The Dirty Fuels Powering the Cleanest Technology on Earth

Let’s talk about the thing no one in Silicon Valley, Washington, or Wall Street actually wants to say out loud: AI is starving for power.

Not software. Not chips. Not data. Power. Electricity. Literal terawatts of it…

The models keep getting bigger. The inference loads keep multiplying. The “AI everywhere” pitch gets louder every quarter.

But the grid? The grid is still the same aging lattice of wires, repairs, and regulatory delays we’ve been complaining about for 30 years.

Remember: This thing literally catches on fire when too many people use their AC.

And here’s the uncomfortable truth: We can’t build new baseload power fast enough to keep up with AI’s growth curve.

Not nuclear. Not natural gas. Not solar or wind.

Everything we need most is stuck behind decade-long permitting queues, supply chain shortages, and politicians arguing about whether transformers count as “infrastructure.”

Which brings us to the Trump administration’s latest proposal. A proposal that sounds outrageous only until you sit down with a calculator…

Use what we already have.

You see, the United States has millions of backup generators — most of them diesel — and hundreds of coal plants that can be restarted, recommissioned, or run at higher output.

Together, they represent enough dispatchable power capacity to support the next wave of AI data center expansion without collapsing the grid or driving consumer electricity prices through the roof.

It’s not pretty. It’s not “green.” It’s not what the ESG crowd had in mind.

But it might be exactly what buys us the decade we need to build the long-term energy infrastructure of the AI era.

Diesel: The Unlikely First Responder of the AI Boom

Every major hospital, government facility, military base, telecom hub, Walmart, and Fortune 500 campus in America already has backup generators…

Mostly diesel, mostly well-maintained, and mostly sitting idle for 365 days a year.

Collectively, this is one of the largest decentralized energy fleets on Earth. We’re talking about over 200 GW of generating capacity that grows at about 5 GW per year.

And unlike nuclear reactors or gigantic gas turbines, they exist today.

They’re installed. Wired. Permitted. Inspected. Ready to go.

So when the administration floated the idea of using this backup generator fleet as a power reserve for new AI data-center projects, the first reaction was predictable outrage.

“Generators? For AI? Are you crazy?”

But, actually… it’s kind of brilliant.

Diesel generators are:

- Dispatchable — flip a switch, they run.

- Distributed — power can be generated close to consumption.

- Scalable — add units as needed.

- Reliable — they exist to operate in emergencies and do so flawlessly.

And for AI developers racing against competitors in China, Abu Dhabi, and Europe, the difference between “We can build the facility this year” and “We can maybe secure enough power in 2032” is enormous.

Now, don’t get me wrong… diesel is not a long-term solution.

But as a 5–10-year bridge, it absolutely can be. We used diesel to industrialize. We used it to digitize. Now we may use it to “intelligenize.”

Coal: The Workhorse America Pretended It Didn’t Need

And that brings us to coal — a political land mine, an environmental lightning rod, and, inconveniently, the only immediately scalable baseload fuel America can increase in the next 24 months.

You don’t have to love coal to recognize its usefulness.

A coal plant can run 24/7. It can follow load. It doesn’t depend on wind or sunshine. The fuel supply exists. The infrastructure exists. The trains and mining equipment exist.

And most importantly, the grid interconnects already sit there humming, waiting.

Meanwhile, the U.S. has fallen into a bizarre paradox…

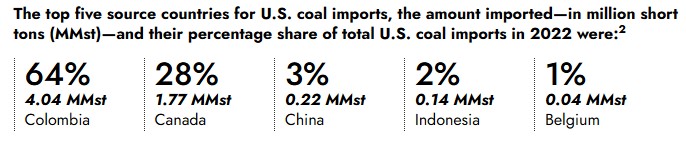

We keep shutting down coal plants while simultaneously importing coal to meet the needs of industrial customers who can’t operate without it.

If we’re going to burn the stuff anyway, why not burn it strategically — to prevent the grid from blowing up while AI demand doubles every 18–24 months?

I mean, just look at the timeline:

- New nuclear reactors: 10–15 years.

- HALEU fuel supply for next-gen reactors: still being developed.

- Natural gas turbines: 5–7 years just to clear the order backlog.

- Solar and wind: cannot meet baseload requirements and cannot support the 24/7 load profile of hyperscale AI inference clusters.

