The Moon is Getting a Nuclear Reactor

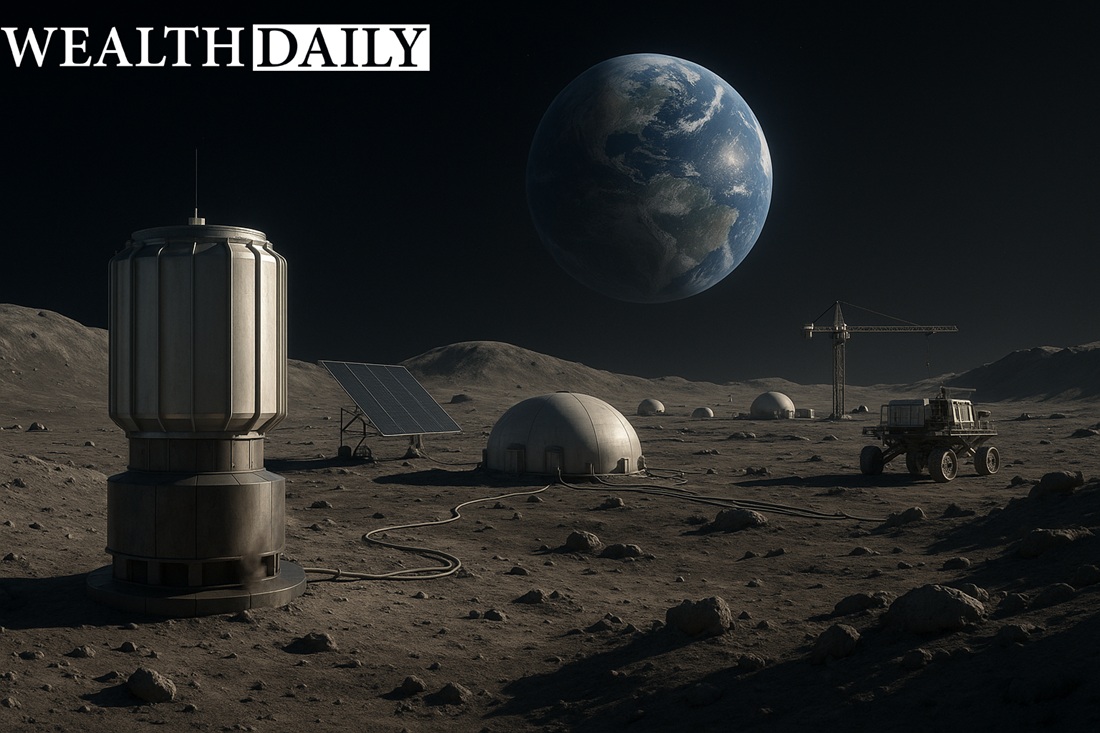

Picture this: it’s 2030, and a small but mighty nuclear reactor is quietly buzzing away on the Moon, generating clean, consistent energy to power astronauts, rovers, and future lunar mining operations.

No, this isn’t a scene from the sequel to The Martian — it’s a real goal now backed by the full weight of the U.S. government. And for investors who pay attention early, it could also be one of the most exciting profit opportunities in years…

NASA, alongside the Department of Energy, has officially fast-tracked a plan to deploy a 100-kilowatt fission power plant to the lunar surface by the end of the decade.

This project is part of a broader push to develop permanent infrastructure in space — not just for exploration, but for industry and national security — before Russia and China beat us to it.

For investors, that means big things are coming — and you don’t need to be a rocket scientist to get in on it.

Why Build a Nuclear Reactor on the Moon?

To establish any sort of long-term presence on the Moon — whether it’s a scientific base, a mining outpost, or a refueling station for missions to Mars — you need power.

And not just solar panels, which are unreliable during the long, cold lunar nights that last about 14 Earth days. You need something that works in the dark, works in the cold, and doesn’t need constant maintenance.

Enter: fission power.

The small modular reactor NASA wants to build would provide a steady stream of energy to support life support systems, communication relays, and lunar construction.

This plan isn’t some backroom fantasy, either.

NASA already awarded $5 million reactor design contracts back in 2022. Lockheed Martin, Westinghouse, and a partnership between Intuitive Machines and X-energy were the recipients.

Now, the national space program is preparing to move into the next phase: selecting contractors to actually build and deliver the reactor to the Moon by 2030.

Who Stands to Profit? Follow the (Publicly Traded) Money

Now we’re getting to the good stuff…

The Best Free Investment You’ll Ever Make

Join Wealth Daily today for FREE. We’ll keep you on top of all the hottest investment ideas before they hit Wall Street. Become a member today, and get our latest free report: “Guardians of Growth: 3 Defense Contractors for Savvy Investors.”

It contains full details on the three companies that are set to provide explosive growth in the defense sector over the next Decade.

After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox daily.

While a lot of the action in the space economy involves private companies, there are still several publicly traded players with a clear path to revenue from this and other lunar projects.

BWX Technologies (NYSE: BWXT) is one of the top names to know…

This company specializes in nuclear reactors for submarines and space propulsion.

They’re already building microreactors for DARPA and the Department of Defense and are seen as a front-runner in space-based nuclear tech.

When news of NASA’s lunar reactor plans hit the wires, BWXT stock shot up nearly 20% — a strong signal that investors are paying attention.

