Platinum: The Quiet Bull That No One Sees Coming

The Quiet Metal Nobody Talks About

When most people think of precious metals, their minds leap to the obvious: gold, silver… maybe even copper if they follow industrial cycles.

But platinum?

For decades, platinum has been the overlooked cousin at the family dinner table of metals.

It’s rarer than gold.

Harder to mine.

More versatile in industry.

And yet it barely registers in mainstream financial conversation.

But here’s the irony: While the financial media parade gold’s rally across headlines and hype silver as the “poor man’s gold,” platinum has been staging one of the most powerful — and quietest — bull markets of the decade.

Dubbed the “metal of kings” because of its exclusivity and limited supply or the “catalyst metal” in industrial circles, platinum is often referred to this way because its superpower is catalysis (autos, fuel cells, chemical processes), the looming supply crunch in platinum is about to shift global markets, impact everything from the cars we drive to the drugs that save lives, and create one of the greatest overlooked investment opportunities of 2025 and beyond.

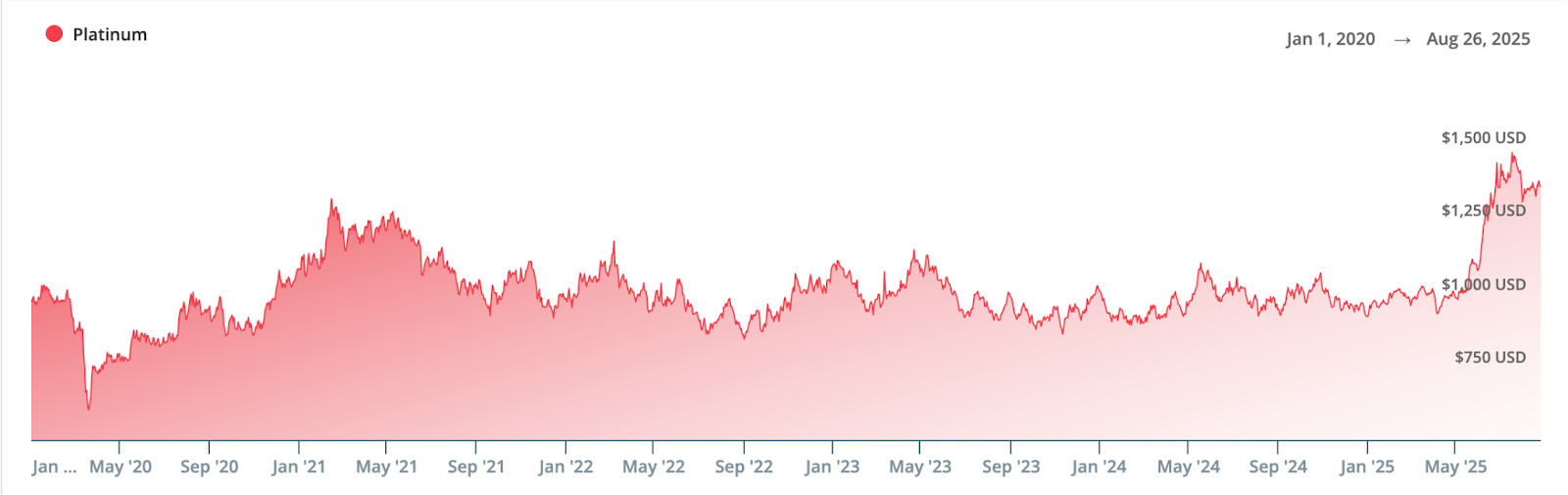

In fact, this year, platinum finally broke out from a long consolidation period.

And make no mistake: When this bull breaks free further from the shadows, the herd will come running.

Act I: The Vanishing Above-Ground Stockpiles

The first chapter in this drama doesn’t take place in a mine. It begins in vaults.

