Tokenized Natural Resources Are Rewriting the Rules of Ownership

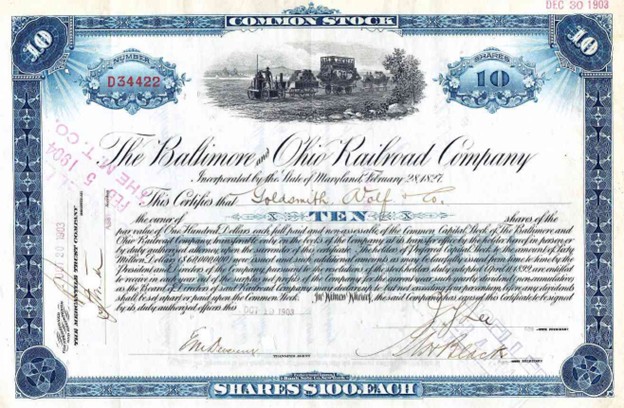

Remember when you actually got paper stock certificates like this one in the mail?

Probably not, since most of us have only ever traded shares on a screen…

The truth is finance has been digital for decades. Even in all my years at Morgan Stanley, I only touched a stock certificate once.

You click "buy," a broker clicks "sell," and that’s the end of it.

No physical documents. No handshakes.

Just bits and bytes confirming that money changed hands and ownership shifted.

So when we talk about tokenization — turning real-world assets into blockchain-based digital tokens — we’re not talking about some future fantasy…

We’re talking about the logical next step in a system that’s already gone digital.

And the big players know it…

BlackRock CEO Larry Fink has called tokenization “the next generation for markets.”

Citi says it could unlock trillions in value.

Fidelity, JPMorgan, Goldman Sachs — they’re all exploring ways to tokenize everything from stocks to real estate to collectibles.

This isn’t crypto hype. This is the financial world upgrading its infrastructure.

Think of tokenization like the internet in 1995 — still early, still misunderstood, but absolutely inevitable… and likely to be wildly profitable for early investors.

The Best Free Investment You’ll Ever Make

Join Wealth Daily today for FREE. We”ll keep you on top of all the hottest investment ideas before they hit Wall Street. Become a member today, and get our latest free report: “A Maverick’s Guide to Gold: 3 Gold Stocks Set to Disrupt the Market”

It contains full details on something incredibly important that’s unfolding and affecting how gold is classified as an investment..

After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox daily.

From Rocks to Riches: Why Natural Resources Are Perfect for Tokenization

While Wall Street dreams of tokenizing equity stakes and private credit portfolios, there’s another category of real-world assets that’s just begging for a blockchain makeover — natural resources.

We’re talking about gold. Silver. Oil. Copper. Lithium. Rare earths.

These aren’t just commodities. They’re the raw ingredients of civilization.

And unlike intangible assets, they have intrinsic value that doesn’t vanish in a market crash.

Tokenizing these resources gives investors direct exposure to something real. Something that actually exists and always will.

And here’s the beauty of tokenizing resources: They’re already measured, quantified, and evaluated through international standards.

NI 43-101 in Canada and JORC in Australia are gold-standard systems for proving how much of a resource is sitting in the ground.

That means when you tokenize a resource, you’re not guessing. You’re basing the value on verified, independently measured numbers.

And once a deposit is verified, it doesn’t need to sit idle waiting for extraction. Instead, it can become a financial asset immediately.

And that’s where things start getting really interesting…

Gold: The Only Commodity That’s Valuable Just by Being There

Most resources only become valuable when they’re pulled out of the ground.

Nobody’s paying top dollar for untapped coal or undiscovered oil unless they’re planning to mine or drill. But gold is different…

Gold is money. And it has been for thousands of years.

It doesn’t degrade. It doesn’t get used up. It just sits there and retains its value.

And here’s the kicker — gold’s value doesn’t require extraction…

As long as a deposit has been verified through something like a NI 43-101 estimate, its presence alone carries monetary weight. That makes gold uniquely suited for tokenization.

