The Executive Order That Could Ignite a $12 Trillion Mining Boom

I remember the day vividly.

March 20, 2025.

While Wall Street analysts were still arguing about whether the Fed would cut rates by 25 basis points or 50, President Trump signed something far more consequential — a quiet executive order that barely made the evening news.

It was just one line in a 200-page energy directive, but it changed everything:

The Federal Permitting Improvement Steering Council shall expand FAST-41 coverage to include critical-minerals mining projects essential to national security and technology supply chains.

That single sentence detonated through the resource world like a depth charge.

Because it means mining is back in the express lane.

The Hidden Law That Built America’s Infrastructure

Most Americans have never heard of FAST-41.

It’s government code — short for “Title 41 of the Fixing America’s Surface Transportation Act.”

When it was passed in 2015, its purpose was simple: streamline the endless maze of federal permits required for mega-projects like highways, bridges, and pipelines.

Before FAST-41, those reviews could take 7–10 years — death by red tape.

FAST-41 changed that. It forced federal agencies to coordinate on one timeline, publish public dashboards of progress, and deliver decisions within 2–3 years.

It worked.

Billions in infrastructure projects moved forward.

But mining? Mining was left behind.

Until now.

Trump’s Stroke of the Pen — and Why It Changes Everything

When Trump returned to office, he didn’t just inherit an inflation problem — he inherited a supply-chain crisis.

AI data centers were devouring electricity.

EVs and batteries were draining copper and lithium reserves.

Uranium stockpiles were collapsing.

And every megawatt of new tech infrastructure required more metals than the last.

The problem: America no longer mined its own.

The Best Free Investment You’ll Ever Make

Join Wealth Daily today for FREE. We’ll keep you on top of all the hottest investment ideas before they

hit Wall Street. Become a member today, and get our latest free report: “Why You Need to Fire Your Money

Manager.”

It contains full details on why money managers are overpaid and provides you with

tools for growing your wealth.On your own terms. No fees, no commission.

So Trump reached for a lever buried deep in the bureaucracy — FAST-41 — and pulled.

Suddenly, the same program that had once fast-tracked highways and oil pipelines now applied to copper mines, gold projects, lithium basins, and uranium hubs.

