Earlier this year, rising interest rates and recession concerns had investors asking "when will growth stocks rebound?" Growth stocks had been under heavy pressure for quite a while which had weighed on their valuations. However it appears, at least for the moment that growth stocks are rising yet again. The S&P 500 Growth Index is up about 20% year-to-date, while the Nasdaq Composite is up about 32%.

Some investors believe that growth stocks continue to be undervalued and could be poised for a massive uptick. However, others believe that the sell-off in growth stocks is not over and that these stocks could fall further, if more volatility ensues.

What Are Growth Stocks?

Growth stocks are shares of companies that are expected to grow their earnings at a faster rate than the market average. For example, a growth stock could be defined as one with 5-year average sales growth above 15%. These stocks are often characterized by high valuations, as investors are willing to pay a premium for the potential for future growth.

Growth stocks can be found in a variety of industries, but they are often concentrated in technology, healthcare, and consumer discretionary sectors. Some of the most well-known growth stocks include Amazon, Apple, Microsoft, Tesla, and Meta Platforms.

Growth stocks can be a good investment for investors who are looking for long-term growth potential. However, they should be aware that these stocks can be more volatile than other types of stocks, and they may not always meet expectations.

Here are some of the characteristics of growth stocks:

- They are often young companies with a new product or service that is disrupting an existing market.

- They have high profit margins and are able to reinvest a significant portion of their earnings back into the business.

- They have a strong management team with a proven track record of success.

- They are well-positioned to benefit from long-term trends, such as the growth of the internet or the aging population.

When Will Growth Stocks Rebound?

There are a number of factors that could contribute to a continued rebound in growth stocks. First, interest rates are close to peaking, which could take some of the pressure off of growth stocks. Second, if the economy avoids a recession, growth stocks could benefit from continued economic growth. Finally, if earnings for growth companies remains strong, this could also support a rebound in their stock prices.

Of course, there are also some risks to consider. If the economy does enter a recession, growth stocks could suffer further losses. Additionally, if interest rates remain elevated for an extended period of time, this could continue to weigh on growth stocks.

Overall, the outlook for growth stocks looks positive at the moment, with many attractive growth stocks selling well below their value.

If growth companies continue to report strong earnings growth, this could also support a rebound in their stock prices. Earnings growth is one of the most important factors that investors consider when evaluating stocks.

See our stock market prediction for the next 5 years.

Overall, the outlook for growth stocks is uncertain. However, some investors believe that the current sell-off in growth stocks has created an opportunity to buy these stocks at attractive valuations.

Here are some tips for investors who are considering buying growth stocks:

- Investment research: Before you buy any growth stock, it is important to do your research and understand the company's business model and financial performance.

- How much risk is too much?: Growth stocks are typically more volatile than value stocks, so it is important to consider your risk tolerance before you invest.

- Invest for the long term: Growth stocks are often best held for the long term, as they may take some time to reach their full potential.

Here's how the top growth ETFs stack up…

With over $92B in assets, the Vanguard Growth ETF VUG is the largest growth ETF. Over the past year the VUG is up more than 22%.

