgotten mineral occurrence on a forgotten ridge in a forgotten part of Montana.

Nearly a century would pass before anyone realized what Baron had really found.

The Sleeping Giant Beneath Montana

Geologists eventually mapped the formation in the 1930s and were incredulous at what they saw.

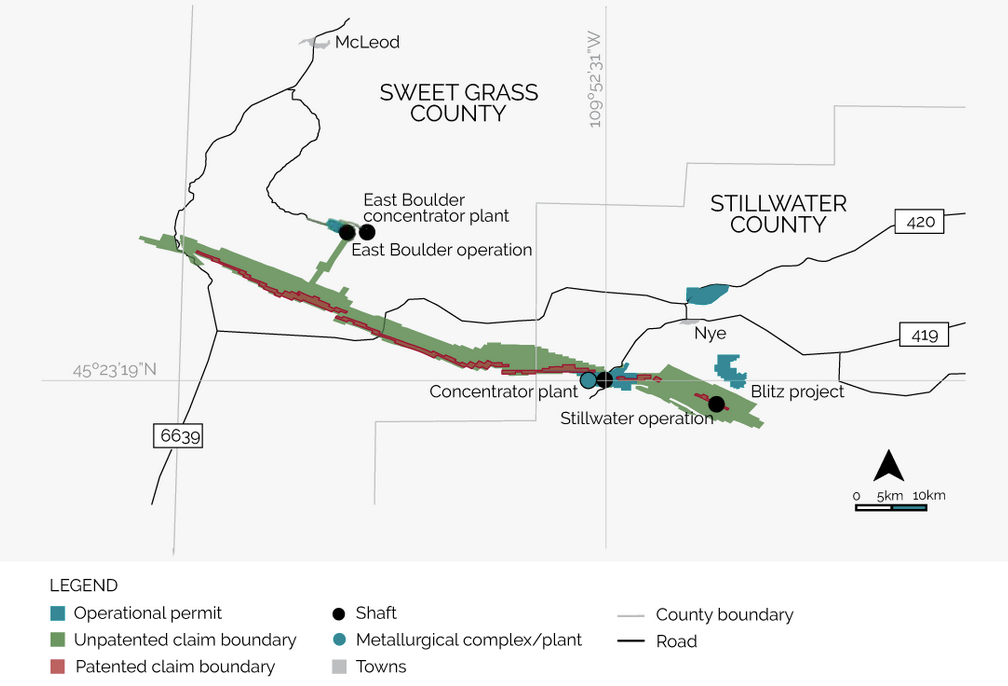

Stretching for 27 miles — from the outskirts of Nye, Montana, through the Absaroka-Beartooth Wilderness, and bending toward the rolling grasslands near Big Timber — lay a continuous, high-grade corridor of platinum and palladium unlike anything else in North America.

It was a geological freak. A once-in-a-continent discovery. The kind of mineral body nations go to war over.

They named it the J-M Reef — the Johns-Manville Reef — and for decades it sat there in silence, its riches sealed beneath 1,500 feet of mountain rock.

You may know it now as the Stillwater mine.

The United States possessed a world-class platinum group metal (PGM) deposit, yet it barely acknowledged it existed.

World War II came and went. The automotive age was born.

Catalytic converters became mandatory. The hydrogen economy flickered into existence.

And still — nothing.

It wasn’t until 1986, 104 years after Baron’s discovery, that the Stillwater Mine finally entered commercial production.

But even then, the mine entered the world like a prizefighter wearing ankle weights

The geology was extraordinary. The resource was undeniable. But the regulatory climate… the politics… the endless environmental reviews… the lawsuits… the multi-agency tug-of-war…

All of it conspired to keep Stillwater from ever becoming what it could have been: America’s PGM powerhouse, our shield against foreign dependence, our platinum and palladium security blanket.

Instead, we imported from Russia.

We imported from South Africa.

We let the world dictate our prices.

And Stillwater — this 27-mile miracle vein — never reached full stride.

Until now.

The Best Free Investment You’ll Ever Make

Join Wealth Daily today for FREE. We’ll keep you on top of all the hottest investment ideas before they hit Wall Street. Become a member today, and get our latest free report: “How to Make Your Fortune in Stocks”

It contains full details on why dividends are an amazing tool for growing your wealth.

The FAST-41 Act Has Changed Everything

You know my thesis: America is entering a mining renaissance that mirrors — almost perfectly — the shale revolution that began in the mid-2000s.

The shale boom wasn’t really about technology. It was about timing. It was about policy. It was about long-ignored domestic resources suddenly becoming viable because the regulatory and economic winds shifted.

FAST-41 is the same kind of shift.