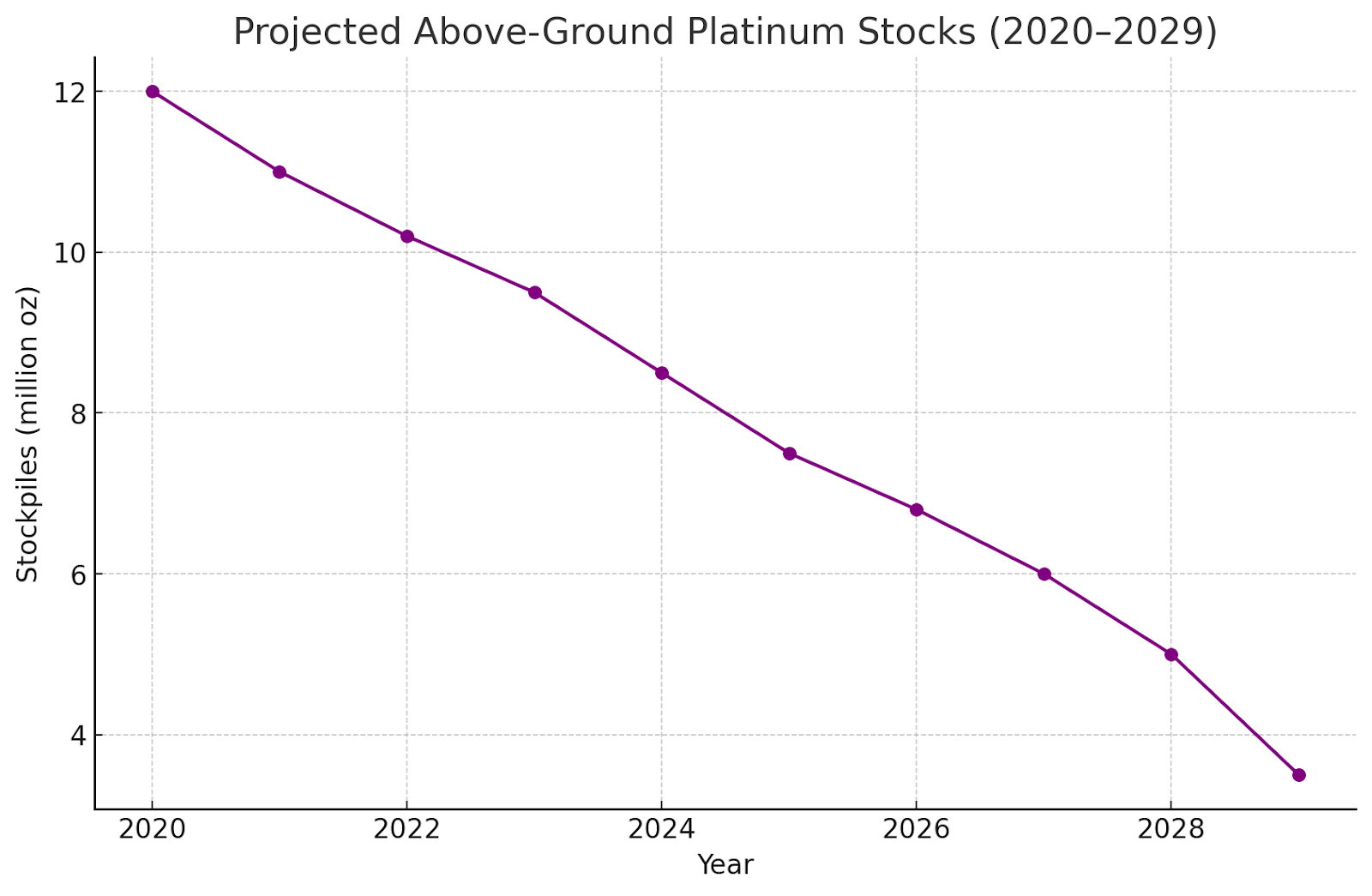

You see, the platinum market has been running a structural deficit for years. Demand has consistently outstripped supply, and the world has been patching the gap by dipping into above-ground stockpiles — the “savings account” of platinum accumulated over decades.

