The Next Netscape Just Launched — and It’s Triggered a MoneyQuake

The market recently celebrated a 30-year anniversary of sorts.

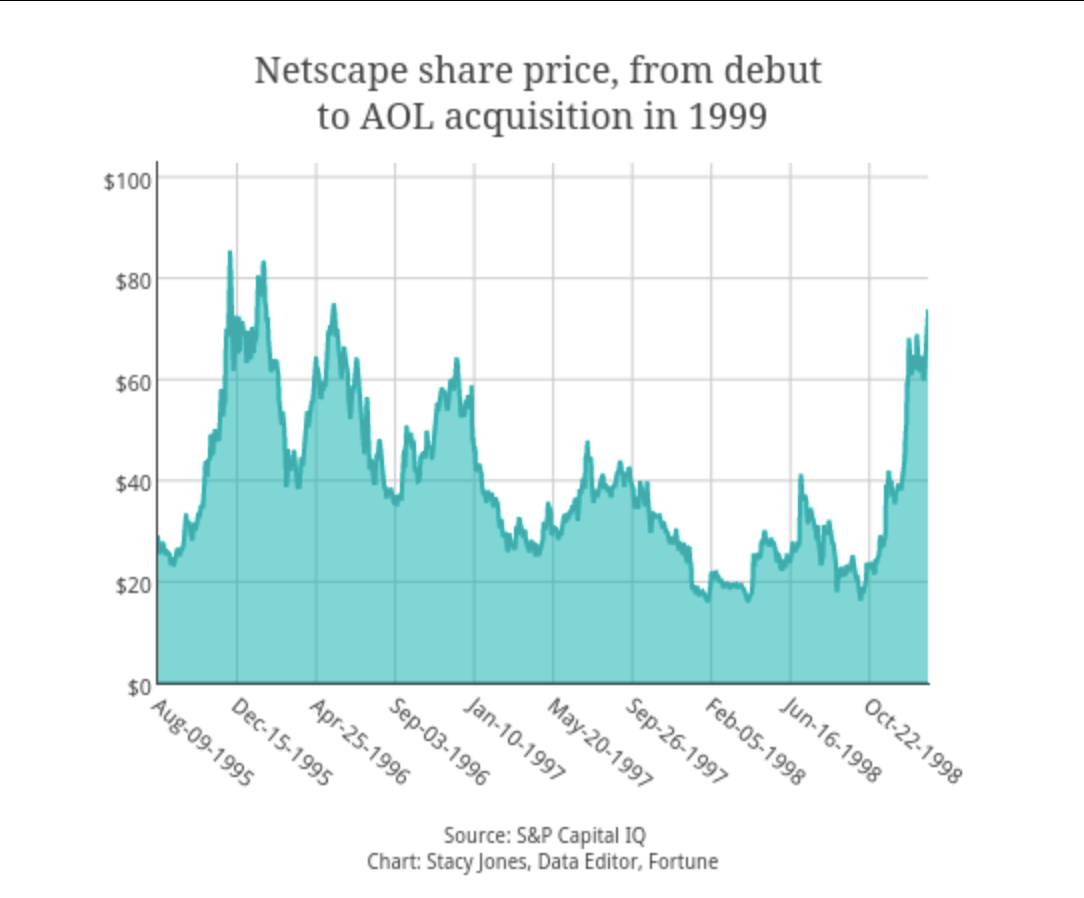

On August 9, 1995, a strange little company called Netscape went public.

It was a hot, quiet summer day. Clinton was in the White House. Most Americans had barely heard of the internet. The rest were still trying to connect to AOL through a modem that sounded like it was eating aluminum foil.

And yet there it was: Netscape Communications, ticker NSCP, priced at $28, ripping to $58.25 by the end of the day — a 100%+ gain, out of nowhere.

Boom.

The spark was lit.

That IPO wasn’t just a market event — it was the ignition point of the internet economy. And over the next five years, the Nasdaq didn’t just go up — it exploded, rising nearly 1,500% in a full-blown supercycle.

Today, I’m here to tell you…

That moment just happened again.

And if you missed Netscape in ’95 — don’t miss this one.

The New Netscape Just Went Public… and It’s Bullish

Last week, a crypto exchange named Bullish went public on the New York Stock Exchange under the ticker BLSH.

You read that right.

A company built on blockchain infrastructure, powered by the future of finance, just crossed over into the belly of TradFi… and made a splash.

Shares popped over 22% at the open.

The media called it “another SPAC deal.” Wall Street called it “just another exchange.”

But here’s what we call it at Wealth Daily:

A thunderclap.

Because this IPO isn’t about a trading platform. It’s about validation.

Bullish going public is crypto’s Netscape moment — the first real signal that blockchain finance isn’t fringe anymore. It’s not theory. It’s not “somewhere out there.” It’s here.

And it's now.