Another one to watch is Lockheed Martin (NYSE: LMT). This defense and aerospace giant is everywhere in the space and nuclear sectors.

Not only did they receive one of the initial design contracts from NASA, but they also have deep experience in both reactor design and space mission integration.

As a top-tier government contractor, Lockheed stands to benefit from nearly every stage of the lunar reactor deployment — from planning and design to launch and operational support.

Westinghouse Electric, while not publicly traded itself, has partnered with Cameco Corp (NYSE: CCJ), one of the world’s largest uranium producers, which now holds a significant interest in Westinghouse.

That means CCJ offers indirect exposure to lunar nuclear tech, while also benefiting from the broader boom in small modular reactor demand here on Earth.

You can also consider Aerojet Rocketdyne, recently acquired by L3Harris Technologies (NYSE: LHX)…

While the company itself no longer trades independently, LHX now owns all of Aerojet’s advanced propulsion capabilities, which could be key to transporting heavy infrastructure — like nuclear reactors — to the Moon’s surface.

And then there’s Northrop Grumman (NYSE: NOC), another defense contractor with space credentials…

They’ve worked with NASA on Artemis missions and were deeply involved in building the James Webb Space Telescope.

Northrop’s experience with autonomous systems, propulsion, and government contracting make it another compelling play in the lunar energy arms race.

Finally, keep your eye on Intuitive Machines (NASDAQ: LUNR) — a pure-play lunar infrastructure company that’s already delivering cargo to the Moon under NASA’s CLPS program.

While small and volatile, this is one of the few public companies solely focused on lunar delivery and systems integration. And their partnership with X-energy for early reactor design puts them squarely in the running for future contracts.

What Will It Cost — and Who’s Paying?

Let’s be clear: this won’t be cheap.

The original 2022 design contracts were a modest $5 million each, but deploying a working nuclear reactor on the Moon is a multi-year, multi-billion-dollar mission.

Just launching the components into orbit could cost hundreds of millions.

Add in the cost of building the reactor, testing it on Earth, safely transporting it through space, and deploying it on the Moon with robots and remote-control tech…

And you’re easily looking at hundreds of billions of dollars.

That kind of budget means two things: first, only the most trusted, well-capitalized contractors will be selected. Second, the money is real, and it’s going to show up in quarterly earnings reports long before astronauts flip the switch.

The timeline also works in investors’ favor.

Proposals will be solicited starting late 2025, with finalists chosen by March 2026.

From there, Earth-based fabrication, testing, and launch planning will create years of contract work and stock-moving headlines for the companies involved.

It’s Not Just the Moon — It’s a Whole New Economy

Sure, a lunar nuclear reactor sounds cool (and a little crazy). But the real value here is in what it unlocks… insane potential profits.

A Moon base powered by fission isn’t just about exploration — it’s about establishing permanent infrastructure.

That includes mining operations, in-situ resource utilization (ISRU), fuel production, communications relays, and even the early building blocks of off-world manufacturing.

Every one of those industries will need companies to build, supply, maintain, and expand them — and many of those companies are publicly traded today.

Even better, the technologies being developed for the Moon will have huge applications back here on Earth…

Microreactors that work in deep space can also serve remote military outposts, disaster zones, off-grid communities, or island nations desperate for clean, reliable energy.

That means today’s lunar tech investments could be tomorrow’s global energy solutions.

You’re Early, and That’s the Opportunity

Let’s wrap this up with the most important thing you should take away: this is not a trend that everyone fully understands yet.

This isn’t crypto in 2021 or AI in 2023.

This is early-stage Moon infrastructure, and the window to get in before the crowd is still WIDE open.

Stocks like BWXT, Lockheed Martin, Northrop Grumman, Cameco, and even speculative names like Intuitive Machines are quietly positioning themselves for contracts that could shape the next 20 years of off-world industry.

And they’re doing it with the backing of the U.S. government, multi-billion-dollar budgets, and a very clear geopolitical incentive to beat China and Russia to the Moon’s “high ground.”

If you believe the next big tech revolution won’t be on Earth at all — but above it — then this is your moment.

The future is lunar. The profits could be astronomical.

And the smart money is getting ready to start building reactors on the Moon.

P.S. Banned for 29 Years — Revived Under Trump!

Clinton’s blunder handed China control of 50 critical materials — now Trump’s declaring a national emergency to take them back. At the center of the fight? A $10 U.S. company sitting on 19 of these vital resources — and first in line for government contracts as America races to cut China out of its supply chain.

To your wealth,

Jason Williams

After graduating Cum Laude in finance and economics, Jason designed and analyzed complex projects for the U.S. Army. He made the jump to the private sector as an investment banking analyst at Morgan Stanley, where he eventually led his own team responsible for billions of dollars in daily trading. Jason left Wall Street to found his own investment office and now shares the strategies he used and the network he built with you. Jason is the founder of Main Street Ventures, a pre-IPO investment newsletter; the founder of Future Giants, a nano cap investing service; and authors The Wealth Advisory income stock newsletter. He is also the managing editor of Wealth Daily. To learn more about Jason, click here.

Want to hear more from Jason? Sign up to receive emails directly from him ranging from market commentaries to opportunities that he has his eye on.

The Best Free Investment You'll Ever Make

We never spam! View our Privacy Policy

After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox daily.

@TheReal_JayDubs

@TheReal_JayDubs Angel Research on Youtube

Angel Research on Youtube