Silver Has Confirmed the New Commodities Supercycle — and the Window for Generational Wealth Is Shrinking by the Hour

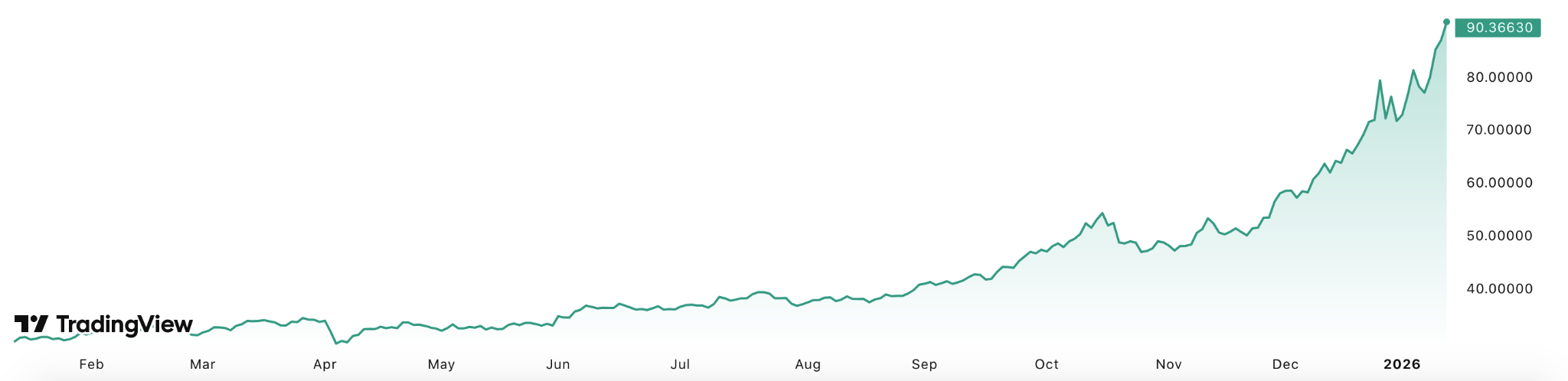

January 14, 2026, will go down in market history as the day the world woke up to the reality we’ve been preparing for over the last two years.

Silver didn’t just break out. It didn’t just rally.

It shattered every prior ceiling ever placed upon it, settling at $92 per ounce and igniting what can only be called the official birth of the next global commodities supercycle.

Every major supercycle in history had a defining moment:

1971 and the Nixon Shock.

2002 and China’s industrial explosion.

2008 and the global scramble for metal and energy.

Today’s silver breakout is exactly that kind of moment.

And we’ve been out in front of it since the beginning.

While Wall Street’s strategists dismissed silver as too dull, too industrial, too overshadowed by gold, we laid out in White Paper #4 and expanded further in White Paper #5 that silver was on the precipice of a decade-defining repricing — not a spike but a structural revaluation of what silver actually is in a world being rebuilt from the grid up.

This is exactly what I said in White Paper #4: Welcome to MoneyQuake 2026 — Gold Beyond Belief: The Unthinkable Price Target:

Silver is the only metal for which both industrial necessity and monetary pressure converge into the same explosive trend line. Once global power grids, AI infrastructure, and electrified transport hit scale, the world will realize there simply isn’t enough above-ground silver to satisfy even baseline demand. In that scenario, silver cannot stay a two-digit metal. Our long-term models place the structural revaluation band for silver between $550 and $750 per ounce — and that may prove conservative.

Now the world is learning the truth the hard way.

The energy transition needs silver.

The AI revolution needs silver.

The monetary reformation unfolding globally demands silver.

And above-ground supplies can no longer meet the accelerating, compounding, electrified reality of 21st-century economics.

This is the supercycle we warned you about.

It has begun.

And the real shock for most people — but not for us, not for those following our research — is this…

Ninety-two-dollar silver is not the top. It is the starting line.

The Industrial Demand Shock Wall Street Ignored

For years, analysts tried to value silver using outdated pricing models from the 1980s and 1990s — models that assumed energy demand would stay flat, that computing power would grow linearly, and that solar technology would never scale beyond boutique adoption.

Those assumptions are already dead.

Today, silver’s industrial demand profile is not merely strong — it is indispensable.

Silver is the irreplaceable conductor for:

- Solar photovoltaic cells

- EV power systems

- High-voltage charging stations

- AI data center cooling and high-density circuitry

- Robotics

- Next-generation semiconductors

- Advanced weapons systems

- Space hardware

- Medical imaging technology

- 5G/6G communications

Every one of these sectors is growing exponentially. Not cyclically. Not seasonally. Structurally.

White Paper #4 laid it out clearly: Silver is now the critical input for the high-voltage, high-data, high-energy world being built at breakneck speed. No substitute metal exists that can replicate silver’s thermal and electrical properties at commercial scale.

That alone makes this supercycle unavoidable.

But there’s another dimension driving silver much higher…

The monetary dimension.