The Best Free Investment You’ll Ever Make

Join Wealth Daily today for FREE. We”ll keep you on top of all the hottest investment ideas before they hit Wall Street. Become a member today, and get our latest free report: “A Maverick’s Guide to Gold: 3 Gold Stocks Set to Disrupt the Market”

It contains full details on something incredibly important that’s unfolding and affecting how gold is classified as an investment..

After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox daily.

What Comes Next? Look at 1995.

Back when Netscape IPO'd, nobody understood what they were buying.

But the ones who felt it — the ones who knew this “web thing” was bigger than most people realized — they got in early.

And it changed their lives.

We saw:

- Amazon founded just a year later

- Yahoo and eBay going public by 1996

- A tech tidal wave that minted millionaires before the new millennium

And at the center of it all?

The Nasdaq.

Which brings us to the QQQ — the ETF that holds the top 100 non-financial tech companies in the U.S..

And guess what?

It’s already on fire.

QQQ Just Broke Out — and It's Only Just Begun

Back in April, while most investors were distracted by the Fed or Ukraine or whatever the crisis of the week was, something happened…

Trump announced Liberation Day.

It sounded like a campaign stunt to some. But to us — and anyone paying attention to the flow of capital and regulation — it was something far more meaningful…

It was a green light.

That moment marked the beginning of a massive deregulatory wave aimed at unlocking American innovation — across AI, blockchain, energy, and, yes, crypto.

And the Nasdaq heard the signal loud and clear.

Since April, QQQ has blasted off — riding a wave of AI optimism, big tech breakouts, and institutional FOMO.

Nvidia? New highs.

Microsoft? Dominating AI.

Meta? Monetizing everything it touches.

And the QQQ is the perfect vehicle for this ride.

It’s diversified, liquid, and laser-focused on the same innovators leading the AI-crypto-cloud convergence that’s now shifting the global economy.

And we’re still early.

Because if history repeats, this QQQ breakout will look like Nasdaq 1995: an early ramp-up… followed by a vertical melt-up through 2026 and beyond.

Welcome to the MoneyQuake

Let’s zoom out for a second.

The Bullish IPO?

The QQQ breakout?

The tokenization of gold, real estate, and even T-bills?

They’re not isolated events.

They’re fault lines.

And the tremors are already shaking the ground under traditional finance.

That’s what we call the MoneyQuake.

It’s not a trend. It’s a tectonic shift — a once-in-a-generation financial realignment happening right now as AI, blockchain, and real-world assets collide.

The internet rewired our lives.

The MoneyQuake is rewiring money itself.

We’re seeing:

- Smart contracts replace trust-based systems.

- Tokenized assets unlock trillions in trapped value.

- AI agents automate entire economic functions.

- Digital gold resurrects scarcity in a world of fiat decay.

If that sounds big, that’s because it is.

NatGold: The Apex Play of the MoneyQuake Era

And right at the epicenter of this earthquake?

If Bullish is the new Netscape…

If QQQ is your exposure to the AI-fueled rocket ride…

Then NatGold is the ultimate convergence trade — where gold, crypto, and AI come together in a single, groundbreaking digital asset.

What makes NatGold different?

- Backed by certified, unmined gold — no speculation, just real reserves.

- On-chain, transparent, and provable — built for trust in an era of doubt.

- No mining, no carbon — a green gold solution.

- AI valuation layers — pricing in market signals before humans can blink.

It’s part gold ETF, part smart contract, part monetary liberation vehicle.

And right now, it’s available to early investors before the rest of the world wakes up.

This is your chance to own the backbone asset of the MoneyQuake era.

Final Word: You’re Not Too Late — but You Can’t Wait

Look — if you missed Netscape, you missed a lot.

If you missed Bitcoin at $300, you missed more.

But today… you’re on the front end of three massive shifts converging all at once:

- Tech is booming again — QQQ is your rocket ship.

- Crypto is crossing over — Bullish and Circle are just the beginning.

- NatGold is anchoring a new monetary system — and it’s live now.

This is your second chance.

Or your last one.

So ask yourself: Do you want to watch it happen… or ride the wave?

Because the MoneyQuake is real.

And it's not waiting.

Get to the good, green grass first…

The Prophet of Profit,

Brian Hicks

Brian is a founding member and President of Angel Publishing. He writes about general investment strategies for Wealth Daily and Energy and Capital. Brian is the managing editor and investment director of R.I.C.H Report (Retired Independent Carefree Healthy), New World Assets and Extreme Opportunities. For more on Brian, take a look at his editor’s page.

P.S. Palantir turned battlefield AI into a $47 billion empire — handing investors 1,759% gains. Now, under Trump's $5.3 trillion "Golden Dome" missile shield, one overlooked defense contractor is set to repeat history. Its tech is already deployed across over 300 military programs… and it could be the biggest AI stock winner of the decade.

The Best Free Investment You'll Ever Make

We never spam! View our Privacy Policy

After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox daily.