The Fast Track to America’s Next Resource Boom

One thing is certain about our great nation… America has never lacked for mineral wealth…

What it’s lacked, for decades, however, is the ability to bring it online fast enough.

Projects that should have taken years have taken decades… On average, from discovery to production, it takes 29 years to get a project going in the U.S.

Only one country in the entire world — Zambia — has a slower pace, at 34 years.

Copper mines have been stalled at the gate. Gold projects have been frozen in regulatory purgatory. And energy infrastructure has been tied in bureaucratic knots so tight that investors eventually just walked away.

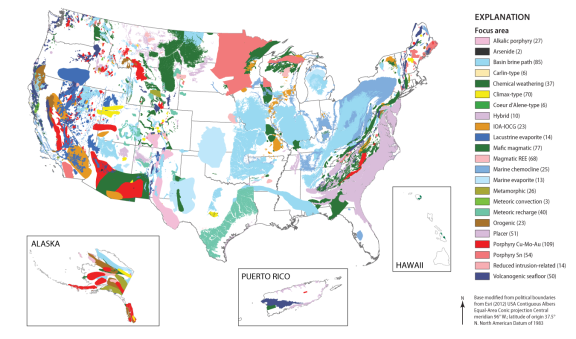

This isn’t because the resources weren’t there. In fact, the U.S. Geological Survey estimates there is over $12 TRILLION worth of trapped resource riches sitting just beneath the surface of our great nation…

It’s because the process of getting these projects from discovery to delivery wasn’t built for speed.

But buried in the alphabet soup of federal permitting law is a four-letter program designed to change that.

It’s called FAST-41.

And if you’re an investor looking to get in on the next wave of resource-sector booms, this is one acronym you need to remember.

FAST-41: The Permit Accelerator

FAST-41 — short for “Fixing America’s Surface Transportation Act Section 41” — is essentially a fast lane for federal permitting.

Once a project is accepted into the FAST-41 program, federal agencies must coordinate on a single, enforceable timeline.

No more endless handoffs between departments. No more “We’ll get back to you next year.” No more regulatory black holes.

Here’s what makes it powerful:

- It compresses project review timelines from a decade or more down to just a few years.

- It forces accountability.

- And it gives investors something most mining projects never have: clarity.

And if you’ve ever seen a small-cap mining or energy stock skyrocket on permitting news… FAST-41 is often the reason why…

The Best Free Investment You’ll Ever Make

Join Wealth Daily today for FREE. We”ll keep you on top of all the hottest investment ideas before they hit Wall Street. Become a member today, and get our latest free report: “A Maverick’s Guide to Gold: 3 Gold Stocks Set to Disrupt the Market”

It contains full details on something incredibly important that’s unfolding and affecting how gold is classified as an investment..

After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox daily.

Trump’s Quiet Super-Weapon

FAST-41 has already become a go-to tool for the Trump administration in just the 10 months he’s been in office…

Instead of fighting the system, Trump’s team simply built a highway through it. LNG export terminals, mining projects, critical infrastructure — all of it suddenly had a path to move faster.

But that shift didn’t just affect Washington. It moved markets, too…

Case Study #1: A Lithium Stock Goes Vertical

In mid-2025, American Battery Technology Company (NASDAQ: ABAT) announced that its Tonopah Flats Lithium Project in Nevada had been accepted into the FAST-41 Transparency program.

This opened the door to an accelerated environmental review and clear permitting timeline.

Within hours of the announcement, the stock exploded higher. By the end of the trading day, shares were up 41% intraday — on permitting news alone.

Over the following six months, ABAT ran up an astonishing 875%…

Yes, lithium prices were rising a tiny bit off the bottom. Yes, EV sales have continued to grow, albeit at a slower pace than in the past. But none of that was new.

What changed was the timeline.

Investors suddenly saw a project with real potential to actually get built.

FAST-41 turned Tonopah Flats from a dream into a countdown clock.

Case Study #2: Silver Giant Gets a Bump

Even larger names can feel the FAST-41 effect.

Hecla Mining Company (NYSE: HL), one of America’s oldest and most recognized silver producers, tied its Libby Exploration Project in Montana to FAST-41 permitting.

While soaring silver prices obviously helped lift the stock, investors also piled in as the project gained permitting visibility.