The Monetary Reformation Is Here — and Silver Has Reentered the Global Store-of-Value Arena

While gold has reclaimed its position as the world’s premier monetary reserve asset, silver is being pulled upward by the same forces transforming global finance:

- Record global debt

- Structural inflation

- Collapsing trust in fiat currencies

- Central bank diversification

- De-dollarization movements across BRICS nations

- A growing preference for hard-asset collateral

- Geopolitical instability and supply-chain weaponization

White Paper #5 expanded on this monetary reformation, explaining that precious metals are not merely hedges in today’s environment — they are becoming requirements.

Silver, which historically traded as secondary monetary metal, is now being re-monetized by necessity. As nations and institutions seek tangible, non-sovereign stores of value, silver is reclaiming a monetary bid that has been suppressed for four decades by synthetic paper markets.

This is why $92 is meaningless in the big picture.

The Best Free Investment You’ll Ever Make

Join Wealth Daily today for FREE. We”ll keep you on top of all the hottest investment ideas before they hit Wall Street. Become a member today, and get our latest free report: “A Maverick’s Guide to Gold: 3 Gold Stocks Set to Disrupt the Market”

It contains full details on something incredibly important that’s unfolding and affecting how gold is classified as an investment..

After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox daily.

The monetary revaluation has barely begun.

And this leads us directly into the most important upgrade to our thesis.

Why Our Updated Silver Price Target Is Now $550–$750 per Ounce

For two years, we’ve published forecasts that seemed aggressive to mainstream analysts. But every prediction — including our early calls for $73 silver by 2026 — has already come true.

Now, with the industrial and monetary forces converging faster than even we projected, it is time to state clearly what the models in White Papers #4 and #5 now support.

The long-term structural fair value for silver is no longer $152 per ounce (my previous 10-year price target from White Paper #2).

It is now between $550 and $750 per ounce.

That range is based on real, quantifiable drivers:

1. Chronic Structural Deficits Are Now Permanent

Silver mine production has been flat to declining for a decade.

Yet demand is accelerating exponentially across every technologically relevant sector.

The deficit is no longer a cycle — it is the new normal.

2. No Major New Silver Mines Are Coming Online

It takes 10–15 years to bring a new silver project into production.

The pipeline is virtually empty.

Even if the world wanted to triple silver output, it physically cannot.

3. Above-Ground Stocks Are Being Drained

Silver inventories on COMEX and LBMA are down dramatically from 2019 levels.

Physical silver is leaving vaults — not entering them.

This supply collapse supports a multi-hundred-dollar valuation on its own.

4. AI and the New Power Grid Will Multiply Demand

White Paper #4 modeled the future AI power grid — a second electrical United States being built from scratch.

AI requires silver in every link of that chain.

Multiply that by solar. Multiply it again by EVs.

The industrial bid is not incremental — it is explosive.

5. Monetary Pressure Is Intensifying Fast

As the U.S., Europe, China, and emerging markets wrestle with escalating debt and currency instability, silver becomes a monetary hedge.

This wasn’t priced into silver between 2010–2022.

It is being priced in now.

6. The Gold-Silver Ratio Will Rebalance

Our white papers projected a collapse in the gold-silver ratio back toward historical norms.

As gold continues its march toward $48,000 in this cycle, silver mathematically must revalue.

Right now the gold/silver ratio is 50. Do the math. It’s jaw-dropping.

This is what a true supercycle does.

It reprices assets at their structural value — not their legacy value.

The Breakout to $92 Proves the Repricing Has Begun

Silver crossing $92 was not a spike or a speculative frenzy.

It was confirmation.

It was validation.

It was the market finally reacting to forces we’ve been describing in detail.

The energy world is being rebuilt.

The AI world is being electrified.

The monetary world is being reshaped.

The geopolitical world is being fractured.

The commodities world is being revalued.

That is a supercycle.

Everything happening now reflects the framework we published years ago.

We called it early.

We called it accurately.

And we are not done calling it.

The Wealth Window Is Still Open — but Not for Long

Most investors will look back at $85 silver the same way people look back at:

- Gold under $300 before the 2000s bull run

- Oil under $20 before the China superboom

- Uranium under $20 before the 2005 nuclear cycle

- Bitcoin under $1,000 before its global monetization

They will realize too late that the repricing happened not gradually but suddenly.

Supercycles reward the prepared.

They punish the hesitant.

They annihilate the complacent.

The money being made in silver over the next several years will look, in retrospect, wildly obvious. But in the moment — in this moment — it still feels unbelievable.

That is exactly how generational wealth events feel before they become common knowledge.

Final Judgment: The Silver Supercycle Is Now Fully Underway

Silver’s surge past $92 marks the beginning of a global revaluation that will ultimately rewrite the price chart for an entire generation. And based on the updated projections from our MoneyQuake research and White Papers #4 and #5, that revaluation is pointing directly toward $550–$750 per ounce as the next logical long-term price band.

The supercycle is here. It is real. And the rewards for those positioned early will be historic.

Get to the good green grass first…

The Prophet of Profit,

Brian Hicks

Brian is a founding member and President of Angel Publishing. He writes about general investment strategies for Wealth Daily and Energy and Capital. Brian is the managing editor and investment director of R.I.C.H Report (Retired Independent Carefree Healthy), New World Assets and Extreme Opportunities. For more on Brian, take a look at his editor’s page.

The Best Free Investment You'll Ever Make

We never spam! View our Privacy Policy

After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox daily.