Why Central Banks Are Turning to Silver — and Why You Should Too

If you think the precious metals rally we’ve been watching over the past year has already played out, think again. We’re only in the early innings here.

Gold has been leading the charge, punching through resistance levels and making headlines every other week. And if history is any guide, silver — gold’s volatile little brother — is about to do what it always does when the yellow metal runs hot: outperform.

That’s right. Gold rips higher. Silver rips higher faster. The record is clear.

Every sustained gold bull market in modern history has seen silver outpace it on a percentage basis. And this time, the stage is set for a blowout.

The Drivers of Silver Demand

Let’s take a look at what’s actually fueling this rally…

Precious metals thrive in uncertain times, and right now the global economy is practically marinating in uncertainty.

Inflation is sticky. Interest rates are poised to fall. Trade wars are heating up. Geopolitical tension is everywhere you look.

For silver specifically, it’s a perfect storm. Not only is it a monetary metal that moves with gold, but it’s also an industrial powerhouse.

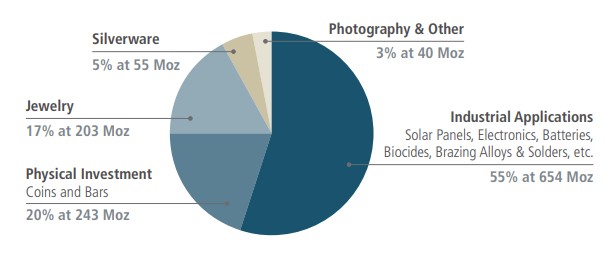

In fact, more than 50% of silver demand comes from industrial uses…

Silver is critical for solar panels, electric vehicles, advanced electronics, and even medical applications.

The global push toward electrification and clean energy only adds rocket fuel to the demand side of the equation.

The Best Free Investment You’ll Ever Make

Join Wealth Daily today for FREE. We’ll keep you on top of all the hottest investment ideas before they

hit Wall Street. Become a member today, and get our latest free report: “Why You Need to Fire Your Money

Manager.”

It contains full details on why money managers are overpaid and provides you with

tools for growing your wealth.On your own terms. No fees, no commission.

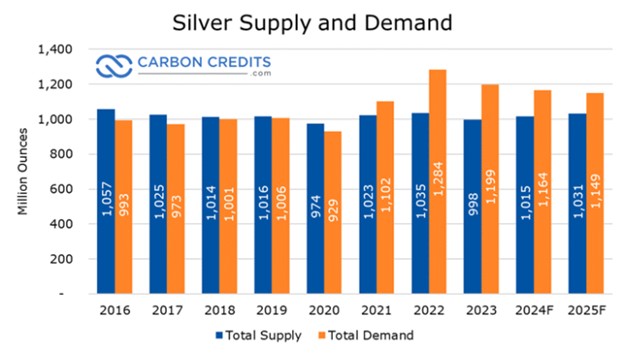

And while demand is surging, supply isn’t keeping up. Years of underinvestment in new mines and exploration mean silver output is constrained.

In fact, we’ve been running annual deficits — consuming more silver than we’re producing — for multiple years now. That imbalance can only resolve one way: higher prices.

Gold’s Tailwind: Central Bank Buying

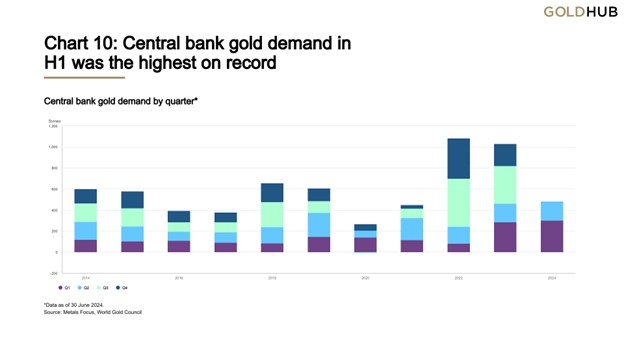

Here’s the thing: As strong as silver’s fundamentals are, it hasn’t enjoyed one of the most powerful accelerants gold has had on its side. I’m talking about central bank buying.

Since 2022, central banks — especially those outside the U.S. sphere of influence — have been hoarding gold at a record pace. And they’ve been net buyers for well over a decade.

China, India, Turkey, and of course Russia have been stockpiling the metal as part of a global movement to “de-dollarize.”

Gold is neutral money, a store of value that doesn’t depend on Washington’s whims.

That wave of central bank purchases has been a huge tailwind for gold’s price. But silver? Until now, it’s been left out of the central bank party.

Enter Russia: The Silver Stockpile Begins

That just changed. Russia’s central bank recently started buying and stockpiling silver alongside its already massive gold reserves.

And this move could mark the beginning of a whole new chapter in the silver story.

