This Is Why The Dollar Isn’t Worth Anything Anymore

Ever since the pandemic, we’ve been collectively gnashing our teeth over inflation.

Higher prices from the grocery store to the liquor store.

Rent. Houses. Clothes. Cars. Toys…

Whatever you’re buying today is more expensive than it was yesterday — and it will be even more expensive tomorrow.

But let’s be real: This isn’t new.

The dollar has been spiraling into the abyss for decades — not just since the pandemic.

And last week showed you why.

Our government is profoundly dysfunctional and highly indebted.

That’s all there is to it.

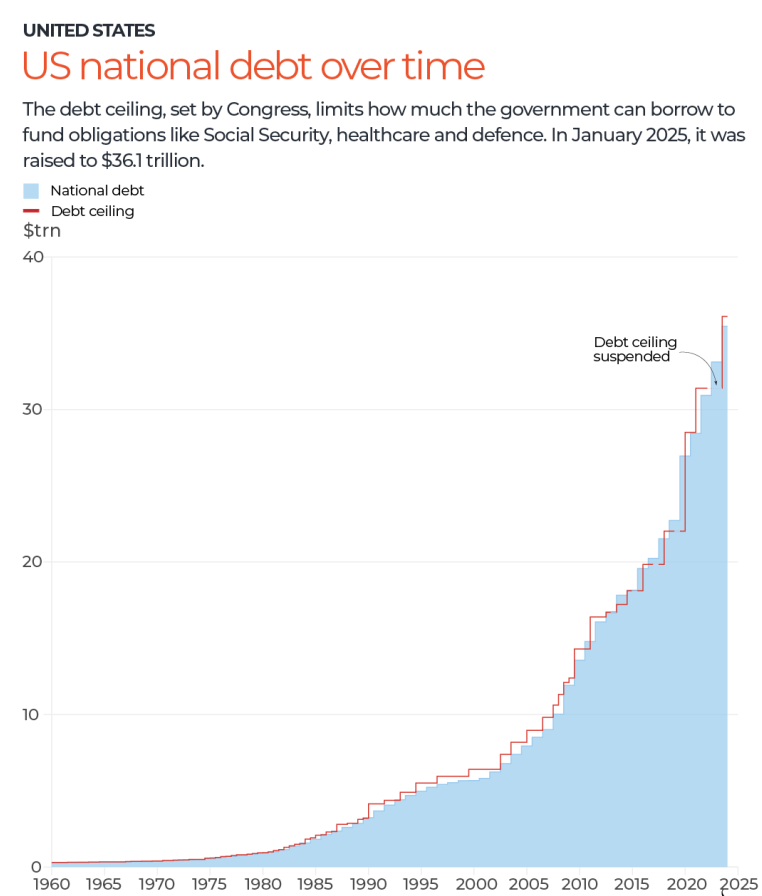

Just look at this chart…

As you can see, our national debt really started to balloon around the 2008 financial crisis.

That’s somewhat understandable, because when the global economy is on the brink of collapse, spending your way out of the situation isn’t the worst thing in the world.

What’s less excusable is the massive run-up in debt we saw from 2010–2020.

Then the pandemic was a unique situation, but what’s the explanation for the next five years?

Especially since Democrats and Republicans have generally shared power since 2008.

No matter who gets elected, both parties have routinely abandoned any assurances of fiscal responsibility the second they get in office.

Fiscal restraint is for the out-of-power party, you see.

The Best Free Investment You’ll Ever Make

Join Wealth Daily today for FREE. We”ll keep you on top of all the hottest investment ideas before they hit Wall Street. Become a member today, and get our latest free report: “A Maverick’s Guide to Gold: 3 Gold Stocks Set to Disrupt the Market”

It contains full details on something incredibly important that’s unfolding and affecting how gold is classified as an investment..

After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox daily.

Most recently, after spending the first three months of his term slashing government jobs and shuttering federal agencies in the name of fiscal austerity, President Trump passed a budget bill that added $5 trillion to the national debt.

The bill was so cancerous it provoked a credit downgrade from Moody’s. That was the third such downgrade since 2011, when S&P issued one, followed another by Fitch in 2023.

But now let’s get back to what I said about being dysfunctional.

Because the issue isn’t just the scale of our debt or our government’s unwillingness to address it, regardless of which party is in power…

It’s that our government can’t govern.

That’s what this latest government shutdown demonstrates — yet again.

After all, how can we be trusted to pay our debt if we can’t even agree on an annual budget?

We can’t.

Again, both parties do this.

We had two government shutdowns when Clinton was president, one under Bush 2 (Electric Bugaloo), one during Obama’s term, two more in Trump’s first term, and now this one.

And that’s not all.

When Fitch cut America’s credit rating back in 2023, it wasn’t just because of the ballooning size of the deficit…

It was because Republicans were playing chicken with the debt ceiling, or what the credit ratings agency called "debt-limit standoffs."

Those standoffs played well for a conservative audience, but they also demonstrated a willingness on behalf of the U.S. government to default on its obligations.

Debt ceiling standoffs, government closures, trade wars, wild swings between Republican and Democratic administrations where compromise and competence are simply jettisoned…

These are the issues that are rotting our currency. These are the antics that have foreign debt-holders rethinking their Treasury holdings.

It’s not just that we’re printing money like newspaper — it’s that our leaders can’t even feign a facade of responsibility.

They act like toddlers ransacking a candy store, fighting over who gets what.

They don’t compromise. They don’t debate. They don’t work together to tackle tough issues.

These aren’t serious people.

And so we don’t get to have serious money.

We get Monopoly money.

That’s why gold and silver prices are blasting through record highs — and why they’ll continue to do so.

It’s why investors are pouring U.S. dollars into alternative currencies (i.e., crypto).

And it’s why I’d advise you to do the same.

In fact, if you want to get the stability of precious metals and the versatility of crypto, then I’d definitely recommend NatGold — an alternative currency that’s backed by gold the same way the U.S. dollar used to be.

Find out more about that here.

Fight on,

Jason Simpkins

Simpkins is the founder and editor of Secret Stock Files, an investment service that focuses on companies with assets — tangible resources and products that can hold and appreciate in value. He covers mining companies, energy companies, defense contractors, dividend payers, commodities, staples, legacies and more… He also serves as editor of The Crow’s Nest where he analyzes investments beyond the scope of the defense sector.

For more on Jason, check out his editor's page.

Be sure to visit our Angel Investment Research channel on YouTube and tune into Jason's podcasts.

Want to hear more from Jason? Sign up to receive emails directly from him ranging from market commentaries to opportunities that he has his eye on.

The Best Free Investment You'll Ever Make

We never spam! View our Privacy Policy

After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox daily.