What Happened to the Recession?

As markets rip higher and go positive for the year after some of the best days in the past two decades, “professionals” are pulling back their recession calls and boosting their year-end targets. Over just the past couple of days, JPMorgan rescinded its recession calls, Yardeni Research reinstated its 6,500 S&P 500 price target, and both Barclays and Goldman Sachs ate crow and boosted their estimates as well.

I think we’re going to have to change the definition of “smart money.” Just last week, every single one of them was warning investors to sell stocks into the bear market rallies.

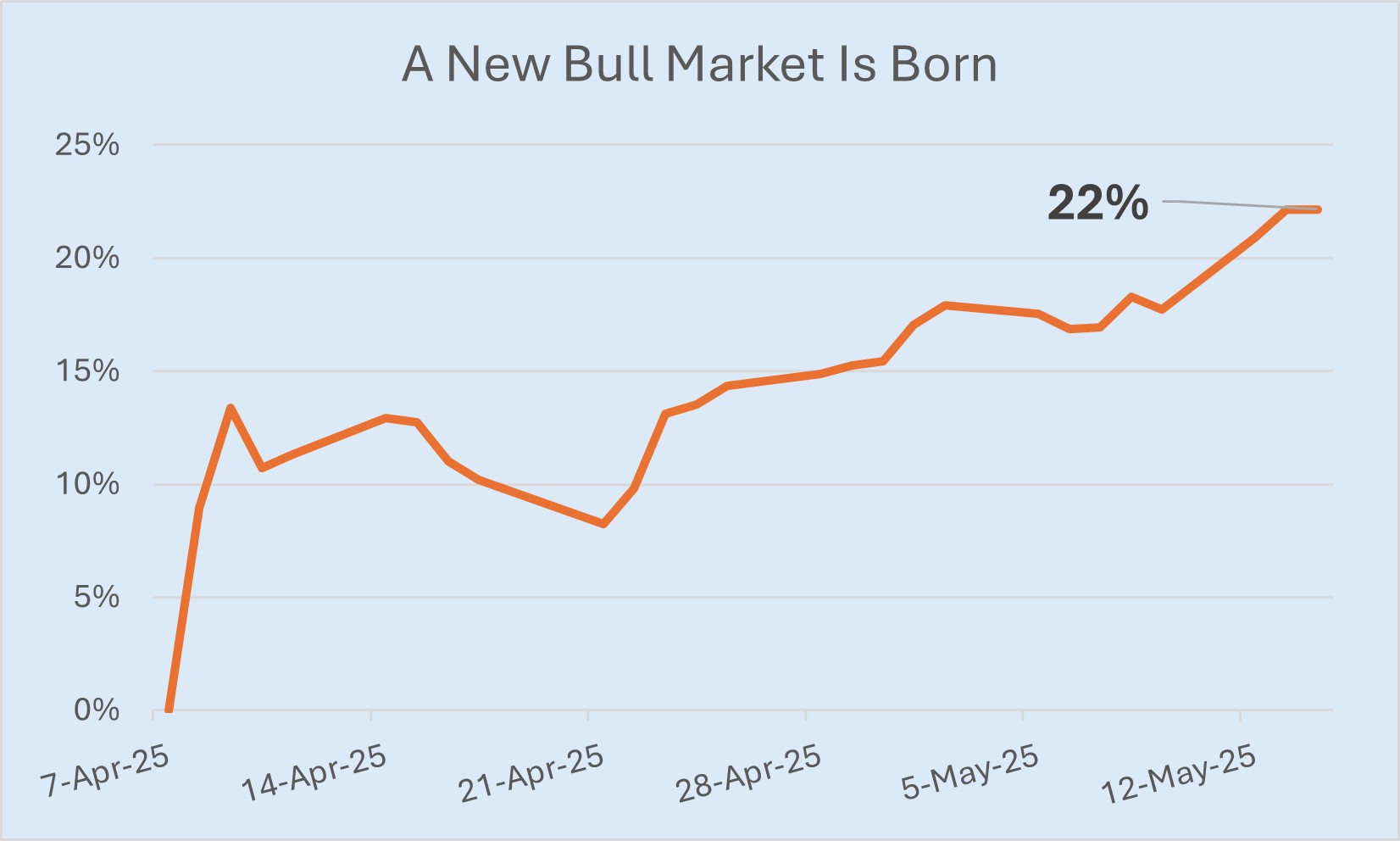

Today, the markets are officially in bull territory, up over 20% off recent lows.

The Best Free Investment You’ll Ever Make

Join Wealth Daily today for FREE. We’ll keep you on top of all the hottest investment ideas before they

hit Wall Street. Become a member today, and get our latest free report: “Why You Need to Fire Your Money

Manager.”

It contains full details on why money managers are overpaid and provides you with

tools for growing your wealth.On your own terms. No fees, no commission.

The Smart Money Turned Scared

They sure weren’t smart as they hit the sell button and took the short side in a bet on America. They were scared money. And now that markets have recovered — over 20%, mind you — they’re ready to buy back in on American exceptionalism.

