The Prophet of Profit Is Back: My MoneyQuake Predictions Leave Wall Street in the Dust

In November 2024, I stood in front of a microphone and did something no one else in the financial world had the guts to do: I gave you precise, bold, almost reckless-sounding predictions for gold and silver.

I didn’t hedge. I didn’t say, “Well, maybe gold could hit $2,500 if the Fed cuts.”

No.

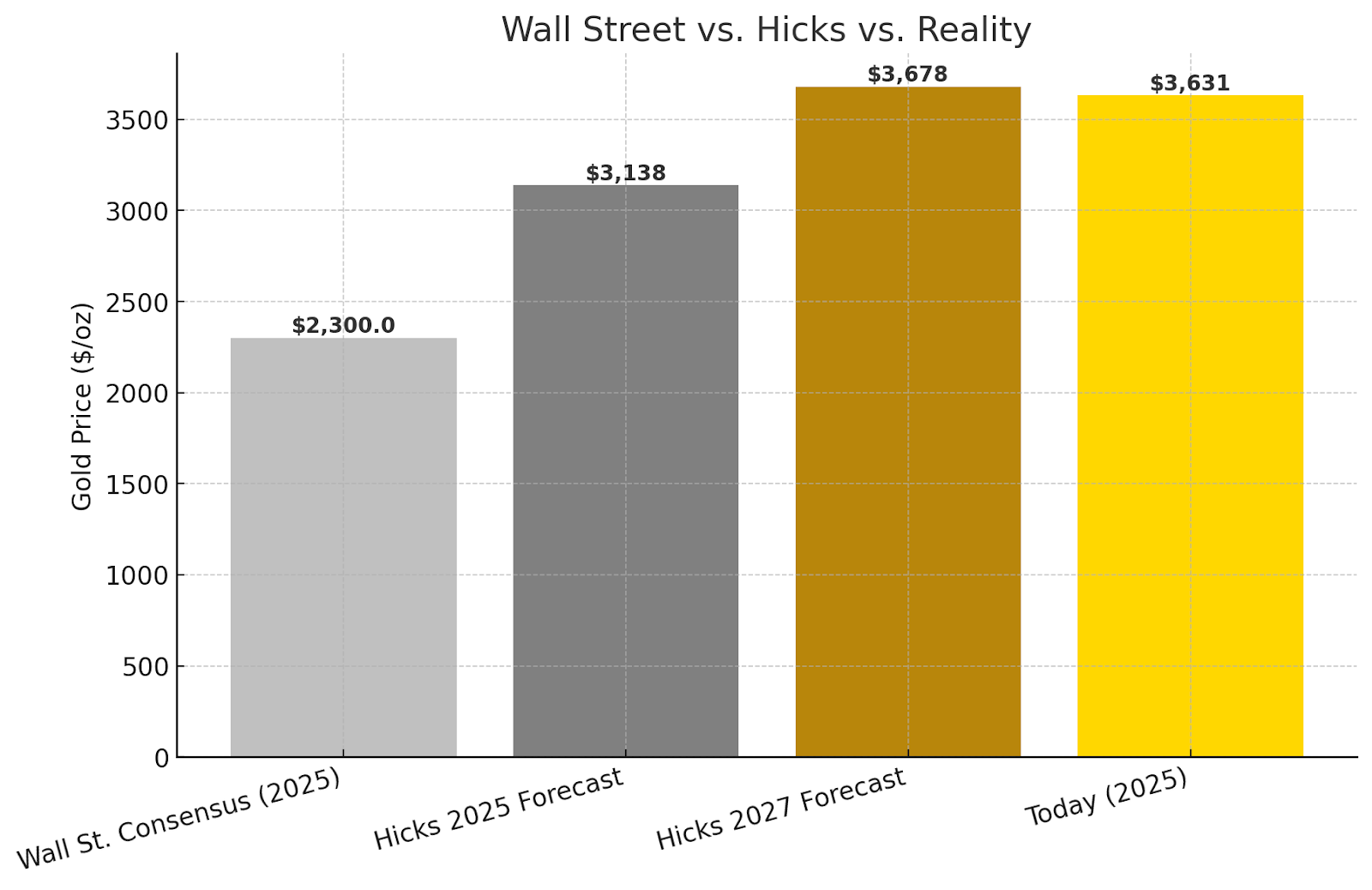

Let’s not forget — my official 2025 prediction for gold in both my annual predictions podcast and in my White Paper #2 was $3,138.