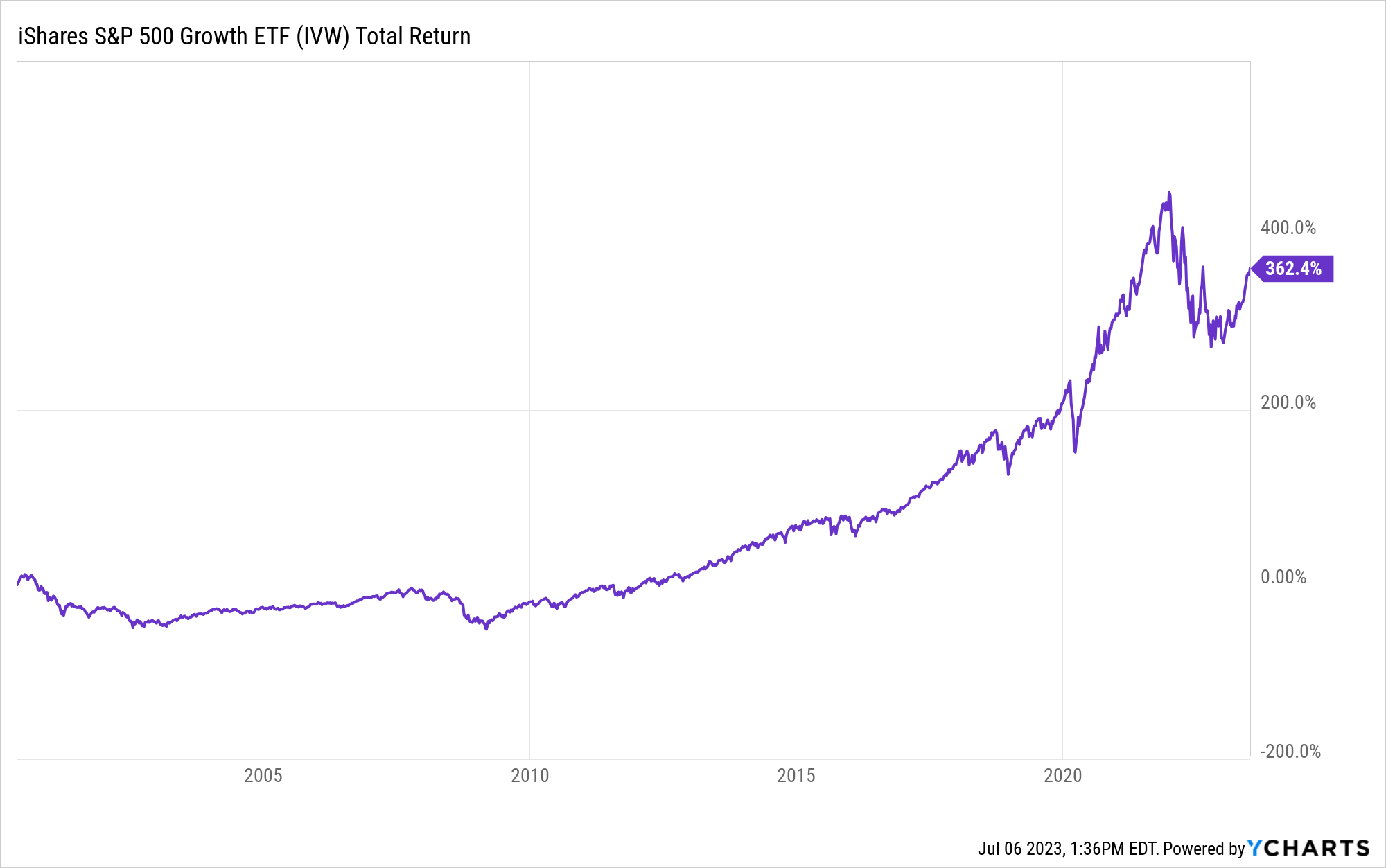

Over the same time period (1 year), the iShares S&P 500 Growth ETF is up 12.53%.

20 Growth Stocks to Watch

- Amazon.com (NASDAQ: AMZN)

- Alphabet (NASDAQ: GOOGL)

- Microsoft (NASDAQ: MSFT)

- Apple (NASDAQ: AAPL)

- Tesla (NASDAQ: TSLA)

- Meta Platforms (NASDAQ: META)

- NVIDIA (NASDAQ: NVDA)

- PayPal (NASDAQ: PYPL)

- Block (NASDAQ: SQ)

- Shopify (NYSE: SHOP)

- Zoom Video Communications (NASDAQ: ZM)

- Salesforce (NYSE: CRM)

- Adobe (NASDAQ: ADBE)

- Equinix (NASDAQ: EQIX)

- Cloudflare (NYSE: NET)

- Datadog (NASDAQ: DDOG)

- MongoDB (NASDAQ: MDB)

- Twilio (NASDAQ: TWLO)

When Will Growth Stocks Rebound? Final Thoughts

In the short-term, many of them have already started to. In addition to the factors mentioned above, there are a few other things that could contribute to a continued rebound in growth stocks. For example, if there is a significant decline in inflation, this could help to ease some of the pressure on interest rates. Additionally, if there is a major technological breakthrough, this could create new growth opportunities for companies.

When will growth stocks rebound? Of course, it is impossible to say for sure if growth stocks will continue to rebound. However, if the factors mentioned above do materialize, we could see all-time highs for many growth stocks.