Pebble Creek Chronicles: The Dawn of the Critical Minerals Supercycle

The hills around Pebble Creek had long whispered secrets of earth’s hidden wealth — glints of silver, veins of copper, flecks of rare earths. To most, they were just geological curiosities; to a new breed of investor, they were the first lines of a story about global power, imminent disruption, and fortunes yet to be made.

But in 2025, the hills themselves seemed to stir.

Act I: The Pentagon’s Gambit — A New Chapter Begins

It started with a classified memo, a whisper in the corridors of defense.

The Pentagon, once content to outsource America’s mineral security, had quietly shifted posture. With China’s tightening grip on the world’s supply chains of rare earths, cobalt, antimony, tantalum, scandium, and more, Washington realized it could no longer rely on others for the backbone of its future industries.

The stakes?

Everything.

And I do mean everything.

From hypersonic missiles to quantum computing, from autonomous drones to advanced battery systems, from your iPhone to the internet… A nation dependent on foreign minerals is a nation vulnerable.

Thus was born the plan: a $1 billion critical minerals stockpile — not for show but for strategic depth.

The Defense Logistics Agency was directed to begin acquisitions of not just classic rare earths, but metals once too niche to merit attention. Breakdowns of planned purchases included $500 million of cobalt, $245 million of antimony, $100 million of tantalum, and $45 million of scandium, among others.

What makes this pivot so electrifying is that many of those volumes exceed what the U.S. currently produces or even imports. The Pentagon is essentially writing checks against future supply — signaling to the market: Miners, you now have a guaranteed buyer.

The implications ripple outward. When the U.S. government moves from passive consumer to active skipper of supply chains, entire sectors reconfigure. It isn’t just defense — it’s the fusion of AI, robotics, energy storage, blockchain, and more, all of which demand a medley of metals. The critical mineral story is not a niche; it's the spine of the 21st-century industrial order.

The Best Free Investment You’ll Ever Make

Join Wealth Daily today for FREE. We”ll keep you on top of all the hottest investment ideas before they hit Wall Street. Become a member today, and get our latest free report: “A Maverick’s Guide to Gold: 3 Gold Stocks Set to Disrupt the Market”

It contains full details on something incredibly important that’s unfolding and affecting how gold is classified as an investment..

After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox daily.

Act II: Flash Points in the Market — UAMY and PPTA Break Out

In the world of speculative resources, lightning rarely strikes twice the same way. But in 2025, two names lit up the tape as emblematic of what a crush of capital, policy tailwinds, and strategic utility can do.