- Grid upgrades: often slower than nuclear.

So what’s left?

Coal. The thing everyone swore we’d never use again.

But when AI data centers start consuming as much power as small cities — and projections say they will — someone has to keep the lights on.

And when the choice is between restarting two or three coal plants versus telling Microsoft, Meta, Amazon, and OpenAI they need to delay expansion for a decade…

Coal starts looking like the grown-ups in the room never should have left it behind.

The Best Free Investment You’ll Ever Make

Join Wealth Daily today for FREE. We’ll keep you on top of all the hottest investment ideas before they

hit Wall Street. Become a member today, and get our latest free report: “Why You Need to Fire Your Money

Manager.”

It contains full details on why money managers are overpaid and provides you with

tools for growing your wealth.On your own terms. No fees, no commission.

The Economics of “Available Now” Power

The market always rewards the path of least resistance.

That’s why AI companies are gravitating toward diesel generators, coal plants, and any other resource that can be tapped immediately.

They can’t afford to wait for the perfect solution. They need the available solution.

And here’s something investors need to internalize…

AI is not optional.

It’s not a fad. It’s not the Metaverse. It’s not EV SPAC season 2.

AI is now the backbone of global economic competitiveness. Governments know it. Corporations know it. Militaries know it.

If America stalls on energy supply, China won’t.

If AI development bottlenecks here, it will simply accelerate elsewhere.

That’s why this administration is taking a page from classic American industrial strategy: Use what works now while building what will work later.

Coal and diesel are not the final answer.

But they are the only answer available quickly enough to matter.

The Coming Industrial Upswing Nobody Sees Yet

Here’s the contrarian takeaway — the part you and I understand but 99% of Wall Street still doesn’t…

AI is triggering a new industrial revolution, and most of the market is asleep at the wheel.

The world is about to rebuild:

- Power plants

- Transmission lines

- Switchgear factories

- Transformer manufacturing

- Substations

- Cooling systems

- Water infrastructure

- Backup fleets

- Mineral supply chains

- Nuclear fuel capabilities

- Grid stabilization systems

- Natural gas turbines

- Battery energy storage

Every one of these sectors is about to become mission-critical.

And the irony of ironies is that the first beneficiaries won’t be the “clean” energy players. They’ll be the dirty ones — the sectors everyone thought were dead:

- Coal operators

- Diesel engine manufacturers

- Industrial equipment suppliers

- Rail companies

- Pipeline operators

- Power plant refurbishment specialists

These are the companies that will keep AI fed long enough for nuclear, geothermal, hydropower, and long-duration storage to catch up.

This is where early money will be made — long before the rest of the market finally connects the dots.

You Can Still Get Ahead of the Second AI Wave

We’re witnessing a technological boom powerful enough to reshape the physical world.

AI is forcing us to rebuild America’s industrial backbone from the ground up, and the fuels we once dismissed are suddenly back in the spotlight — not forever, but for long enough to matter.

Diesel will steady the ship.

Coal will carry the load.

Nuclear, geothermal, and next-gen gas will finish the job.

There is real money to be made in this transition — if you’re paying attention.

The Bottom Line

If you want to stay ahead of the herd — and position yourself before Wall Street wakes up to the industrial boom AI is forcing…

Keep learning, keep watching, and keep investing in the energy systems that will power the future.

Because by the time the “rank and file” realize what’s happening…

The real fortunes will already be made.

To your wealth,

Jason Williams

After graduating Cum Laude in finance and economics, Jason designed and analyzed complex projects for the U.S. Army. He made the jump to the private sector as an investment banking analyst at Morgan Stanley, where he eventually led his own team responsible for billions of dollars in daily trading. Jason left Wall Street to found his own investment office and now shares the strategies he used and the network he built with you. Jason is the founder of Main Street Ventures, a pre-IPO investment newsletter; the founder of Future Giants, a nano cap investing service; and authors The Wealth Advisory income stock newsletter. He is also the managing editor of Wealth Daily. To learn more about Jason, click here.

Want to hear more from Jason? Sign up to receive emails directly from him ranging from market commentaries to opportunities that he has his eye on.

The Best Free Investment You'll Ever Make

We never spam! View our Privacy Policy

After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox daily.

@TheReal_JayDubs

@TheReal_JayDubs Angel Research on Youtube

Angel Research on Youtube