The Hidden Jackpot in the Precious Metals Boom

If you're bullish on precious metals like we are, you're already ahead of the herd…

You’ve seen the writing on the wall: shaky fiat currencies, reckless central banks, and a global economy bracing for impact.

So you stack gold. You hold silver. Maybe it’s in a vault, maybe under the mattress. Either way, you know your metals will hold their value when the financial system doesn’t.

But here’s something most people don’t realize…

At this stage of the cycle, silver usually runs harder than gold. Always has. Always will. And when silver moves, silver miners move even faster.

Which is why if you’re only holding bullion, you’re playing defense. The real offensive firepower? It’s in the miners.

The Hidden Power of Leverage

Gold and silver are great at preserving wealth. But if you're looking to grow it — really grow it — you need something with more torque.

That’s where miners come in.

They don’t just ride the wave when metals rally — they rocket off of it. When the price of gold rises, miners don’t get a nice little bump… they often explode.

Let’s say a miner pulls gold out of the ground at $1,000 per ounce. With gold trading at $1,200, the company is clearing $200 in profit per ounce.

Now let’s say gold jumps to $1,500.

That’s a 25% gain in the metal… but the miner’s profit margin just jumped 150% — from $200 to $500.

And if operating costs stay stable, most of that cash flows straight to the bottom line.

This is what we mean by leverage…

The miners don’t just follow the metal. Instead, they multiply it. And in a bull market, that leverage turns into fireworks.

The Best Free Investment You’ll Ever Make

Join Wealth Daily today for FREE. We”ll keep you on top of all the hottest investment ideas before they hit Wall Street. Become a member today, and get our latest free report: “A Maverick’s Guide to Gold: 3 Gold Stocks Set to Disrupt the Market”

It contains full details on something incredibly important that’s unfolding and affecting how gold is classified as an investment..

After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox daily.

Miners Are the Rocket Fuel of a Metals Bull Run

Gold might double in the next leg of this rally. And historically, that means silver might triple…

But the right miners?

They can rise 5x… 10x… even 20x in value.

That’s not just hype. It’s history. And we’re seeing the setup again right now.

The big names — Newmont, Barrick, Pan American — are solid, sure. But they’re also large and well-followed.

If you want the really big wins, you have to go looking where Wall Street isn’t.

Valuation Gaps You Could Drive a U-Haul Through

Enter the junior miners…

These are the small-cap explorers and developers sitting quietly on world-class assets. They don’t have production yet. They might not even have an operating mine.

What they do have is verified gold or silver in the ground… and a market that hasn't caught on yet.

That’s where the upside comes from. These companies are trading at fractions of what they’re potentially worth.

The result? Explosive re-rates when the market wakes up.

Imagine a junior gold company with 2 million ounces in the ground.

That’s $4 billion worth of gold at current prices. But the stock trades for just $100 million. Why?

Because it's early. Because it’s not producing yet. Because most investors are still sleeping on it.

But once the rally grabs attention and the spotlight hits the juniors — boom. Prices re-rate. Analysts upgrade. Majors start sniffing around…

And suddenly that quiet little explorer becomes a 10-bagger.

This Market Is Still Hitting the Snooze Button

We’re still early in this precious metals rally. Gold’s running. Silver’s coming alive.

But most of the market is distracted by tech and AI and meme stock charts.

Which is great news. Because while everyone else is watching American Eagle ads, smart money is quietly building positions in the miners.

And the juniors? They're still dirt-cheap. For now.

So, before the rest of the market wakes up to what you and I already know, let’s talk about some of the most promising junior miners out there when it comes to both gold and silver…

Seabridge Gold: More Ounces, Less Digging

Seabridge Gold (TSX: SEA; NYSE: SA) is kind of a unicorn in the mining world…

It doesn’t mine gold.

It just owns an enormous amount of it — more than 88 million ounces of measured and indicated gold and over 65 million ounces inferred just at its flagship KSM project in British Columbia.

That, and a disciplined capital allocation plan, gives it the highest gold ounces per share of any public company in the world…

And despite never having mined an ounce, the market still gives those ounces real value.

Why? Because in a world starved for Tier 1 gold discoveries, just owning the dirt can be enough.

When gold prices rise, companies like Seabridge benefit enormously — without needing to operate a single truck or drill.

NatBridge Resources: The Seabridge Model, Reimagined for the Digital Age

Now imagine that model — collecting massive, verified gold deposits — but with a twist.

That’s what NatBridge Resources (CSE: NATB; OTC: NATBF) is doing…

Like Seabridge, NatBridge has focused on acquiring high-quality, NI 43-101-compliant gold resources in mining-friendly jurisdictions.