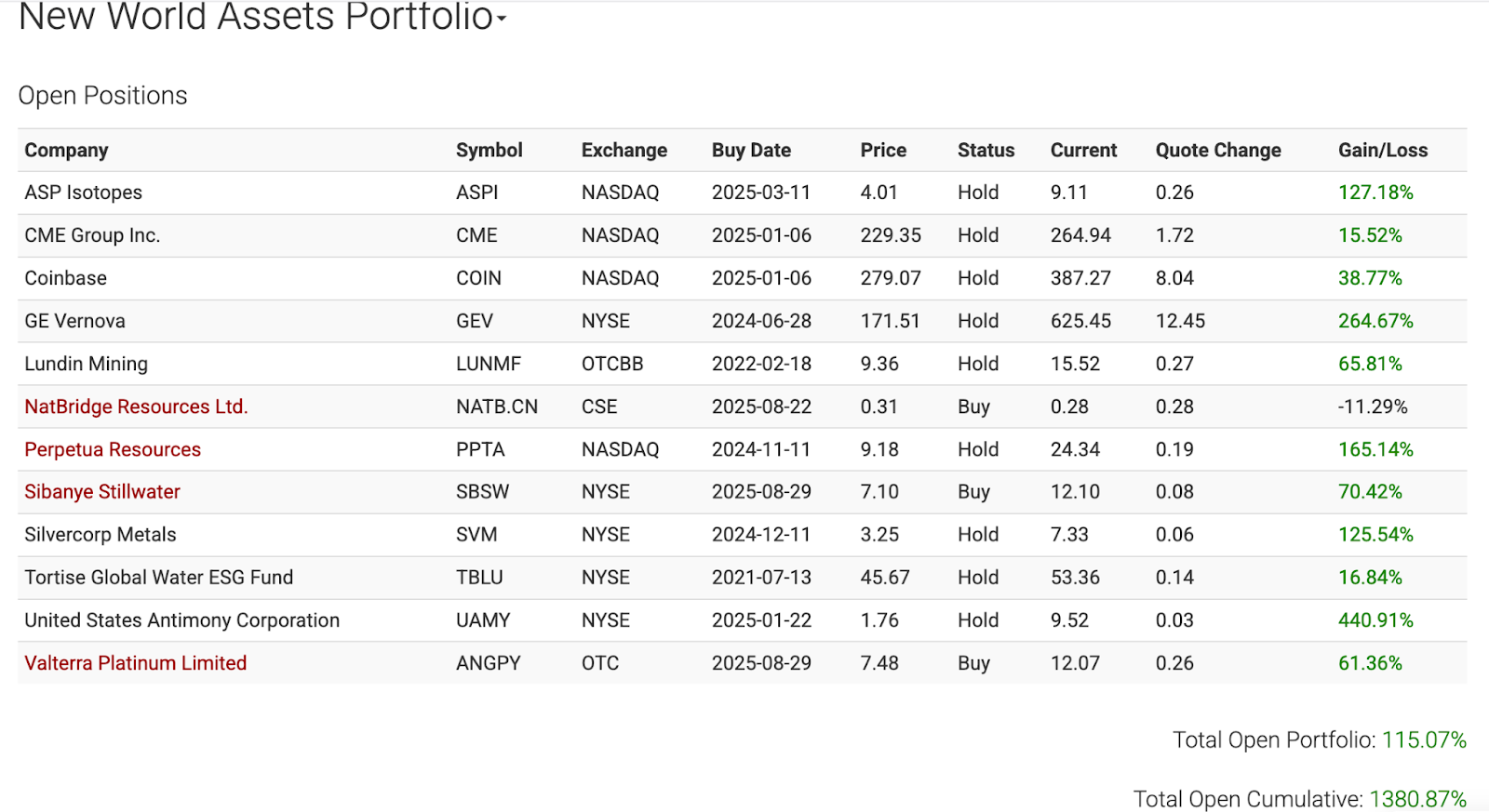

In my New World Assets investment service, we own both United States Antimony (NYSE: UAMY) and Perpetua Resources (NASDAQ: PPTA).

I don’t mind showing you the NWA portfolio for free, because we’ve already made generational wealth off of these names… and made it within two years!

United States Antimony Corp. (UAMY)

Antimony — once the dusty footnote in elemental tables — shot to center stage. In just days, UAMY’s share price blasted off. The company disclosed a $25 million institutional placement priced above market, and investors followed with near-hysterical enthusiasm. The stock raced to new all-time highs, carrying a market cap north of $1.6 billion in short order.

Analysts marveled: Here was a microcap mining company, largely ignored just months ago, suddenly embraced by institutions and sector speculators alike. The timing was no accident — with antimony explicitly named in the Pentagon’s stockpile plans, UAMY found itself manifesting overnight as a strategic asset.

Perpetua Resources Corp. (PPTA)

PPTA’s ascent was slower and more methodical, yet no less dramatic. Centered on the Stibnite Gold Project in Idaho, the company sits at the intersection of gold and critical minerals — specifically antimony. The project was recently designated a “Transparency Project” by the White House, tapping into the framework of streamlined permitting and federal support.

By mid-2025, PPTA had secured its final federal permits, closed around $474 million in equity financing, and applied to the U.S. EXIM bank for up to $2 billion in project debt. Early works within the mine are poised to commence in fall 2025, subject to bonding and final state approvals.

Investors smelled the leverage. PPTA is not a pure antimony play; it’s also a gold play. When you combine upside in precious metals with critical mineral optionality, the upside is magnified. In recent sessions, PPTA shares climbed double digits, setting fresh records.

The lesson: When the narrative aligns — policy drive, plus strategic demand, plus capital markets' thirst — junior miners can go hyperbolic. UAMY and PPTA are case studies for the new resource regime.