You can access my white paper here: Angel Investment Research White Paper #2

$3,138/oz for gold wasn’t a casual number. That was the level I told readers would be in play by the end of 2025. And it was already one of the boldest calls in the market.

Well… look where we are.

Gold didn’t just tag $3,138. It obliterated it. We’re now at $3,631. Nearly $500 beyond my forecast, with four months left in the year.

Do you see what’s happening here?

Not only did my thesis come true — it’s running so hot, so fast, that even I underestimated the velocity.

When your predictions are so accurate that you outperform your own targets… that’s when you know you’re standing in the right place, at the right time, in the right market.

That’s why investors who listened to me are sitting on windfall profits while the “consensus crowd” is still fumbling with their $1,700–$2,500 targets for 2025:

As of mid‑2024, projections from JPMorgan were notably muted — for example, they had forecast gold at just “above $2,300 per ounce in 2025”

A Bloomberg Terminal consensus range for 2025 was roughly $1,710–$2,728.

Swiss strategist Nicky Shiels predicted that gold would average $2,750 across 2025, with silver around $36.50

Yet we were courageous… and made our predictions as we saw it!

The Best Free Investment You’ll Ever Make

Join Wealth Daily today for FREE. We’ll keep you on top of all the hottest investment ideas before they hit Wall Street. Become a member today, and get our latest free report: “How to Make Your Fortune in Stocks”

It contains full details on why dividends are an amazing tool for growing your wealth.

But We’re Not Done — Not by a Long Shot

I said gold would rocket all the way to $3,678 an ounce by 2027.

I said silver — ignored, ridiculed, forgotten — would blow past the $40 barrier.

Those were my calls.

Calls that were mocked, dismissed, even laughed at by the so-called “smart money.”

And today?

- Gold has already hit $3,631.

- Silver is trading above $41.

We’re not talking about 2027. We’re talking about right now — in September 2025.

That means my predictions didn’t just come true… they obliterated every other forecast out there. Every. Single. One.

Ahead of Schedule — by Years

Look around: Goldman Sachs, JPMorgan, UBS, Citi — none of their forecasts even sniffed these levels.

Most of Wall Street had $2,200–$2,400 targets for 2025. The boldest of the bold dared to whisper $2,600.

Me? I put a $3,1,38 marker in the sand… and we’ve already blown through that level and are within striking distance of $3,678 — two full years ahead of schedule.

Do you realize what that means?

It means every hedge fund manager, every trading desk, every retail analyst with a blue-check account has been wrong.

And it means they’re watching my team at Wealth Daily now. Reading me. Stealing our ideas. I see it almost every day.

Because let’s be blunt: We’ve been the most accurate voice in gold and silver on the planet.

And the story’s not over — it’s just getting started.

The MoneyQuake 2025 Thesis — Validated

In my November 2024 podcast — the one where I introduced the world to my MoneyQuake 2025 thesis — I laid it all out:

- The dollar was heading into terminal decline.

- Global debt was past the point of no return.

- Central banks — especially in the BRICS bloc — were panic-buying gold.

- Silver demand was about to go nuclear thanks to solar, EVs, and high-tech infrastructure.

That was the framework. The spark.

And every single piece of it has unfolded exactly as I told you it would.

Go back and listen to the tape:

👉 Click here to watch the original podcast.

When you hear me say that gold would take out $3,678 by 2027… and then look at today’s $3,631 price tag, you’ll feel the goosebumps.

Because what I said back then wasn’t hype. It wasn’t clickbait. It was prescience.

Wall Street: Always Late, Always Wrong

Here’s the thing about Wall Street — they love to play it safe.

They give you “consensus estimates.” They shift their numbers only after the move has already happened.

That’s why they were caught flat-footed when oil spiked, when tech stocks collapsed in 2022, and when crypto roared back in 2023.

And now? They’re caught flat-footed again — this time on gold and silver.

While I was pounding the table in 2024… they were mumbling about “range-bound markets.”

While I was shouting “$3,138!”… they were patting themselves on the back for calling $2,200.

It’s embarrassing.

But it’s also proof that if you want to be early — if you want to be where the fortunes are made — you can’t follow the herd. You’ve got to listen to the one guy who gets it right before the headlines.