But instead of sitting on them and waiting for a buyer, NatBridge is going a step further — tokenizing the gold via blockchain.

Through a new digital asset called NatGold, NatBridge is preparing to offer tokenized, in-ground gold ownership to investors around the globe.

As of July 30, 2025, over 35,000 NatGold tokens have been reserved by investors in hundreds of countries, totaling more than $60 million in pre-market demand…

And NatBridge is entitled to mint the first 2.5 million tokens, positioning it as a potential bridge for other companies to tokenize suitable resources through joint ventures.

It’s a modern version of Seabridge’s model. And it’s one that could open up the world’s gold to everyday investors through a digital asset economy.

(Side Note: Click here if you want to learn more about NatBridge’s role in this rapidly evolving ecosystem and how you can lock even more potential profits before the crowd or even the suits on Wall Street ever get a chance.)

Avino Silver: Early-Inning Breakout With More to Come

Avino Silver (NYSE: ASM) is already making waves.

The company’s shares nearly quadrupled year to date before pulling back lately, driven by its producing mine in Durango, Mexico, and surging investor demand for silver exposure.

But this correction isn’t the end of the story…

Avino is sitting on even more potential with its La Preciosa project — one of the largest undeveloped primary silver resources in Mexico. As silver restarts its move higher — and as more capital rotates into silver miners — Avino is set up to outperform again.

And if silver outpaces gold, as it often does, and miner flows continue to favor producers with scale and growth potential, Avino could double or triple again before all’s said and done.

Apollo Silver: California Gold? Try California Silver — and a Mexican Wild Card

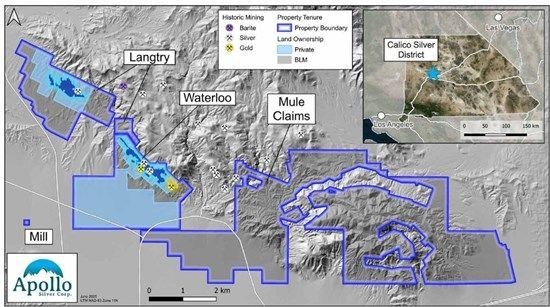

Apollo Silver (TSX-V: APGO; OTC: APGOF) is another extremely under-the-radar play on a resumption of the precious metals rally. But it likely won’t be unknown for long…

You see, Apollo holds one of the biggest untapped silver assets in the world (but it's the largest in the United States).

Apollo's Calico project in Southern California boasts over 110 million ounces of measured and indicated silver, plus inferred resources. At current prices, that’s worth nearly $4.8 billion…

Yet its current market cap is under $100 million. 😕

That means Calico alone supports a much higher valuation.

And then there’s the wild card…

Apollo’s Mexican assets, including the Cinco de Mayo project. If work there pans out, the market could add hundreds of millions in value almost overnight.

So you’ve got a flagship asset that already justifies a re-rate AND a second that could blow the lid off.

That’s the kind of setup junior mining dreams are made of.

Don’t Wait for the Rush. Stack the Stuff that Explodes Now

If you’re already holding metals, good. That’s the foundation. Gold and silver protect.

But the rally is just getting started. And the biggest upside won’t come from bullion.

Miners amplify. And junior miners? They explode.

Seabridge stores value underground. NatBridge tokenizes it. Avino mines it. Apollo might just redefine it.

These are the companies that:

- Offer unmatched leverage to metal prices

- Trade at a fraction of their resource value

- Could re-rate dramatically as gold and silver catch fire

Whether it’s ounces per share, tokenized in-ground gold, meteoric early gains, or district-scale silver resources…

This is where the real money will be made.

Now is the time to research. To position. To stake your claim before the rest of the market figures it out.

Because once they do, these stocks won’t be cheap anymore.

And the next leg of the rally will belong to those who got in before the boom.

To your wealth,

Jason Williams

After graduating Cum Laude in finance and economics, Jason designed and analyzed complex projects for the U.S. Army. He made the jump to the private sector as an investment banking analyst at Morgan Stanley, where he eventually led his own team responsible for billions of dollars in daily trading. Jason left Wall Street to found his own investment office and now shares the strategies he used and the network he built with you. Jason is the founder of Main Street Ventures, a pre-IPO investment newsletter; the founder of Future Giants, a nano cap investing service; and authors The Wealth Advisory income stock newsletter. He is also the managing editor of Wealth Daily. To learn more about Jason, click here.

Want to hear more from Jason? Sign up to receive emails directly from him ranging from market commentaries to opportunities that he has his eye on.

The Best Free Investment You'll Ever Make

We never spam! View our Privacy Policy

After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox daily.

@TheReal_JayDubs

@TheReal_JayDubs Angel Research on Youtube

Angel Research on Youtube