But that account is running dry.

Analysts at the World Platinum Investment Council warn that 2025 marks the third straight year of major deficits, with nearly 1 million ounces short this year alone. At current run rates, above-ground reserves could be nearly depleted by 2029.

Sprott, one of the most respected resource investment firms, paints an equally stark picture: Inventories could plunge to just 2.5 million ounces in 2025, barely enough to satisfy 6–9 months of demand.

This isn’t a headline-grabbing wildfire like oil shocks of the 1970s or the copper crunch of the EV boom. This is a slow burn. And slow burns are often more dangerous because no one feels the heat until it’s too late.

The Best Free Investment You’ll Ever Make

Join Wealth Daily today for FREE. We”ll keep you on top of all the hottest investment ideas before they hit Wall Street. Become a member today, and get our latest free report: “A Maverick’s Guide to Gold: 3 Gold Stocks Set to Disrupt the Market”

It contains full details on something incredibly important that’s unfolding and affecting how gold is classified as an investment..

After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox daily.

Act II: The Platinum Under Our Hoods

While investors chase stories about electric vehicles and battery metals, the true workhorse of the current automotive transition has been ignored: hybrids.

And hybrids are platinum hogs.

Every catalytic converter in a hybrid vehicle needs platinum group metals (PGMs) to scrub harmful emissions. And while palladium dominated for decades, automakers are now switching back to platinum because palladium prices skyrocketed in the late 2010s and early 2020s.

Here’s the kicker: Hybrids generally require more platinum than palladium.

And hybrids are not a niche sideshow — they’re the bridge technology between the internal combustion engine and fully electric adoption. Global hybrid sales are exploding, particularly in North America and Asia, where charging infrastructure for EVs lags.

In 2025, platinum use in autos is at its highest level in eight years. That’s not a trend — that’s a tidal force.

The global hybrid vehicle market size was estimated at $292.01 billion in 2024 and is anticipated to reach around $580.90 billion by 2034, growing at a CAGR of 7.12% from 2025–2034.

- North America dominated the global hybrid vehicle market with the largest market share of 52% in 2024.

- Asia Pacific is expected to expand at a solid CAGR during the forecast period.

- By hybridization, the fully hybrid segment contributed the highest market share of 50% in 2024.

Think about it: Every time someone buys a Toyota Prius, a Ford hybrid truck, or a Honda Accord Hybrid, they’re effectively voting for platinum.

Act III: Platinum’s Many Hats

But platinum isn’t just about cars.

This metal wears many hats.

- Hydrogen economy: Platinum is the catalyst of choice for hydrogen fuel cells. If you believe hydrogen will play a role in decarbonizing trucking, shipping, and heavy industry, you’re implicitly bullish on platinum.

- Chemicals and petrochemicals: Platinum is essential in producing fertilizers, plastics, and high-octane fuels.

- Glass manufacturing: High-temperature glass and fiberglass production depends on platinum-lined equipment.

- Medicine: Platinum compounds (like cisplatin) are literally used to fight cancer. Every vial of those drugs represents ounces of platinum saving lives.

- Jewelry: In Asia, particularly China and India, platinum jewelry demand is roaring back post-pandemic. Chinese platinum processing volumes jumped 26% year over year in Q1 2025 alone.

This isn’t a “one-industry metal” like lithium. Platinum is woven into the fabric of modern civilization — autos, energy, health, tech, jewelry. Pull the thread and the fabric unravels.

Act IV: The Quiet Bull Market

Now, let’s talk price action.

So far in 2025, platinum has quietly delivered a 40% return year to date — outpacing gold and silver. In June, the metal logged a 27% monthly surge, its biggest monthly gain in nearly 40 years.

And yet… silence.

CNBC panels are debating gold’s breakout. Kitco headlines trumpet silver’s “comeback kid” status. Meanwhile, platinum’s rally barely earns a paragraph.

But the smart money is already rotating. Hedge funds and specialized resource managers are sniffing around PGMs, positioning ahead of the herd. Baker Steel Capital recently noted that platinum is "benefiting from a dual tailwind of industrial demand" while "prices remain far below historic highs."

