The Trillion-Dollar Secret… and the Pebble Creek Trigger

There's a trillion-dollar secret buried in America's vaults.

I'm not talking about Fort Knox. Not West Point. Not the Denver Mint or the New York Fed's underground lair.

I'm talking about a place 4,000 miles away in the Alaskan wilderness… a place called Pebble Creek.

It's here — under the tundra and the salmon streams — that Northern Dynasty Minerals (NYSE: NAK) controls one of the largest untapped gold and copper deposits on Earth. A deposit so massive it makes Fort Knox look like a child's piggy bank.

I first brought you Northern Dynasty in early March of this year when it was trading for just $0.60.

Today — in just six months' time?

It has doubled in price.

I own it in my personal portfolio.

And here's the kicker: If this mountain of gold were ever tokenized — if its underground reserves were brought onto the blockchain and marked to market — it would unleash a wave of wealth creation like the world has never seen.

Washington’s Hidden Fortune

But let's back up for a second.

The U.S. Treasury currently reports that its gold reserves — some 261.5 million ounces — are worth just $11 billion. Why so low? Because the government values its gold at $42.22 per ounce, a number locked in by law in 1973.

At today's market price near $3,800 an ounce, that same stash is worth more than $1 trillion.

That's the secret: America's gold is undervalued by nearly 100-fold on its own books. The wealth is real… but hidden. Untouchable.

The Best Free Investment You’ll Ever Make

Join Wealth Daily today for FREE. We’ll keep you on top of all the hottest investment ideas before they

hit Wall Street. Become a member today, and get our latest free report: “Why You Need to Fire Your Money

Manager.”

It contains full details on why money managers are overpaid and provides you with

tools for growing your wealth.On your own terms. No fees, no commission.

Pebble Creek: Bigger Than Fort Knox

Now shift your gaze north, to Alaska's Pebble deposit.

The U.S. government owns 261 million ounces of gold. Pebble Creek alone contains an estimated 107 million ounces of gold — nearly half as much as all the official U.S. reserves — plus 80 billion pounds of copper and billions more in molybdenum, rhenium, and silver.

Think about that.

One company — Northern Dynasty — sits on a resource base that could rival entire nations.

At today's gold prices, the deposit is worth over $400 billion on the gold alone… before even counting copper, silver, and other metals.

Yet on Wall Street, you can buy the entire company for just a little over a dollar a share.

The Tokenization Twist

Here's where the story takes a turn no mainstream analyst dares to follow.

Imagine Pebble Creek's reserves not being mined in the traditional way — with decades of permitting battles, lawsuits, and environmental protests. Imagine instead they were digitally minted into tokens — just like NatGold is doing with certified in-ground reserves worldwide.

- Each token represents a fractional, verifiable claim on the real gold in the ground.

- No trucks, no shovels, no tailings ponds. Just blockchain certificates backed by geology and third-party verification.

- Investors, central banks, sovereign funds — anyone, anywhere — could own “digital Pebble Creek gold” instantly.

If even a fraction of Pebble's estimated 107 million ounces were tokenized, it would create a new digital monetary base worth hundreds of billions of dollars.

That's not theory. That's the exact same model already being rolled out by NatGold: turning the world's stranded gold into tradeable, tokenized wealth.

Why the World Is Ready

Think about the timing.