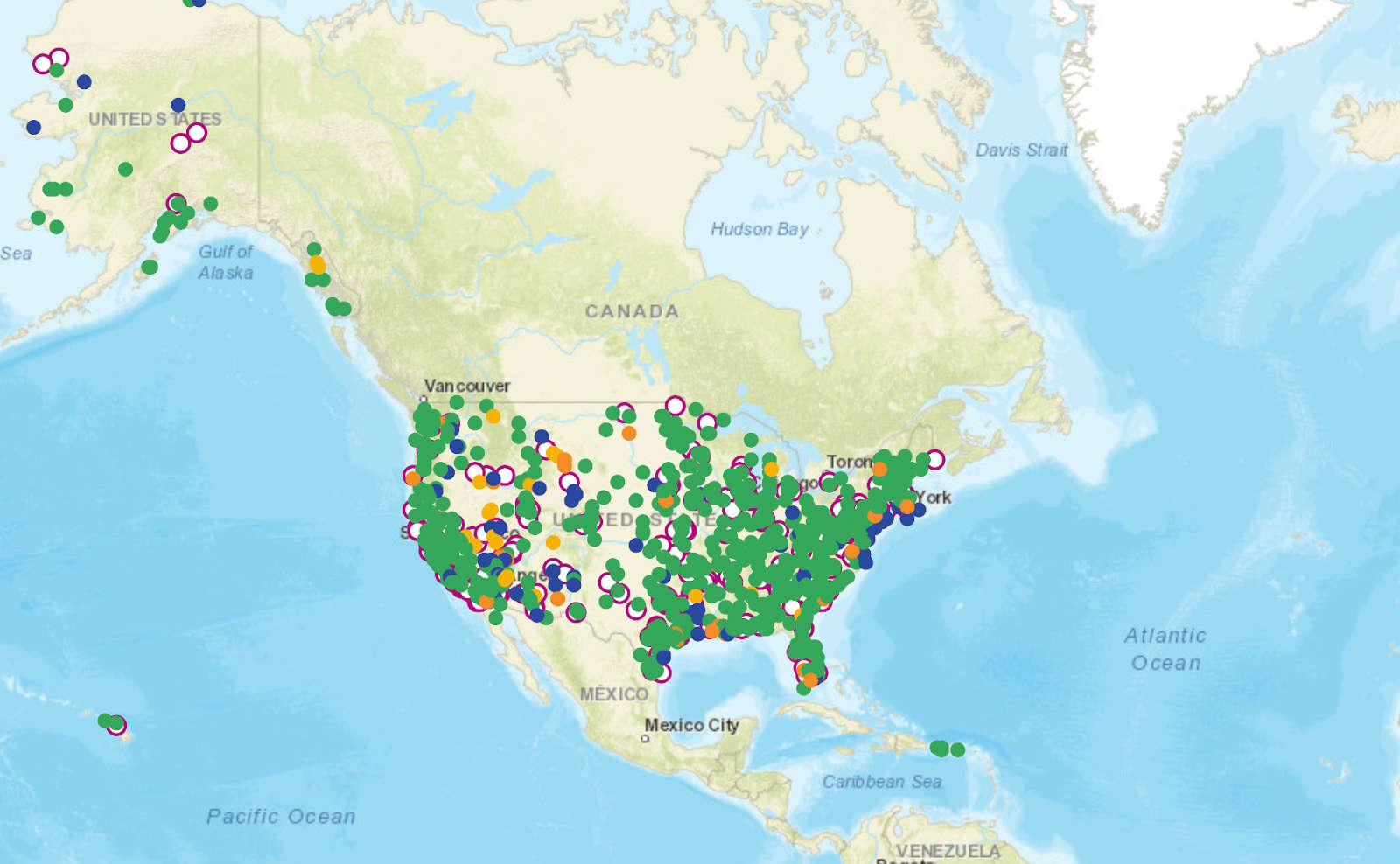

Within weeks, the Department of Interior added a new wave of mines to the Federal Permitting Dashboard — the public list of projects receiving accelerated treatment under the law.

This is what the Permitting Dashboard looks like:

This wasn’t bureaucratic housekeeping. It was industrial re-armament.

The AI Power Shock

The timing couldn’t be more urgent.

According to BloombergNEF, AI-related data-center power demand is set to quadruple by 2035, consuming as much electricity as the entire nation of Japan.

Each hyperscale facility — the kind used by Microsoft, Google, and Nvidia — requires miles of copper cabling, tons of silver, rare-earth magnets for cooling fans, and vast quantities of uranium and natural gas to feed the grid.

In short, every AI data center is a metal-eating machine.

And whoever controls those metals controls the future of AI.

That’s why the United States and China are no longer just competing in algorithms — they’re in an AI resource arms race.

China dominates rare-earth refining, lithium processing, and copper smelting.

It’s also building nuclear plants at three times the U.S. pace.

If America wants to stay competitive — not just in chips but in power — it must secure its own domestic supply of metals and fuel.

And that’s exactly what FAST-41 is designed to do.

The Express Lane for a Resource Renaissance

Here’s what the new FAST-41 expansion means in practice:

- 24–36-month permitting windows instead of 10 years.

- Inter-agency coordination under one federal timeline.

- Public accountability dashboards to keep agencies on schedule.

- Priority status for projects deemed critical to national security, AI infrastructure, or energy independence.

Translation: The U.S. just opened the express lane for domestic mining — the first time in modern history the federal government has treated miners like builders of essential infrastructure.

Think of it as a green light for geology.

FAST-41’s First Wave: The New American Treasure Map

Already, more than 20 mining and critical-mineral projects have been accepted or flagged for coverage under FAST-41’s expanded scope.

Among them:

- A gold-antimony project in Idaho, now fully permitted — the first in a generation.

- A copper-silver monster in Arizona that could supply millions of EVs and data centers.

- Uranium and lithium developments in the Southwest, now enjoying federal coordination.

But beneath the radar are the next wave of applicants — massive deposits of copper, gold, and uranium sitting inside U.S. borders, previously trapped in regulatory purgatory, now poised to be unleashed.

And that’s where the real fortunes will be made.

The Three Quiet Giants Poised to Explode

I call them the FAST-41 Winners.

Three companies, all publicly traded, all controlling projects that fit the new fast-track profile:

- A copper-gold colossus in Alaska with over 100 million ounces of gold and 80 billion pounds of copper in the ground — a project once dismissed as “unminable,” now on the brink of rebirth.

- An Alaskan titan sitting on one of the largest undeveloped gold deposits in America — a project that becomes wildly profitable at $2,500 gold and astronomical at over $10,000.

- A uranium revivalist operating permitted mines and processing hubs in the U.S. Southwest — perfectly aligned with the administration’s nuclear renaissance push.

Together, they form the backbone of what I call "The FAST-41 Winners Playbook" — the first new wave of American resource wealth in half a century.

Why FAST-41 Matters to AI — and to You

To understand how these stocks could soar, you have to grasp one simple equation:

Metals = Data.

Every new data-center rack adds incremental power load, which demands new transmission lines (copper), transformers (copper and steel), and backup generators (silver and uranium).

Without more domestic mining, AI expansion literally hits a wall.

The same is true for crypto. Each mining rig requires enormous electrical draw, and both industries compete for the same grid capacity.

That’s why the federal government isn’t treating these mines as commodities — it’s treating them as critical technology infrastructure.

By cutting permitting times from 10 years to two or three, the U.S. can build out its AI power grid faster than China — and that’s a matter of national survival in the new Cold War of computation.

For investors, it means every FAST-41 mine is effectively a guaranteed buyer of its own future production.

The Numbers Don’t Lie

Let’s look at the economics driving this move.

- The U.S. imported $46 billion in critical minerals last year.

- Copper prices recently hit all-time highs above $5/lb, and analysts at Goldman Sachs see demand doubling by 2035.

- Silver demand for solar, batteries, and AI electronics is projected to outstrip supply by 25% annually through 2030.

