The World Is Waking Up to Gold Again

Let’s start with something obvious — though somehow still not fully appreciated.

Gold. 👏 Is. 👏 Primed. 👏 To. 👏 Rally. 👏 Hard! 👏

Prices are up. Mining stocks are popping. Central banks are buying like it’s going out of style. And yet… the average investor still isn’t paying attention. 🤦

But it’s that disconnect where your opportunity lies…

We’re in the early stages of a major repricing of gold — and a complete reset of how the world sees, values, and uses this timeless asset.

And right now, there’s a way to get in on the ground floor of that shift through a revolutionary new digital asset backed 1:1 by real, verified, in-ground gold.

It’s called NatGold — and if you haven't heard of it yet, you're not alone. But that won't be the case for long.

So, let’s walk through what’s happening in the gold market and why NatGold might be the smartest move you can make right now — before the rest of the world wakes up…

Central Banks Are Saying One Thing — and Buying Another

Let’s talk about central banks. These are the same institutions that, for decades, told us we don’t need gold anymore.

“We’ve got fiat currency now,” they said. “Trust the system.”

And yet…

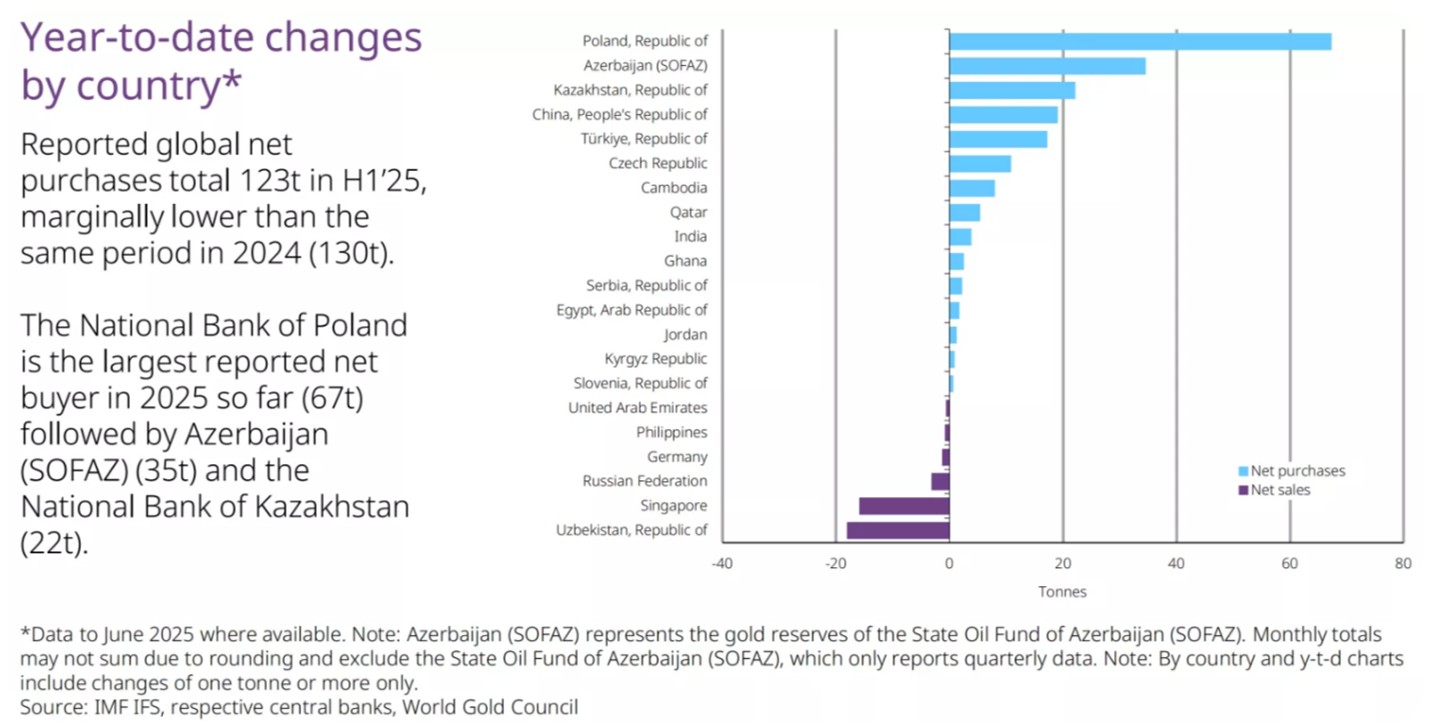

They’re now buying more gold than at any time in modern history…

According to the World Gold Council, 2022 and 2023 were the two highest years ever for central bank gold purchases. 2024 kept pace. And 2025 could turn out to be even bigger…

China, Russia, Turkey, India — these governments are aggressively adding gold to their reserves. Even Western nations are quietly building their stacks.

Ask yourself: If fiat money is so trustworthy, why are the people printing it scrambling to buy gold?

The answer is simple: because deep down, everyone knows what real value looks like…

And gold is real value.