This is the definition of a quiet bull: massive gains, no fanfare. Exactly the type of market we love to stalk before the herd arrives.

Act V: The Long-Term Bullish Clouds

Now let’s peer ahead.

- Persistent supply deficits. With mining investment weak, South African production plagued by power outages and strikes, and Russia isolated by sanctions, supply cannot keep up with demand.

- Above-ground stock depletion. Once the vaults run dry, the market has nowhere to hide.

- Hybrid demand. Even if EVs eventually take over, the hybrid boom guarantees years of platinum-intensive auto production.

- Hydrogen economy. The global pivot to green hydrogen requires platinum in fuel cell stacks. Europe and Japan are leading this charge.

- Relative value. Historically, platinum traded at a premium to gold. Today, it trades at a fraction of gold’s price. If it simply reverts to mean, we’re looking at multi-bagger potential.

Yes, some inventories remain — about 9 million ounces, equal to 14 months of demand. But drawdowns like that don’t last forever. We’ve seen this movie before with silver in 2011 and palladium in 2019. The finale is always explosive.

Act VI: Platinum at Home — The North American Story

So where do we get our platinum?

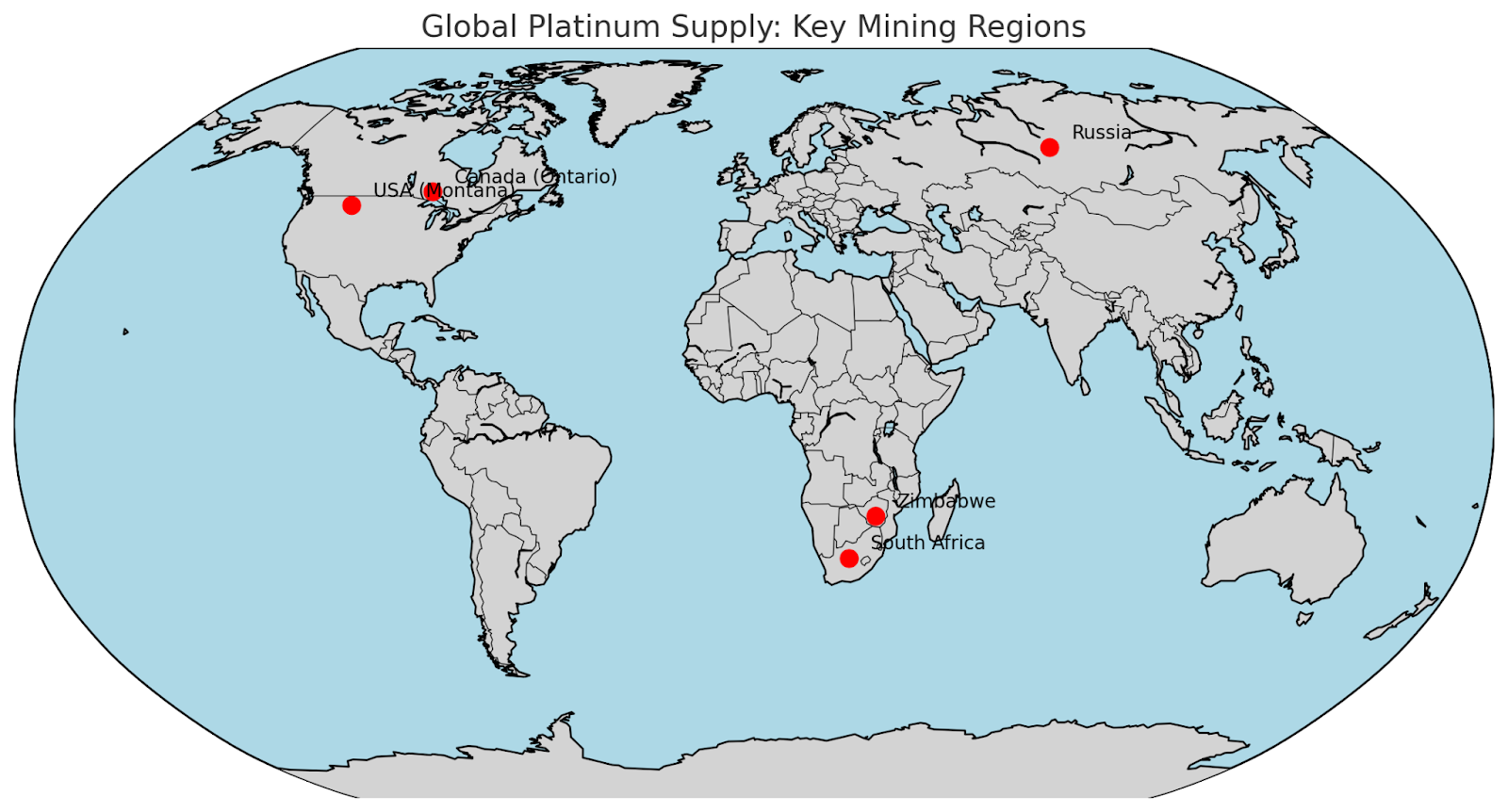

The hard truth is that platinum mining is dominated by South Africa and Russia, which together account for more than 75% of global supply. That’s geopolitically risky, to put it mildly.

But there is a North American story.

- Stillwater Complex, Montana. The J-M Reef, operated by Sibanye-Stillwater, is the only significant primary source of platinum in the Western Hemisphere. This deposit is legendary — one of the richest PGM reefs in the world.

- Lac des Iles, Ontario. Primarily a palladium mine, but also produces platinum as a byproduct.

- Smaller deposits exist in Alaska and Minnesota, but they’re not yet major contributors.

So yes, we have platinum on American soil. But it’s modest compared with the scale of South African production. That scarcity — and that domestic exposure — makes North American platinum assets strategic crown jewels in this bull cycle.

Act VII: What Comes Next