But you know who wasn’t scared? The crew here at Wealth Daily and our research arm, Angel Investment Research. We were practically climbing the walls with excitement…

And we let you know it. Nearly every email we sent and article we posted was imploring you to ignore the naysayers and buy into the fear like real smart money does.

On April 4, the S&P 500 closed at 5,074.08. And I begged you not to sell your stocks…

I showed you how close the best days in the market often fall to the worst. And I showed you how much it would cost you if you missed just a handful of those good days.

I said if you were going to do anything at all, you should buy stocks while they were falling.

The following Monday, markets bottomed, and the next day, they experienced one of the best days in modern history!

Talk about good timing on my part with that "best days" commentary. But I digress…

The point I’m trying to make is that while the mainstream media were dragging out every doomsayer they could find and airing people who’ve called 11 out of the last three market crashes to tout the risk of global economic collapse…

We were begging you to bet on America and buy into the fear.

Making Bull Market Gains Look Small

Since bottoming out on April 8 at 4,835.04, the S&P 500 has rallied 22%. Some individual stocks are up even more…

Nvidia is up 55% since it bottomed out around the same time as the market.

Tesla is up about 58% in the same time frame.

Microsoft is up 31%. And Apple is up 26%.

Those are just a handful of big names. Some of our smaller recommendations are flying even higher…

SoundHound AI, a stock my Future Giants investors already cashed out a 1,100% win on, is up 87% since it bottomed out in early April when my colleagues and I were pleading with investors to buy stocks.

We Weren’t the Only Ones

But the other point I need to make is that we weren’t the only ones who were right about betting on America. We weren’t the only ones out there shouting from the rooftops that it was a great time to buy stocks…

I almost hate to say it because I know how much feedback it’s going to have me sifting through, but Donald Trump was right too. And he was out there practically begging folks to bet on America and buy stocks while the smart money was running scared…

He was right that trading partners wouldn’t want to risk losing the biggest consumer in the world. And he was right that they’d approach the U.S. separately. He was even right that China would rather work out a deal than see U.S. importers switch to other suppliers.

And whether you’re happy about that or angry that I’m even mentioning it, what you should be thinking about now is this…

What Will Trump Be Right About Next?

That’s what you need to be thinking about. Because the media aren't going to tell you. In fact, as the markets rip higher, they’re still out there trying to downplay the significance of a U.S./China trade deal…

They’re still telling you what they want the truth to be. They’re not telling you the truth. Fortunately for you, that’s what my colleagues and I are here to do…

And today, I’m telling you that you need to be thinking about how you can position yourself to profit when Trump proves the biased media critics wrong once again.

Because the coming wave of growth isn’t just going to deliver a new bull market. It’s going to deliver generational wealth…

We’re talking about the kind of legacy your children will be able to pass down to their children. And I want you to benefit from it.

Side note: Hopefully you’re already benefiting from my advice not to run scared like the mainstream media wanted you to.

They Say He Can’t Do It

Trump’s been one of the biggest proponents of American energy dominance for years. And it’s about to pay off big-time…

You see, his push for not just American energy independence, but American energy exceptionalism has supercharged oil and gas production, opening up yet another massive opportunity for investors.

And while the mainstream media continue to downplay his achievements…

Savvy investors are already quietly reaping the rewards as certain American companies are thriving under these policies, but they remain completely off the radar of the general public.

We Say He Can

But other investors are catching on. And the administration's deregulation efforts and strategic appointments are attracting global investment by the trillions.

By streamlining regulations and opening new areas for exploration, the U.S. is solidifying its position as a global energy leader. This isn't just about politics, though. It's about profits…

Like I said, you shouldn’t expect to hear this story from the mainstream press — they’re too busy pushing their anti-Trump narratives.

That’s why they missed out on the record-setting rally the markets just had. But we’re willing to look past our own beliefs in search of profit opportunities for our investors.

And while the media unfortunately often lie to you, the numbers don't…

Trump was right about tariffs and he’s going to be right about energy, too.

And if you want to capitalize on the momentum, now's the time to get informed and get invested.

So grab the full report and position yourself to benefit from America's energy resurgence.

To your wealth,

Jason Williams

After graduating Cum Laude in finance and economics, Jason designed and analyzed complex projects for the U.S. Army. He made the jump to the private sector as an investment banking analyst at Morgan Stanley, where he eventually led his own team responsible for billions of dollars in daily trading. Jason left Wall Street to found his own investment office and now shares the strategies he used and the network he built with you. Jason is the founder of Main Street Ventures, a pre-IPO investment newsletter; the founder of Future Giants, a nano cap investing service; and authors The Wealth Advisory income stock newsletter. He is also the managing editor of Wealth Daily. To learn more about Jason, click here.

Want to hear more from Jason? Sign up to receive emails directly from him ranging from market commentaries to opportunities that he has his eye on.

The Best Free Investment You'll Ever Make

We never spam! View our Privacy Policy

After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox daily.

@TheReal_JayDubs

@TheReal_JayDubs Angel Research on Youtube

Angel Research on Youtube