Why This Bull Market Could Run Longer Than You Think

If you’ve been watching the tape in 2025, you’ve probably noticed something big happening. Recent IPOs like Circle and Bullish have exploded in the secondary market.

It’s giving major 1995 vibes — the start of a five-year run that became the legendary dot-com rally.

Back then, a wave of tech companies flooded the public markets with promises to “change the world.”

The internet was new, the possibilities felt infinite, and valuations soared to stratospheric levels.

And here’s the thing — if you were lucky (or smart) enough to be in the market during that time, you probably made money… a lot of money.

Even if you eventually rode it down when the bubble burst in 2000, odds are you were still ahead compared with the people who sat on the sidelines waiting for “the perfect entry point.”

The Lesson the Dot-Com Era Left Behind

The dot-com bubble is remembered mostly for its spectacular end — stocks collapsing, fortunes evaporating, and analysts on CNBC suddenly pretending they saw it coming all along.

But what too many investors forget is that the rally didn’t just make millionaires — it kept making millionaires right up until the day it popped.

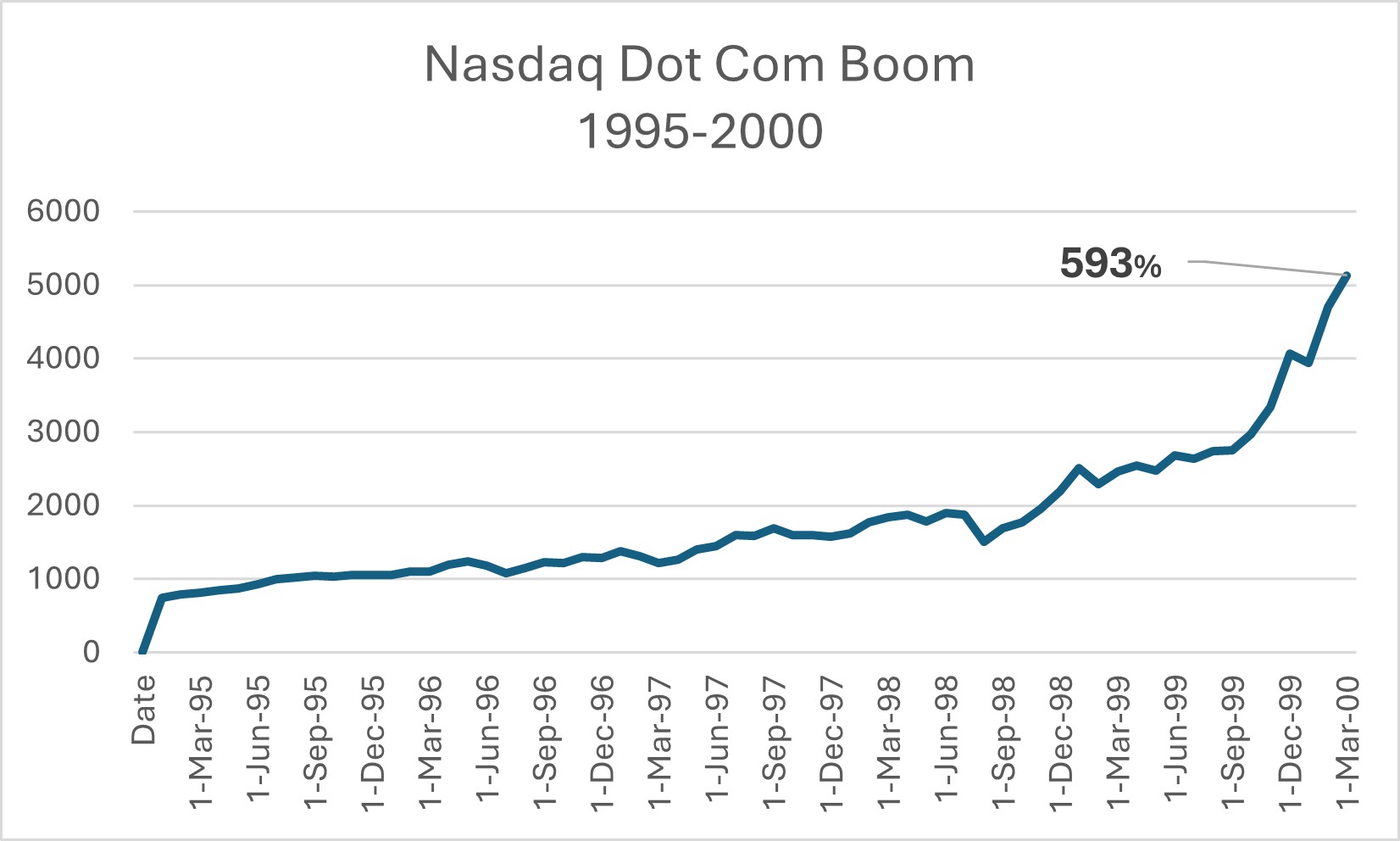

The Nasdaq didn’t climb slowly during those years — it went vertical.

Between 1995 and 2000, it rose more than 500%.

Sure, the crash was brutal. But the bigger mistake wasn’t being in the market when the bubble burst — it was not being in the market at all.

Legendary investor Peter Lynch said it best:

Far more money has been lost by investors trying to anticipate corrections, than lost in the corrections themselves.