The Rally Is Real… But Still Under the Radar

Gold isn’t just getting scooped up by central banks, though. It’s rallying on the charts, too.

Spot gold recently broke through all-time highs above $3,400 an ounce. That’s not a fluke. It’s a signal.

More importantly, gold mining stocks are on the move, with junior and senior miners alike seeing double- and even triple-digit gains. The GDX gold miners ETF is up significantly over the past year.

But here’s the twist: investor participation is shockingly low.

The Best Free Investment You’ll Ever Make

Join Wealth Daily today for FREE. We”ll keep you on top of all the hottest investment ideas before they hit Wall Street. Become a member today, and get our latest free report: “A Maverick’s Guide to Gold: 3 Gold Stocks Set to Disrupt the Market”

It contains full details on something incredibly important that’s unfolding and affecting how gold is classified as an investment..

After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox daily.

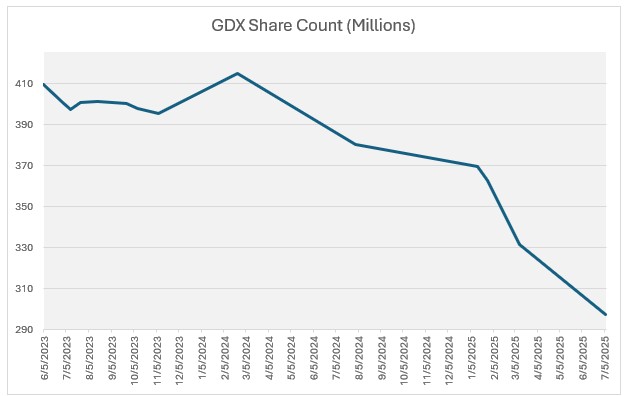

You’d expect the number of shares in a rising ETF like GDX to go up as more people pile in. But the opposite is happening.

GDX’s share count is shrinking.

That means investors aren’t flooding into the trade. They’re either sitting it out or selling into strength. That’s not bearish. That’s the definition of a stealth bull market.

The gains so far have come despite investor apathy.

Just imagine what happens when the crowd finally wakes up and tries to squeeze into one of the smallest corners of the entire financial market.

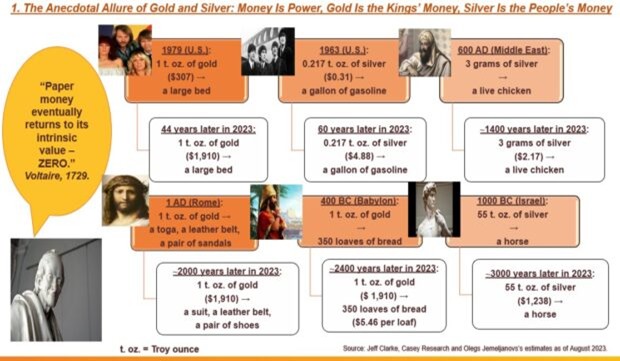

Gold Has Been a Store of Wealth for 2,000 Years… and It Still Works

People like to say gold is “useless” because it doesn’t generate yield.

But that’s missing the point entirely.

Gold’s job isn’t to grow. It’s to preserve.