You have to get to the good, green grass first…

That’s me.

Why This Move Is Just the Beginning

Now here’s the dangerous part for anyone still on the sidelines:

If you think this move is “done”… you couldn’t be more wrong.

Gold isn’t peaking — it’s breaking out from a 5-month consolidation period. It’s a coiled-spring. Bull markets need to breathe before they sprint. And what’s coming next will make $3,631 look like a foothill before the mountain.

Here’s why:

- Debt Crisis: With U.S. debt racing past $36 trillion, interest payments alone are devouring the federal budget. That’s unsustainable. The only “fix”? More printing. More debt. More gold demand.

- Central Bank Frenzy: Nations from China to Turkey to India are buying gold hand over fist. Why? Because they see the writing on the wall. The dollar’s days as global reserve king are numbered.

- Silver Supernova: The industrial demand curve is vertical. Solar panels, EV batteries, AI-driven data centers — every single one needs silver. Supplies can’t keep up. Prices will.

Every trendline is flashing the same signal: up.

And if we’re already hitting my 2027 targets now, imagine what the next two years look like.

The Prophet Is Back

Let’s not dance around it: I’ve proven myself again.

My predictions aren’t just correct — they’re demolishing the competition.

- I called the levels.

- I called the timeline.

- I called the catalysts.

And I called them first.

No one else in the business has even come close. And the markets are finally admitting it.

So yes: The prophet of market predictions is back.

And if you think Wall Street isn’t secretly tuning into my podcast and scouring my white papers for their next “ideas,” you’re dreaming.

But here’s the good news: you don’t have to wait for them. You don’t have to settle for sloppy seconds.

You can get it straight from me — early, accurate, and actionable.

2026: The Podcast That Will Redefine the Market

If my 2024 podcast was a lightning bolt, my upcoming 2026 predictions podcast is going to be a nuclear detonation.

Because I’m not just updating my MoneyQuake thesis — I’m escalating it.

What I’m seeing now makes last year’s calls look like child’s play.

- Gold smashing through $3,678 and rocketing into territory no analyst has dared to forecast. Next stop for gold: $5,558 by 2030… and $16,402 by 2035.

- Silver ripping higher into levels no living investor has seen in their lifetime. Next stop… $56.60 by 2027… $96.80 by 2030… and $152 by 2035.

- A seismic market rotation that will reward my readers and listeners with the kind of gains that make legends.

You’ll hear it all — soon.

And when you do, you’ll realize this isn’t just about gold or silver. It’s about positioning yourself ahead of the single greatest wealth transfer of the 21st century.

The Call to Action

Here’s what you need to do — right now:

- Go back and watch my November 2024 podcast. See for yourself how dead-on my analysis was. 👉 Watch here

- Prepare for my 2026 predictions podcast. Clear your schedule. Bookmark your reminders. Because when it drops, you’re going to want to be first in line.

This isn’t optional. Not if you want to be where the money is going — not where it’s been.

The profits are massive. The urgency is real. The time is now.

Closing the Loop

Gold at $3,631. Silver above $41.

My predictions — once mocked — have not only come true, they’ve come true years early. They’ve blown Wall Street out of the water.

And that’s why investors are turning to me and my team for guidance. Because when I make a call, it’s not just a prediction — it’s destiny.

The MoneyQuake is here. The ground is shaking. The profits are erupting.

And the prophet of market predictions? Well the prophet is back.

Stay tuned for 2026.

Brian Hicks

Brian is a founding member and President of Angel Publishing. He writes about general investment strategies for Wealth Daily and Energy and Capital. Brian is the managing editor and investment director of R.I.C.H Report (Retired Independent Carefree Healthy), New World Assets and Extreme Opportunities. For more on Brian, take a look at his editor’s page.

P.S. Beijing just cut off key minerals to the U.S., threatening to choke America’s AI, defense, and energy sectors. Trump’s answer? A $100 trillion counterattack that unlocks 640 million acres for mining, fast-tracks 10 elite projects, and funnels billions into America’s most critical mineral suppliers. Four tiny public companies are at the heart of this plan — and their shares could skyrocket once final approvals hit. Get all the details on these four stocks right here.

The Best Free Investment You'll Ever Make

We never spam! View our Privacy Policy

After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox daily.