“Robots to Replace Millions of Workers — United States Faces Ruin!”

The headline is as alarming as it is accurate:

[Tesla’s Optimus Robots] to Replace Millions of Workers — [United States] Faces Ruin!

The alarming editorial continues…

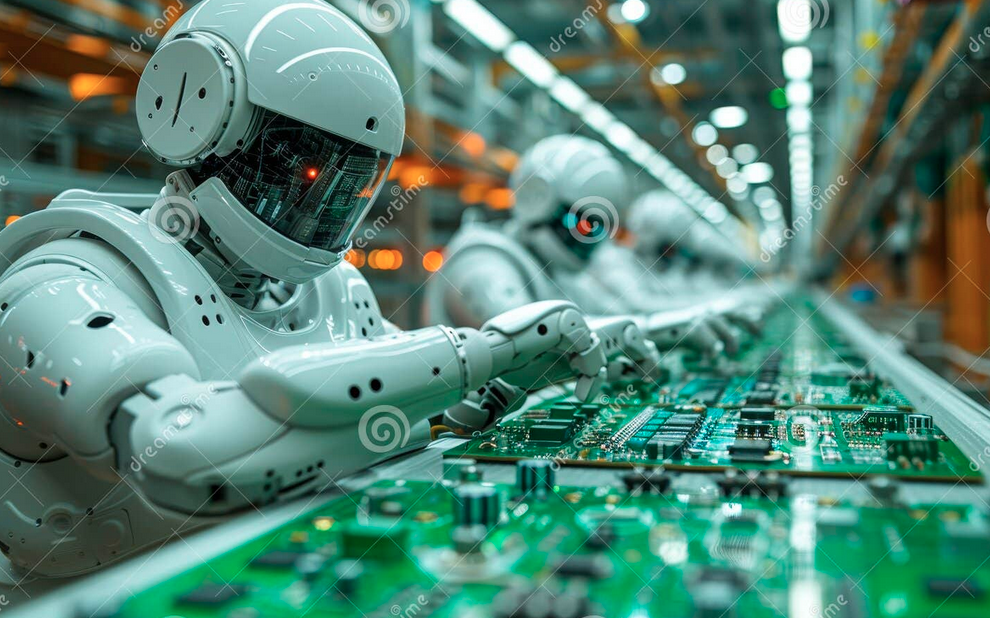

Warehouses stand silent. Manufacturing facilities once filled with the hum of human hands now move with mechanical precision — tireless, speechless, soulless.

Across the United States, fear grips the working class as “thinking machines” and humanoid automatons threaten to do in minutes what men and women once did in a day.

From Detroit to Des Moines, from offices to warehouses, and now the great American farms, the story is the same: The march of progress is trampling the American worker.

The industrial heart of the nation — once the envy of the world — now trembles under the weight of innovation run amok.

Robots that never tire, algorithms that never sleep, and artificial minds that never forget are flooding the workplace. The common man, it is said, will soon have no place in the economy he built with his own hands.

“Robots,” one labor leader warns, “will not rest until every man is made idle, every family is brought to its knees, and every town echoes with the sound of lost wages.”

Economists predict a tidal wave of unemployment — millions cast aside by the very ingenuity that once promised prosperity. What was meant to free mankind from drudgery now threatens to chain him to despair.

If something is not done soon, they say, the American dream itself may become a casualty of progress.

Now Here’s the Twist

That headline wasn't written in 2025…

It was first printed nearly two centuries ago — in 1842 — when British newspapers warned:

Machines to Replace Millions of Workers — England Faces Ruin!

The “machines” they feared were the spinning jenny, the power loom, and the steam engine.

The villains were iron gears and pulleys, not microchips and neural networks.

And the fear was the same: Human labor was finished, families would starve, innovation would collapse civilization itself.

Of course, none of it happened.

Instead, those same machines created the modern middle class.

They made goods cheaper, life spans longer, and societies wealthier.

The “job destroyers” became job multipliers.

By the end of that century, more people were working — and earning — more than at any point in human history.

History’s Oldest Broken Record

Every technological revolution comes wrapped in panic.

Every time, the experts warn that this is the one that ends human relevance.

The steam engine would eliminate all manual labor…1. The Age of Steam (1780–1850)

Technology: Steam engine, textile machines, railroadsResource Twin: Coal

Result: Powering factories, trains, and ships — coal becomes the heartbeat of industrialization. England’s “machine menace” created not unemployment… but the world’s first middle class.

- Coal demand rose 700% during the first half of the 19th century.

Electricity would make the workforce obsolete…

2. The Age of Electricity (1880–1940)

Technology: Telegraph, telephone, light bulb, early motors

Resource Twin: Copper and steel

Result: Every wire, every bulb, every motor needed copper. Cities lit up. Industries modernized. Jobs multiplied.

⚡ Copper demand exploded 15x between Edison’s first light bulb and WWII.