Lynch wasn’t speaking theoretically, either…

When he ran the Fidelity Magellan Fund from 1977–1990, he averaged a jaw-dropping 29% annual return for more than two decades.

But here’s the kicker… Most of his investors didn’t come close to matching those returns.

The Best Free Investment You’ll Ever Make

Join Wealth Daily today for FREE. We’ll keep you on top of all the hottest investment ideas before they

hit Wall Street. Become a member today, and get our latest free report: “Why You Need to Fire Your Money

Manager.”

It contains full details on why money managers are overpaid and provides you with

tools for growing your wealth.On your own terms. No fees, no commission.

Why? Because they couldn’t resist the urge to jump in and out.

They pulled money to “avoid” market corrections, then bought back in only after the market had recovered — locking in losses and missing rebounds.

Lynch, on the other hand, stayed invested through thick and thin.

He understood that the market’s biggest gains often come clustered in short bursts — bursts you miss if you’re sitting in cash waiting for a perfect entry point.

That’s why he could average nearly 30% a year while many of his investors barely broke even.

2025 Feels Like 1995… With Bigger Numbers

Fast-forward to today…

We’re watching the early innings of what could be another massive multi-year bull run.

AI, blockchain, space tech, digital assets — these are our generation’s version of the internet in the '90s.

And just like back then, capital is flowing into bold, ambitious companies that aim to reshape the economy.

Circle and Bullish aren’t just “crypto plays.”

They’re infrastructure for a new financial system that’s being built in real time. The kind of market infrastructure that will be around for decades.

The secondary market pop we’re seeing isn’t just hype — it’s a signal that investors are willing to pay up for growth stories again.

That’s the exact sentiment shift that lit the match in 1995.

The Charts Tell the Story

Take a look at the Nasdaq’s run from 1995–2000:

- 1995: The index broke above 1,000 for the first time.

- 2000: It peaked at 5,132.52 — a more than 500% rise in just five years.

Now look at 2025:

- As of mid-August, the Nasdaq Composite is up nearly 12% year to date.

- The Nasdaq-100 is up about 13.5%.

- AI, tech earnings, and investor optimism are pushing new highs.

We’re not anywhere near bubble levels yet. But if history’s any guide, we could be in the opening act of a long and powerful rally.

Why Sitting Out Could Be the Costliest Move

If you’re thinking, “Yeah, but the bubble will burst eventually,” you’re right. It will.

All manias end. But here’s the secret seasoned investors know: The market usually runs far longer than most people expect.

During the dot-com boom, there were countless “this is it” moments when everyone said the rally was over.

Those who bailed out early missed the steepest, fastest gains — the ones that can make a career, a retirement, or generational wealth.

Think about it: if you were fully invested during the run-up but lost 50% when the bubble burst, you still walked away with more than the guy who kept his money in cash waiting for the crash.

In other words, the real risk isn’t losing money in a correction — it’s missing the run entirely.

The Power of Staying In

The smartest investors — Lynch, Buffett, Templeton — didn’t get rich by dancing in and out of the market. They got rich by identifying long-term trends and riding them through the noise.

Right now the noise is telling you to be cautious. That’s what it said in 1995, too.

But the underlying trend is telling you something else: We’re in the early stages of a secular bull market driven by innovation, liquidity, and a global appetite for risk.

History says this could run for years. The question is whether you’ll be on the ride — or waving from the sidelines.

Your Move

If there’s one takeaway from the dot-com era, it’s this: Fortune favors the invested.

You don’t need to put every dollar into high-flying IPOs.

You don’t need to chase every headline.

But you do need to be in the market — consistently, patiently, and with an eye on the long game.

Because when the rally ends (and it will), the people who stayed in will have collected years of gains.

The ones who waited for the “perfect moment” will have collected… excuses.

So get invested and stay invested.

And keep coming back to Wealth Daily for the best ideas to maximize your profits in this new bull market.

We’ve seen this movie before…

The ending might not be pretty, but the middle is one heck of a ride.

To your wealth,

Jason Williams

After graduating Cum Laude in finance and economics, Jason designed and analyzed complex projects for the U.S. Army. He made the jump to the private sector as an investment banking analyst at Morgan Stanley, where he eventually led his own team responsible for billions of dollars in daily trading. Jason left Wall Street to found his own investment office and now shares the strategies he used and the network he built with you. Jason is the founder of Main Street Ventures, a pre-IPO investment newsletter; the founder of Future Giants, a nano cap investing service; and authors The Wealth Advisory income stock newsletter. He is also the managing editor of Wealth Daily. To learn more about Jason, click here.

Want to hear more from Jason? Sign up to receive emails directly from him ranging from market commentaries to opportunities that he has his eye on.

P.S. With the explosive success of the Circle and Bullish IPOs, Wall Street has officially embraced tokenization—and the market has made it clear it’s starving for new, innovative investments. That’s why now is the time to start getting exposure to digital assets backed by real-world commodities. The next wave of opportunity is already building, and those who get in early will be the ones telling the story later.

The Best Free Investment You'll Ever Make

We never spam! View our Privacy Policy

After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox daily.

@TheReal_JayDubs

@TheReal_JayDubs Angel Research on Youtube

Angel Research on Youtube