- Uranium prices have tripled since 2020 and could reach $250/lb under Trump’s new nuclear mandate.

In other words, every pound of metal pulled from U.S. soil under FAST-41 will sell into a screaming bull market.

Now imagine what happens when these projects, previously discounted for regulatory risk, suddenly have a clear federal path.

Valuations don’t just rise — they re-rate by orders of magnitude.

The MoneyQuake Connection

If you’ve followed my work, you know the broader thesis: We’re living through the MoneyQuake — a once-in-a-century shift in global wealth from paper assets to real ones.

FAST-41 is the tectonic plate under that quake.

It takes stranded assets — gold, copper, uranium still locked underground — and monetizes them instantly by clearing the bureaucratic choke point.

In a world drowning in $36 trillion of debt and crumbling fiat confidence, geology becomes the new collateral.

And under FAST-41, that collateral just went liquid.

The New Energy Arms Race

China already refines 68% of the world’s nickel, 73% of cobalt, 80% of rare earths, and 60% of lithium. It’s building AI-ready nuclear capacity while the U.S. still debates permits.

If that continues, the U.S. could fall behind not just economically but militarily — because AI drives both.

That’s why this isn’t just an economic policy; it’s a national-security doctrine.

By accelerating domestic mining, FAST-41 effectively nationalizes resource resilience. It ensures that the metals feeding our AI grids, electric vehicles, and weapons systems are mined under American jurisdiction.

This is the new Manhattan Project — except instead of splitting atoms, we’re mining them.

From Bureaucracy to Boom

Before FAST-41, getting a mine approved was like navigating Dante’s Inferno — 12 federal agencies, four state reviews, and 10 years of uncertainty.

That’s why investors avoided U.S. juniors.

But now, with a publicly published dashboard and deadlines enforced by the White House, projects can no longer be buried in silence.

The market hasn’t caught on yet, but once it does, expect a flood of capital back into America’s neglected miners.

ETFs like GDXJ and SILJ will re-weight toward domestic names.

Majors like Barrick and Newmont will go on acquisition sprees.

And early shareholders in FAST-41-aligned juniors could see 10x, 20x, even 100x returns as valuations reset.

Meet the Three FAST-41 Winners

I won’t reveal their tickers here — that’s reserved for my subscribers — but here’s a taste:

- The Copper-Gold Colossus — a project valued at over $2 trillion in contained metal, trading for pennies per ounce. One stroke of a permitting pen could multiply its market cap 100x.

- The Alaskan Titan — 20 million ounces of high-grade gold on U.S. soil. At $2,000 gold it’s viable; at $10,000 gold (my MoneyQuake forecast) it’s a monster.

- The Uranium Revivalist — already producing, already profitable, and now expanding under federal coordination. If uranium hits $250/lb, this becomes a multi-billion-dollar powerhouse.

These aren’t pipe dreams. They’re the next generation of America’s resource champions.

And under FAST-41, their time has come.

The Window Before the Rush

Right now you’re early — and that won’t last.

The Permitting Council is adding projects in waves.

The next 10–15 mines are expected to be posted any week now.

Once those updates hit Bloomberg terminals, Wall Street will pounce.

By then, the easy money will be gone.

That’s why I’ve compiled all the research, charts, and permitting details into one new report:

“The FAST-41 Winners Playbook: 3 Stocks That Have 10,000% Profit Potential.”

Inside, I name the three companies I believe will lead this new mining boom.

You’ll see why each one is in position to multiply in value as Washington clears their path.

I’ll be revealing the three names of these stocks when I publish White Paper #4: Gold Beyond Belief.

I hope to have White Paper #4 in your hands within the next few weeks.

If you’ve ever wondered how the early investors in the Bakken oil fields or the shale gas revolution made their fortunes — this is your second chance.

Final Word

The 1970s gave us the oil kings.

The 2000s gave us the shale millionaires.

The 2020s will mint the FAST-41 barons.

Because when the president of the United States declares mining a national-priority infrastructure — and hands you the keys to the express lane — you don’t ask questions.

You hit the gas.

And the next 12–24 months could deliver the most explosive gains in the history of American resource investing.

Gold. Copper. Uranium.

They’re no longer just commodities.

They’re the code metals of the AI age — and FAST-41 is the accelerant.

The quake has already started.

The smart money is already moving.

The only question left is…

Will you be standing on the fault line when it erupts?

Get to the good, green grass first…

The Prophet of Profit,

Brian Hicks

Brian is a founding member and President of Angel Publishing. He writes about general investment strategies for Wealth Daily and Energy and Capital. Brian is the managing editor and investment director of R.I.C.H Report (Retired Independent Carefree Healthy), New World Assets and Extreme Opportunities. For more on Brian, take a look at his editor’s page.

P.S. To access my new report — "The FAST-41 Winners Playbook: 3 Stocks That Have 10,000% Profit Potential" — subscribe to Wealth Daily today and claim your early entry before the next wave of projects hits the federal dashboard.

The Best Free Investment You'll Ever Make

We never spam! View our Privacy Policy

After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox daily.