Before FAST-41, mines like Stillwater faced 10–15-year permitting timelines, unpredictable agency coordination, environmental reviews that restarted for trivial reasons, and legal challenges that could freeze an entire district.

After FAST-41, the rules have changed:

- Hard timelines

- A single lead agency

- Transparency

- Interagency discipline

- Litigation-proof procedural structures

- Political momentum behind domestic resource independence

For Stillwater, this act doesn’t just remove obstacles — it frees the project’s very identity.

FAST-41 unclogs a century-long bottleneck.

It is everything Stillwater has been waiting for.

It is the missing piece of a puzzle first drawn in 1882.

A World-Class PGM Asset — Finally Treated Like One

For the first time in its long, tortured history, the Stillwater Complex is being recognized for what it truly is…

One of the greatest platinum and palladium deposits on Earth.

This is not hyperbole.

The U.S. Geological Survey has said repeatedly that the Stillwater Igneous Complex is the only meaningful PGM analog to South Africa’s Bushveld — the very deposit that supplies 70% of the world’s platinum.

The J-M Reef’s continuity, grade, purity, and geological predictability are unparalleled outside the African continent.

And what’s inside it?

79.1 million ounces of platinum and palladium resources.

Another 19 million ounces of proven, economically viable reserves.

Plus rhodium… iridium… ruthenium… gold… nickel… copper.

In today’s market, you’re talking about a buried treasure easily worth tens of billions of dollars — perhaps more — depending on metal prices.

And here’s where the story gets good…

Platinum Just Hit a 19-Year High — and Nobody Is Prepared

You have to go back nearly two decades to find platinum trading at these levels — and unlike 2005, when South Africa was the undisputed king of PGM production, the world today is in a very different place.

South Africa’s power grid is failing.

Russia is sanctioned and isolated.

Global automotive demand is shifting.

Hydrogen technologies are proliferating.

AI data centers are consuming catalytic materials at unprecedented rates.

And into this tightening, stressed, geopolitically fractured supply chain…

Stillwater emerges — newly empowered — with FAST-41 at its back.

This is the moment the mine was built for. This is the culmination of a 140-year arc. This is the inflection point.

The Forgotten Giant Awakens

I want you to picture the map.

To your left: The town of Nye, Montana, population barely 200, a dot on the edge of the Beartooth Wilderness.

To your right: The rolling ranchlands near Big Timber, where the reef’s northeastern flank lies beneath the soil.

Between them: A 27-mile underground ribbon of platinum group metals so continuous, so uniform, that geologists still marvel at it decades after the first core samples were pulled.

It is one of the longest, most consistent PGM-bearing structures ever documented.

And until recently, it was barely allowed to breathe.

But now the floodgates are cracked.

FAST-41 has forced the bureaucratic machine to do what it has resisted for decades…

Approve. Move. Decide. Act.

For investors, this is where these stories always turn — where the sleeping giant shifts, where the once-forgotten mineral district becomes the center of attention, where value locked away for generations begins to reprice almost overnight.

PGMs are rising.

Platinum has hit a 19-year high.

Palladium is tightening.

Hydrogen is in its adolescence.

Defense demand is climbing.

AI and data infrastructure need catalysts and alloys that only PGMs can provide.

And beneath Montana, the only primary PGM mine in the United States is stepping into the light with a legal, regulatory, and political tailwind it has never enjoyed before.

The MoneyQuake Beneath Our Feet

You’ve heard me say it many times: The great wealth waves are never purely financial — they are geological, structural, infrastructural. They begin with what the world suddenly needs more of than the world can supply.

Copper.

Silver.

Gold.

Lithium.

Nickel.

Uranium.

And yes — the platinum-group metals.

Stillwater is no longer a mine.

It is a fulcrum.

It is leverage.

It is the point where America’s mining renaissance tilts from possibility to inevitability.

Just like the Bakken did for oil.

Just like shale did for natural gas.

Just like data centers are doing for electricity.

When the government finally opens the door to resources it has ignored for a century…

When supply chains are frail and geopolitical tensions are rising…

When a metal like platinum hits a 19-year high…

When an asset like Stillwater contains billions of dollars of strategic minerals the world desperately needs…

You are not witnessing a cycle.

You are witnessing a reset.

A MoneyQuake.

And it’s already rumbling beneath the surface of Montana’s mountains.

Get to the good, green grass first…

The Prophet of Profit,

Brian Hicks

Brian is a founding member and President of Angel Publishing. He writes about general investment strategies for Wealth Daily and Energy and Capital. Brian is the managing editor and investment director of R.I.C.H Report (Retired Independent Carefree Healthy), New World Assets and Extreme Opportunities. For more on Brian, take a look at his editor’s page.

The Best Free Investment You'll Ever Make

We never spam! View our Privacy Policy

After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox daily.