Think about it. For years, nations hoping to insulate themselves from the dollar have piled into gold. But gold isn’t the only precious metal with monetary value.

Silver has been money for thousands of years, from Roman denarii to American half dollars. If one major central bank is willing to hold it again, others may follow.

And they’ll have every reason to do so…

Silver has all the same monetary advantages as gold — but with one key bonus: It’s a critical industrial metal in a world that’s electrifying at warp speed.

If central banks around the world decide they want exposure to both monetary and industrial insurance, silver is the only game in town.

Silver’s Perfect Storm

So let’s sum this up. Silver already benefits from everything pushing gold higher: inflation, geopolitical chaos, dollar weakness — and now central bank accumulation.

On top of that, it has massive industrial demand growth, critical mineral status in the U.S., and a supply crunch.

It’s not just a perfect storm. It’s a superstorm. The kind of setup that can create generational wealth for those who get in early.

Of course, the obvious safe play here is to buy silver itself. That’s the steady move.

But the investors who are going to absolutely electrify their portfolios are the ones willing to take on a little leverage — by betting on the miners.

When silver goes up, the miners’ margins expand. That’s where the real fireworks happen.

Hecla Mining: The Veteran

If you want a silver miner with history, scale, and staying power, Hecla Mining is at the top of the list.

Founded back in the 19th century, Hecla is the largest silver producer in the United States.

It operates a portfolio of long-lived, high-grade mines across North America, giving it both stability and growth potential.

Hecla has been through every cycle you can imagine and it’s still standing strong.

In fact, the company has been expanding its production capacity in recent years, positioning itself perfectly for a rising silver price environment.

For investors looking for a reliable way to ride this silver bull, Hecla is a rock-solid choice.

Coeur Mining: The Contender

Next up is Coeur Mining. Coeur is a mid-tier producer with operations spread across the United States, Canada, and Mexico.

It’s not as big as Hecla, but that’s part of the appeal…

Mid-tier companies like Coeur tend to have more torque to rising silver prices because they can grow production faster relative to their size.

Coeur has also been investing heavily in exploration and development projects, building a pipeline of future growth.

The company’s Kensington gold mine in Alaska and Palmarejo mine in Mexico provide diversification, but silver remains a key driver of its business.

As silver prices climb, Coeur is poised to deliver outsized returns compared with the more established giants.

Apollo Silver: The Wild Card With Moonshot Potential

And then there’s Apollo Silver. This is where things get really exciting…

Apollo is a much smaller player, but don’t let that fool you. It controls the Calico silver project in California, one of the largest undeveloped silver resources in the United States.

Apollo is essentially where today’s major silver miners were a decade ago — sitting on a massive resource base and working to unlock its value.

If silver prices keep rising the way history suggests they will, Apollo could see its valuation explode as institutional investors and larger miners look to acquire projects with serious scale.

Investing in Apollo today is a classic asymmetrical bet: limited downside compared with the potential upside.

If the company delivers on its development plans, early shareholders could be sitting on life-changing gains.

The Bottom Line: Electrifying Profits Await

Here’s the reality: Silver is set up for one of the most powerful runs in its history.

The metal has all the catalysts gold enjoys, plus industrial demand tailwinds that are only getting stronger.

And now, with Russia breaking the seal on central bank silver stockpiling, we could be on the verge of a new era of institutional demand that turbocharges the rally.

Investors have a choice to make here. And sitting it out is not an option…

You can play it safe and stick with the metal itself, or you can go for the big money and bet on the miners.

Companies like Hecla, Coeur, and Apollo are positioned to deliver electrifying profits as silver enters its supercycle.

And the best part? This is just the beginning. So if you’re ready to ride the lightning this perfect storm creates to the biggest profits…

Click here to get access to our brand-new report detailing four other ways to leverage this silver supercycle for even more explosive gains.

To your wealth,

Jason Williams

After graduating Cum Laude in finance and economics, Jason designed and analyzed complex projects for the U.S. Army. He made the jump to the private sector as an investment banking analyst at Morgan Stanley, where he eventually led his own team responsible for billions of dollars in daily trading. Jason left Wall Street to found his own investment office and now shares the strategies he used and the network he built with you. Jason is the founder of Main Street Ventures, a pre-IPO investment newsletter; the founder of Future Giants, a nano cap investing service; and authors The Wealth Advisory income stock newsletter. He is also the managing editor of Wealth Daily. To learn more about Jason, click here.

Want to hear more from Jason? Sign up to receive emails directly from him ranging from market commentaries to opportunities that he has his eye on.

The Best Free Investment You'll Ever Make

We never spam! View our Privacy Policy

After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox daily.

@TheReal_JayDubs

@TheReal_JayDubs Angel Research on Youtube

Angel Research on Youtube