Act III: Tech Convergence and Commodity Supercycle

What makes the critical minerals thesis unlike previous commodity cycles is the convergence of multiple megatrends:

- Artificial Intelligence and Compute Infrastructure

AI models demand massive amounts of compute hardware — GPUs, ASICs, data centers. The memory, connectivity, cooling systems, and advanced semiconductors behind these machines require exotic metals: gallium, indium, tellurium, rare earths, and copper among them. - Blockchain, Crypto, and the Infrastructure Layer

Mining rigs, high-performance nodes, secure key vaults — they all consume specialized electronics. Some next-gen blockchains may even rely on novel materials for hardware acceleration, optical communication, and integration with AI. - Robotics and Autonomous Systems (Including Humanoid Robots)

Tesla’s Optimus robot is not a toy. It needs actuators, sensors, rare earth magnets, advanced battery systems, and power electronics. Each limb may be a mini-lab for high-end material demand. As these systems proliferate, demand for cobalt, lithium, niobium, manganese, and REEs soars. - Military and Defense Technologies

The Pentagon’s stockpile plan is the clearest signal. Hypersonics, directed energy, quantum sensors, advanced avionics — each requires unique alloys and rare metals to operate at the edge. For decades, China dominated the supply side. Washington has decided that's no longer tolerable. - Energy Storage, Grid Resilience, and Nuclear

Next-gen batteries (solid state, liquid metal, flow), green hydrogen, grid-scale storage — all require metals like vanadium, zinc, cobalt, nickel, and lithium. Add in small modular reactors and advanced nuclear designs, and we’re talking uranium, zirconium, molybdenum, and rare elements for control systems.

Together, these forces create not just demand — multiplied, correlated demand across sectors. We are no longer chasing gold or copper in isolation. We are chasing the alloy, the mineral bundle, the resource layer beneath the tech stack.

This is a supercycle, not a blip. And those who understand it in 2025 will look back in 2030 and wonder how they missed the initial run.

Act IV: The Long Game — Why This Is Not Just Another Boom-Bust

Critics always point to volatility and technical execution risk in juniors. That’s fair. Permitting, environmental opposition, capital cost overruns, metallurgy surprises — they are real hazards. But what makes this cycle different is policy anchoring.

When the U.S. government is itself signing off on stockpiles, priority designations, streamlined permitting orders, and direct subsidies, you've shifted some of the risk from commodity price bets to national security bets. The state is now your co-investor.

This means that companies like UAMY and PPTA (and similarly positioned juniors) are not just bets on mineral discovery — they are bets on policy, geopolitics, and industrial transformation.

As AI, robotics, crypto, defense, and energy sectors all lean into these resources, the optionality embedded in junior critical mineral names compounds. The winners will be those who:

- Own high-margin or scarce minerals (e.g., antimony, scandium, rare earths).

- Secure offtake or government backing early.

- Navigate permitting/ESG smoothly.

- Scale production rapidly to match demand curves.

For long-term investors, the focus is not timing the top — it's riding consolidation waves, watching mergers, and securing exposure to the rising tide of demand.

Epilogue: Gold’s Return to the Critical Roster — The Bull That Roars

In a fitting twist to this unfolding saga, President Donald Trump recently added gold to the U.S. critical mineral list last March. Yes, you read that right. The “yellow metal” — long demonized in some circles as a relic or hedge — has reemerged as a key strategic asset.

Why include gold? Because unlike many exotic metals, gold possesses unmatched liquidity, portfolio insurance, and strategic optionality. When you reclassify it as critical, every ounce becomes not just a store of value, but a national asset. It becomes, in a sense, the ultimate “fallback” metal in times of crisis.

That means that gold, already supported by macro uncertainty and inflationary pressures, now benefits from another underpinning: strategic demand.

In short, the gold bull is no longer just macro-driven — it’s geo-policy-driven. As capital floods into critical mineral juniors and infrastructure plays, some of it will inevitably “spill up” into gold, sucking capital into the safe-haven layer.

So what do we have in 2025?

- A government that is now a buyer and guarantor of mineral supply.

- A demand superstructure stacking AI, robotics, blockchain, defense, nuclear, and energy.

- Junior explorers like UAMY and PPTA showing what hyperbole in this space looks like.

- And gold, recast as a strategic metal, reentering the bullish narrative.

If you asked me whether we are witnessing a mere commodity cycle or a tectonic shift in capital allocation — I say the latter. The hills around Pebble Creek are only the beginning. The race is underway, and the prize is strategic control over the raw bones of technology.

Welcome to the critical minerals supercycle. Strap in.

Get to the good, green grass first…

The Prophet of Profit,

Brian Hicks

Brian is a founding member and President of Angel Publishing. He writes about general investment strategies for Wealth Daily and Energy and Capital. Brian is the managing editor and investment director of R.I.C.H Report (Retired Independent Carefree Healthy), New World Assets and Extreme Opportunities. For more on Brian, take a look at his editor’s page.

The Best Free Investment You'll Ever Make

We never spam! View our Privacy Policy

After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox daily.