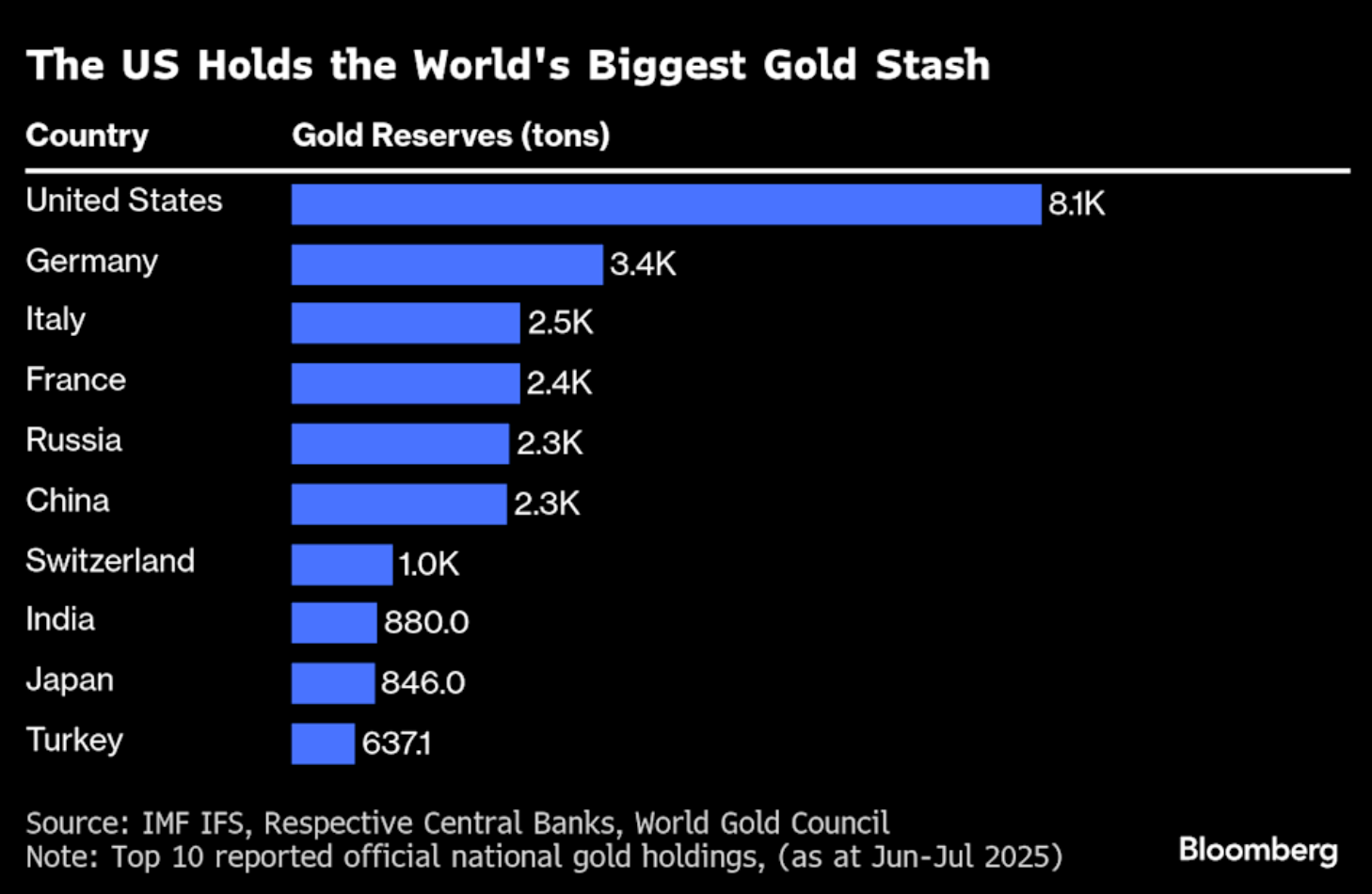

- Central banks are hoarding gold at record rates. China, India, Turkey — they're buying hand over fist.

- The dollar is under siege. BRICS nations openly talk of a gold-backed currency to rival the greenback.

- The U.S. itself sits on a trillion dollars of hidden gold value, valued at 1973 prices — a frozen relic in a world that's going digital.

If Washington won't revalue its gold, someone else will.

And Northern Dynasty's Pebble Creek may be the flashpoint.

Northern Dynasty: The $1 Lottery Ticket

Here's the market disconnect that should make your pulse quicken.

- Washington's official $42/oz valuation massively understates U.S. gold wealth.

- Northern Dynasty's Pebble deposit, at 107 million ounces, massively understates what investors are paying today.

- Tokenization bridges the gap. It takes stranded, unmined reserves and turns them into instant, global-grade financial assets.

If Pebble Creek's gold were ever tokenized — even partially — it would reprice Northern Dynasty's stock overnight. What's a $1 stock today could quickly command 10x, 20x, even 50x returns as investors rush to own the world's newest gold-backed digital asset.

And here's the irony: Pebble Creek has been attacked, delayed, and buried in red tape for decades. Yet the very thing regulators use to stop it — the impossibility of traditional mining — makes it the perfect candidate for tokenization.

The Hidden Fuse of the MoneyQuake

For two years now, I've warned about the MoneyQuake — the tectonic financial realignment shaking the foundations of currencies, commodities, and credit.

This is what it looks like in action:

- A trillion dollars of hidden gold wealth in U.S. vaults, masked by 1970s accounting tricks.

- A $400 billion buried fortune in Alaska, trading for pennies on the dollar through Northern Dynasty stock.

- A digital revolution in tokenization that can unlock this dormant wealth without ever digging a hole in the ground.

When these forces converge, it won't just create another bull market. It will ignite a monetary reformation.

And Pebble Creek — ignored, ridiculed, fought over for decades — could be the match.

The Takeaway

Most investors will miss this. They’ll read about U.S. gold reserves hitting “$1 trillion in value” and shrug, because the government still lists it as $11 billion on the books.

They’ll dismiss Northern Dynasty as “too political” or “too speculative” — the same way they dismissed Amazon in 2001 or Bitcoin in 2012.

But you and I know the secret.

The real story is not what Washington says its gold is worth. The real story is what happens when that hidden wealth gets unlocked. And the easiest lever to pull — the one sitting right under Wall Street’s nose — is Pebble Creek.

It’s a gold vault bigger than Fort Knox, attached to a company trading for pocket change. And if tokenization turns that vault into digital gold, the wealth unleashed will make Roosevelt’s 1934 revaluation look like pocket lint.

This isn’t just another gold story. It’s the hidden fuse of the MoneyQuake.

And Northern Dynasty is sitting right on top of it.

Get to the good, green grass first…

The Prophet of Profit,

Brian Hicks

Brian is a founding member and President of Angel Publishing. He writes about general investment strategies for Wealth Daily and Energy and Capital. Brian is the managing editor and investment director of R.I.C.H Report (Retired Independent Carefree Healthy), New World Assets and Extreme Opportunities. For more on Brian, take a look at his editor’s page.

P.S. Wall Street has no clue this tiny gold stock exists — but that won’t last long. Within the first 90 days of 2026, the inaugural NatGold tokenization event will mint the world’s first digitally mined gold tokens — and one forgotten $0.30 stock controls 73% of the supply. With patents filed, $700 million in gold secured, and demand already topping $103 million, this monopoly play could explode overnight. Get all the details NOW, before Wall Street catches on.

The Best Free Investment You'll Ever Make

We never spam! View our Privacy Policy

After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox daily.