And it’s done that better than anything else in human history…

One ounce of gold bought 350 loaves of bread in ancient Rome. It buys roughly the same amount today.

That’s thousands of years of wealth preservation in a form that needs no batteries, no updates, no government approval, and no counterparty risk.

Try saying that about your favorite stablecoin or bank account.

Precious Metals Rallies Happen in Two Stages

And the thing is, this setup isn’t new, either. In fact, we’ve seen this all go down before…

Gold runs. A few sharp investors jump in. Miners start moving.

But most people are still stuck in yesterday’s trade — tech stocks, meme coins, whatever’s trending.

Then gold cools off for a minute. The “weak hands” lose interest.

And then it explodes.

That’s the second leg of a precious metals bull market. It’s the one where both institutional and retail money panic-buy into the tiniest sector in the market, sending prices parabolic.

We saw this in the 1970s, when gold ran from $35 to over $800 an ounce. We saw it in the early 2000s, when it ripped from $250 to $1,900.

In both cases, the biggest gains didn’t come at the beginning — they came when momentum kicked in, sentiment flipped, and capital flooded into a supply-constrained market.

We’re setting up for that again right now.

And this time, there's a digital twist…

Introducing NatGold: The Gold Token with Real Weight Behind It

The world is changing.

Digital assets are here to stay. But most of them? Backed by nothing. Just code and hype.

Every NatGold token is backed 1:1 by gold that actually exists — in the ground — verified by independent geologists and compliant with strict global standards (NI 43-101 and JORC, for those who know the lingo).

That makes NatGold something the market has never really seen before:

- A digital gold asset with full physical backing

- Real-world value secured by geology, not guesswork

- An opportunity to get in before Wall Street wakes up

NatGold bridges the old and the new. It’s the timeless value of gold… with the accessibility, liquidity, and transparency of blockchain technology.

And the best part? It's still early.

Why You Should Get in Before the Crowd

Let’s be clear: once everyone hears about this, the easy profits will be gone.

Right now, NatGold is still flying under the radar. It's not listed on major exchanges. The mainstream media isn’t talking about it. Most investors haven’t even heard the name.

But the pieces are all falling into place:

- Gold prices are at all-time highs.

- Central banks are backing up the truck.

- Miners are rallying.

- Retail and institutional investors are still mostly on the sidelines.

- Tokenization is going mainstream.

That’s the setup for something big.

And while everyone else is distracted by the latest meme stock or the next AI IPO, you’ve got a chance to stake your claim to one of the most interesting assets to hit the market in decades.

One Last Thing Before You Go…

There’s a small company behind NatGold — one that’s quietly building a monopoly on tokenizable gold deposits.

We’re talking about massive, geologically verified gold resources… locked in the ground, untouched, and now being converted into the next generation of digital gold assets.

They’re not digging it up. They’re not selling it off. They’re simply unlocking the value and sharing it with the world — token by token.

Want to learn more?

Click here to get the detailed investor report that explains everything you need to know about NatGold, the project, and the incredible upside potential ahead.

But don’t wait too long.

Because by the time the world catches on… you’ll be the one they wish they listened to.

To your wealth,

Jason Williams

After graduating Cum Laude in finance and economics, Jason designed and analyzed complex projects for the U.S. Army. He made the jump to the private sector as an investment banking analyst at Morgan Stanley, where he eventually led his own team responsible for billions of dollars in daily trading. Jason left Wall Street to found his own investment office and now shares the strategies he used and the network he built with you. Jason is the founder of Main Street Ventures, a pre-IPO investment newsletter; the founder of Future Giants, a nano cap investing service; and authors The Wealth Advisory income stock newsletter. He is also the managing editor of Wealth Daily. To learn more about Jason, click here.

Want to hear more from Jason? Sign up to receive emails directly from him ranging from market commentaries to opportunities that he has his eye on.

The Best Free Investment You'll Ever Make

We never spam! View our Privacy Policy

After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox daily.

@TheReal_JayDubs

@TheReal_JayDubs Angel Research on Youtube

Angel Research on Youtube