We’ve now arrived at the crux of the story.

Platinum is:

- Structurally undersupplied

- Increasingly demanded by hybrids, hydrogen, and industry

- In a stealth bull market already

- Geopolitically concentrated

- And underappreciated by mainstream investors.

That’s the perfect recipe for what I call a “MoneyQuake moment.”

Remember Netscape in 1995? Nobody saw the internet coming — until suddenly everyone did. Remember Bitcoin at $200? Gold at $300 in 2001? Oil at $20 before the China boom?

Platinum today is standing in that same doorway.

The Cliffhanger

And this is where we leave today’s story — at the cliffhanger.

I’ve shown you the deficit. I’ve walked you through the hybrid boom. I’ve laid out platinum’s diverse uses, its quiet bull market, its long-term bullish clouds, and the few precious domestic sources we control.

Now comes the part everyone’s waiting for: Which platinum stocks are best positioned to profit?

That’s the chapter I’ll reveal very soon. And trust me — when I do, you’ll want to be standing in the green grass first, before the herd tramples through.

Because this bull isn’t coming. It’s already here. And once the world wakes up to the platinum supply crisis, the quiet will be gone forever.

Stay tuned. Our research team is finalizing the list of the best platinum mining stocks to own for this cycle. We’ll be revealing them very soon.

We've identified an $8 platinum miner that's already up over 150% for 2025. It just broke out… and, similar to gold stocks, this is just the beginning!

Get ready — because platinum is about to shine brighter than it ever has before.

Get to the good, green grass first…

The Prophet of Profit,

Brian Hicks

Brian is a founding member and President of Angel Publishing. He writes about general investment strategies for Wealth Daily and Energy and Capital. Brian is the managing editor and investment director of R.I.C.H Report (Retired Independent Carefree Healthy), New World Assets and Extreme Opportunities. For more on Brian, take a look at his editor’s page.

The Best Free Investment You'll Ever Make

We never spam! View our Privacy Policy

After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox daily.