The automobile would put millions out of work in transportation…

The Best Free Investment You’ll Ever Make

Join Wealth Daily today for FREE. We’ll keep you on top of all the hottest investment ideas before they

hit Wall Street. Become a member today, and get our latest free report: “Why You Need to Fire Your Money

Manager.”

It contains full details on why money managers are overpaid and provides you with

tools for growing your wealth.On your own terms. No fees, no commission.

3. The Age of the Automobile (1900–1970)

Technology: Combustion engines, assembly lines, aviation

Resource Twin: Oil and rubber

Result: The car reshaped the world. Oil barons and tire makers became tycoons. Entire cities were built around the internal combustion engine.

- U.S. oil production soared from 100,000 barrels/day in 1900 to 9 million bpd by 1970.

The computer would destroy the office economy…

4. The Digital Age (1980–2010)

Technology: Computers, internet, mobile devices

Resource Twin: Silicon, rare earths, and energy

Result: The “information economy” was powered by physical materials — silicon wafers, lithium batteries, copper cables. Data isn’t weightless; it’s metal-heavy.

- The average smartphone contains over 60 elements mined from the earth.

The internet would wipe out every brick-and-mortar business…

5. The Age of AI (2020–2035)

Technology: Artificial intelligence, robotics, autonomous systems

Resource Twin: Copper, silver, uranium, lithium, and gold

Result: The next digital supercycle demands an even larger physical foundation.

AI doesn’t live in the “cloud” — it lives in power-hungry data centers, copper grids, and mineral-rich circuits.

💡 Each AI data center consumes as much power as 50,000 homes — and that power runs through copper, silver, and uranium.

And every time, the opposite happened.

Each disruption created an even greater expansion of wealth, productivity, and entirely new industries — things no one could imagine at the time.

Fear always sells headlines.

But opportunity always rewards vision.

Enter the MoneyQuake

We’re in the same moment right now — except this time, the quake is global and simultaneous.

AI isn’t killing jobs.

It’s reshaping the very foundations of the global economy.

And here’s what almost no one is talking about…

Every technological revolution is twinned with an industrial resource revolution.

They are conjoined twins — born together, growing together, rising together.

When steam power arrived, coal demand exploded.

When electricity took off, copper and steel went vertical.

When the internet took hold, the demand for semiconductors, rare earths, and energy skyrocketed.

And now, AI — the brain of this new age — is demanding its body.

The AI Brain Needs a Physical Backbone

Data centers don’t exist in the cloud — they exist in concrete, steel, copper, and silicon.

Every chatbot, every algorithm, every robotic arm needs electricity, metals, and minerals to live and breathe.

AI is nothing without infrastructure — the power plants, the transmission grids, the processors, and the cooling systems that keep this digital brain alive.

That’s why, as AI accelerates, so does demand for:

- Copper, the metal of electrification.

- Silver, the conductor of the future.

- Lithium, nickel, and graphite, the lifeblood of storage and transport.

- Uranium, natural gas, and geothermal heat, the real power behind the power.

- Gold, the ultimate anchor of value in a world spinning faster every day.

This is the MoneyQuake — the convergence of artificial intelligence and real-world assets.

One digital, one physical.

One speculative, one tangible.

Together, they’re rewriting the definition of wealth.

The Conjoined Twins of Prosperity

Think of AI and resources as twin engines on the same rocket.

As the digital world consumes more data, it consumes more power.

As it consumes more power, it consumes more materials.

And as it consumes more materials, the companies that mine, refine, and supply them go vertical.

That’s the other half of this story — the one CNBC and Bloomberg won’t tell you.

Every chip built in a fab needs copper wire.

Every cooling system requires silver.

Every AI-trained server draws energy from uranium, gas, or the next generation of geothermal.

The smarter our machines get, the harder our metals work.

That’s the twin-engine reality of the 21st-century economy.

And it’s where the next decade’s fortunes will be minted.

The Great Misunderstanding

So when you see the next headline scream:

Robots to Replace Millions of Workers — United States Faces Ruin!

Just smile. You’re looking at a rerun of a 200-year-old show.

Because the truth is simple: AI won’t end work — it will end drudgery.

And it will unleash a global demand for power, infrastructure, and minerals unlike anything in history.

The last industrial revolution built railroads and refineries.

This one will build data corridors and digital empires — powered by the same foundational elements: energy, metals, and human ingenuity.

That’s the MoneyQuake.

And if you know where to stand when it hits — between the digital brain and the material backbone — you won’t get crushed by the quake…

You'll profit from it.

Get to the good, green grass first…

The Prophet of Profit,

Brian Hicks

Brian is a founding member and President of Angel Publishing. He writes about general investment strategies for Wealth Daily and Energy and Capital. Brian is the managing editor and investment director of R.I.C.H Report (Retired Independent Carefree Healthy), New World Assets and Extreme Opportunities. For more on Brian, take a look at his editor’s page.

The Best Free Investment You'll Ever Make

We never spam! View our Privacy Policy

After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox daily.