Now imagine this: a blockchain-based token backed 1-for-1 by in-ground, independently verified gold.

Not paper promises. Not ETFs. Not mining stock speculation.

Real gold backed by geology, not government.

That’s exactly what NatGold offers. It’s a digital asset backed by gold that hasn’t been dug up yet.

Instead of destroying the earth to pull gold from the ground only to vault it away again, NatGold captures the monetary value of gold where it already exists.

Then it fractionalizes that value into tokens that anyone, anywhere in the world, can buy, trade, or hold.

It’s the perfect merger of the old and new worlds — gold as humanity’s oldest store of value and blockchain as today’s most efficient form of global ownership.

The Tokenization Candidates: Three Gold Giants You Need to Know About

And did you know that some of the biggest, most exciting gold deposits in the world are still sitting dormant, waiting for the right moment to shine?

In a world moving toward tokenized natural assets, these could become the most valuable “digital goldmines” of the next decade…

Let’s start with Northern Dynasty Minerals and its massive Pebble Project in Alaska.

This isn’t just another gold deposit. It’s one of the largest undeveloped resources in the world.

Environmental red tape and political pushback have kept it from getting mined, but the gold is there — verified, measured, and immense in scale. And guess what?

That’s exactly what makes it a perfect candidate for tokenization. Instead of fighting for extraction permits, imagine monetizing the verified in-ground gold through NatGold.

Then there’s NovaGold Resources, whose Donlin Gold project is a similar story.

It’s another massive, undeveloped, and geologically proven deposit — over 39 million ounces in total gold resources.

It’s located in Alaska, in a politically stable jurisdiction, with clear NI 43-101 estimates to back it up.

Donlin could be decades away from production — or it could be tokenized tomorrow and generate value without disturbing a single ounce of earth.

But the real twist comes with a third company — one you probably haven’t heard of yet…

That’s because it’s not trying to be a traditional mining firm at all. Instead, it’s built its entire business around locating and acquiring gold assets that are ideal for tokenization.

What’s more is that this company was the first to secure priority access to NatGold’s token minting program, positioning itself to be the gatekeeper of the first several million dollars’ worth of NatGold tokens.

While others are chasing permits and trying to build billion-dollar infrastructure in remote jungles or mountain ranges, this firm is going digital.

It’s quietly locking in perpetual mineral rights to verified gold deposits and setting itself up to monetize those ounces without ever digging a single one up.

Get Ahead of the Curve — While You Still Can

Gold has always been the asset smart money runs to when the world gets shaky.

Now it’s becoming the asset smart money runs to when the financial system upgrades to blockchain…

NatGold isn’t just a new form of ownership. It’s a new form of value.

And the small-cap company with front-row access to its tokenization could become one of the biggest winners of this financial revolution.

If you want to learn more about this under-the-radar gold stock and how it’s poised to profit from the digital gold rush, we’ve put together a research report with all the details.

Because when it comes to the future of money, the ground beneath your feet might just be the most valuable asset you’ve never owned.

To your wealth,

Jason Williams

After graduating Cum Laude in finance and economics, Jason designed and analyzed complex projects for the U.S. Army. He made the jump to the private sector as an investment banking analyst at Morgan Stanley, where he eventually led his own team responsible for billions of dollars in daily trading. Jason left Wall Street to found his own investment office and now shares the strategies he used and the network he built with you. Jason is the founder of Main Street Ventures, a pre-IPO investment newsletter; the founder of Future Giants, a nano cap investing service; and authors The Wealth Advisory income stock newsletter. He is also the managing editor of Wealth Daily. To learn more about Jason, click here.

Want to hear more from Jason? Sign up to receive emails directly from him ranging from market commentaries to opportunities that he has his eye on.

The Best Free Investment You'll Ever Make

We never spam! View our Privacy Policy

After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox daily.

@TheReal_JayDubs

@TheReal_JayDubs Angel Research on Youtube

Angel Research on Youtube