The result? Hecla’s stock more than doubled over the next six months, with sharp jumps around permitting and environmental review milestones.

Big or small, the market responds when regulatory uncertainty shrinks. Risk premium goes down. Valuation goes up.

Case Study #3: A Mega Copper Project Clears a Hurdle

The story isn’t just about juniors, either. Look at Rio Tinto’s Resolution Copper project in Arizona — one of the largest undeveloped copper deposits in the world.

For years, it was bogged down by lawsuits, environmental reviews, and political delays.

Then, after the federal government signaled its willingness to expedite key approvals and the U.S. Supreme Court rejected a major legal challenge, the project suddenly looked real again.

That ruling and the permitting signals sent a shock wave through the copper sector.

Rio’s stock ticked higher immediately — but more importantly, it changed how investors viewed U.S. copper assets as a whole…

If the government was willing to fast-track a massive copper mine, smaller projects suddenly looked a lot more viable, too.

Why Investors Should Pay Attention to FAST-41

I need to be crystal clear here… These are not isolated stories. They’re proof of a pattern. When a resource project enters or advances through FAST-41:

- Markets notice

- Timelines compress

- And valuations jump.

For early investors, that can mean explosive returns. It’s not magic — it’s simply the market pricing in the end of uncertainty.

And here’s the kicker: FAST-41 isn’t limited to lithium or LNG or copper. It applies to any “covered project” deemed nationally significant.

That includes critical minerals — copper, zinc, gold, silver — the very stuff America needs to secure its energy future.

Why Now Matters More Than Ever

The United States is racing to onshore critical mineral supply chains…

EVs, AI, defense technology, advanced manufacturing — all of it depends on metals we’ve spent decades outsourcing.

Washington knows it. Investors know it. And FAST-41 is one of the few tools that can actually move the needle fast enough.

Every day that permitting timelines shrink is another day America gets closer to resource independence…

And another day that savvy investors make money on projects the market once thought were dead in the water.

And Then There’s the “Sleeping Giant”…

Somewhere in Michigan’s Upper Peninsula sits one of the most valuable undeveloped mineral deposits in the country.

Rich in copper. Loaded with zinc. With a dash of gold that makes geologists’ eyes light up.

For years, this project has been tangled in red tape, environmental reviews, and political paralysis.

But here’s the thing: This project isn’t just “a good candidate” for FAST-41.

It’s exactly what FAST-41 was designed for.

A domestic resource project. Strategically important metals. Ready to go — if only someone can light a fire under the permitting process.

We’re not talking about a pipe dream…

We’re talking about a real, drilled, well-defined deposit. One with the potential to become a multi-billion-dollar mining operation in the heart of America’s industrial belt.

This project has a name — and a legendary one at that: the Back Forty.

And if FAST-41 can do for the Back Forty what it did for Tonopah Flats…

Or Libby…

Or Resolution Copper…

Well, let’s just say the rerating could be explosive.

Coming up Next…

That’s what I’ve got for you today, but tomorrow, in Part 2, we’ll dive into the history of the Back Forty deposit…

We’ll discuss the decades-long fight to bring it to life, and we’ll expose why this may finally be its moment.

The resource is there. The demand is there.

And now, thanks to FAST-41, the fast lane may finally be open.

To your wealth,

Jason Williams

After graduating Cum Laude in finance and economics, Jason designed and analyzed complex projects for the U.S. Army. He made the jump to the private sector as an investment banking analyst at Morgan Stanley, where he eventually led his own team responsible for billions of dollars in daily trading. Jason left Wall Street to found his own investment office and now shares the strategies he used and the network he built with you. Jason is the founder of Main Street Ventures, a pre-IPO investment newsletter; the founder of Future Giants, a nano cap investing service; and authors The Wealth Advisory income stock newsletter. He is also the managing editor of Wealth Daily. To learn more about Jason, click here.

Want to hear more from Jason? Sign up to receive emails directly from him ranging from market commentaries to opportunities that he has his eye on.

P.S. The Back Forty isn’t the only American resource primed to be unlocked. These four mining companies are also sitting on massive riches that FAST-41 could unlock in the next few months and send share prices soaring.

The Best Free Investment You'll Ever Make

We never spam! View our Privacy Policy

After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox daily.

@TheReal_JayDubs

@TheReal_JayDubs Angel Research on Youtube

Angel Research on Youtube